What happened?

It appears to be getting harder to find a place to park our cash these days.

The yield on the Singapore T-bill has been declining, and banks have been cutting their fixed deposit rates too.

Just yesterday, I saw a question in the Beansprout community about where to park our cash to earn a higher yield. What are the options that allow us to earn a yield of above 3% p.a.?

In this article, I will share the following:

- Latest interest rates on fixed deposits, T-bills, SSBs and money market funds

- Advantages and disadvantages of putting your cash into these options

- What I would consider in deciding between fixed deposits, T-bills, SSBs and money market funds

- My strategy for parking my cash to earn a higher yield

Best 12-month fixed deposit rate in Singapore of 3.20% p.a.

Firstly, let’s take a look at the best fixed deposit rates in Singapore in November.

- The best 3-month fixed deposit rate is 3.00% p.a. offered by Bank of China.

- The best 6-month fixed deposit rate we found was 2.90% p.a. offered by Maybank and SBI.

- The best 9-month and 12-month fixed deposit rate we found was 3.10% p.a. and 3.20% p.a. offered by DBS respectively.

| Tenure | Best fixed deposit interest rate (p.a.) | Bank |

|---|---|---|

| 3 months | 3.00% | Bank of China |

| 6 months | 2.90% | Maybank/SBI |

| 9 months | 3.10% | DBS |

| 12 months | 3.20% | DBS |

To get the latest list of best fixed deposit rates this month, check out our guide to the best fixed deposit rates in Singapore.

Best no-frills savings account in Singapore offers interest rate of up to 3.28% p.a.

If you are looking for a no-frills savings account to park your savings, GXS is also offering an interest rate of up to 3.28% p.a. for a 3-month tenure through its Boost Pocket. Learn more about the GXS Boost Pocket here.

The HSBC Everyday Global Account (EGA) is offering a promotional interest rate of up to 3.15% p.a. In addition, you can earn an additional 1% bonus interest rate on the incremental SGD average daily balances under the HSBC Everyday+ Rewards Programme.

Learn more about the best savings account in Singapore here.

Latest 6-month Singapore T-bill offers yield of 2.99%

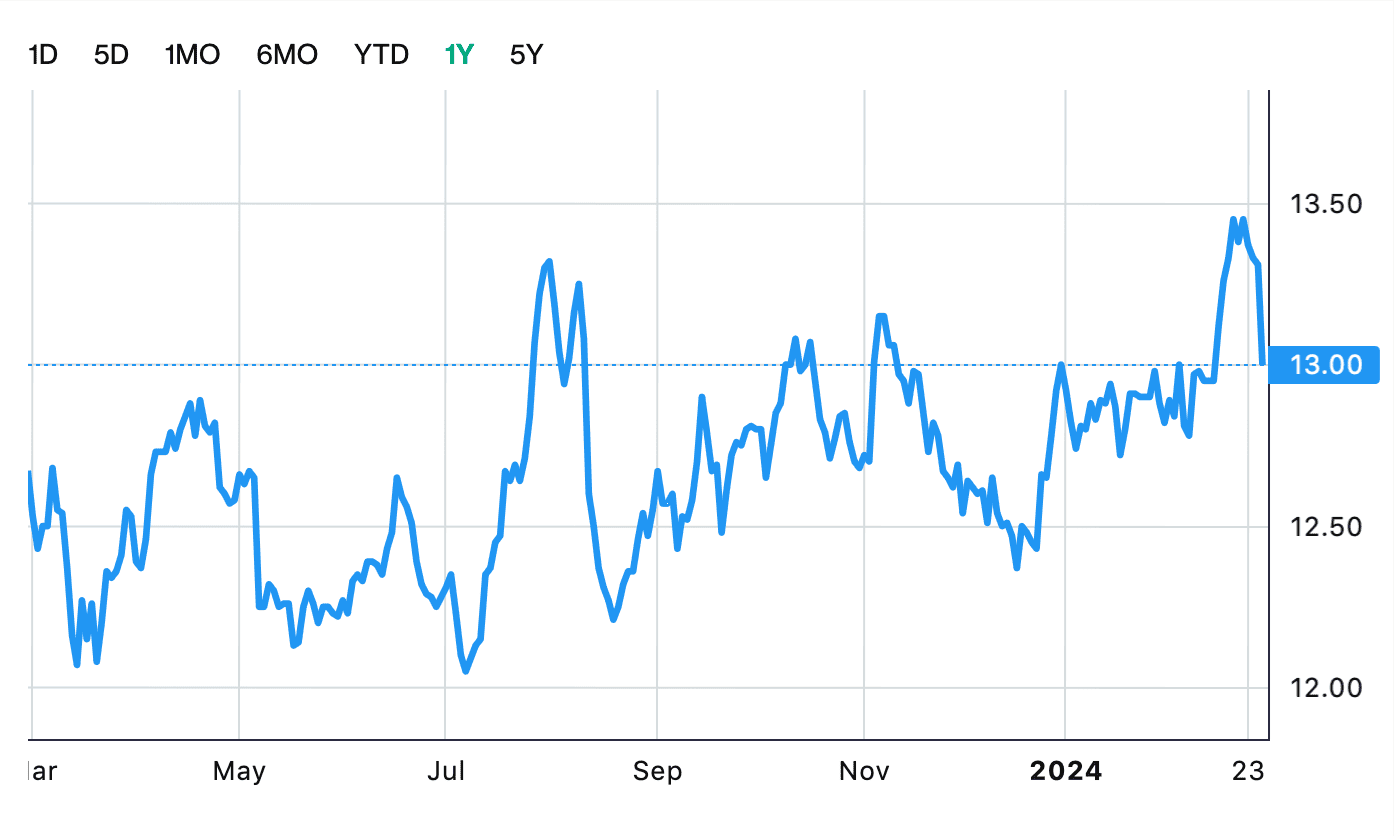

The yield on the Singapore T-bill has dived in the past few months.

The cut-off yield on the 6-month T-bill in Singapore was at 2.99% in a recent auction on 24 October 2024, having fallen from 3.06% in the auction on 10 October.

Despite the decline in the T-bill yield, it is still above the best 6-month fixed deposit rate of 2.90% p.a. given that some banks have cut interest rates further.

| Auction Date | T-bill | Cut-off yield |

| 24 Oct 2024 | BS24119S | 2.99% |

| 10 Oct 2024 | BS24120V | 3.06% |

| 26 Sep 2024 | BS24119S | 2.97% |

| 12 Sep 2024 | BS24118Z | 3.10% |

| 29 Aug 2024 | BS24117F | 3.13% |

| 15 Aug 2024 | BS24116E | 3.34% |

| 1 Aug 2024 | BS24115A | 3.40% |

| 18 Jul 2024 | BS24114V | 3.64% |

| 4 Jul 2024 | BS24113N | 3.70% |

| Source: MAS | ||

Latest Singapore Savings Bonds (SSB) offer a 10-year average return of 2.81%

The December issuance of the SSB (SBDEC24 GX24120F) offers a 1-year interest rate of 2.66%, and a 10-year average return of 2.81%.

This is much higher than the 10-year average return of the previous SSB, which was 2.56%.

The 1-year interest rate of 2.66% is below the best 12-month fixed deposit rate of 3.20% p.a.

However, I would consider the SSB mainly for the opportunity to lock in the yields for a period of up to 10 years.

You can get the latest interest rate projections for the next SSB here.