Many investors ask us about valuation and wonder if 2023 was indeed the “year of AI.” Has the near-term opportunity passed, and are the stocks now too expensive?

We see the broad array of companies engaged in a differentiated set of AI activities generally as not expensive. In fact, there is a massive dispersion between certain well-known and widely followed stocks and all the rest.

Nvidia—The Story Stock of 2023

Nvidia’s results are one of the historic stories in business. The firm’s earnings announcement in May 2023 was nothing short of incredible, and its other announcements have also been strong. Nvidia’s market capitalization has risen hundreds of billions of dollars in less than a year.

Nvidia has a charismatic CEO who is a visionary leader in AI. The company is a clear household name—likely one of the next words you think of after the term “AI” is mentioned. Consequently, Nvidia’s valuation reflects its leadership at the moment.

Now, it’s also the case that the Magnificent Seven (Apple, Microsoft, Meta, Alphabet, Tesla, Nvidia and Amazon) have been associated with driving U.S. equities forward in 2023.

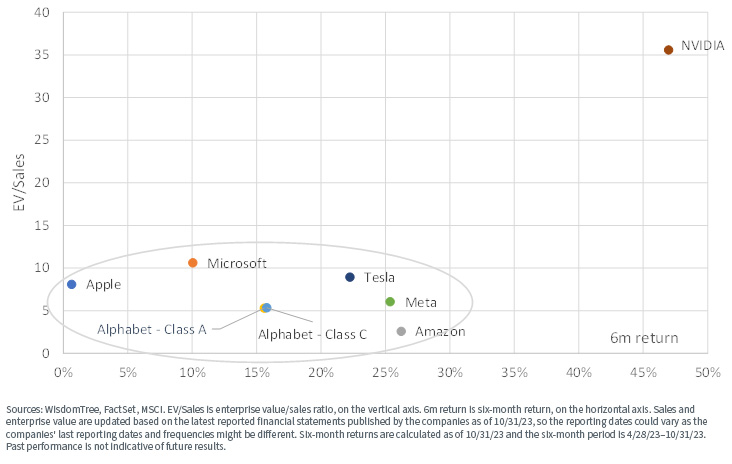

Figure 1 tells us:

- There has been some dispersion of the Magnificent Seven’s returns, but the returns have been strong, by and large, and we have to just remember that these stocks are such large components of the S&P 500 or Nasdaq 100 indexes that their returns will have undue influence.

- The valuation and six-month returns of the Magnificent Seven, however, have been nowhere close to Nvidia’s returns. The reason we mention this—if one is taking the Nvidia case, because it is familiar and well-known, and assuming it as representative of more cases, this would actually be inaccurate. At the moment, Nvidia is in a class by itself.

Figure 1: Nvidia Has Crushed the Magnificent Seven

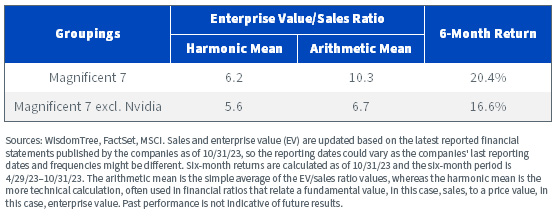

Another way to look at the “Nvidia Effect” is in figure 2, where we group the Magnificent 7 with and without Nvidia.

- There was close to a 4% difference in returns—a big impact. Notably, this was for the most recent six-month period.

- There was slightly more than a one-third reduction in valuation—another big impact, when considering the arithmetic mean calculation.

- Since the harmonic mean is often used when calculating averages of different ratios that use a fundamental value relative to a measure of price—in this case, enterprise value—we also provide it as a reference point.

Even against the most widely known and widely held stocks in the U.S. market, Nvidia’s recent results and performance have stood alone.

Figure 2: The Massive Influence of Nvidia—Valuations and Returns

But what does all this mean for an investor thinking about initiating a position in AI? Maybe they are paying attention to the recent case of Microsoft offering a version of Copilot in Office 365 and considering that this could represent a platform of hundreds of millions of users that might access this software in the coming months or years.

If the AI megatrend is going to truly grow, we believe we are currently closer to the beginning than the end. Why? Think about whether you have used generative AI today in any of your normal software experience. If this megatrend plays out as we believe, almost everyone using software will be using generative AI and won’t even realize it.

At WisdomTree, we developed the WisdomTree Artificial Intelligence and Innovation Fund (WTAI) which tracks the WisdomTree Artificial Intelligence and Innovation Index. The strategy, in broad strokes, is not meant to call the next big AI topic, which this year was clearly generative AI and natural language processing. It recognizes that over time, different parts of the AI ecosystem will heat up and cool down but overall the space will likely broadly grow as we move forward.

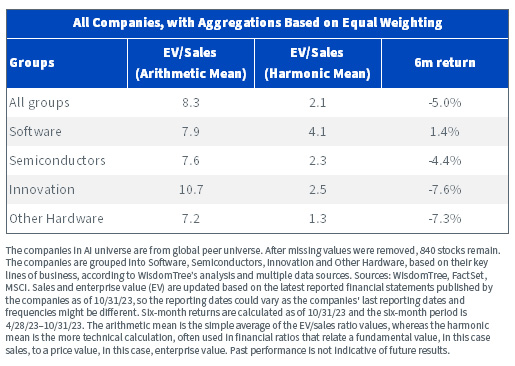

Figure 3 denotes the four major groups of companies in our AI strategy, and we see that they all have quite different valuations and returns over the past six months. However, we do not solely look at companies within the WisdomTree Artificial Intelligence and Innovation Index—we look at a broader universe of 840 companies.

- Other Hardware, at least on an EV/sales basis, appears the least expensive group. Software and Innovation appear the most expensive, depending on aggregation method. Software stocks trade more richly than stocks that build physical things in the real world, in that the margins are high and the cost to replicate the software, once designed, to a broad base of users is quite low. It’s also the case that innovation stocks and software stocks can be subject to the strong emotions of investors, both positive and negative, thereby moving valuations.

- Other Hardware and Innovation also had the lowest six-month returns, while Software was the highest and sole positive. We’d note that Semiconductors had a negative return overall—something most people would not expect. In the world of semiconductors today, there is Nvidia and then basically all the rest, and the rest have not had a spectacular 2023. It’s possible the inventory cycle turns in 2024 and people upgrade more cell phones and laptops, but that remains to be seen. We do always come back to the fact that Taiwan Semiconductor Manufacturing Co. (TSMC) notes that only about 6% of their total revenue comes from the big AI accelerating chips that hog the world’s attention.

Figure 3: The General AI Ecosystem Has NOT Delivered Universally Strong Returns in 2023

Conclusion: The Broad AI Ecosystem Still Has Potential

We believe AI represents potentially the biggest boon to productivity we have seen in decades and we are only just beginning in seeing this play out. We encourage investors to consider a broad range of companies that may benefit from the growth in this megatrend over coming years and that is what we have designed in WTAI.

Important Risks Related to this Article

For current Fund holdings, please click here. Holdings are subject to risk and change.

There are risks associated with investing, including the possible loss of principal. The Fund invests in companies primarily involved in the investment theme of artificial intelligence (AI) and innovation. Companies engaged in AI typically face intense competition and potentially rapid product obsolescence. These companies are also heavily dependent on intellectual property rights and may be adversely affected by loss or impairment of those rights. Additionally, AI companies typically invest significant amounts of spending on research and development, and there is no guarantee that the products or services produced by these companies will be successful. Companies that are capitalizing on innovation and developing technologies to displace older technologies or create new markets may not be successful. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is governed by an Index Committee and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

]]>