Weekend Reading – How To Park Your Cash: Short-Term Investing Hacks

Weekend Reading is a collection of Investment Research and Lifestyle topics from all corners of the Web.We source the highest quality insights from Wall Street and Main Street that you may apply to your investment process. Unlike the rest of Bankeronwheels.com, this series is provided without additional guidance. As usual, everything is to be used at your own risk. Below is the type of content we shortlist.

Invest Wisely section is dedicated to research on how to invest for the Long Run using Passive Investment Strategies. Read Topics related to (i) Portfolio Construction and Asset Allocation (ii) Acting wisely by avoiding behavioural traps and also (iii) publications that help understand how financial markets work.

Active Investing section relates to improving your knowledge about active investing. If you decide to sin, then sin only a little. Given ample evidence, combined active bets should be ideally a relatively small fraction of your portfolio. This section also includes Sustainable Investing. You can invest in a Socially Responsible way, but there are many ESG traps. Learn how to invest sustainably, and what it means for expected returns, with our definitive guide to sustainable investing.

Personal Finance section is dedicated to UK and European Products. It can also touch on other European jurisdictions outside the Euro-zone.

The one thing I will tell you is the worst investment you can have is cash. Everybody is talking about cash being king and all that sort of thing. Cash is going to become worth less over time… Cash is a bad investment over time.

Warren Buffet

INVEST WISELY

CONSTRUCT YOUR PORTFOLIO

Have you ever considered matching bond cash flows with a life event, such as buying a house or covering kids’ tuition fees, using an ETF iBonds act like regular Bonds. The ETF will mature, and you will be repaid at a predetermined date. However, they offer several ETF advantages over regular bonds – they trade like stocks, are diversified, and don’t require high investment amounts to get started. So, who should buy them, and how do they work?

-

How to Use Cash in a Portfolio (Morningstar)

-

The 60/40 Portfolio is Alive & Well (A Wealth of Common Sense)

-

Put Down the Dividends and Slowly Back Away (Excess Returns – 31 min)

-

Dodging Dividend Disaster (Pension Craft – 18 min)

-

In conversation with Itzhak Ben – David on ETFs & their role within your portfolio (Rational Reminder – 1 hr 25 min)

-

Fun with Funds (Italian Leather Sofa)

UNDERSTAND FINANCIAL MARKETS

Cash is a terrible long-term investment, even at 5% interest (Ben Felix Podcast – 8 min)

With a 5% return on cash, why would anyone want to invest in stocks? True that cash feels good because its nominal value is stable – it feels safe, but is it counterintuitively extremely risky for long-term investors?

Lets find out!

HOW TO INVEST

-

In conversation with Vanguard CIO on forecasting, diversification (Ritholtz – 1 hr)

-

Aspects of investing that often go unsaid and underappreciated (Investment Talk)

-

Not Even The Machines Are Rational (Joachim Klement)

-

Do Major Projects and Investment Decisions Go Wrong for the Same Reasons? (Behavioural Investment)

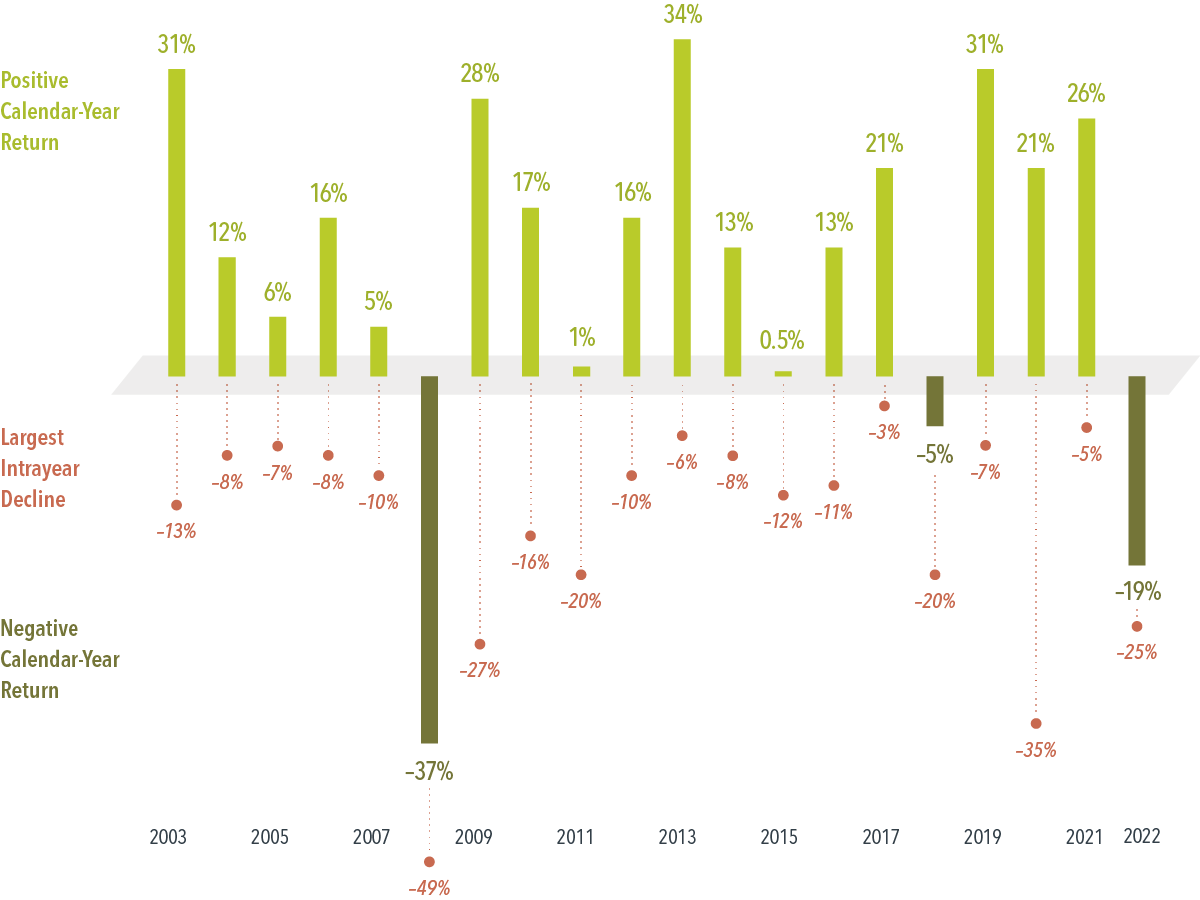

Stock market slides over a few days or months may lead investors to anticipate a down year. But the US stock market had positive returns, despite some notable dips in many of those years. The truth is, volatility is a normal part of investing. Tumbles may be scary, but they shouldn’t be surprising. In fact, a long-term focus can help investors keep perspective.

Read more on Dimensional Funds

Active Investing

FACTOR investing

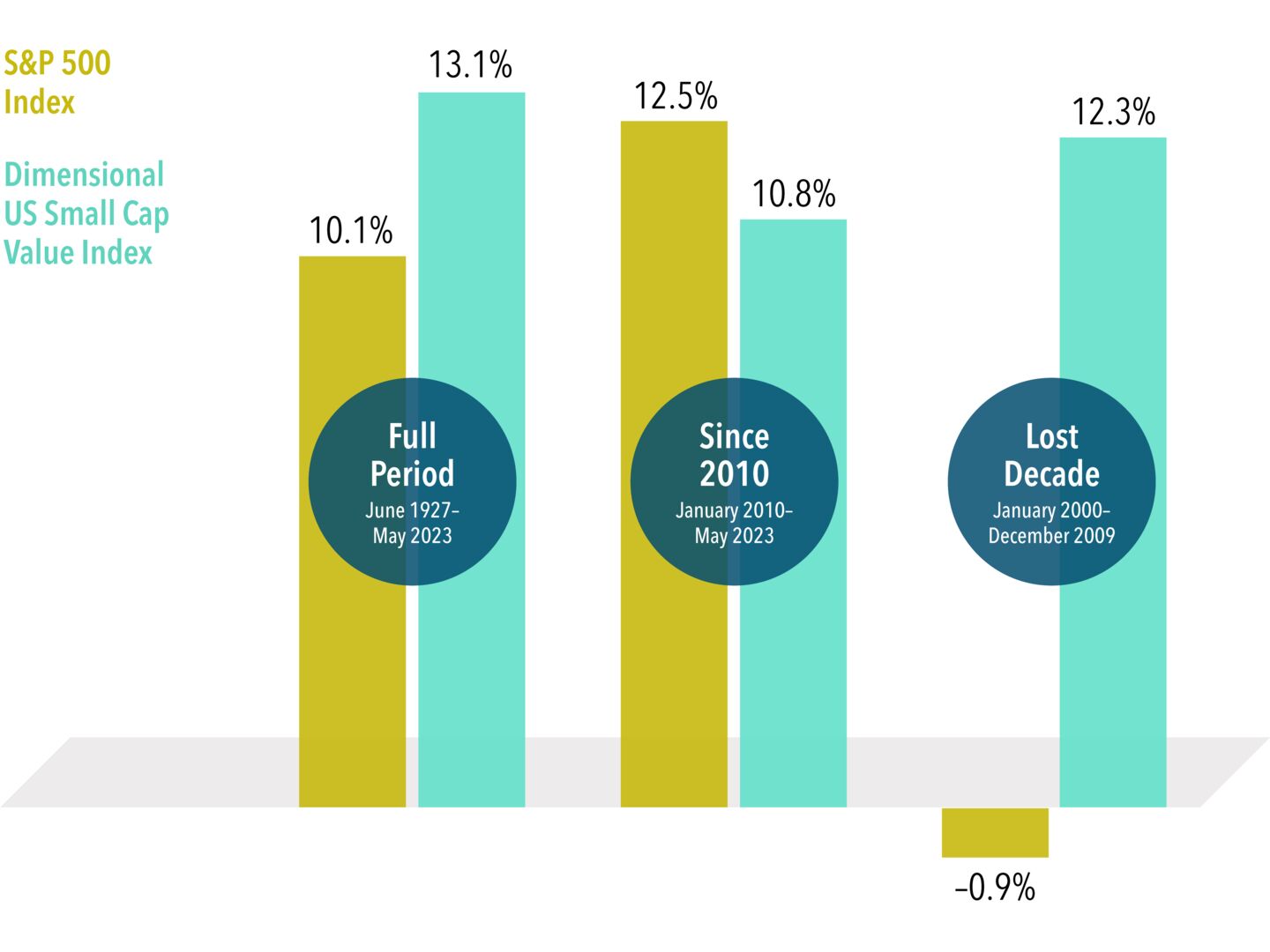

Anyone who’s ever bought a used car knows the importance of avoiding a cherry-picked depiction of history. Low mileage and regular oil changes don’t matter much if the seller fails to mention the car was once submerged in floodwater. Many investors have been drawn to the shiny-object stocks of the S&P 500 index on account of their recent performance—since 2010, the large cap S&P has outperformed US small cap value stocks by an annualized 1.7 percentage points. the decade of the dot-com bubble—had the lowest contribution from dividends of just 15%.

Read more on Dimensional

discretionary investing

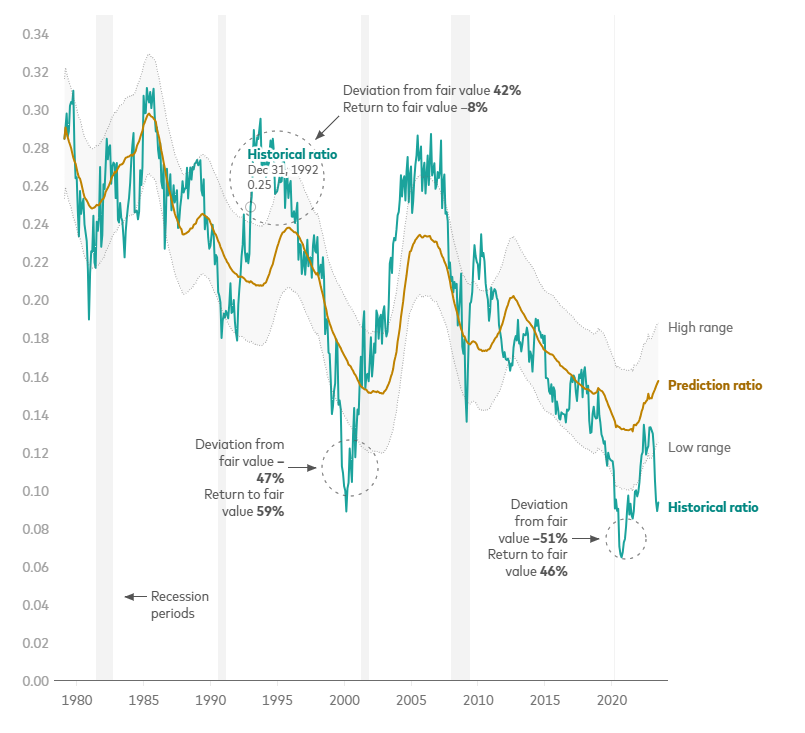

As measured by the Standard & Poor’s 500 Index, U.S. stocks have risen more than 20% since they hit a trough in mid-October 2022—a dismal year that brought the S&P 500’s worst calendar-year decline since 2008 but just its second loss in 14 years. They’ve roughly doubled in value since the pandemic-induced low of March 2020. The extent and pace of the gains are enough to make the wary equity investor wonder: Where is there opportunity in the U.S. stock market?

Read more on Vanguard

Aswath Damodaran is the ‘Dean of Valuation.’

For almost four decades, he has been teaching valuation at NYU. He also teaches millions of people online.

Here are 7 Key Valuation Lessons from him

Read more on Twitter

ALTERNATIVE ASSET CLASSES

Is the UK housing market going to crash? (Pension Craft – 21 Min )

If we combine the cost of living crisis, soaring interest rates, and sky-high prices, it seems as if the UK housing market is set up for a big crash. This video looks at the reasons for and against an impending crash. And, also gives you some forecasts for UK house prices.

WALL STREET

Throwback- Buffet’s First Televison Interview (Value Theory – 8 min)

Before he was the sage of Omaha, he was relatively camera shy. Yet, the universality of his simple investing strategy was as evident as it is today. Tune in for an insightful walk down memory lane as he talks: The most important quality of an investor and What he does that’s different to 90% of investors.

SUSTAINABLE investing

crypto

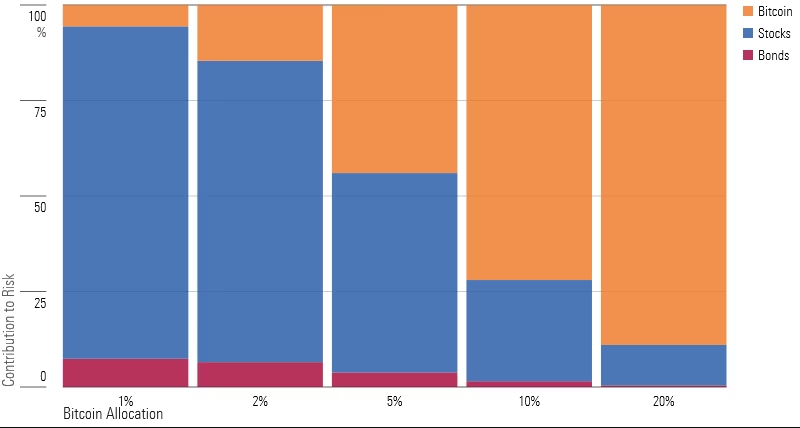

Bitcoin Index posted a 76.4% return through July 2023 in defiance of the gloomy narratives that haunt the rest of the cryptocurrency ecosystem. The trusty balanced portfolio has also beaten expectations as of late. So far in 2023, risk has paid handsomely. That fact may leave many investors wondering whether to add some extra firepower to their portfolio in the form of an allocation to bitcoin.

Read more on Morningstar

BAD BETS

PERSONAL FINANCE

Wealth Management

Early Retirement

Cody Garrett is an advice-only financial planner passionate about helping families refine their path to financial independence (FI) as DIY investors. Cody specializes in comprehensive financial plan development, topic research, and personalized financial education.

On this podcast, he joins John Luskin to talk all things early retirement!

FINANCIAL PRODUCTS

COST OF LIVING

OUR Community

Question of the week

DESIGN YOUR LIFESTYLE

Personal Development

Justin Gary is an award-winning designer, author, speaker, and entrepreneur. He is CEO of Stone Blade Entertainment and creator of the innovative and award-winning Ascension deck-building game series. Explore the path less travelled, the phenomenon of magic, how analytical people can become creative people & much more!

Health & Wellness

CAREERS

TECH AND SCIENCE

Travel

Raph has travelled the world with his bike in tow & it is nstural for him to be asked numerous questions related to his adventures. “What did you think of China?” is one of these questions. The answers are complex but a day from his life on the bike can give you some flavour. The highlight of this trip to China is without any doubt the Qinghai Province. Logistically, China was also the most challenging country on a bike. Here is why.

miscellaneous

Inside Taiwan’s Strategy to Counter a Chinese Invasion (Wall Street Journal – 8 min)

For decades, Taiwan has looked to its east coast as a safe haven to survive a Chinese invasion until allies, particularly the U.S., can arrive to assist. In the east, Taiwan’s rugged mountain terrain also helps create a natural shield in the event of an attack. But China’s PLA activity on the island’s east has thrown that strategy into question. WSJ takes a look at how serious China’s threats to Taiwan’s east coast are and explores whether the island needs to change its defense strategy.

OUR Community

Last Week We asked you

How would you describe your current life situation?

SUGGEST AN ARTICLE

Thank you for reading.

Good Luck & keep’em* rolling!

(* Wheels & Dividends)

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🎁 Taking advantage of our affiliate links when setting up a broker account. This doesn’t increase your costs, and we often secure exclusive bonuses for our audience.

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.