In this final part, we try to bring it all together by offering thoughts on “framing the wealth management experience,” make an argument for the role of outsourcing and then close with some summary thoughts and perspectives. So, here we go.

Framing the Wealth Management “Experience”

Advisors know they often need to wear multiple “hats” to deliver a superior wealth management solution. These hats are critical to running their business. But the burden of all these hats can make an advisor feel like the business is running them.

This begs the question: which “hats” are most important?

A framework based on Maslow’s hierarchy of needs can help answer this.1

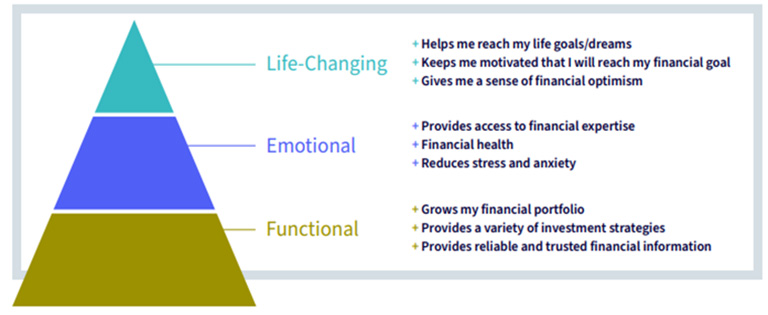

Maslow’s hierarchy of needs helps us understand human motivations. We’ve adopted Maslow’s traditional “hierarchy of needs” pyramid into an “Advisor Value Pyramid.” This illustrates the value clients put on the products and services advisors offer.

With Maslow, the functional needs at the bottom of the pyramid are food and shelter. With investors, the functional needs are related specifically to their portfolios. Once these needs are met, they look to advisors to help meet their “emotional” and “life-changing” needs.

Research suggests that, with an advisor’s in-depth knowledge of their clients, they are the only ones who can deliver these emotional and life-changing values. This is in stark contrast to functional needs, where leveraging software and third-party expertise is more practical.

Using Maslow’s hierarchy of needs as a framework, advisors should assess where their time is best spent within the Advisor Value Pyramid. The goal is to offload as many “hats” as possible related to the functional level and spend more time delivering the emotional and life-changing services clients value most.

For example, many advisors use model portfolios to satisfy functional needs. Leveraging the expertise of third-party managers achieves the clients’ functional needs of “grows my financial portfolio” and “provides a variety of investment strategies,” as referenced in the Pyramid.

The Argument for Outsourcing

All the trends identified and discussed in this article point to an inevitable conclusion—the outsourcing of wealth management services will increase dramatically in the coming years.

Consider the benefits of outsourcing in comparison to the alternative methods for creating a successful wealth management solution (i.e., building it organically or buying it via acquisition):

- It allows firms to focus on business development and client relationship management while still delivering “best market practices.”

- Partnering with proven providers allows a wealth management firm or practice entering this highly competitive space to “hit the ground running.”

- It may actually maximize net profitability by reducing operational, staffing and compliance requirements.

- It allows the firm’s internal focus to be on professional development and education.

- It allows the RIA or wirehouse practice to quickly evolve away from suboptimal legacy systems and service platforms.

Consider the findings of several industry surveys:

- Advisory focus on “the client experience” results in a 93% higher median client size.2

- Advisors who outsource at least 90% of their assets save an average of 8.4 hours per week on investment management.3

- (1) 90% of investors welcome third-party models in their portfolios; (2) 70% of investors believe third-party models will help improve their portfolio performance; and (3) 75% fewer investors would consider leaving their advisor if they used third-party models.4

- More than 50% of advisors currently outsourcing their investment management have reported a decrease in operating costs since they began outsourcing, with 40% seeing declines in costs of 5% or more.5

- More than 80% of advisors reported both stronger client relationships and increased client retention as a direct result of outsourcing; 67% of all advisors increased the number of client referrals.6

- Advisors who outsourced experienced financial benefits: 1) 77% reported an average of 27% growth in assets; 2) 72% reported an average of 26% higher personal income; and 3) 67% reported an average of 17% lower operating costs.7

- Advisory practices that dedicate 70%+ of their time to client service and asset gathering report 3.5x the number of new clients and 2x the asset growth of those that don’t.8

The Wealth Management Experience

The current and future state of the wealth management industry can be summarized as follows:

- HNW families increasingly demand an objective and consultative wealth management solution.

- There are very few products and services that cannot be outsourced effectively.

- It will be increasingly difficult to differentiate yourself based on an investment product, as there are so many institutional-quality outsourced solutions available.

- Technology improvements will allow an ever-more-seamless delivery of outsourced products and services.

- Niche players will continue to develop as outsourced service providers—specialization means differentiation and higher margins.

Wealth management is now in a post-product, post-service stage of development. Wealth management is now a design industry. Think of Starbucks, Disney, Apple, Whole Foods, Nordstrom and the Four Seasons and Ritz-Carlton hotel chains—what do they have in common?

Do they sell a quality product? Absolutely. Do they deliver quality service? Of course. But what sets them apart—and allows them to charge a premium price—is the overall experience clients enjoy in dealing with these firms.

So how does this translate to the wealth management industry? What is the appropriate wealth management experience? In a highly competitive marketplace where products are widely and cheaply available and where everyone claims to offer excellent service, offering a wealth management experience means having the most talented people operating as a team in the most conducive environment and delivering a “best of strategies” solution to specific client needs.

The wealth management practice that can capture this experiential magic in its wealth management offering will be the firm that succeeds.

1 Maslow’s hierarchy of needs is a motivational theory in psychology consisting of a five-tier model of human needs, often depicted as hierarchical levels in a pyramid. See, for example: https://www.simplypsychology.org/maslow.html

2 See: https://www.thinkadvisor.com/2018/12/20/advisors-focused-on-client-experience-have-93-bigger-clients-cerulli/

3 “Impact of Outsourcing” whitepaper by AssetMark and ©2020 BlackRock, Inc. All rights reserved. Quoting: Cerulli Associates, “U.S. Advisor Metrics 2018: Combatting Fee and Margin Pressure.” Time savings estimation assumes 20% time savings x a 45-hour work week x 50 weeks per year = 450 hours saved.

4 WisdomTree proprietary research: https://www.wisdomtree.com/investments/mac/client-research

5 See: https://f.hubspotusercontent40.net/hubfs/2512747/Impact%20of%20Outsourcing%20-%20AssetMark%20Study.pdf

6 Ibid.

7 Ibid.

8 See: https://docplayer.net/42941077-The-value-of-time-quantifying-how-client-focus-increases-the-value-of-your-business.html

]]>