What happened?

Singapore REITs have experienced significant volatility in recent months.

After rebounding in anticipation of the US Federal Reserve interest rate cuts, their share prices have since declined by close to 10% and are now nearing 2024 lows once again.

While some REITs have been able to raise their dividends, the distributions of most REITs remain under pressure.

This has led to many REIT investors in the Beansprout Telegram community asking what we should look out for when investing in Singapore REITs.

To address these inquiries, we held a webinar this week to explore the fundamentals and future outlook of Singapore REITs.

During the session, I highlighted the key factors I am monitoring to assess the potential direction of REIT share prices.

For those who couldn’t attend, here is the presentation I shared during the webinar.

Transcript of Webinar on “What’s Next For Singapore REITs?”

Summary

- Look at bond yields and not just headline interest rate changes.

- Investors have moderated expectations for rate cuts in 2025.

- Singapore REITs are trading within 10% of their 2024 low.

- REIT sub-sectors face mixed outlook.

- Look for REITs with ability to grow/maintain distributions and trade at attractive valuation.

- Consider REIT ETFs to get broad based exposure to REITs

1:57 – 11:20 Market Update

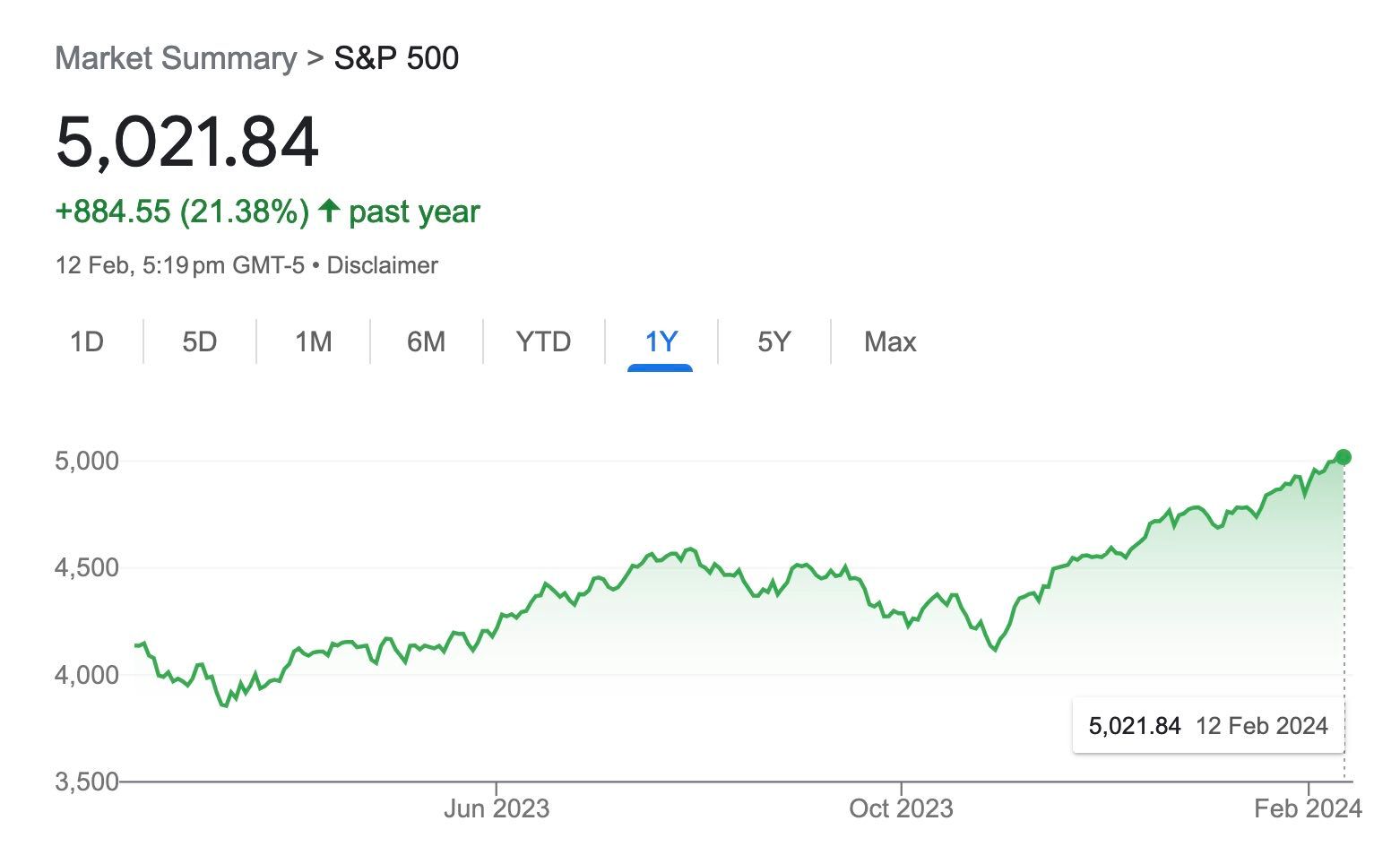

- The probability of an interest rate cut in December has come down to below 60%, from almost 80% a month ago.

- With fewer rate cuts anticipated, bond investors are pricing in the likelihood of higher interest rates for a longer period, pushing bond yields higher.

11:21 – 14:41 Impact on Singapore REITs

- Higher financing costs from existing debt may lead to a decline in distributions and share prices.

- Higher interest rates can lead to lower property valuations, impacting the book value of REITs.

- Low-risk alternatives like Singapore Savings Bonds and T-bills may be more attractive to investors, reducing demand for higher-risk assets like REITs.

16:57 – 24:32 Retail Sector

- Retail sales growth has been slow, with discretionary spending on items like apparel, watches, and jewelry declining.

- Suburban malls have shown resilience, but downtown malls, reliant on tourist spending, are underperforming.

- Retail rents have remained stagnant, with minimal increases due to subdued retail sales performance.

24:33 – 28:53 Hospitality Sector

- While tourist arrivals continue to grow year-on-year, the momentum has slowed significantly compared to the post-COVID rebound.

- Revenue per available room (RevPAR) growth has stalled, reflecting limited potential for further earnings growth from existing assets.

28:54 – 33:10 Office Sector

- Downtown office vacancy rates have increased due to an oversupply of office space and muted demand.

- New office spaces may further suppress rental growth if demand does not increase.

33:11 – 39:13 Industrial Sector

- Rents for multi-user factory spaces grew but at a slower pace than in 2022-2023.

- Business park rents declined due to a vacancy rate exceeding 20%.

- A significant supply in the pipeline could lead to higher vacancy rates and rental pressure.

39:14 – 41:01 Data Centres Sector

- Data centres remain a bright spot, with near 100% utilization driven by demand from AI and cloud computing.

- New data centre supply through 2027 has been largely pre-committed to anchor tenants, ensuring stability and mitigating oversupply risks.

41:02 – 51:15 How to Find the Best Singapore REITs

- Check the latest interest rate expectations using the CME Fedwatch Tool.

- Use the Beansprout REIT Screener to look for Singapore REITs in positive sub-sectors, and compare their dividend yields, gearing ratio, and valuation

51:16 – 52:00 How to Select the Best REIT using Beansprout’s REIT checklist

- Use the Beansprout REIT checklist to understand the fundamentals, financial strength, and valuation of REITs

52:01 – 53:07 Consider REIT ETFs to gain diversified exposure to Singapore REITs

- Consider REIT ETFs for immediate diversification and exposure to a basket of different REITs.

Resources mentioned in the video

-

CME Fedwatch Tool: Stay updated on the latest US interest rate expectations.

-

Best Singapore REITs Screener Tool: Compare Singapore REITs to find the best REIT for your portfolio.

-

Singapore REIT ETFs: How to choose the best one for your portfolio

Join the Beansprout Telegram group get the latest insights on Singapore REITs, stocks, bonds, and ETFs.

Sign up for our free newsletter to stay updated on our next webinar coming up!