-

Commercial real estate loans cause anxiety amid high interest rates

-

Bank risks remain low but cannot be ignored

It’s not that quiet on the bank front

The US economy has proved surprisingly resilient to the fastest increase in interest rates in forty years. Six months after the latest rate hike, the economy keeps growing at a healthy pace, defying recession risks, which some of its peers are already sinking into. This is great news for the US dollar and one less problem for President Biden, who aims for a second term at the end of this year. But it’s still too soon to celebrate. Despite the persisting geopolitical risks, the latest headlines from the US banking sector reminded investors that financial jitters could still resurface, although they are not a major threat for now.

Recently, the regional New York Community Bancorp (NYCB) made headlines when it reported a loss of $252 million in the fourth quarter compared to a profit of $172 million in the same period last year. Its loan losses multiplied, and the bank decided to cut its dividend and increase provisions to protect itself from potential future loan losses. The news emerged after the purchase of $34 billion of deposits and $13 billion of commercial and industrial loans from Signature Bank, which collapsed along with the tech-focused Silicon Valley Bank and First Republic Bank last spring, creating some anxiety that a chain effect might be underway.

In a relief to investors, the Fed chairman Jerome Powell said that the issue is monitored and manageable, although he acknowledged the risk of additional closures and/or mergers, with the Treasury Secretary echoing this narrative.

Regulations bite regional banks

Perhaps more closures of zombie regional banks may not shock the US financial system immediately but could still transmit the risk to their rescuers. Following the purchase of Signature’s assets and liabilities and having previously acquired the double-its-size Flagstar Bank, NYCB was placed in a higher regulatory category of large banks with more than $100 billion in assets. As a result, the bank was forced to make provisions faster than it did previously, with the amount accelerating to $833 million for the year ending 2023 from $133 million at the end of 2022. The bankrupted First Republic Bank is an epic example of how rapid growth can lead to liquidity crunches.

Commercial real estate debt closely monitored

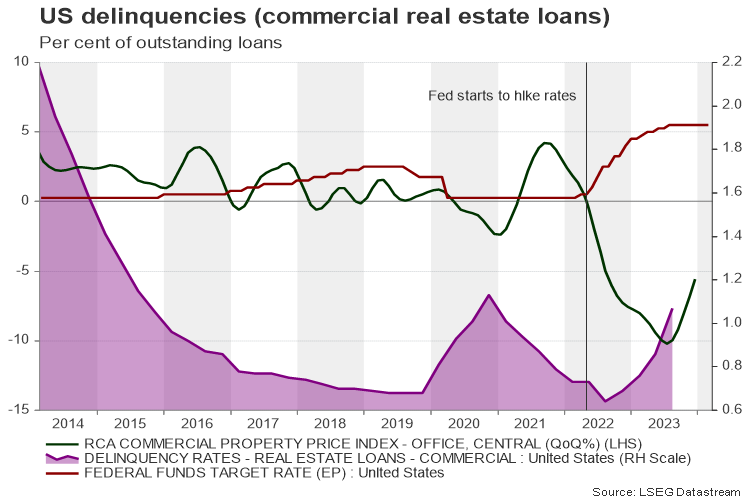

What might be discussed more in the coming months, though, is the banks’ high exposure to the fragile commercial real estate sector. Hybrid work has left commercial real estate office buildings empty, while the 2019 rental laws in New York city put a cap on rent increases. On top of that, the Fed’s aggressive rate hike cycle triggered a steep decline in valuations, which consequently created imbalances in the banks’ books.

Refinancing at higher interest rates is now a less wise option, while selling battered bonds may not be enough to recoup losses. Hence, unless the Fed starts to cut interest rates or commercial properties are repurposed, investors might hear more about commercial real estate delinquencies in the coming years if not months, given the increasing vacancy rates. Also, even if the Fed proceeds with rate cuts this year, it will probably take baby steps to avoid a resurgence in inflation, leaving borrowing costs above pre-pandemic lows.

According to a Morgan Stanley report, 70% of the commercial real estate loans owned by regional institutions will mature by 2025, with the Trepp data provider estimating an amount of $560 billion by the end of the same year. Among the big US banks, Wells Fargo is relatively more vulnerable to price volatilities in office properties, while JP Morgan Chase and Bank of America also caught attention after announcing an increase in provisions for potential future CRE loan defaults.

Encouragingly, the Fed’s latest banking stress test has found that a systemic banking crisis on the scale of the global 2008 crisis is unlikely, showing that US banks have enough safety nets to mitigate undesirable financial conditions.

US bank stocks underperform S&P 500

The ongoing upward pattern in US bank stocks, which started in the second half of 2023, and JP Morgan’s record high are an indication of investor confidence in the banking sector, but the flattening regional bank stocks remain a laggard within the financial sector. Specifically, NYCB’s battered stock is perhaps telling us that investors could hear more bad news from the bank in the near future.

All in all, supervisors should not be relaxed. The full impact of the aggressive tightening has yet to be felt and although the talk of rate cuts is a daily exercise for markets, “the higher for longer” scenario is the reality for now. Also, it’s worth noting that the CRE issue is not only a US story, but Europe and Asia are facing similar problems.