One of the most common questions I observe out there in the chat is

What do you think of this product/strategy/solution? Is it good for income?

Usually, the question is phrased in this manner, and frankly, I don’t know what to say.

This is not just in chats but… I heard from our client advisers that clients will ask them about their opinions of these products. Prospects mention them or compare our retirement income solutions against these products from time to time.

It is easier for my colleagues to explain to their clients because we understand their financial situations better. After finding out what they know about these products and why they are drawn to them, we can share our perspectives about the product/strategy or solution better.

For everyone else asking, it is a struggle.

Investments and insurance are typically sold.

We don’t wake up one day with the idea that we need these things in our lives.

So we were pitched these products or investment ideas.

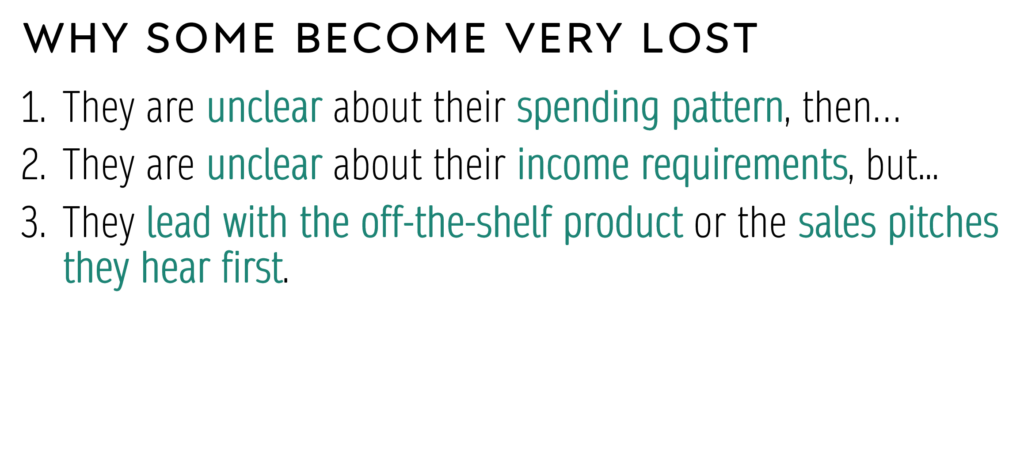

Then, our thinking is led by these products and investment ideas first.

We then think, and also HOPE that these products and investment idea is the holy grail to provide passive income to get me out of the rat race.

I have taken enough look at all this stuff.

Insurance endowment market as retirement income plans. Universal life plans that is flexible enough to provide income. I was a DIY individual dividend stock investor. Probably wrote a whole series, which many find really good on Real estate investment trusts (REIT).

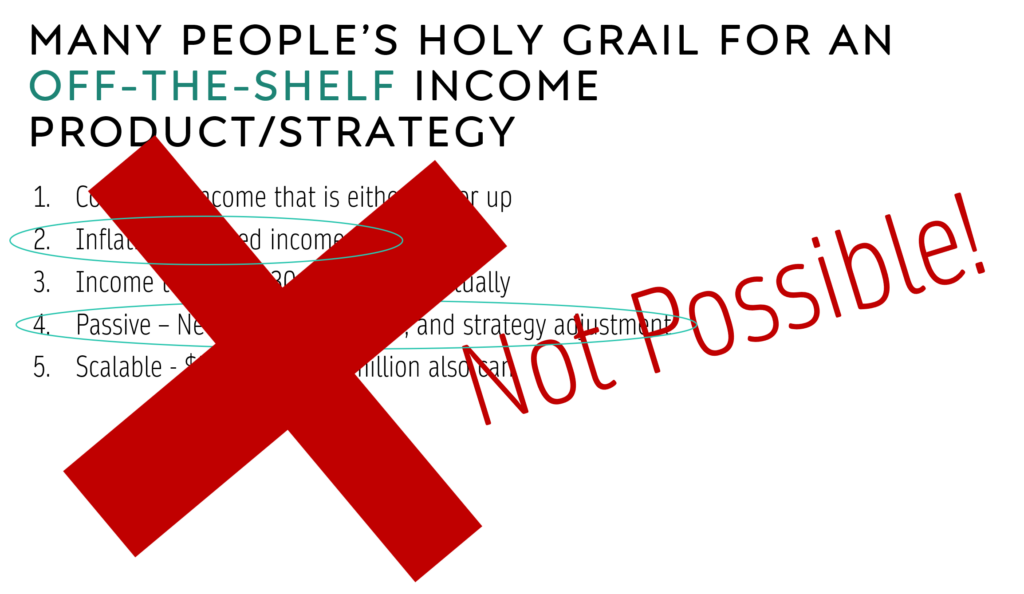

There are no holy grail off-the-shelf income products that will satisfy what you want.

Investment ideas should be seen as investments with clear compounded returns that come from their asset allocation and their manager’s skill (usually not much).

This doesn’t mean the products are shit.

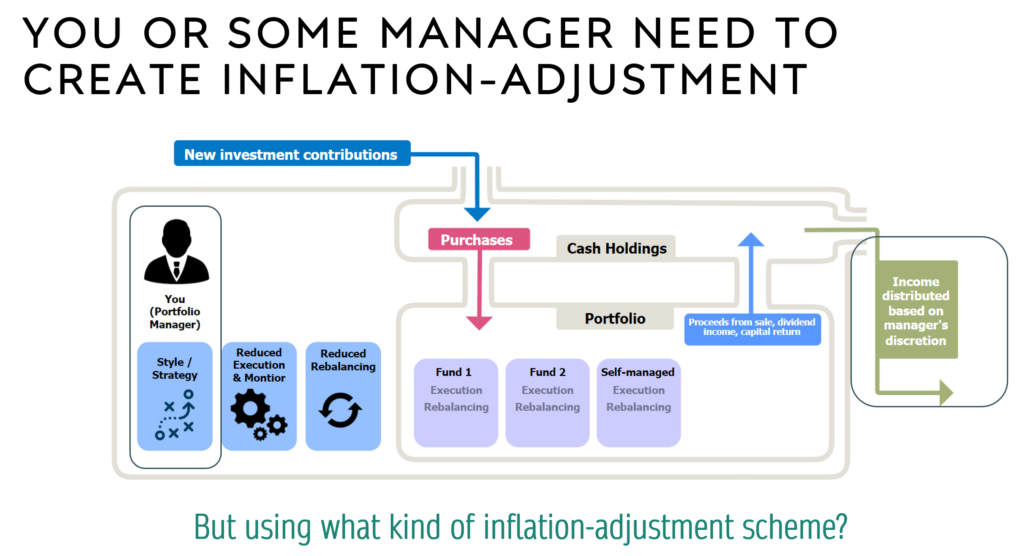

If all the products and strategies have flaws, if we think of them from the income perspective, we (as the portfolio manager) needs to do something about it.

Usually. we need an income strategy.

But many don’t really have those.

Having said that, I think is healthy to evaluate more products with an open mind.

When you evaluate more products, but bearing in mind what I said that there is no holy grail income product out there, you start seeing their uniqueness easier.

You can use a fix set of wealth planning characteristics and an investment characteristic to review these products to see if they are closer to your needs:

- income consistency

- inflation-adjustment

- how long will the income last

- effort needed

- scalability

- are there empirical evidence the income strategy gives you what you want?

- investment total returns –> asset allocation

In this podcast video that I did, I explain all of these, with some examples why most off-the-shelf products tend to disappoint your expectations:

Let me know if you have further questions.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I currently work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

The post Why Off-The-Shelf Income Products & Investment Ideas Will Not Solve Your Passive Income Needs appeared first on Investment Moats.