Wisdom Tree has a small article on their Dividend Indexes.

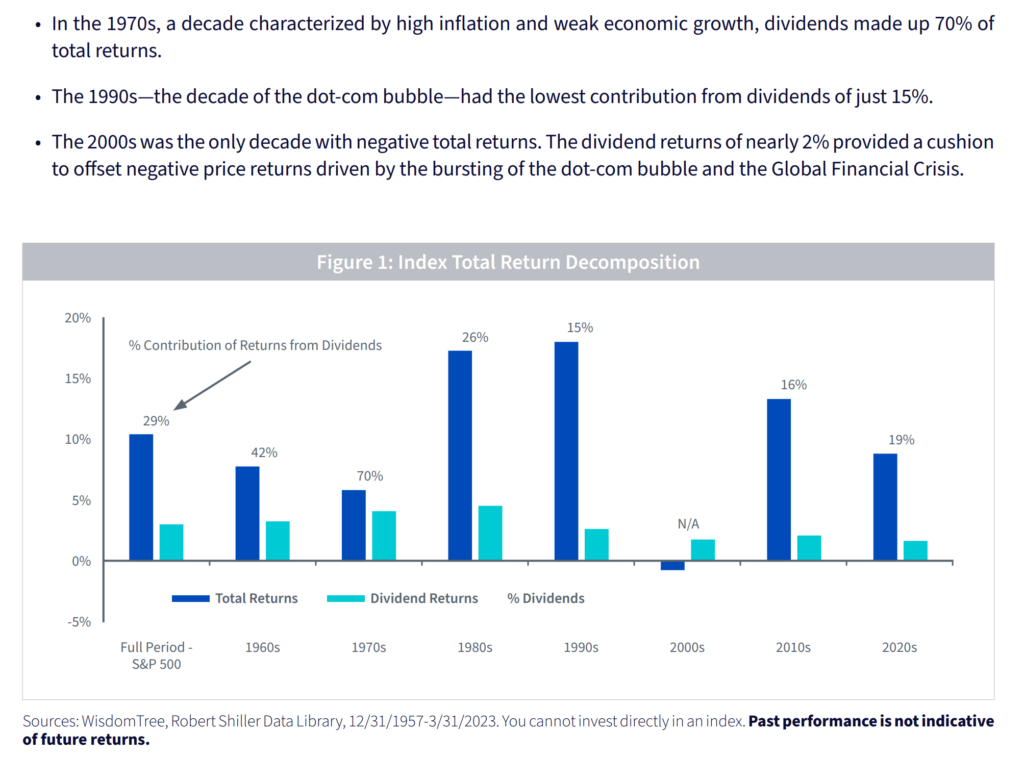

Wisdom Tree did the hard work crunching the US stock data with Shiller. The dividend was able to buffer the periods where the capital appreciation was poor.

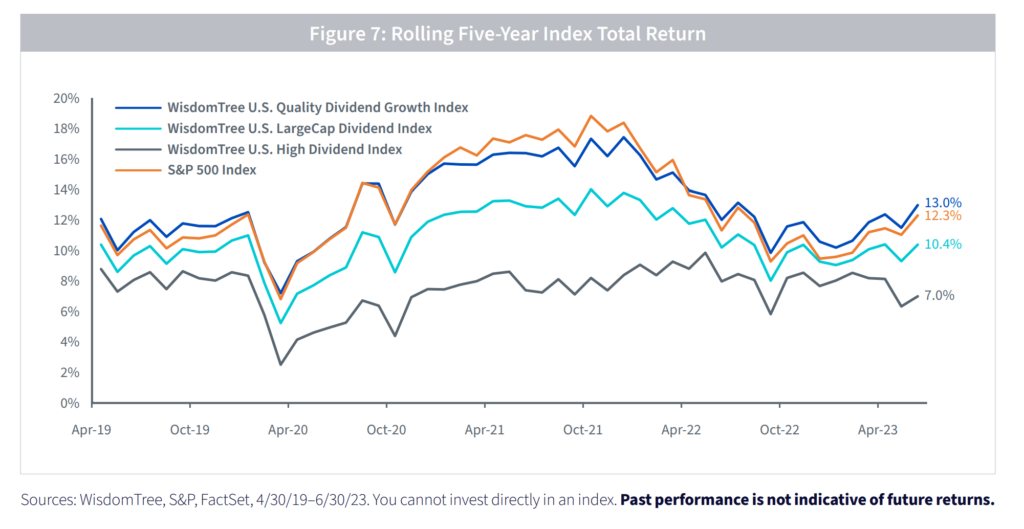

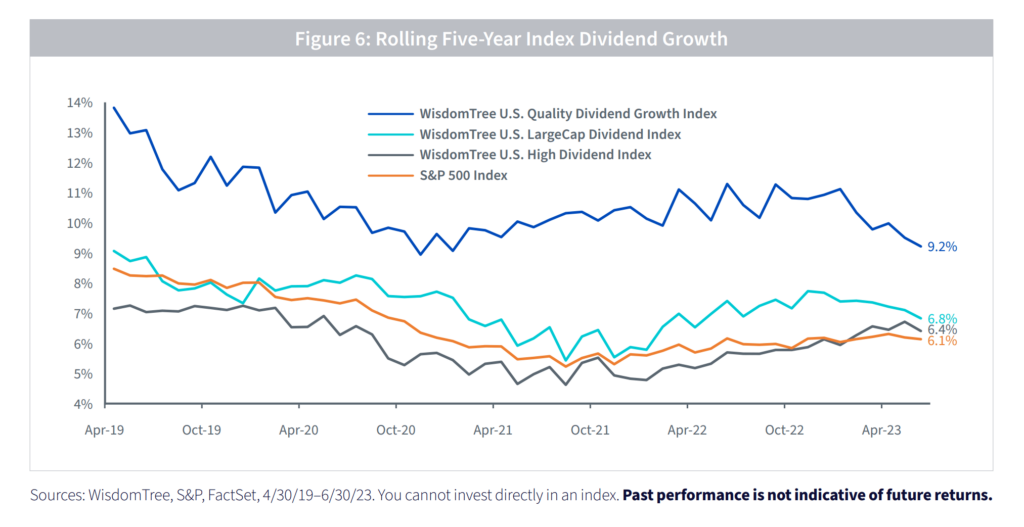

Wisdom Tree crafted a few different dividend indexes. The rolling 5-year performance over a very short timeframe is shown below:

They probably roll the performance month by month.

What you will notice is that the Quality dividend growth index kinda mirrors the performance of the S&P 500. The quality dividend growth index builds in a few metrics such as weighting for medium-term estimated earnings growth, three-year average ROE, three-year average ROA, and also a momentum layer.

With these metrics, it will regularly curate a set of companies that do well when most of the cash flow is in the future. Not surprising the companies that did the worse are the high dividend index where the cash flow is today.

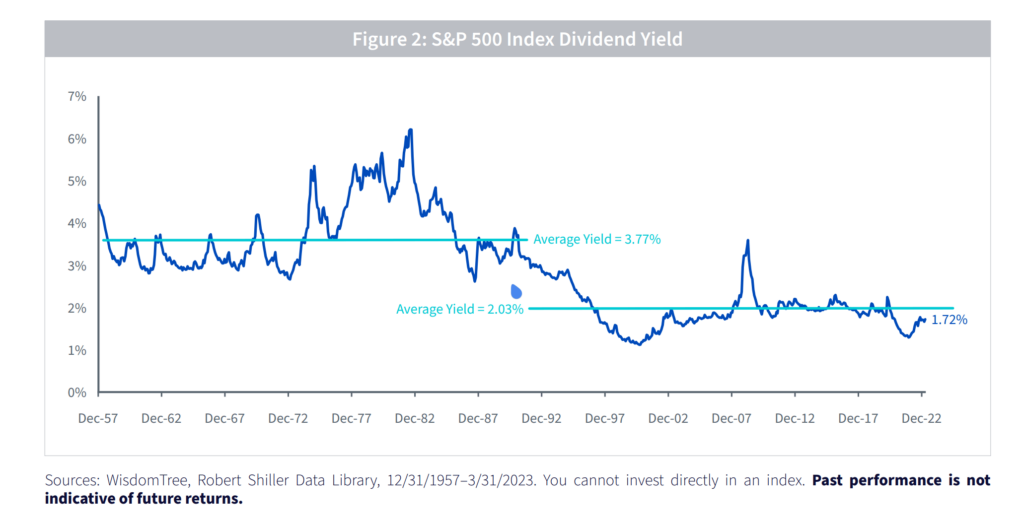

The US dividend has fallen to a lower regime since the turn of the 1990s.

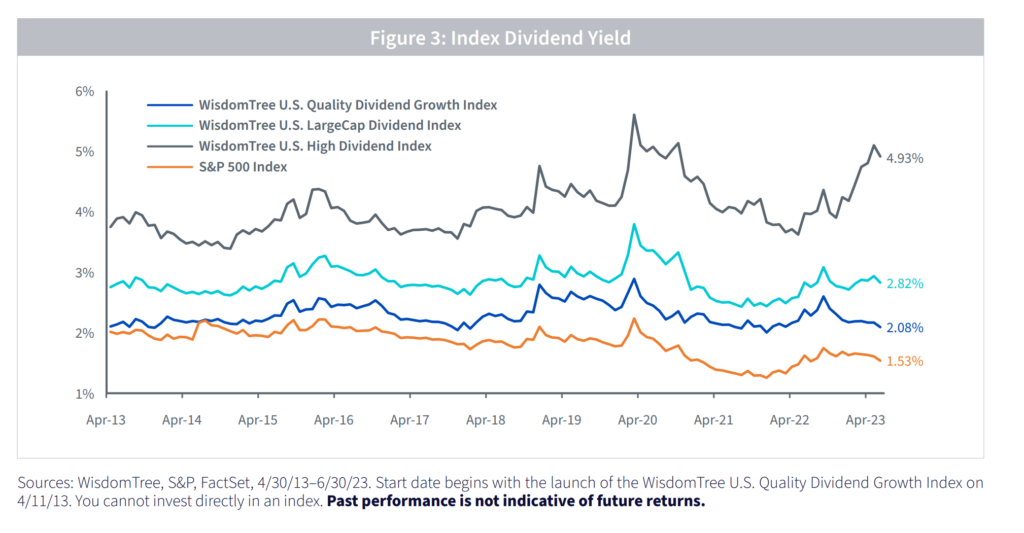

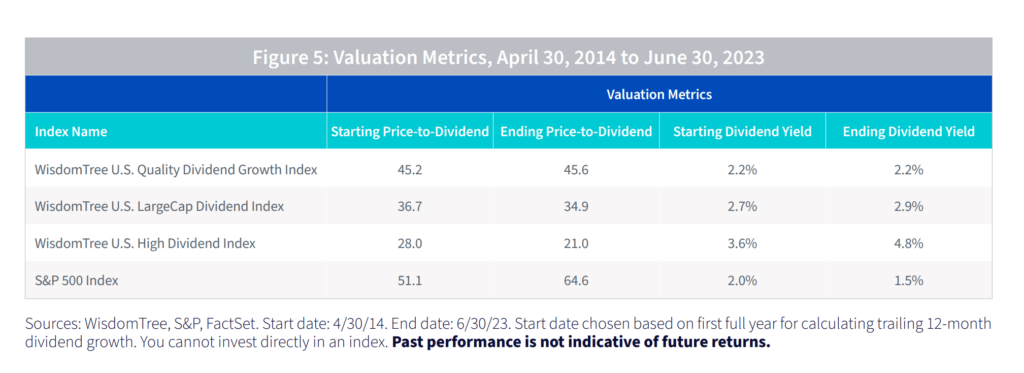

The quality dividend growth index has a tad higher dividend yield than the S&P 500.

But take a look at the growth of dividends.

I like this chart because you always wonder collectively how much can dividends grow for a portfolio of high dividend stocks. The dividend growth can be 5-6%.

If we layer the dividend growth of the US Quality Dividend Growth Index, we can see that the ending dividend yield is same as the starting dividend yield.

This more or less means that all the share price of the stocks in the index also grow over time.

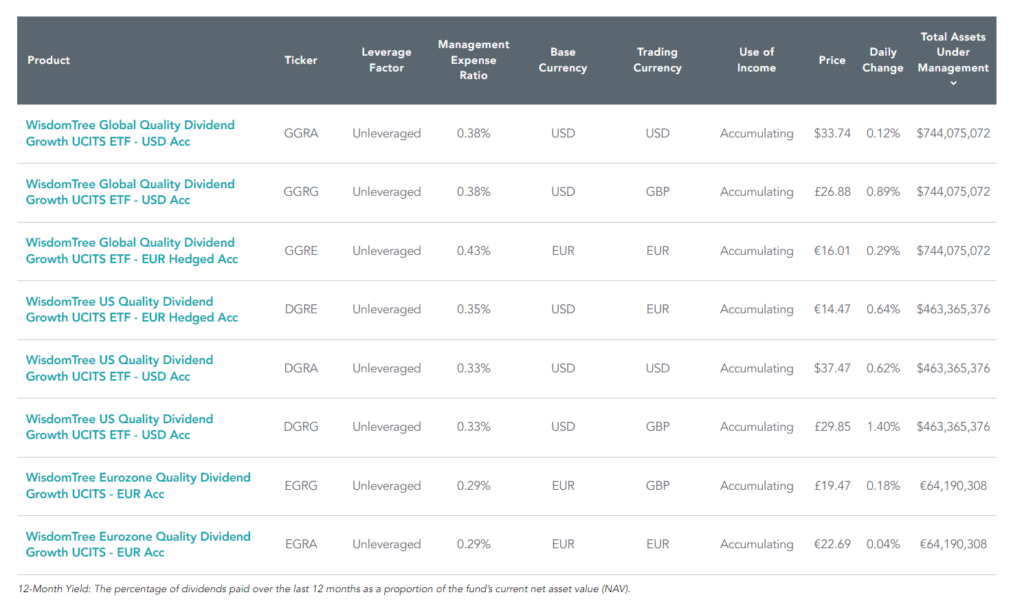

If these data have perk your interest in Quality Dividend Growth, do be aware that WisdomTree have a set of UCITS exchange-traded funds (ETFs) listed on the London Stock Exchange:

These ETFs would be considered as Smart Beta funds, multifactor ETFs, which allow you to systematically invest in high-quality companies. The dividends are more used as a form of signalling, to identify companies that may be able to grow their dividends well, which is a sign of a sustainable, higher-quality company.

The first data chart do make me wonder how dividend growth will be in a high inflationary environment.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

The post WisdomTree’s Data on High Dividend, Quality Dividend Growth appeared first on Investment Moats.