Vanguard LifeStrategy Review – A Retriever In A Babushka Doll

Your friend’s stock first skyrocketed, then hit a plateau, and ultimately lagged behind the market. Sound familiar? That’s because it’s a tale as old as time. He’s now so attached to it, he can’t bear to sell. Imagine a world where he didn’t agonise over every buy or sell.

A world without the balancing act of portfolio rebalancing.

He probably hasn’t even heard of Vanguard LifeStrategy. And with the hefty fees his financial advisor charges, that’s hardly surprising.

Enter a quasi Golden Retriever Portfolio in a single fund. Let’s dive into why every investor should at least give it a glance.

KEY TAKEAWAYS

- All-in-One Solution: Combine Equities and Bonds with an annual fee of 0.25% in Europe and 0.22% in the UK.

- Tax, Time and Cost-Efficient – Portfolio rebalancing can trigger tax events and transaction fees. Automatic rebalancing within Lifestrategy Funds does not involve either.

- Know Your Fund: In the UK, Vanguard Lifestrategy is available in Mutual Fund format. In Europe, the funds are UCITS ETFs. UK Investors can also benefit from them.

- UCITS ETFs Are Truly Passive – Equities include market allocations to different countries. Bonds are currency-hedged to EUR.

- UK Mutual Funds? There’s a Home-Bias. We don’t like the fact that 25% of Equities is allocated to the UK, vs a 4% UK market share in Global Indices.

- Choose Your Risk – ETFs exist with 20%, 40%, 60% and 80% Equity allocation.

- What’s the reward? Long Term expected returns range from 3.9% to 7%. Inflation-adjusted returns are expected to be between 1.5% and 4.6%.

- Understand the limitations – Lifestrategy Funds aren’t target funds. Think also about tailoring your asset allocation, to protect from a 1970s scenario? It all depends on your investment horizon and risk appetite.

Here is the full analysis

The Magic of Fund-of-Funds

It may help someone you know

The Babushka doll Concept

Learn more about these funds to help a family member when they ask about the best investment. Whether it’s a bull or a bear market, it could save them lots of money.

Until 2020, it was fairly easy to buy the Equity portion of a Golden Retriever portfolio – a Global ETF. But combining it with bonds in one fund was not possible. At least not in Europe. Bonds can reduce your family member a lot of stress.

Today, the Babushka doll also includes the Bond portion of a Golden Retriever Portfolio.

But Why Not Yourself?

It may not necessarily be your cup of tea – I get it. Some investors like flexibility.

While the these ETFs may not fulfil all your needs, they can still serve as the backbone of your portfolio. You can then add other investments around this core fund.

Should you consider theM?

Here are some typical use cases, and two considerations explained in more detail that may not be obvious.

Potentially suitable

potentially NOT Suitable

-

You want an established and reliable ETF provider -

You are looking for simplicity, cost-efficiency -

You don’t want to rebalance your portfolio -

You want to potentially lower taxes

-

You want to customise your portfolio or tax situation -

You want to reduce TER to the absolute minimum -

You want another asset allocation, e.g. a gliding path allocation -

If you’re a UK Investor, and don’t like a home bias

Potentially suitable

-

You want an established and reliable ETF provider -

You are looking for simplicity, cost-efficiency -

You don’t want to rebalance your portfolio -

You want to potentially lower taxes

Potentially NOT Suitable

-

You want to customise your portfolio or tax situation -

You want to reduce TER to the absolute minimum -

You want another asset allocation, e.g. a gliding path allocation -

If you’re a UK Investor, and don’t like a home bias

If you are a Tax alpha harvester

What is Tax Alpha?

- Rebalance with Ease: Lifestrategy Funds rebalance themselves. What’s that mean for you? Underperformers get bought, while high-flyers get trimmed.

- Avoid the Tax Sting: But usually, such moves mean capital gain taxes. Lifestrategy’s magic? Rebalancing happens internally, within the fund. So, kiss those tax events goodbye!

- Cherry on top: There are also zero trading commissions and no time wasted. It’s all on autopilot.

If you want to retire in southern europe

As we will see, UK Funds have a home bias. But, the European ETFs are hedged to EUR.

Are there still use cases for UK investors and those that are outside the Euro-zone? Potentially yes.

- Think UK investors are out of the UCITS game? Not if you’re planning a sun-soaked retirement in Marbella. ETFs might be your ticket over UK Mutual Funds.

- And for Our Continental Friends: Let’s say you’re Polish, but Sicily’s calling your name for those golden years. With Bonds set in EUR, your future’s looking bright (and sun-drenched).

Be Careful, there are two Fund Types

Global availability

Vanguard LifeStrategy Funds aren’t newbies:

- Anglo Roots: US got them in ’94. UK in 2011. Canada? 2018. All in Index Mutual Fund format.

- European ETF Twist: Europe got a taste of them in 2020, but with a twist – as UCITS ETFs.

Mutual Funds vs. ETFs: What’s the Deal?

- An ETF (Exchange Traded Fund) – is a basket of securities that you can buy or sell on a stock exchange throughout the trading day at fluctuating prices, much like individual stocks. It can contain both Global Equities and Bonds.

- A Mutual Fund – pools money from many investors to purchase Global Equities and Bonds , but its price (or NAV) is determined only once at the end of the trading day.

So, ETFs may incur a broker commission but are more liquid. Outside of that, you could be getting the same exposure. They can both hold the same Stocks and Bonds, and have the same returns.

European ETFs vs UK MUTUAL FUNDS

| Characteristic | UCITS ETF | UK Mutual Fund |

|---|---|---|

| Available To | UK and EU Investors | UK Investors |

| Traded on Exchange | Yes | No |

| Fund Pricing | Contiunous | End of Day |

| Trading Commission | Yes | No |

| ETF Management Fee | Yes | Yes |

Source: Bankeronwheels.com

Are you buying a bulldog Or a retriever?

But Are Lifestrategy Mutual Funds and ETFs really the same?

UK Mutual Fund Babushka

UCITS ETF Babushka

UK MF Babushka

ETF Babushka

You’d think Vanguard might house identical Golden Retrievers inside each Babushka. That’s an elegant blend of Global Stocks and Bonds.

But here’s the twist: Vanguard had other plans.

For some reason, Vanguard believed UK Investors have a soft spot for local giants – think BP, Shell, and AstraZeneca.

So, while both Babushkas may be painted in different colours (and that’s okay), the surprise is the dog breed inside. Recommend the UK LifeStrategy Mutual Funds, and your family might raise an eyebrow. They were expecting a Retriever, but they might find an English Bulldog.

But judging by assets under management, many UK investors seem okay with the Bulldog surprise. We? We’ll take the Retriever any day.

Lifestrategy Mutual Fund vs ETF

| Characteristic | UCITS ETF | UK Mutual Fund |

|---|---|---|

| Fund Type | ETF | Mutual Fund |

| Currency | EUR | GBP |

| Domicile | Ireland | UK |

| Inception | Dec-20 | Jun-11 |

| TER | 0.25% | 0.22% |

| Equity Allocation | Market | Home-Bias (25%) |

| Bonds Allocation | Market | Home-Bias (35%) |

| Bonds | Hedged (to EUR) | Hedged (to GBP) |

| Total Size (m$) | 825 | 35,000 |

Source: Bankeronwheels.com, as of September 2023.

What All Lifestrategy Funds share in common

What are the common characteristics of LifeStrategy Funds?

All the Lifestrategy ETFs have the same two building blocks:

All LifeStrategy Funds are rebalanced regularly, so that the asset allocation remains fixed over time.

What risk profiles Can you choose from?

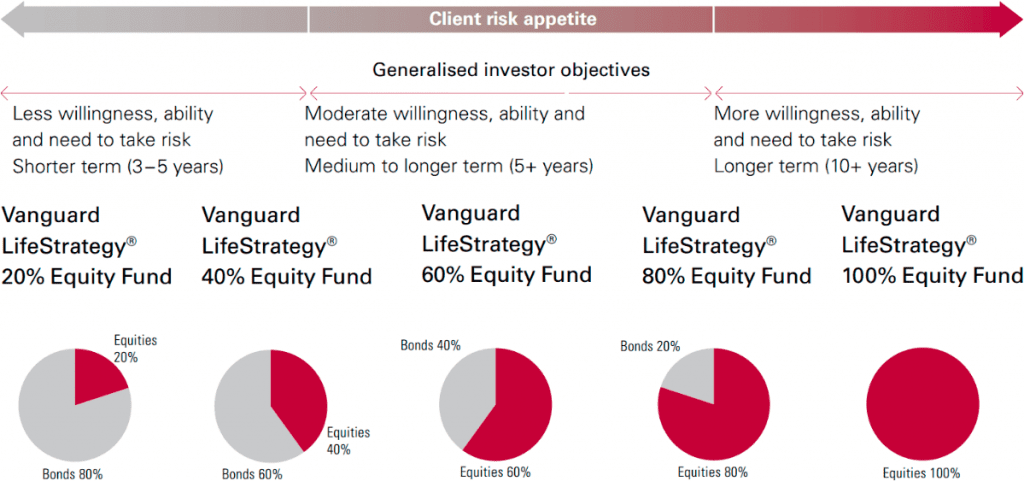

LifeStrategy Funds differ by the asset allocation or the proportion of Equity and Bond ETFs.

Vanguard recommends 60% and 80% Equity ETFs for investors with higher risk profile and 5+ years investment horizon.

Risk Appetite vs. Equity Allocation

Are Vanguard LifeStrategy Funds the same as Golden Retriever Portfolio?

Yes, Equity and Nominal Bonds are equivalent. The portfolio doesn’t contain a dedicate Inflation hedge, though.

If you X-ray the UCITS ETFs and you see more funds, don’t worry. There is a little quirk in the way these ETFs are assembled, due to UCITS regulations, but essentially that’s all you need to know.

As mentioned, UK Funds will have a home bias, for both Equities (target of 25% allocation of all Equities to the UK) and bonds (target 35% allocation of all Bonds to the UK).

Why is Vanguard 100% Equity Not Available in ETF Format?

Vanguard 100% Equity UCITS ETF does not exist because it would be equivalent to Vanguard FTSE All-World UCITS ETF. Why does it exist as UK Mutual Fund? Because of its home bias.

How to choose a Lifestrategy fund

What losses can you stomach

The #1 criterion when choosing a LifeStrategy Fund is how much risk you can tolerate.

You don’t want to end up like this guy.

Let’s rewind to the era of the Dot Com bubble and the 2008 financial crisis—a perfect storm to measure these funds’ resilience. Use the animation below to gauge your (or your family’s) comfort with potential unrealised losses during market downturns, based on a €1,000 peak value.

It’s theoretical, of course. Real-life reactions during crises can be a different ball game, but it’s a solid place to start.

PICK YOUR DIP: 50-60% OR 25-30%?

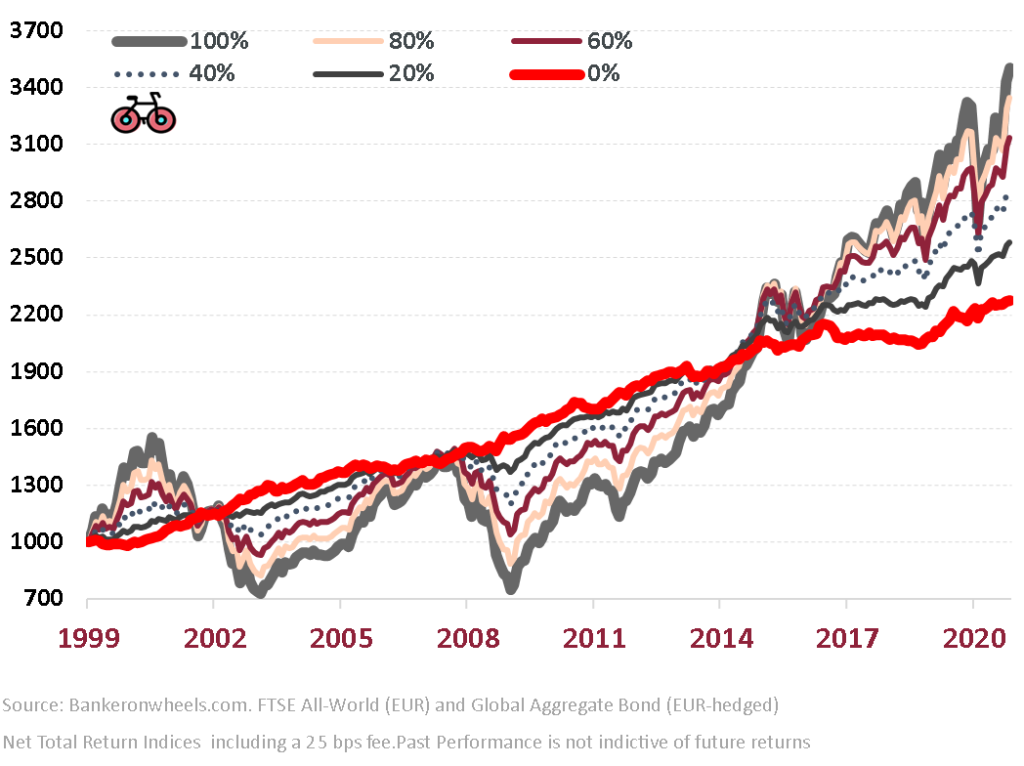

I combined the benchmarks for which data is available since 1999, accounting for 0.25% fee, and the underlying Funds since their launch to see how they would have performed. During both stress periods:

- 100% Equity portfolio lost around 55%

- An 80% Equity portfolio lost around 40%

- A 60% Equity portfolio dropped 25-30%.

And, yes, Covid-19 was just a blip.

For all below simulations, we use UCITS ETFs. They are more straightforward to model, without UK home bias related to both Equities and Bonds in Mutual Funds.

UCITS ETF drawdowns for €1,000 from prior market peak

What happened since 2000?

Historical Performance

Why it could be a good starting point

Returns expectations are where things get more challenging.

The past two decades are quite useful for stress testing, due to a combination of extremes for Equities:

- Lost Decade – Equities experienced the 2001 dot com crash and the 2008 Global Financial Crisis.

- Unusual bull market – over the past decade, that offset the lost decade.

- Yields being the same today – Bond yields are roughly in the same ballpark as the average over the past two decades.

Below is the performance of a 1,000 EUR portfolio from 1999 until January 2021, for different asset allocations.

UCITS ETF historical Performance Simulation (EUR)

Combing Dot Com & GFC with a Bull Run

If we take the last two decades, from December 2000 until January 2021:

- 100% Equity World ETF: 5% annual return; 14.1% volatility

- Lifestrategy 80/20: 5% annual return; 11.2% volatility

- Lifestrategy 60/40: 4.9% annual return; 8.4% volatility

- 100% Bond Portfolio: 3.9% annual return; 2.8% volatility

Bull Market

Over the exceptional decade from 2011 until January 2021:

- 100% Equity World ETF: 10.4% annual return; 11.8% volatility

- Lifestrategy 80/20: 9% annual return; 9.5% volatility

- Lifestrategy 60/40: 7.5% annual return; 7.3% volatility

- 100% Bond Portfolio: 3% annual return; 2.7% volatility

UCITS ETF simulated historical performance (EUR)

| Equity and Bond Allocation | % of Equities | 2011-20 Return | 2000-20 Return | 2011-20 Risk | 2000-20 Risk |

|---|---|---|---|---|---|

| Vanguard FTSE All-World ETF | 100% | 10.4% | 5.0% | 11.8% | 14.1% |

| Vanguard LifeStrategy 80 | 80% | 9.0% | 5.0% | 9.5% | 11.2% |

| Vanguard LifeStrategy 60 | 60% | 7.5% | 4.9% | 7.3% | 8.4% |

| Vanguard LifeStrategy 40 | 40% | 6.0% | 4.6% | 5.1% | 5.6% |

| Vanguard LifeStrategy 20 | 20% | 4.5% | 4.3% | 3.4% | 3.3% |

| Vanguard Global AGG Bond ETF | 0% | 3.0% | 3.9% | 2.7% | 2.8% |

Source: Bloomberg, Vanguard, Bankeronwheels.com. FTSE All-World (EUR) and Global Aggregate Bond (EUR-hedged) Net Total Return Indices, including a 25 bps fee. Rebalanced monthly.

What the heck happened in 2022?

If you look at the 2022 returns, the performance may seem upside down:

- 100% Equity World ETF: -13%

- Lifestrategy 80/20: -13%

- Lifestrategy 60/40: -13.7%

- 100% Bond Portfolio: -15.3%

UCITS ETF 2022 performance

| Actual Returns for 2022 | % of Equities in Portfolio | Return (EUR) |

|---|---|---|

| Vanguard FTSE All-World ETF | 100% | -13.0% |

| Vanguard LifeStrategy 80 | 80% | -13.0% |

| Vanguard LifeStrategy 60 | 60% | -13.7% |

| Vanguard LifeStrategy 40 | 40% | -14.7% |

| Vanguard LifeStrategy 20 | 20% | -15.7% |

| Vanguard Global AGG Bond ETF | 0% | -15.3% |

Source: Vanguard.

What can you expect in the future?

Equities and Bonds

Long term Global Equities return

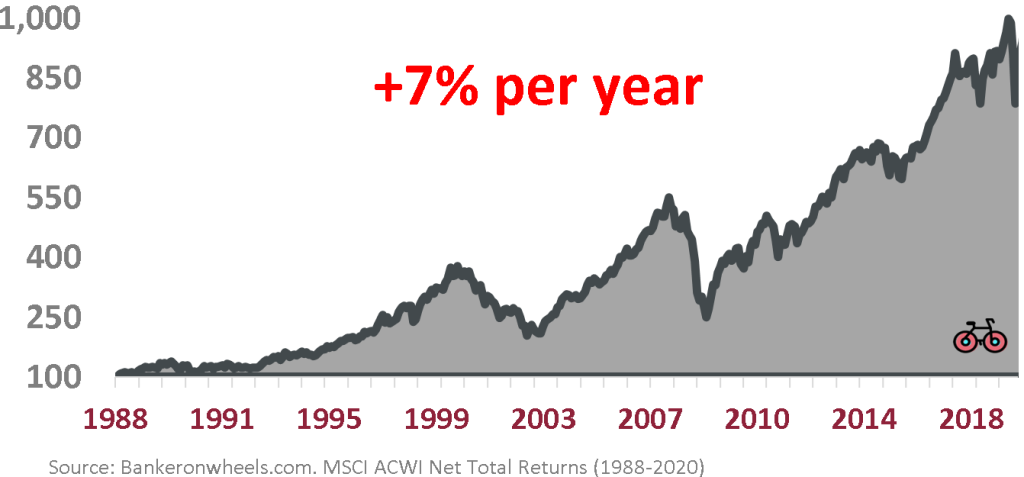

How Do Equities Usually Fare?

In the short to medium term, Equities are unpredictable. But a reasonable long-term average (think a couple of decades) is a 7% annual return. Your portfolio value would double after 10 years, and then grow exponentially. Like a snowball.

What About Bonds?

Bonds are more predictable. 90% of their return is determined by their initial Yield. Currently, Vanguard Global Aggregate Bond UCITS ETF yields around 5%. But, if you adjust it for currency hedging, the expected return is around 3.9%.

CombinEd Performance

What return can you expect from Lifestrategy ETFs?

At first sight, the above estimations are not entirely useful in predicting the overall ETFs returns, because of different time horizons:

- Equities returns are earned over at least 15 years – if they follow historical trends, the 7% return could be earned over, at least, 15-20 years.

- Bond returns are earned up to 15 years – the 3.9% return will most likely be earned over the next 7 years (it can be more if we hit another recession), or a bit longer (up to 14 years) if inflation continues to surprise Central Banks.

What if my horizon is at least 15 years?

But, for retirement planning, you need some kind of Base Case scenario.

I don’t have a crystal ball, but if we make a few assumptions:

- Interest rates stay flat over a much longer horizon (think up to 30 years), which the market currently expects for e.g. OATs

- Equity Returns are in line with historical averages

- Investment Grade Spreads stay in the same ballpark

We could extrapolate the following estimations.

Long-Term Estimated Returns

| UCITS ETFs – Risk Profiles | Equities | Nominal | Real |

|---|---|---|---|

| Vanguard FTSE-All World UCITS ETF | 100% | 7% | 4.6% |

| LifeStrategy 80% Equity UCITS ETF | 80% | 6.4% | 4.0% |

| LifeStrategy 60% Equity UCITS ETF | 60% | 5.8% | 3.4% |

| LifeStrategy 40% Equity UCITS ETF | 40% | 5.1% | 2.8% |

| LifeStrategy 20% Equity UCITS ETF | 20% | 4.5% | 2.2% |

| Vanguard Global AGG Bond ETF | 0% | 3.90% | 1.5% |

Source: Bankeronwheels.com. As of September 2023. Real Returns calculated using 10-Year Inflation-linked bonds of the Federal Republic of Germany.

What About Inflation?

The above real returns take a view of a German investor.

In Q3’23, implied long term inflation (10+ years), is expected to be 2.4% in Germany.

Lifestrategy Implementation

Where things could go wrong

High Inflation, For Longer.

Is LifeStrategy a panacea for all potential investing problems?

Certainly not. There are tides that might sway the Vanguard ship off course. Even if Equities ultimately navigate inflationary currents, those nearing retirement must tread with caution.

The sequence in which returns materialise can make or break a strategy, especially under circumstances reminiscent of the 1970s or a prolonged version of 2022. Your dreams might hang in the balance, especially if your horizon is short.

When you fail to reduce riskS

LS ETFs are not Target Date Funds

As you traverse your 30s or delve into the 40s, your investment risk compass might reorient. It is surprising how rapidly life episodes can recalibrate this:

- Parenting

- Health challenges

- Family support obligations And more.

With retirement (early, perhaps?) looming on the horizon, pivoting towards a more bond-heavy portfolio, or incorporating inflation safeguards tailored to your unique needs, or even diversifying with real assets becomes appealing.

LifeStrategy offers a static allocation, so unfortunately it doesn’t gracefully adjust with the ebbs and flows of your life. Always keep these nuances in mind when assembling your portfolio

What Lifestrategy Funds are available?

Key considerations

- Available in Distributing and Accumulating UCITS Formats

- Domiciled in Ireland for tax efficiency

- Slightly confusing components due to UCITS law, but asset allocation is not impacted

What’s under the hood?

Note that if you check the underlying ETFs, you may be surprised to see more ETFs. Don’t worry if some ETFs are added to the two I mentioned above. This is just how Vanguard is implementing it because of UCITS law limiting any single component to a maximum of 20%. Vanguard goes around that restriction using other funds, but the result is the same as if you had exposure to these two ETFs.

What Vanguard LifeStrategy UCITS ETFs are available?

Lifestrategy UCITS ETFS ISINs

| Lifestategy UCITS ETF | Distributing | Accumulating |

|---|---|---|

| LifeStrategy 80% Equity UCITS ETF | IE00BMVB5S82 | IE00BMVB5R75 |

| LifeStrategy 60% Equity UCITS ETF | IE00BMVB5Q68 | IE00BMVB5P51 |

| LifeStrategy 40% Equity UCITS ETF | IE00BMVB5N38 | IE00BMVB5M21 |

| LifeStrategy 20% Equity UCITS ETF | IE00BMVB5L14 | IE00BMVB5K07 |

Source: Vanguard, Bankeronwheels.com

What Vanguard LifeStrategy UK Mutual Funds are available?

Lifestrategy UK Mutual Funds ISINS

| UK Lifestategy Mutual Funds | Distributing | Accumulating |

|---|---|---|

| LifeStrategy® 100% Equity Fund | GB00B545NX97 | GB00B41XG308 |

| LifeStrategy® 80% Equity Fund | GB00B4KWNF91 | GB00B4PQW151 |

| LifeStrategy® 60% Equity Fund | GB00B4R2F348 | GB00B3TYHH97 |

| LifeStrategy® 40% Equity Fund | GB00B41F6L43 | GB00B3ZHN960 |

| LifeStrategy® 20% Equity Fund | GB00B4620290 | GB00B4NXY349 |

Source: Vanguard, Bankeronwheels.com

Will you buy it?

A number of our community members are fans of LS. What about you? Do you think this is a good way of investing?

Good Luck and Keep’em* Rolling!

(* Wheels & Dividends)

HELP US

🙋 Wondering why finding honest Investing Guidance is so difficult? That’s because running an independent website like ours is very hard work. If You Found Value In Our Content And Wish To Support Our Mission To Help Others, Consider:

- 📞 setting up a coaching session

- ☕ Treating us to a coffee

- 🎁 Taking advantage of our affiliate links when setting up a broker account. This doesn’t increase your costs, and we often secure exclusive bonuses for our audience.

- ❤️ Exploring Other ways to support our growth, both financially and non-financially.

DISCLAIMER

All information found here, including any ideas, opinions, views, predictions expressed or implied herein, are for informational, entertainment or educational purposes only and do not constitute financial advice. Consider the appropriateness of the information having regard to your objectives, financial situation and needs, and seek professional advice where appropriate. Read our full terms and conditions.