The Japanese yen has resumed its meltdown, falling victim to widening rate differentials and rising energy costs. Despite the currency trading at levels that prompted FX intervention last year, Japanese authorities don’t appear so concerned this time, which suggests that another round of intervention is some distance away. For this dynamic to change, USD/JPY would need to approach the 150 region in a hurry.

Yen feels the blues

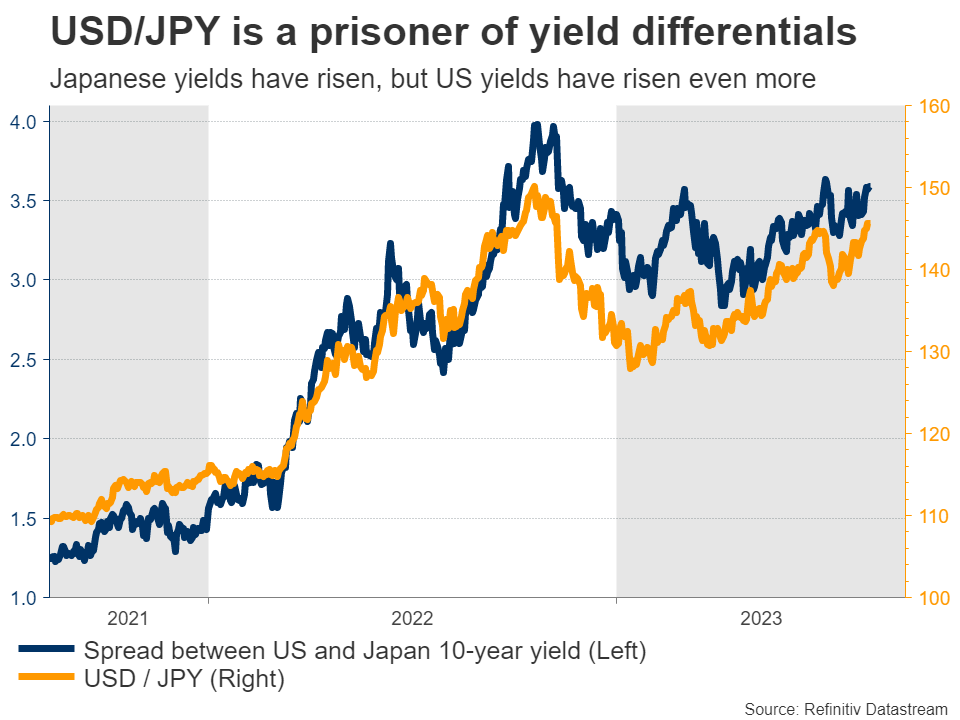

It has been another bruising year for the Japanese yen, as the forces that devastated the currency after the pandemic came back into play. Interest rate differentials have been the primary driver. In sharp contrast to other major central banks, the Bank of Japan has still not raised rates.

Over time, this gap in rates incentivizes capital to flow out of Japan and search for higher returns abroad, putting downward pressure on the currency. While the BoJ did tweak its yield control strategy lately to allow long-dated Japanese yields to rise as high as 1%, the move has not stopped the yen’s bleeding.

That’s partly because the BoJ intervened in the bond market to prevent a rapid rise in yields, and partly because foreign yields have risen even more lately, resulting in yield differentials widening further.

Soaring energy prices have also inflicted damage on the yen through the trade channel. Japan imports nearly all of its oil and gas, so higher energy prices have deprived the nation from its trade surplus. Although this negative effect dissipated earlier this year as a weaker yen boosted exports and oil prices fell, it might become more pronounced again following the latest rally in oil prices, which started in late June and therefore hasn’t been captured in the data yet.

Soaring energy prices have also inflicted damage on the yen through the trade channel. Japan imports nearly all of its oil and gas, so higher energy prices have deprived the nation from its trade surplus. Although this negative effect dissipated earlier this year as a weaker yen boosted exports and oil prices fell, it might become more pronounced again following the latest rally in oil prices, which started in late June and therefore hasn’t been captured in the data yet.

In other words, capital and trade flows have both moved against the yen recently, and the fallout is reflected in the charts.

So why is FX intervention unlikely?

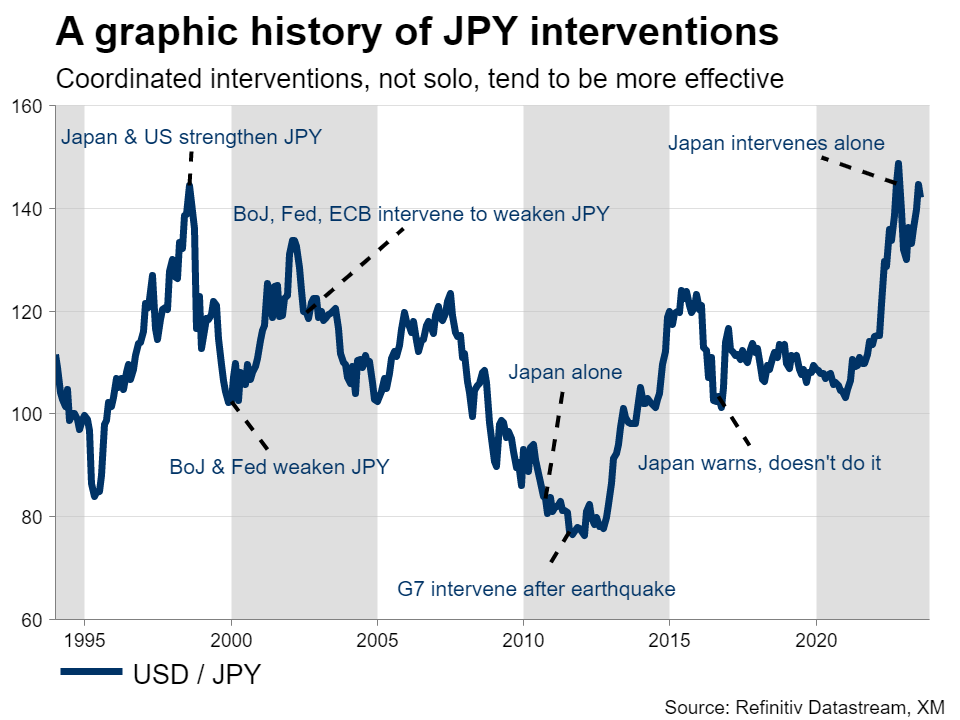

The main argument against FX intervention is that Japanese authorities have not threatened it lately. There haven’t been many concerned comments about exchange rates from government officials in recent weeks, even as the yen fell to the ‘danger zone’ that the government decided to defend last year.

Tokyo has been relatively silent, and sometimes silence can speak volumes. Before real intervention takes place, there will be several verbal warnings from various officials. It’s a cost-free method to discourage speculators from attacking the yen.

Speed matters a lot in this calculation. One reason why Tokyo seems more relaxed this time is that the pace of the yen’s depreciation is not as severe as last year. A slow and orderly drop is very different from a rapid breakdown in the currency. Policymakers ultimately want to preserve stability.

Another reason is the latest policy tweak by the Bank of Japan. With the central bank finally taking the first steps towards normalizing policy, there is less concern about a chaotic yen collapse that requires intervention.

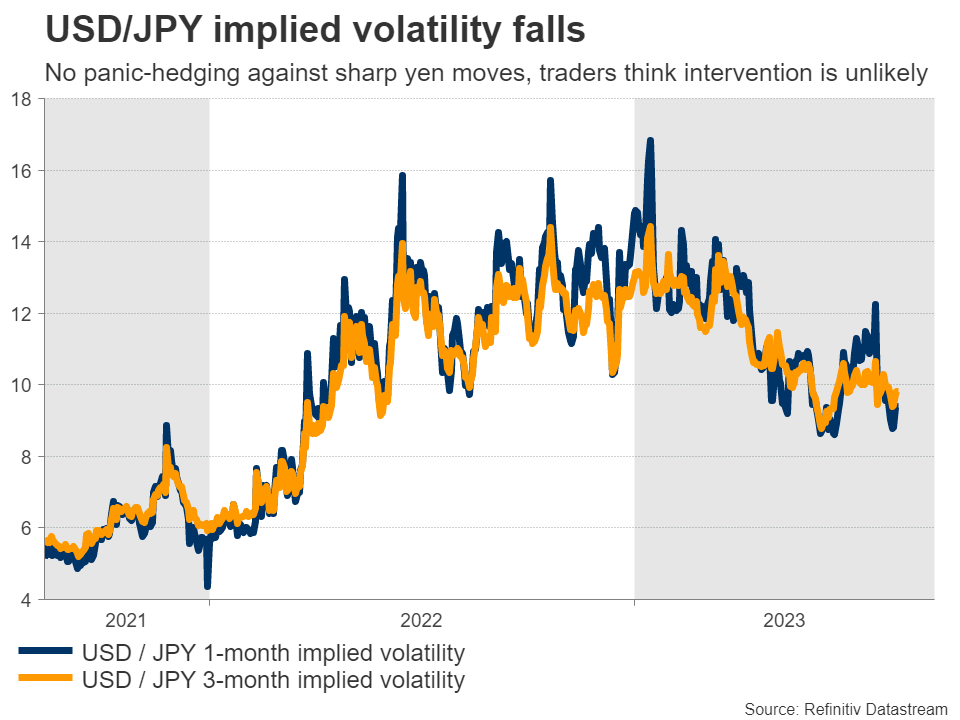

Of course, this narrative could change if the yen continues to sink, especially if the decline accelerates in speed. But for now, the risk of actual intervention is low and investors appear to agree, judging by the decline in USD/JPY implied volatility. This means the big players are not really hedging against any massive moves in the yen.

The buzzwords that would suggest Tokyo is ready to take action would be government officials describing FX moves as ‘disorderly’ or ‘one-sided’. The minister of finance – Shunichi Suzuki – is the final authority in intervention matters, so hearing those words from him would be the tell.

Suzuki made some comments this week, but he only said that the government would respond to “excessive” moves. The fact that he hasn’t ramped up his warnings suggests we are still some distance away from actual FX intervention.

What’s the line in the sand?

It’s difficult to say exactly where Tokyo might draw the line and step in, because that line is a moving target, which changes depending on the speed of FX moves. A slow decline might not be very concerning, but a sharp and violent drop would be.

Looking at the USD/JPY chart, the most important area to watch is 150, which is where the second round of intervention took place last year. The tone of Japanese officials as we approach this region will reveal whether they intend to defend it again.

All told, for the yen to mount a lasting recovery, it would probably need some crisis or recession in foreign economies that fuels bets for rate cuts abroad, helping to compress yield differentials. Europe and China are certainly losing steam, although the United States economy remains resilient.

Solo intervention can slow the depreciation, but is unlikely to change the yen’s trend by itself. And since the Bank of Japan doesn’t seem to have much appetite for a continued tightening campaign, the yen is once again left in the hands of external forces – namely how global yields perform.