‘Should I invest in gold?’

Well, it’s an intriguing question.

Just the other day, I was talking to a Wealth Morning Managed Accounts client, and she asked me for my honest thoughts on the matter.

You see, her friend had just bought a gold bar. Her friend’s idea was to hide the precious metal in a secure location on her property. Possibly bury it in her backyard.

Her friend urged her to do the same: buy gold bullion. Hide it like treasure. For the sake of posterity.

But my client was unsure. It sounded like a lot of work. So she wanted to run it by me first.

‘Should I invest in gold?’

Well, indeed, this is an interesting subject to consider.

What does my client stand to gain if she invests in gold? And…what does she stand to lose if she decides not to? Or…is this issue actually more complicated than it first appears to be?

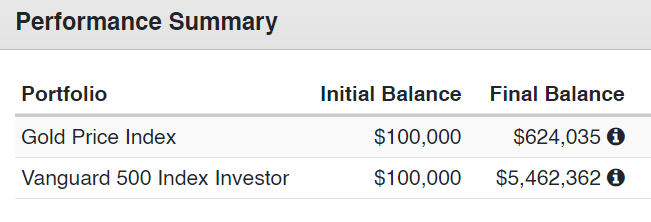

The true cost of holding gold over 38 years

Out of curiosity, I decided to investigate this matter further.

I used historical data to build a graph. And I used it to construct a split test.

Here’s what it looks like:

- Team Blue — this line measures the return on investment for gold, as represented by the Gold Price Index.

- Team Red — this line measures the return on investment for the stock market, as represented by the Vanguard 500 Index Investor (which tracks the S&P 500).

- To start with, I used an investment amount of $100,000. And I set the time horizon to run from January 1985 to January 2023. That’s 38 years.

So…in this split test…who will prevail in the end?

Team Blue or Team Red?

And…what will the margin of victory be?

Well, I crunched the numbers. And the final moment of truth actually surprised the heck out of me:

Source: Portfolio Visualizer

I must admit. I’m staggered by this result. The divergence in value between Team Blue and Team Red is huge.

So, here’s the final tally:

- If you had invested $100,000 in gold in January 1985, it would be worth over $620,000 by January 2023.

- Meanwhile, if you had invested $100,000 in the S&P 500 in 1985, it would be worth over $5.4 million by January 2023.

It’s unanimous. Team Red is the winner. By a huge margin.

Now, when I take a closer look at the numbers over 38 years, I find them to be incredibly revealing:

- The annualised return for gold is 4.93%.

- The annualised return for the S&P 500 is 11.08%.

- Because of compounding, this difference becomes larger and larger over the years.

- Eventually, the final divergence is gigantic.

So, from January 1985 to January 2023, if you had invested $100,000 into gold, choosing to forego the stock market, you would have missed out on some serious profits.

Your total opportunity cost?

Over 775% in compounded growth — or over $4.8 million.

The difference is mind-blowing.

Time to diversify beyond gold?

Look, I get it. Gold is sexy. Always has been.

The ancient Egyptians called it the flesh of the gods.

It’s hard to escape the mythical allure of it.

Source: National Geographic

These days, the people who buy the precious metal — goldbugs — often cite the following reasons for their love affair with bullion:

- It’s a store of value.

- It’s a hedge against inflation.

- It’s a safe-haven asset.

During times of political turmoil and economic uncertainty, the price of gold seems to act as fear index. Some people rush to buy it because they think it will be the last solid asset class standing when the dust clears.

But…such emotions can often be at odds with reality.

In the case of my client’s friend — yes, the one who made the decision to hide gold on her property — she was filled with fear because of what she had seen in the news headlines.

I can’t say I blame her.

If the media is to be believed, a total meltdown of civilisation as we know it is going to happen any day now.

Source: Wallpapers Wide

Think Fallout.

Think Mad Max.

Think The Last of Us.

But…does the media exaggerate?

Well, years ago, my former university lecturer told me something that has always stayed with me: ‘The news is the news because it’s something that almost never happens.’

In other words, the news exists to appeal to our negativity bias.

In fact, we now live in an age of fragmented media and short attention spans. Journalists are hungry for eyeballs. They understand that negative headline can get up to 63% more clicks than a positive one. And more clicks mean more ad revenue. Ka-ching!

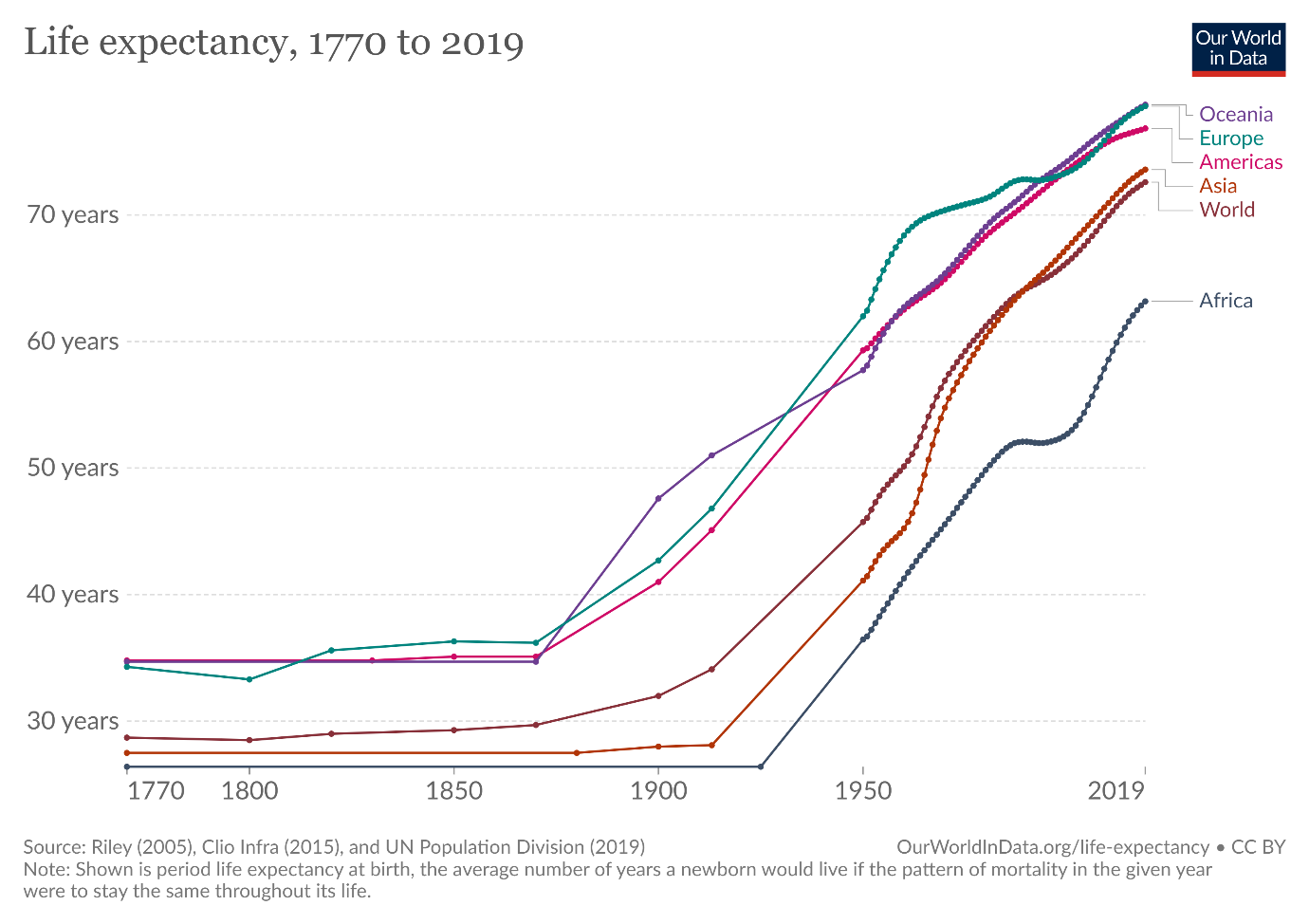

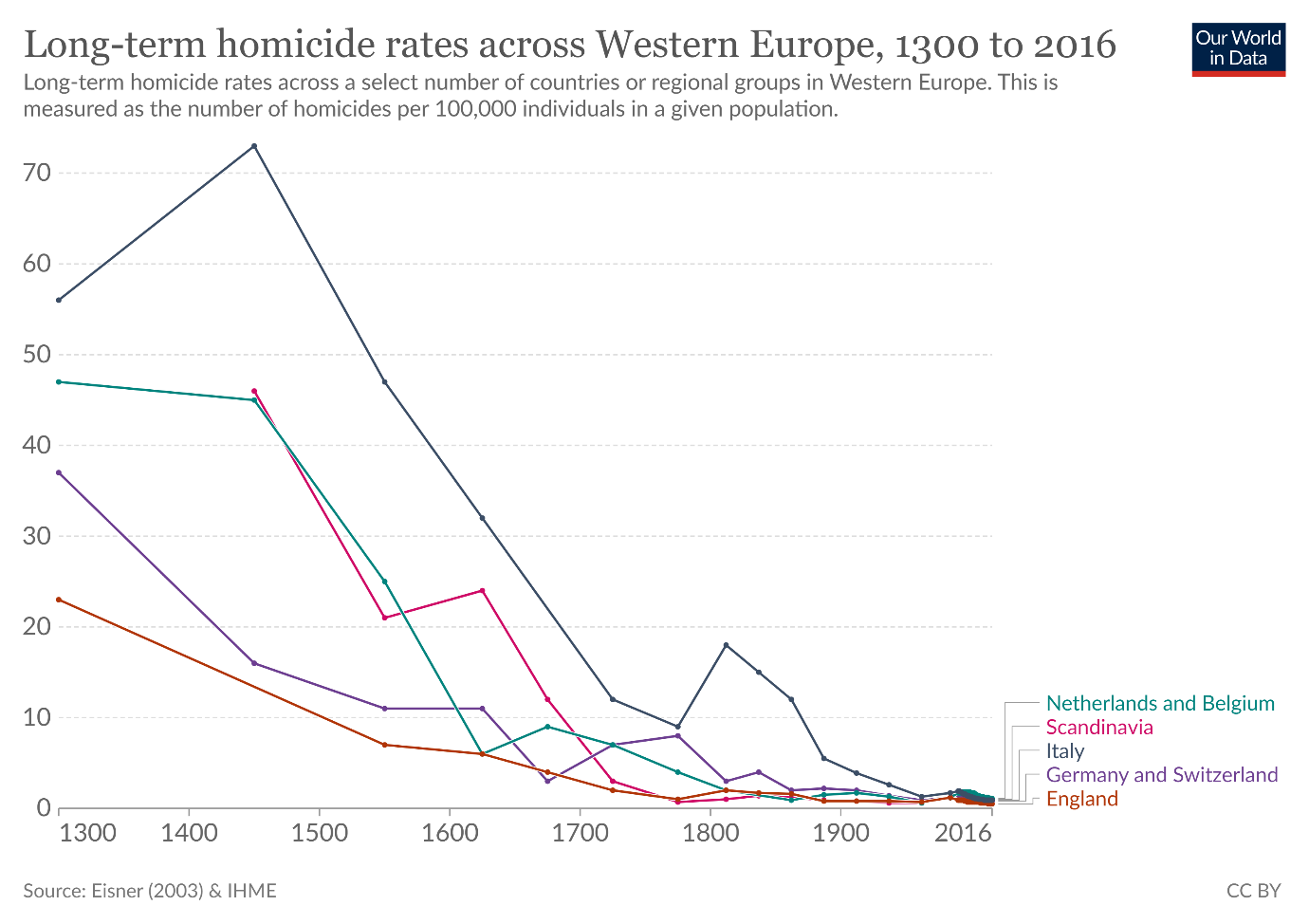

So it’s clear that positivity doesn’t sell the news — even though positivity is what the long-term trend for humanity looks like.

I’ve shared this before, but it’s worth repeating again:

Source: Our World in Data

Source: Our World in Data

Source: Our World in Data

When you look at the last 5,000 years of our recorded human history, you can see that the world is safer and healthier today than it has ever been:

- In 1770, the average life expectancy of a human being in the Western world was around 35. In 2019, it’s well over 70.

- In 1820, the number of people living in extreme poverty was 89% of the global population. In 2015, it’s only 10%.

- In 1800, the number of people who couldn’t read and write was 88% of the global population. In 2016, it’s only 14%.

So…humanity is resilient. Perhaps more resilient than we give it credit for.

No war, no virus, no recession will keep humanity down for too long.

People will continue creating businesses. Continue solving problems. Continue generating wealth.

They will adapt. They will improvise. They will overcome.

Now, provided that you believe that the sun will keep on shining and the birds will keep on singing — which I certainly do — it makes sense to broaden your investment options.

Here’s what you should consider:

- The stock market has outperformed not just gold, but bonds and real estate over the long-term.

- The stock market offers immediate diversification across multiple sectors.

- The stock market offers both growth and income.

Of course, I’m not saying that you shouldn’t invest in gold at all. Nor am I saying that gold is not useful. Rather, I’m saying that adopting a more holistic view of investing can be helpful for your long-term wealth.

For example, it’s possible that investing in a gold-mining company may offer more practical advantages than holding physical gold alone. Investors may benefit from receiving a dividend yield as income. And if the price of gold does go up, the stock value of a mining company will tend to rise as well, which is a bonus.

So, ultimately, is this better than hoarding gold in your backyard?

Well, you be the judge.

Regards,

John Ling

Analyst, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice.)

The post Warning: Don’t Buy Gold Until You Read This appeared first on Global Opportunities Beyond the Radar.