Since we are still in the Lunar New Year season, here’s a couple of good news to bring more festive joy.

There was some relief for T-bill investors after the cut-off yield for the latest 6-month Singapore T-Bill rebounded to 3.66%.

Based on our current SSB interest rate projections, the next SSB may also offer a 10-year average return of more than 3% with the bounce in government bond yields.

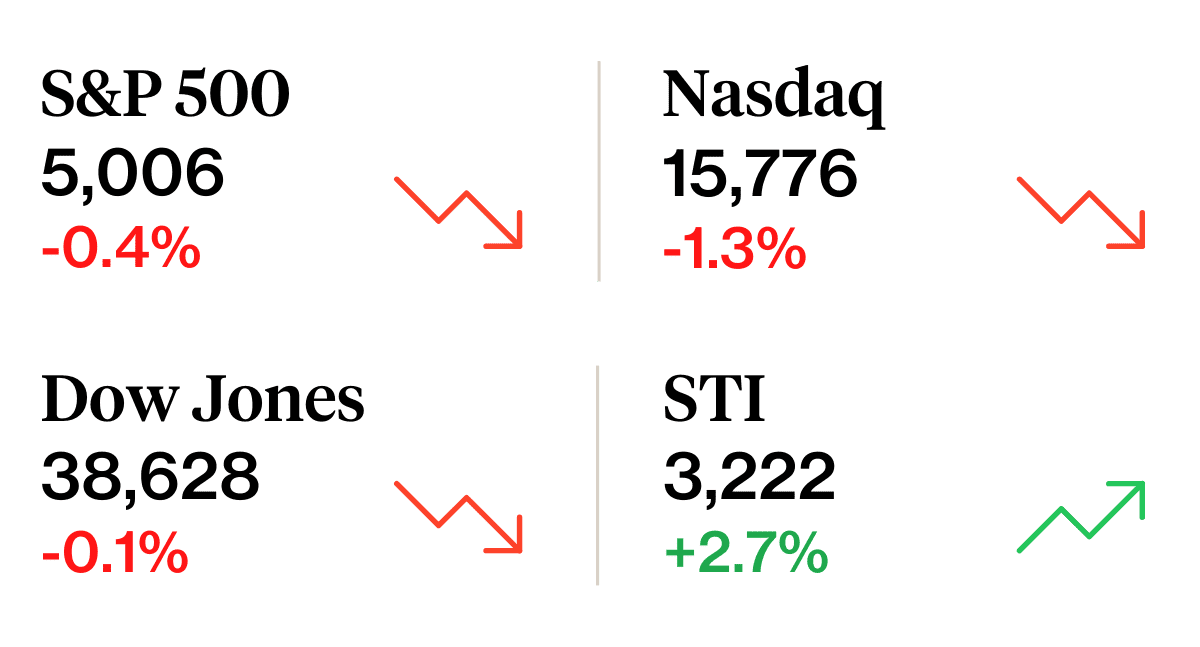

The S&P 500 reached a record high this week but subsequently gave up its gains. However, it continues to hover above the key 5,000 level.

All Singaporean households will receive additional $600 in CDC vouchers amongst various measures that were announced in Budget 2024.

If you are looking for an ang pow bonus, make sure to check out these 8 Lunar New Year promotions!

⏰ RATE CUTS DELAYED

What happened?

The US Consumer Price Index (CPI) rose by 3.1% in January compared to the previous year.

This represents a faster pace of price increase relative to the market forecast of 2.9%.

What does this mean?

The hotter-than-estimated US inflation led investors to moderate expectations that the Fed will cut rates soon.

According to the CME Fedwatch Tool, the probability that the Fed will maintain rates in May has risen to 62% from 39% a week ago.

This would mean that investors are largely expecting that the first rate cut may now only happen in June this year.

Why should I care?

US bond yields rebounded further, with the 2-year US government bond yield rising to 4.65% from 4.20% at the end of January.

The cut-off yield on the Singapore T-bill and projected interest rate for the next SSB rose in tandem with higher US rates.

DBS’ share price also rose with easing concerns about a sharp fall in its net interest margins. The company had earlier announced a dividend hike and bonus share issue.

💡 THE BIG IMPORTANT STORY

T-bill yield rebounds to 3.66%. What’s driving the bounce?

The cut-off yield on the latest 6-month Singapore T-bill auction on 15 February rose to 3.66%.

🚗 WHAT’S MOVING

- Keppel Pacific Oak US REIT (KORE) announced that it plans to suspend distributions beginning 2H2023 through the 2H2025 distribution that would be paid in 1H2026. KORE noted that lenders remain concerned about the US office market and banks are reluctant to lend above 45% leverage for the US market. Read our analysis here.

- Keppel DC REIT will receive S$13.3 million from DXC Technology Services as a commercial and amicable resolution to the payment dispute. The dispute pertains to DXC’s partial default of payment for data centre services in Serangoon North. Read our analysis here.

- Far East Hospitality Trust (FEHT) reported distribution per stapled security (DPS) of 2.17 cents for the second half of 2023, a 25.4% increase from the previous year. The higher distribution was driven by higher revenue contributions across all segments, particularly in the hotel segment.

- Singapore Airlines’ group passenger traffic rose 23.1% year-on-year to reach 3.22 million for January 2024. However, its passenger load factor declined as its capacity increased by a larger extent.

- Thai Beverage reported earnings before interest, taxes, depreciation and amortisation (Ebitda) of 13.8 billion baht for the fiscal year first quarter ended 31 December, a 1.9% increase compared to the previous year. While sales declined over the period, this was offset by effective cost management by the company.

Source: Bloomberg, CNBC, Financial Times, Business Times, Edge Singapore

🤓 WHAT WE’RE LOOKING OUT FOR THIS WEEK

- Tuesday, 20 Feb: Singapore Airlines results

- Wednesday, 21 Feb: Sasseur REIT, iFast, Wilmar, Nvidia results

- Thursday, 22 Feb: UOB, Genting Singapore results, FOMC meeting minutes

Source: Bloomberg, SGX

💰 PROMO

8 Lunar New Year promos to earn your red packet bonus

Get your red packet bonus with Lunar New Year promotions from UOB, OCBC, POEMS, StashAway & more.

👩💻 WATCH OUR RECAP

Missed out on what has been happening in the markets? We’re pleased to partner with Securities Investors Association Singapore (SIAS) to bring you a Weekly Market Review. Catch the video every Monday on Facebook.