Chinese markets continued to have bearish vibes in August and international assets that rely on Chinese business conditions suffered too, ultimately reducing global growth potential. On Thursday, China’s National Bureau of Statistics will release new data on manufacturing and services activity, with forecasts pointing to a mixed, but still unfavorable report.

Chinese markets suffer

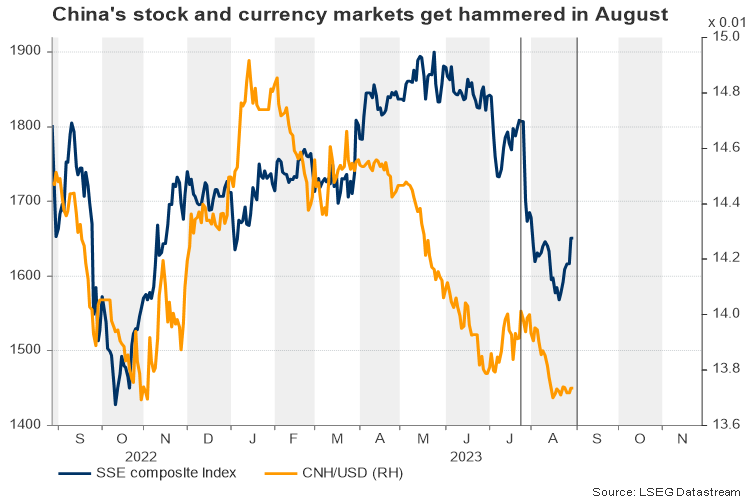

China’s SSE composite industrial index experienced one of its worst monthly declines in more than a year, falling by 5.0% m/m. Its renminbi currency has depreciated by an equivalent percentage against the US dollar in yearly terms, currently trading just shy of the 15-year low that was registered last October.

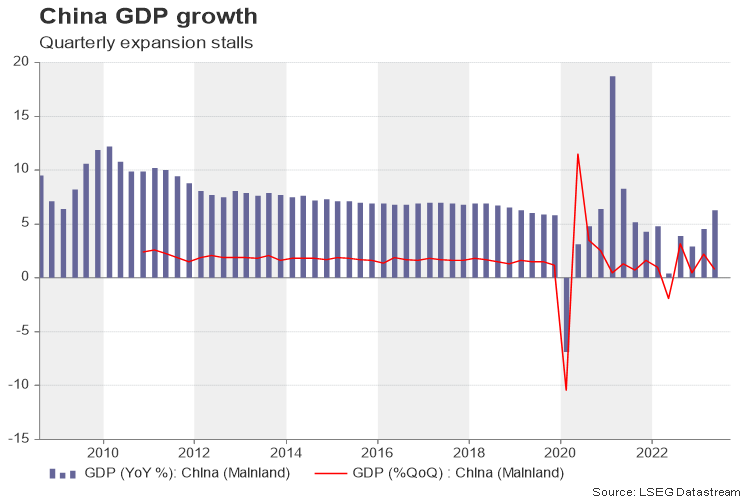

Analysts anticipated a huge increase in China’s spending and sizeable growth spillover effects to the rest of the world when the government finally lifted the brutal pandemic lockdowns after three years in December 2022. Disappointingly, 2023 GDP stats did not show a big bang recovery, nor a return to double-digit growth rates observed during the 2000s, expanding by 0.8% quarter-on-quarter in Q2 and 6.3% year-on-year instead.

While the numbers are still much higher than those in the US and the eurozone, the details reflect an ugly reality, making investors wonder whether Beijing will finally meet its 5.0% growth target at the end of this year.

The property sector cannot help anymore

The property sector remains a major economic risk. It used to be a traditional giant growth engine for China over the past few decades, pushing total debt-to-GDP to 250%. The threat, however, was silent until the government introduced three red lines to restrict heavy borrowing in 2020. Rising interest rates abroad caused more pain in the sector thereafter. Although the People’s Bank of China has been actually cutting interest rates to stimulate battered demand, a couple of big developers issued some of their debt on international markets, with Country Garden being the latest large real estate company to default on its foreign bonds in a domino cycle.

The government has announced plenty of other support packages, from tax cuts to bond financing with scope to revive consumers’ and businesses’ confidence, but stimulus steps have been targeted and measured. China is probably using a careful approach to ensure manageable debt levels and high-quality growth, though the data reveal that a Plan B is needed.

August’s business PMI estimates

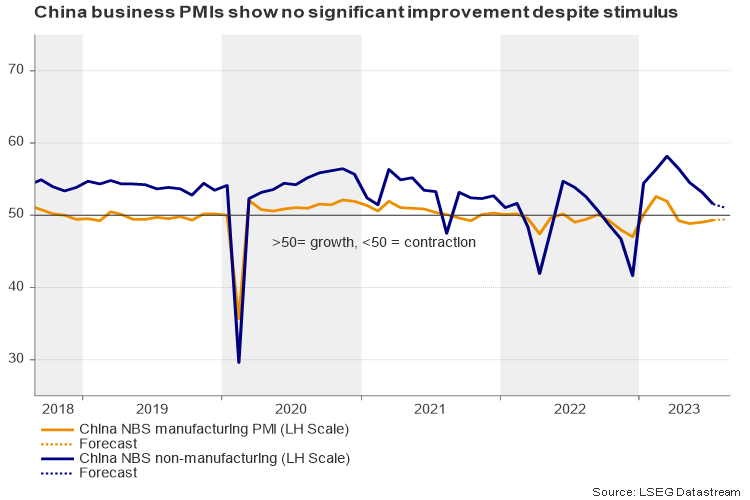

The business PMI survey for August might show a continuous contraction in the manufacturing sector. Although the index has pivoted from May’s low, the improvement has been gradual so far while remaining below the 50 mark, which separates growth from contraction. Estimates suggest a negligible pickup to 49.4 from 49.3 previously, with investors likely paying attention to month-on-month new orders and raw material inventories sub-indices, which underpinned the slight upturn in the sector last month.

Price and employment sub-indices could be another important spot as deflation and a high youth unemployment rate keep spending muted. The services PMI index, which is more sensitive to consumers’ purchasing habits, could be a better proxy of consumption. Yet, forecasts suggest a drop from 51.5 to 51.1.

AUD/USD

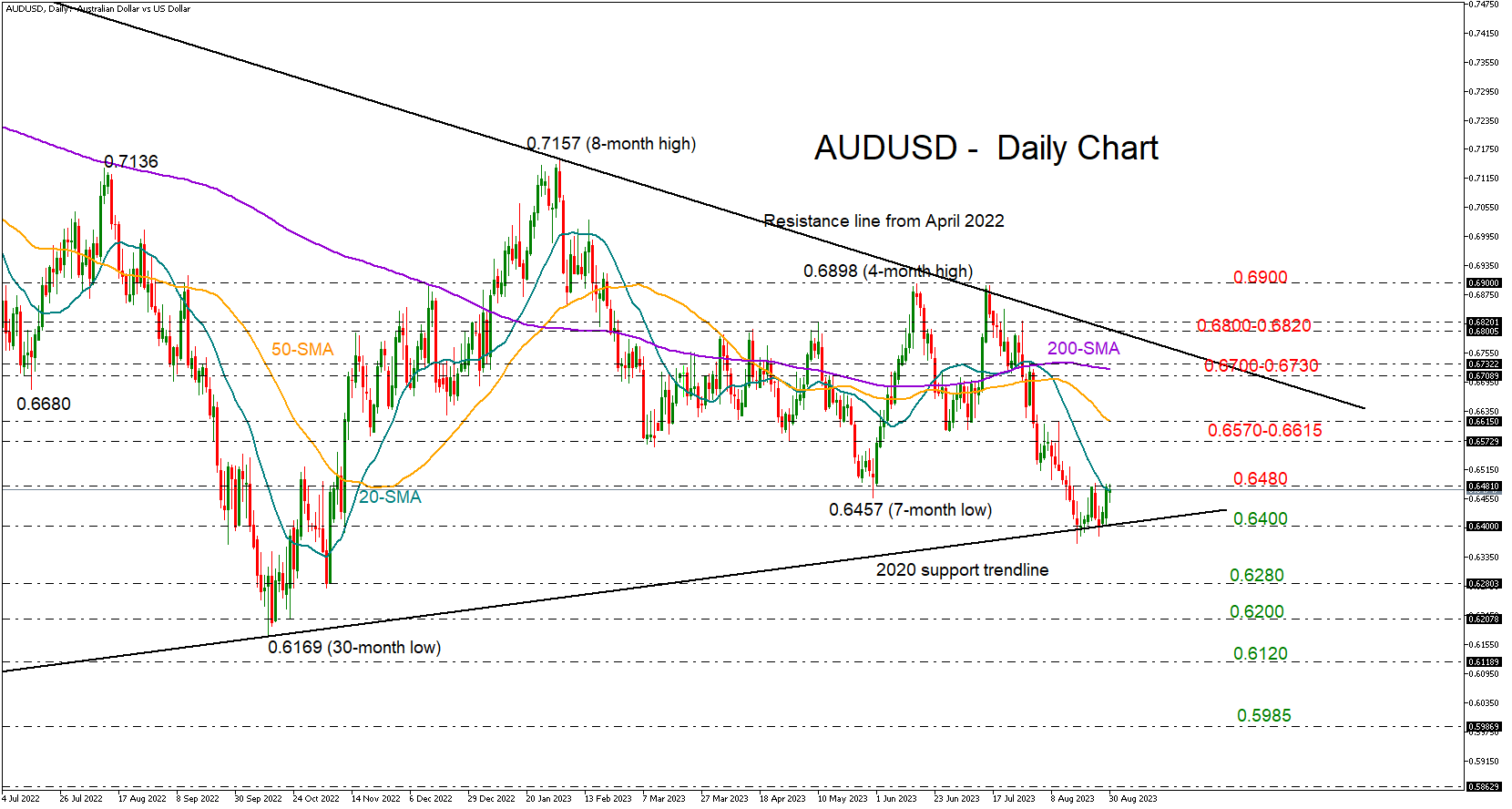

Turning to FX markets, the focus will be on the antipodean currencies ahead of a busy week of US data releases, as China is a major buyer of Australian and New Zealand exports. International stock markets could also face some volatility if China’s PMI data send negative global growth signals.

Looking at aussie/dollar, the pair is thirsty for a new bullish cycle after setting a strong foothold around the familiar 2020 support trendline at 0.6400. Tuesday’s bold rebound has been encouraging but not sufficient to drive the price above the 20-day simple moving average (SMA) and the 0.6480 resistance. Thursday’s PMI data will need to beat analysts’ estimates to help the pair crawl above that wall and run towards the 0.6570-0.6615 territory.

If the readings come in below expectations, it would be interesting to see if the bears can snap the 0.6400 floor ahead of the US core PCE inflation and jobs data.