U.S. Total Nonfarm Payrolls – 3-Month Moving Average

U.S. Total Nonfarm Payrolls – 3-Month Moving Average

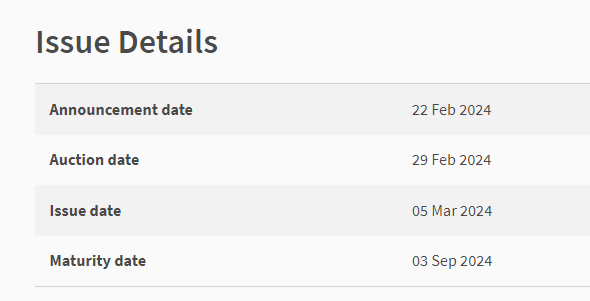

Obviously, the first place to look at is the level of new job creation, as measured by total nonfarm payrolls. For August, overall payrolls rose a slightly better than expected +187,000. That headline number in and of itself could be considered a relatively good outcome, considering the economy has endured 525 basis points worth of Fed rate hikes since last March. However, in a less well-known stat, the prior two months’ tallies were revised downward by a combined -110,000.

In order to smooth out monthly volatility, a good practice is to look at three-month moving averages, and that is where a more visible slowing trend in new hiring becomes apparent. The most recent figure on that front put new hiring at +150,000, a decline of -31,000 from July’s +181,000 reading. In fact, as the top bar chart illustrates, the three-month moving average has been consistently edging lower throughout all of this year.

This is where it gets a little interesting, though. If you look at the three-month trend numbers from 2017 through 2019 (pre-COVID-19), the current level is not really all that bad and only 27,000 below the monthly average for that entire three-year period.

Another measure of employment that is closely followed is the jobless rate. In August, the unemployment rate rose +0.3 pp to 3.8%. However, this was due to a +736,000 surge in the civilian labor force, typically viewed as a good sign for labor market activity. Civilian employment (the alternate job creation gauge) actually rose a solid +222,000, but that was not enough to offset this large inflow into the labor force.

Conclusion

The expectation was for no Fed rate hike at this month’s FOMC meeting, and the August jobs data does nothing to change that narrative, but we do have one more CPI print before the September 20 convocation.

Either way, “higher for longer” with no rate cuts on the horizon remains the Treasury market backdrop.

]]>