Traders,

I’ll be sharing my top ideas, thought process, and precise entry and exit plans with you for the upcoming week.

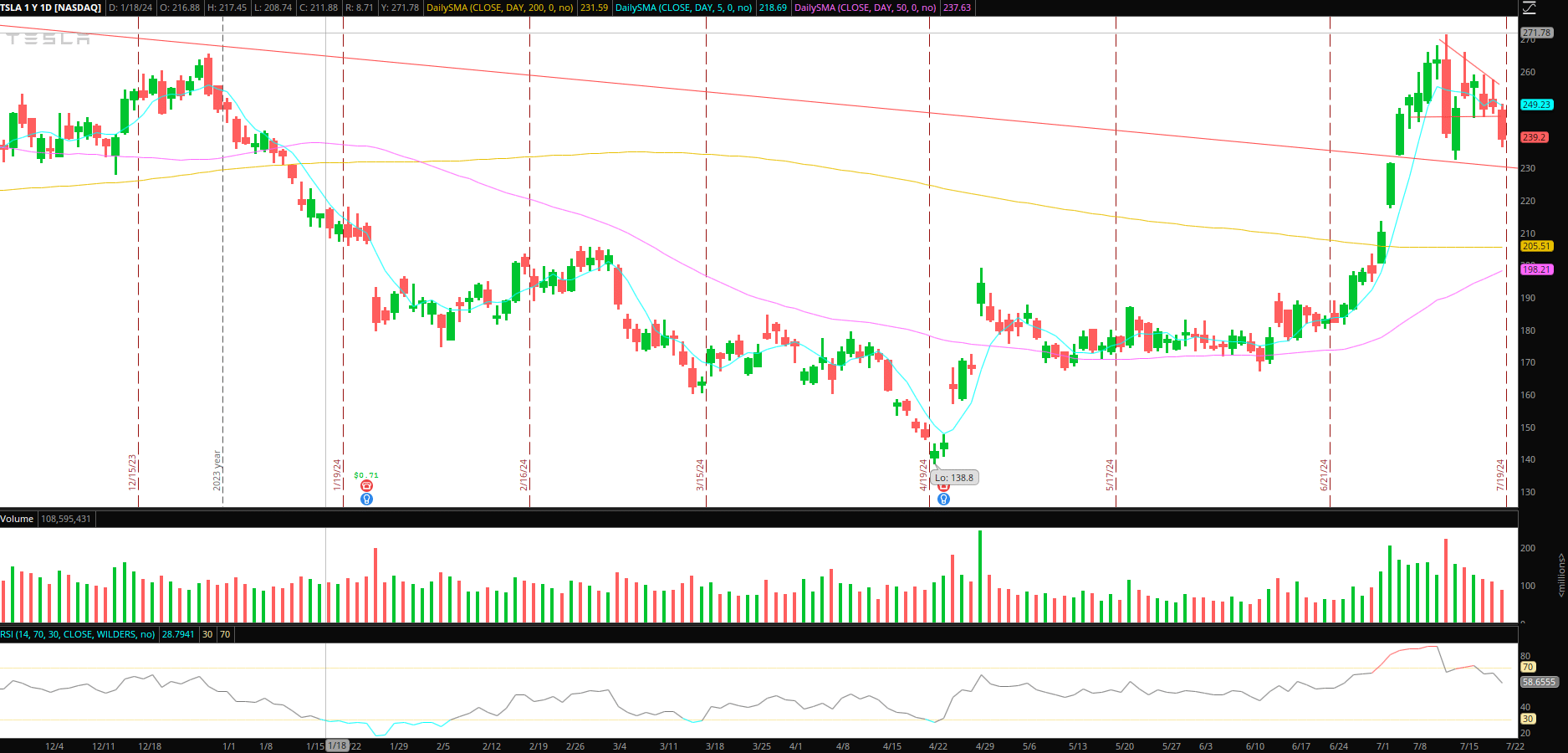

Now, just before we get into that, some important reminders. Earnings are getting underway, and this week, several market giants, like Tesla and Alphabet, reporting earnings. Last week was driven in many aspects by breaking news and headlines, which created both opportunities and uncertainty. So, a further reminder to always be in tune with what is happening and flexible enough to adapt your plans and risk management accordingly.

Now, for the week ahead, here is what I am watching.

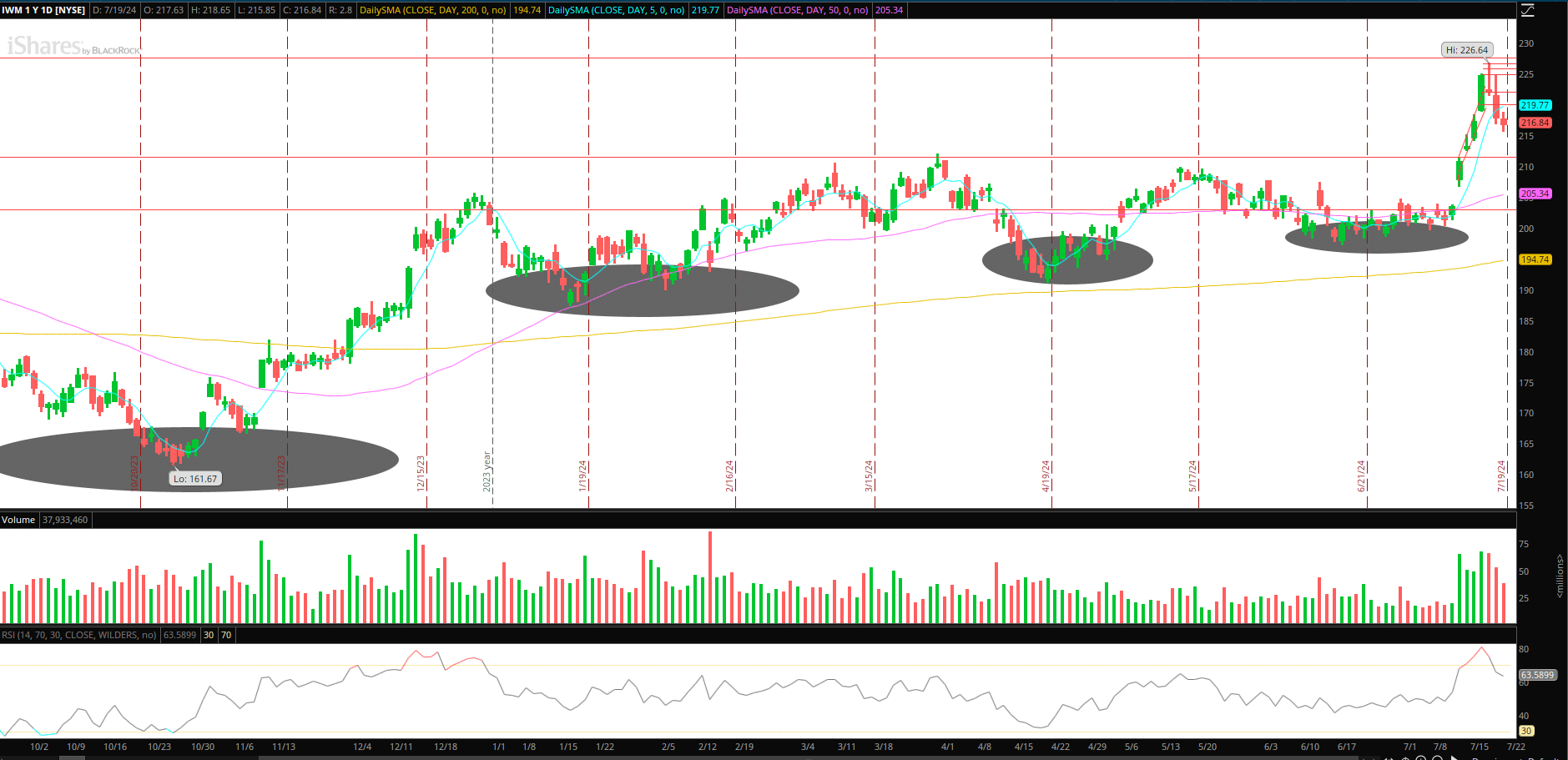

Stalking Small Caps for a Long Entry (IWM/TNA)

Undoubtedly, one of the top opportunities so far in the month has been the breakout in IWM, followed by the pullback trade, and I’m glad to have seen several traders on the desk crush the opps. In the latest Inside Access meeting, we reviewed the opportunity in the IWM in detail.

Now, similar to my thoughts last week, my top idea coming into the week will be stalking the IWM for a bottom and long entry for a bounce and potential second leg.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Here’s my plan:

It was a fantastic higher-timeframe breakout, followed by a steady pullback into the end of last week. With the area of $216 establishing itself on Friday as support, it will now be a key area I watch going forward.

Ideally, I would like to see IWM display some relative strength to the overall market, indicating that the theme of short-term outperformance remains intact. For an entry, I would like to see a higher low versus Friday’s low and/or a wash below Friday’s low and immediate reclaim. That would get me to place a starter position long. I would like to see the IWM hold firm above the $218 zone and Friday’s high to size into the position. While I will manage this position on the 15-minute timeframe, scaling out on higher highs and trailing using higher lows, I will also target ATRs to scale out and key daily levels over multiple days, such as $222 and $225.

Here are Several Additional Ideas for the Week

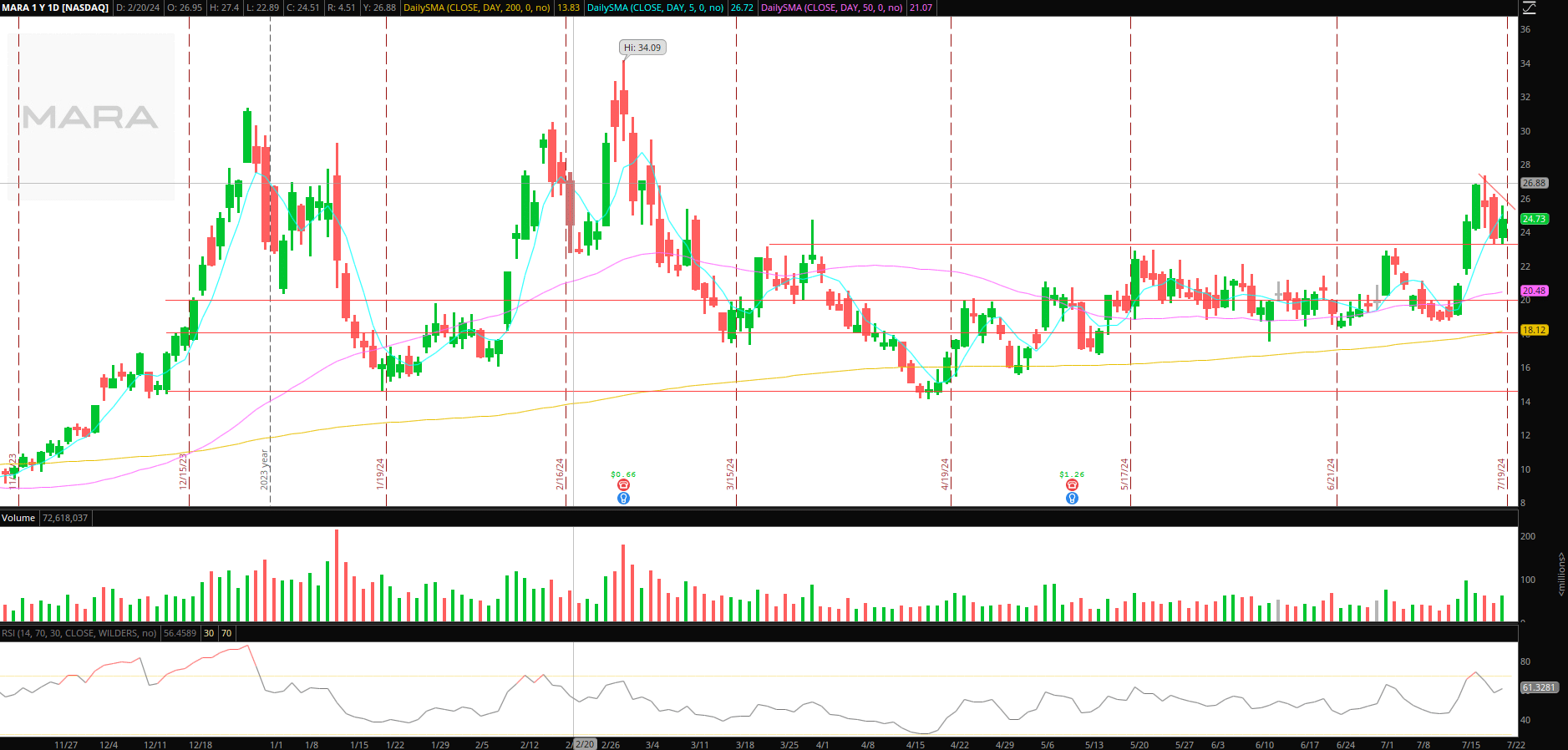

Higher Low in Bitcoin Names: Bitcoin had a great recovery last week. Going forward, I’ll be monitoring crypto-related names, such as MARA, CLSK, IBIT, etc. For example, in MARA, along with keeping a close eye on Bitcoin, I will be looking for further build and a higher low in this consolidation for a potential long-swing entry. Given the extent of Bitcoin’s bounce, I won’t be too eager to pay up but rather monitor the action going forward to see how it shapes up.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

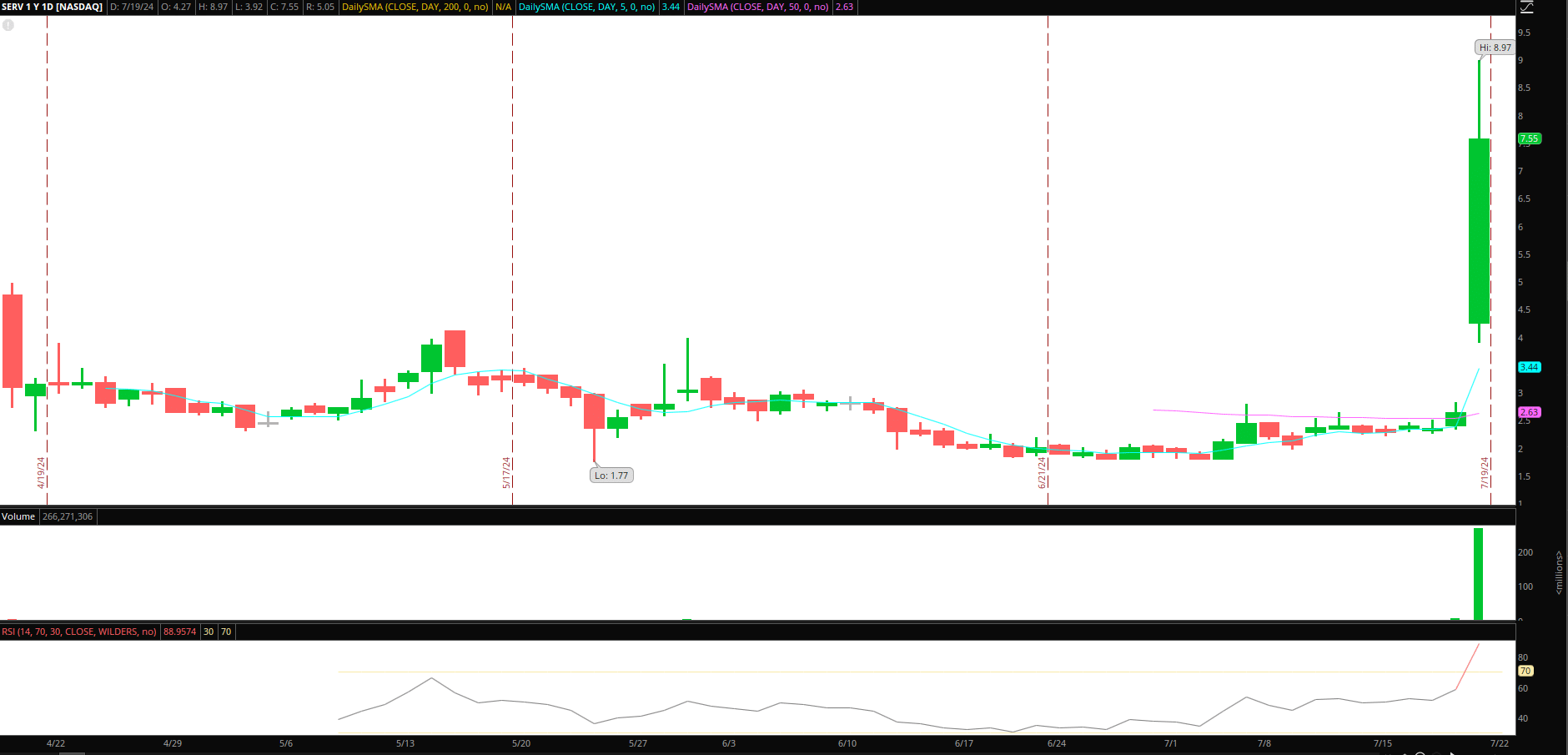

Momentum Trades in SERV: Beautiful momentum mover on Friday, offering brilliant long and short trades intraday. While you only need to look at the SOUN chart to see how it ends, there is no need to be biased in the short term. I’ll be actively watching this for momentum trades intraday until a clear backside is confirmed; in this case, I will switch to a swing mindset. What could that look like to confirm? Blow-off top, consecutive lower highs, uptrend break, shift in price action, and VWAP crack.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Tesla and Alphabet Earnings: Two mega-caps report early next week. I will look for opportunities after earnings. First, before I look for a setup, I will familiarize myself with key levels, overall sentiment, and the results. Only then will I familiarize myself with the price action and look to form a trade plan if a setup begins to form. We’ll go over this and review the action in further detail in the upcoming Inside Access meeting.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

The post The Weekly Trade Plan: Top Stock Ideas & In-Depth Execution Strategy – Week of July 22, 2024 appeared first on SMB Training Blog.