A bombshell week is coming up, featuring rate decisions in the United States, Eurozone, and Japan. The Fed is likely to ‘pause’ according to market pricing, but the decision might ultimately depend on the inflation stats that will be released the previous day, fueling volatility in the dollar. By contrast, there isn’t much scope for surprises in Europe or Japan, leaving those currencies mostly in the hands of other forces.

Split Fed decision?

It will be a difficult decision for Fed officials on Wednesday. By most indications, the US economy is in good shape. The labor market is firing on all cylinders, economic growth is on track to hit 2% this quarter, the housing sector has staged a recovery, and the resilience in demand means that core inflation continues to burn hot.

Hence, the economic data pulse argues for another rate increase next week, although some Fed officials have expressed caution. Led by Chairman Powell, there is a large group within the FOMC that favors “skipping” a rate increase this month, effectively postponing the decision until July.

One of the main elements behind this ‘take it slow’ approach is that the Fed has already raised rates by 5% since last year. The full impact of all this tightening hasn’t been felt yet, and unleashing even more could inflict unnecessary damage on the US economy. Hence, several Fed officials would like some extra time to examine incoming data.

The sharp slowdown in the manufacturing sector has amplified these concerns. Manufacturing is usually seen as a leading recession indicator, so this is worrisome. But in this case, the manufacturing weakness might reflect a hangover following the pandemic boom, as consumption globally switches from goods towards services. As such, it doesn’t seem too scary.

Markets currently assign a 25% probability for a rate increase next week, which increases to 80% for the July meeting. What might influence these percentages though, and the Fed decision itself, is the CPI inflation report on Tuesday.

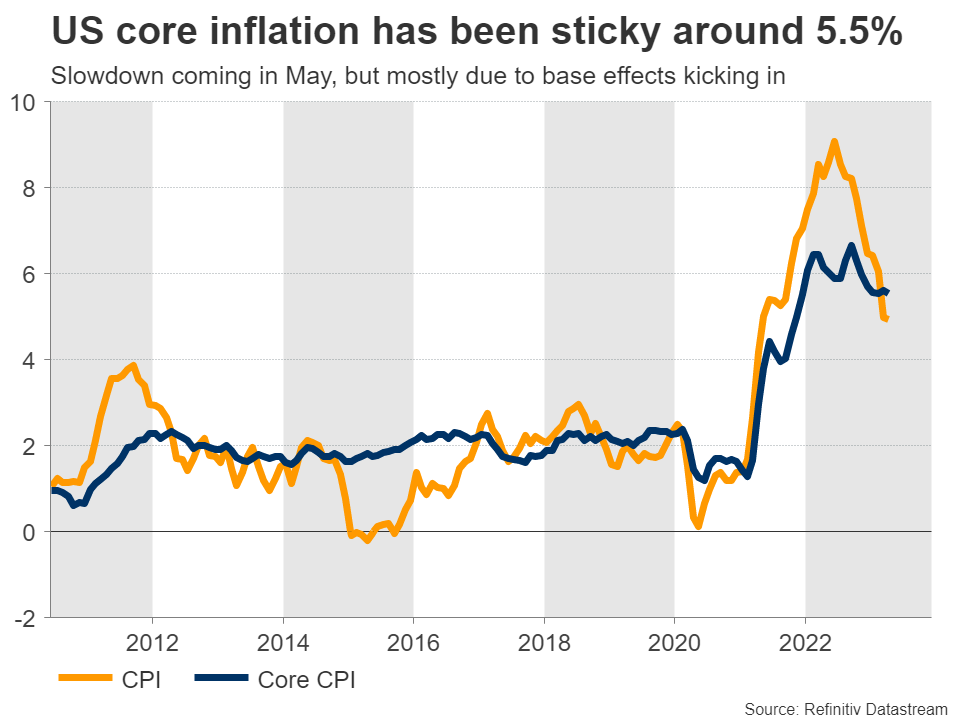

Both headline and core inflation are likely to have cooled in May on a yearly basis. Yet, that’s mostly mechanical, as some very hot prints from last year will be dropping out of the 12-month calculation. In other words, this is probably a story of base effects, not an ‘organic’ cooldown in inflationary pressures.

As for the Fed decision, it might be a split affair, with a few officials voting for a rate increase but most of them voting for no action. The camp that favors a ‘pause’ is larger and more influential, so that’s the most likely endgame.

Such an outcome might hurt the dollar initially, although whether any weakness persists will depend on the rate projections in the new ‘dot plot’ and Powell’s commentary. If he keeps the door wide open for July, the dollar could bounce back quickly.

In other releases, producer prices for May are due out Wednesday ahead of the Fed decision, while retail sales for the same month are out Thursday.

ECB set to hike despite technical recession

Over in the euro area, the main event will be the European Central Bank meeting on Thursday, where markets have fully priced in a 25bps rate increase. Therefore, the euro’s reaction will depend mostly on any messages about future moves, not the rate hike itself.

The Eurozone economy has fallen into a technical recession according to the latest revised GDP figures, as the troubles in the manufacturing sector left their marks on Germany. Meanwhile, inflation finally seems to be cooling, something reflected in the latest CPI data.

With economic growth rolling over and inflation moderating, it’s likely that the ECB will preach caution and patience. The economy is already contracting and the last thing the central bank wants is to pour gasoline on the recessionary fire.

Market pricing suggests another rate hike is in the pipeline for July, but under these circumstances, the ECB is unlikely to validate that. Officials probably want to keep their options open, and if they signal that they could ‘take a break’ next month, that might come as a disappointment for the euro.

BoJ to bide its time

Wrapping up the week will be the Bank of Japan on Friday. Looking at economic data alone, it’s tempting to speculate that some tightening is warranted. Economic growth turned positive in Q1, inflation is near its highest levels in three decades, and the outlook for wage growth has brightened after the results of the spring wage negotiations.

However, the BoJ is not convinced this is sustainable. Governor Ueda has warned that inflation would likely cool off later this year and that it’s doubtful whether the victories on the wage front will persist. Additionally, the BoJ is concerned about a global slowdown that inflicts collateral damage on Japan.

It’s essentially a game of patience. The BoJ wants credible evidence that inflation will remain sustainably above 2% before it phases out its massive stimulus, so any policy tweaks might take some time. Simply waiting until July would allow policymakers to access new economic forecasts, which makes that meeting a more realistic candidate for any tightening decisions.

This means that for now, the yen is mostly at the mercy of external forces, namely how foreign central banks act and how global risk sentiment evolves, given its status as a safe haven.

British and Chinese data releases

Elsewhere, it will be a busy week in terms of economic data, starting with monthly GDP data from the UK on Wednesday. Then on Thursday, there will be a deluge of releases from China that include retail sales and industrial production.

Amid signs that the Chinese economy is losing steam as the manufacturing downturn deepens, these figures will be closely watched and could impact commodity-linked currencies like the Australian and New Zealand dollars.

Those economies will also be on the receiving end of crucial data, with Australia’s monthly jobs report and New Zealand’s quarterly GDP numbers both hitting the markets on Thursday as well.