Uranium prices moved steadily higher in 2023’s second quarter as positive catalysts continued to build.

Acceptance of nuclear power is growing at a global level as the world’s energy needs continue to evolve, and with that revitalization on the horizon both longstanding and new investors are looking for exposure to the sector.

Here the Investing News Network (INN) presents a recap of key Q2 events in the uranium space.

How did uranium prices perform in Q2?

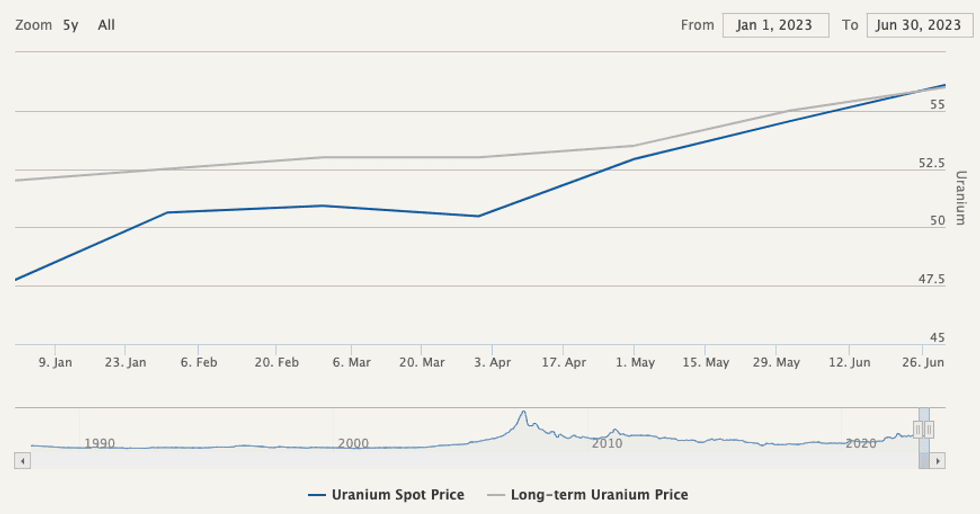

Even in a difficult economic environment characterized by recession concerns and high interest rates, uranium has distinguished itself from some of its commodity peers by continuing to maintain momentum.

Prices for the energy fuel traded solidly above the US$50 per pound level in Q2.

Speaking to INN in late June, Justin Huhn, founder and publisher of Uranium Insider, said he thinks there’s a solid price floor for uranium at US$50 and noted that he would be surprised if it went back to that level at all.

“The market is thin enough and the demand is sufficient enough that we should see a pretty stable and rising spot price for the remainder of the year,” he commented, pointing to increased contracting from utilities.

“Years of undercontracting ultimately and inevitably leads to years of overcontracting, and we’re just starting that now,” he said. Huhn expects utilities to contract at greater than their replacement rates for a multi-year period, and with uranium prices at a high base and with supply looking thin, the stage is set for higher levels in the relatively near future.

“Utilities right now are contracting for the later part of the decade, and it’s extremely tight for the coming few years,” Huhn said. “That is a backdrop for a potentially rapidly increasing price of uranium that we’re literally on the precipice of witnessing.”

Watch the full interview with Huhn above.

John Ciampaglia, CEO of Sprott Asset Management, also shed light on activity from utilities in a recent conversation with INN, noting that they seem to be realizing that they will need to pay higher prices to fill their needs.

“I think utilities are finally starting to figure out that the prospects for uranium look much more bullish, and the prospects for nuclear energy remain much more bullish than the situation two years ago,” he said, adding, “I think the utilities understand that the producers are partners, and that they have to pay fair prices based on today’s realities.”

Watch the full interview with Ciampaglia above.

New physical investment vehicle sparks interest

Utilities are major buyers of uranium, but other sources of demand are emerging too.

Huhn also spoke about Switzerland-based Zuri-Invest’s recently launched actively managed certificate. Although it has key differences from the Sprott Physical Uranium Trust (TSX:U.U), it too is a physical investment vehicle.

The expert said this fund has been able to quickly get set up, raise money and buy uranium.

“They trade at (net asset value) always, because there is no front running of the vehicle prior to the purchasing, and there aren’t any redemptions of the vehicle that don’t correspond to redemptions of uranium,” Huhn said.

The ideal investor for this offering isn’t in immediate need of liquidity, but wants exposure to the commodity at net asset value all the time. While the fund isn’t listed publicly, Huhn said most brokerage firms can secure access for investors.

Notably, he teased to INN that at least three more similar investment vehicles are set to reach the market soon. “There’s probably going to be a half dozen of these things by this time next year,” Huhn said.

Investor takeaway

Uranium is at a fascinating point this year as its price growth continues and acceptance keeps increasing. With new methods of investing on the way, market participants will soon have even more ways to get access to the sector.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.