Weekend Reading – What Returns From Vanguard Lifestrategy Can You Expect & New iBonds.

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web. We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process. Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance. As usual, everything is to be used at your own risk. Below is the type of content we shortlist:

The price of education is paid once. The price of ignorance is paid forever.

Ted Nicholas

INVEST WISELY

CONSTRUCT YOUR PORTFOLIO

Imagine a world where he didn’t agonise over every buy or sell. A world without the balancing act of portfolio rebalancing. Most probably haven’t even heard of Vanguard LifeStrategy. And with the hefty fees financial advisors charge, that’s hardly surprising. Enter a quasi Golden Retriever Portfolio in a single fund. Let’s dive into why every investor should at least give it a glance.

-

An Update on the Stock-Bond Correlation (Verdad)

-

The Bond Bear Market & Asset Allocation (A Wealth of Common Sense)

-

Duration matching asset allocations with personal goals (Excess Returns – 1 hr 8 min)

-

Are Leveraged ETFs Worth the Costs and Risk? (Wall Street Journal, Paywall)

-

On Dividend Investing Strategies (Italian Leather Sofa)

-

Honey, the Fed Shrunk the Equity Premium (AQR)

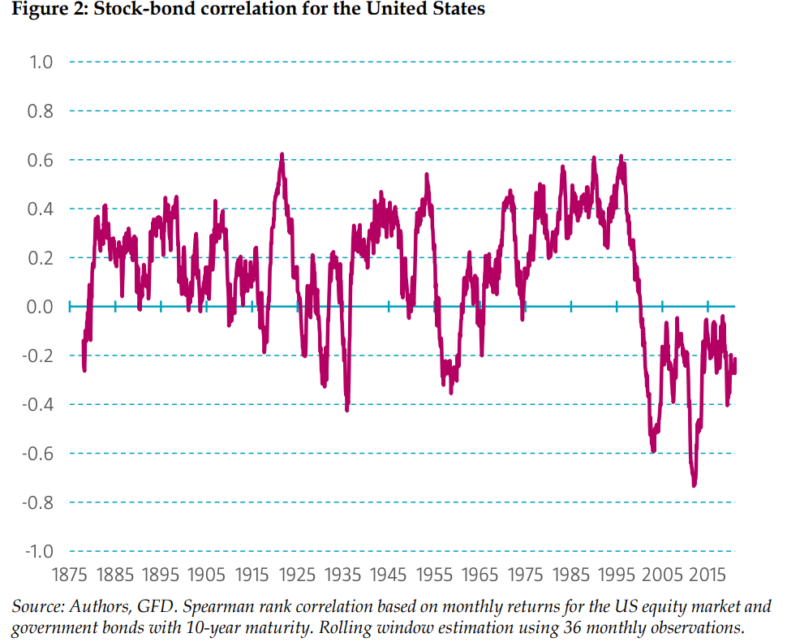

The correlation between stocks and bonds should be a critical component of any asset allocation decision, as it impacts not only the overall risk of a diversified multi-asset class portfolio but also the risk premia one should expect to receive for taking risk in different asset classes. The problem for investors is that the correlation between stocks and bonds fluctuates extensively across time and economic regimes.

Read more on Alpha Architect

UNDERSTAND FINANCIAL MARKETS

Why is Argentina’s economy such a mess? (The Economist – 13 min)

Rampant inflation, a booming black market for US dollars and crippling debt – welcome to Argentina, one of the world’s most dysfunctional economies. How did it end up like this?

HOW TO INVEST

Active Investing

FACTOR investing

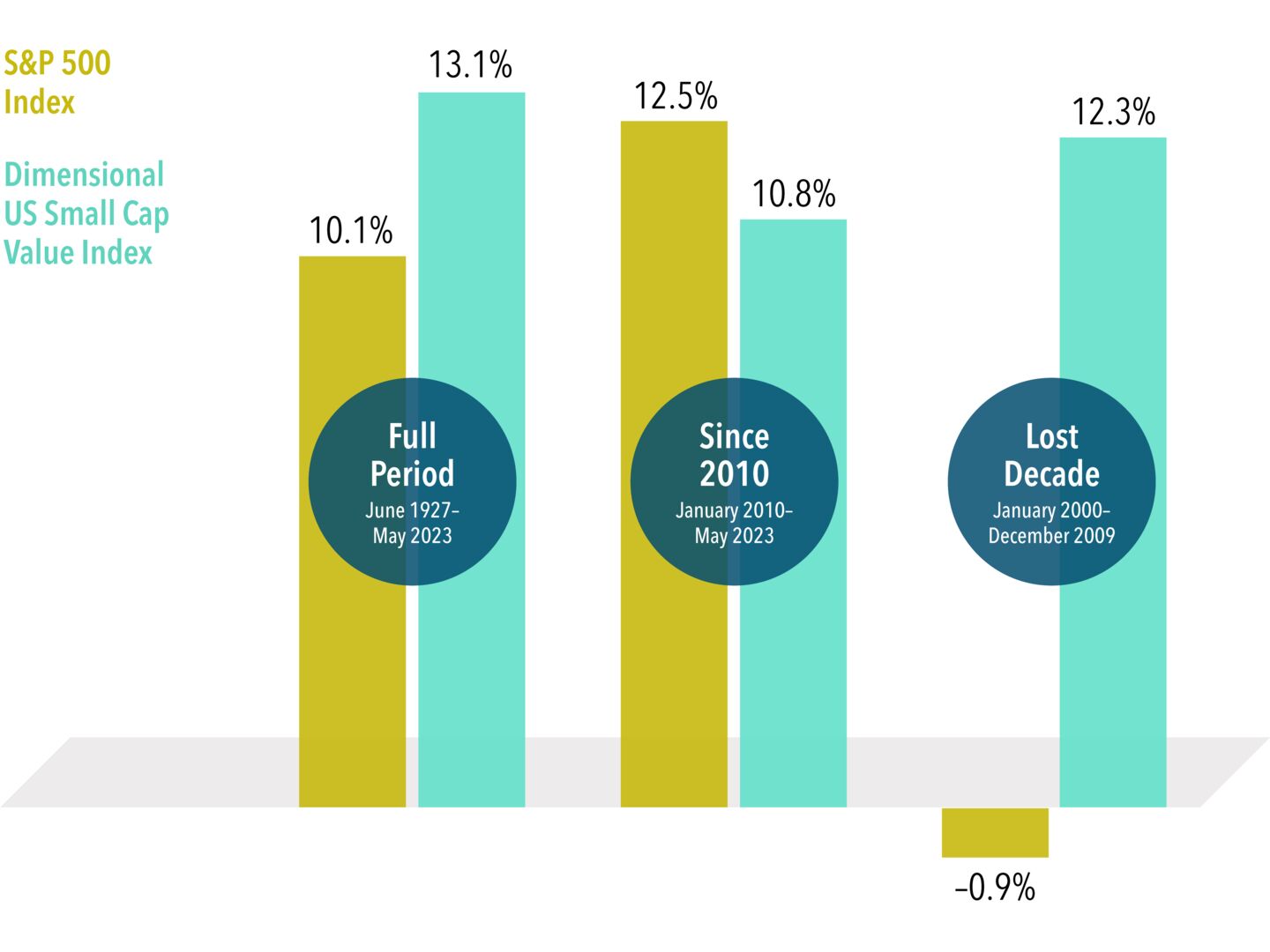

Anyone who’s ever bought a used car knows the importance of avoiding a cherry-picked depiction of history. Low mileage and regular oil changes don’t matter much if the seller fails to mention the car was once submerged in floodwater. Many investors have been drawn to the shiny-object stocks of the S&P 500 index on account of their recent performance—since 2010, the large cap S&P has outperformed US small cap value stocks by an annualized 1.7 percentage points. the decade of the dot-com bubble—had the lowest contribution from dividends of just 15%.

Read more on Dimensional

discretionary investing

ALTERNATIVE ASSET CLASSES

WALL STREET

How Traders Make Billions in The New Age of Crisis (The Tim Ferris Show – 2 hr 4 min)

Explore the world of chaos with Nassin N Taleb & Scott Patterson. Taleb is the author of a multivolume essay, the Incerto (The Black Swan, Fooled by Randomness, Antifragile, The Bed of Procrustes, and Skin in the Game), covering broad facets of uncertainty. His work has been published into 49 languages. Scott Patterson is an investigative reporter for The Wall Street Journal.

SUSTAINABLE investing

crypto

BAD BETS

The fake genius: a $30b fraud (James Jani – 1 hr 5 min)

Sam Bankman-Fried was supposed to be a billionaire genius running the world’s largest Crypto exchange: FTX. In only a few weeks, his $32B empire crumbled, leading to his arrest. In this video, we unravel one of the decade’s most significant cases of financial fraud.

Wealth Management

New UCITS ETFs

1. BlackRock iBonds ETFs. BlackRock has introduced five more iBonds ETFs, expanding the total to nine with maturities between 2025 to 2028. These ETFs offer exposure to IG corporate bonds across different countries and sectors, as well as US treasuries. The range now covers maturities in December of 2025, 2026, 2027, and 2028.

2. VanEck US Fallen Angel High Yield Bond UCITS ETF – VanEck has listed this ETF on the London Stock Exchange and Deutsche Börse Xetra. The ETF targets US dollar-denominated high-yield bonds formerly rated as investment grade and rebalances monthly with a TER of 0.35%.

3. WisdomTree Physical Ethereum – WisdomTree has activated staking in its Ethereum ETF. The product is named WisdomTree Physical Ethereum.

Personal Finance

Listen in as Preet provides a comprehensive overview of the current state of financial planning and shares his most intriguing findings before unpacking the policy and regulatory recommendations that emerge from his research. His research interrogates the value of financial advice within households and explores the pressing question of whether it’s worth getting it.

Early Retirement

FINANCIAL PRODUCTS

COST OF LIVING

Eminem on getting a Rolex (Academy of Wealth – 1 min)

You would think that people who have a lot of money don’t think twice before spending it & Song Oscar winning hip hop artist Eminem would probably fit in to this category. Well, maybe think again.

OUR Community

Question of the week

DESIGN YOUR LIFESTYLE

Personal Development

Arthur C. Brooks is the Parker Gilbert Montgomery Professor of the Practice of Public and Nonprofit Leadership at the Harvard Kennedy School and Professor of Management Practice. He speaks to audiences all around the world about human happiness and works to raise well-being within private companies, universities, public agencies, and community organizations.

Health & Wellness

CAREERS

TECH AND SCIENCE

Travel

Raph has travelled the world with his bike in tow & it is nstural for him to be asked numerous questions related to his adventures. “What did you think of China?” is one of these questions. The answers are complex but a day from his life on the bike can give you some flavour. The highlight of this trip to China is without any doubt the Qinghai Province. Logistically, China was also the most challenging country on a bike. Here is why.

miscellaneous

Inside Taiwan’s Strategy to Counter a Chinese Invasion (Wall Street Journal – 8 min)

For decades, Taiwan has looked to its east coast as a safe haven to survive a Chinese invasion until allies, particularly the U.S., can arrive to assist. In the east, Taiwan’s rugged mountain terrain also helps create a natural shield in the event of an attack. But China’s PLA activity on the island’s east has thrown that strategy into question. WSJ takes a look at how serious China’s threats to Taiwan’s east coast are and explores whether the island needs to change its defense strategy.

OUR Community

Last Week We asked you

How would you describe your current life situation?

SUGGEST AN ARTICLE

Thank you for reading.

Good Luck & keep’em* rolling!

(* Wheels & Dividends)

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🎁 Taking advantage of our affiliate links when setting up a broker account. This doesn’t increase your costs, and we often secure exclusive bonuses for our audience.

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.