Traders,

I hope you all had a wonderful Thanksgiving holiday!

As always, I look forward to sharing my top ideas with you for the upcoming week. In this Watchlist, I’ll share my top ideas and plans for each idea, including my precise entry and exit targets.

So, let’s jump right into it.

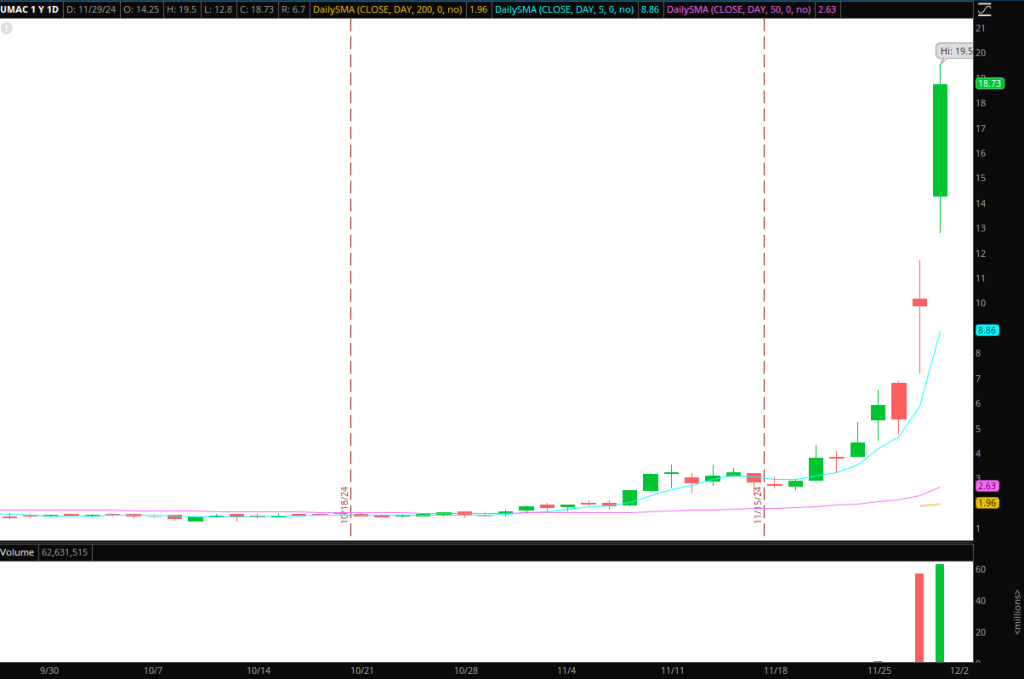

Frontside / Momentum in UMAC (Drone Industry)

After it was announced that Trump Jr. joined the advisory board, the name ignited, and so did the industry, resulting in a theme play. Am I short-biased right now? No. Why? The stock closed above VWAP and remains in an uptrend. Therefore, it is still on the frontside, and momentum longs intraday are valid.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Now, it all depends on where this opens on Monday. I would be interested in a potential FRD setup if this gaps down. In that scenario, I would be looking for the stock to remain heavy under VWAP and the $17 key area from Friday for a move toward $14, where the squeeze and breakout intraday began. Alternatively, a failed push to green and confirmation of a failed follow-through setup.

Alternatively, if the stock gaps up or opens flat, washes out, and reclaims VWAP, I would be focused solely on further upside for a potential parabolic move. In that scenario, I would be focused on momentum longs intraday until the stock goes parabolic (multiple ATR extension over VWAP Intraday and volume exhaust), in which case I will then shift to a short bias and look to hold a core for overnight swing.

Keep it simple and remember to consider: float size, what side of VWAP the stock is trading, volume intraday, holding above the previous day’s high/key support? And whether the uptrend is intact.

Sympathy names on watch with UMAC: UAVS, JOBY.

UMAC is the leader and so-called head of the snake here. I’ll closely monitor sympathy names for long and short-reactive trades to UMAC. For example, if UMAC traps and breaks out, I would look for reactive momentum longs. Once the top is in, I will look to short the sympathy stocks versus the HOD intraday and potential overnight short swing if we get a weak close.

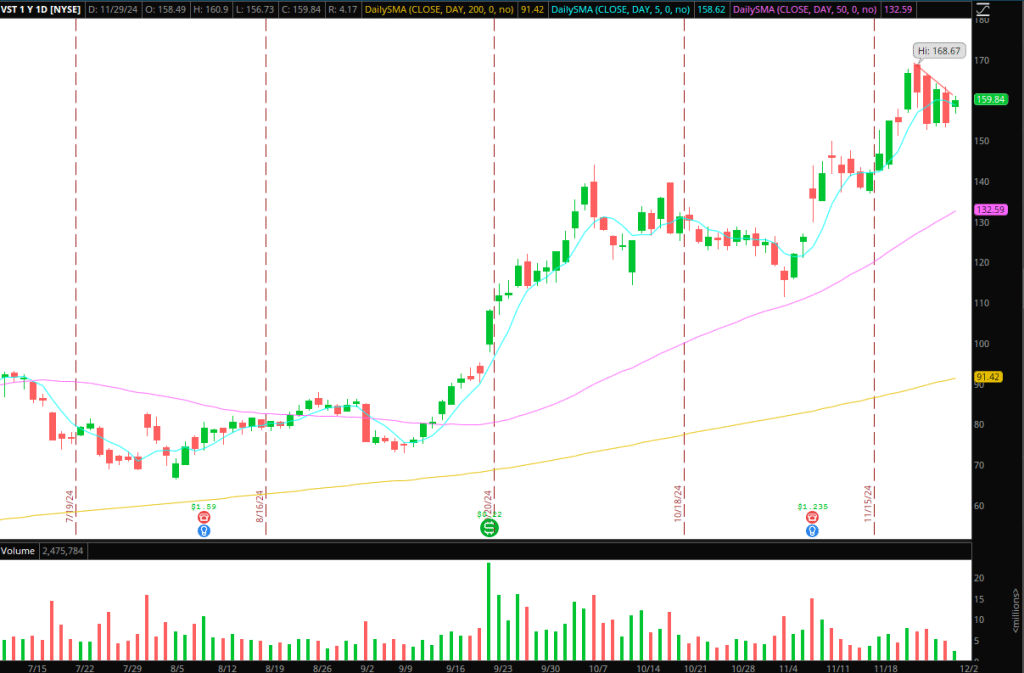

Consolidation Breakout in VST

The Idea and Plan: Straightforward consolidation breakout setup in the leading stock within the nuclear energy theme and one of the top-performing S&P 500 stocks YTD. I like how VST aligns across multiple timeframes and has contracted volume and range during this consolidation.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Therefore, keeping it simple, I am looking for a burst in volume and price to push above the $162 mark. If that materializes, I’ll look to get long on dips risking versus the LOD. The first target would be an ATR up move toward the $168 – $170 potential resistance area to take off half of the position and trail the rest versus the day’s low, targeting a multi-day / 3-day move.

Additional Names on Watch with Alerts:

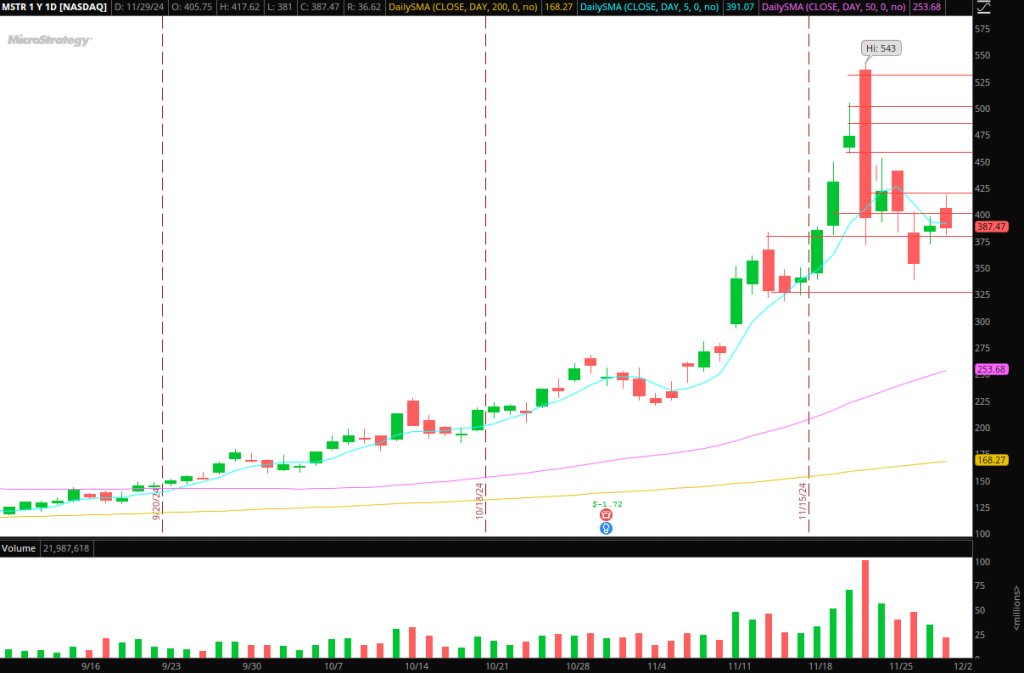

MSTR / Bitcoin: $100k BTC remains a notable area of interest. In that regard, I maintain a similar plan and overall thoughts as to last week’s watchlist. That plan remains relevant for the upcoming week.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

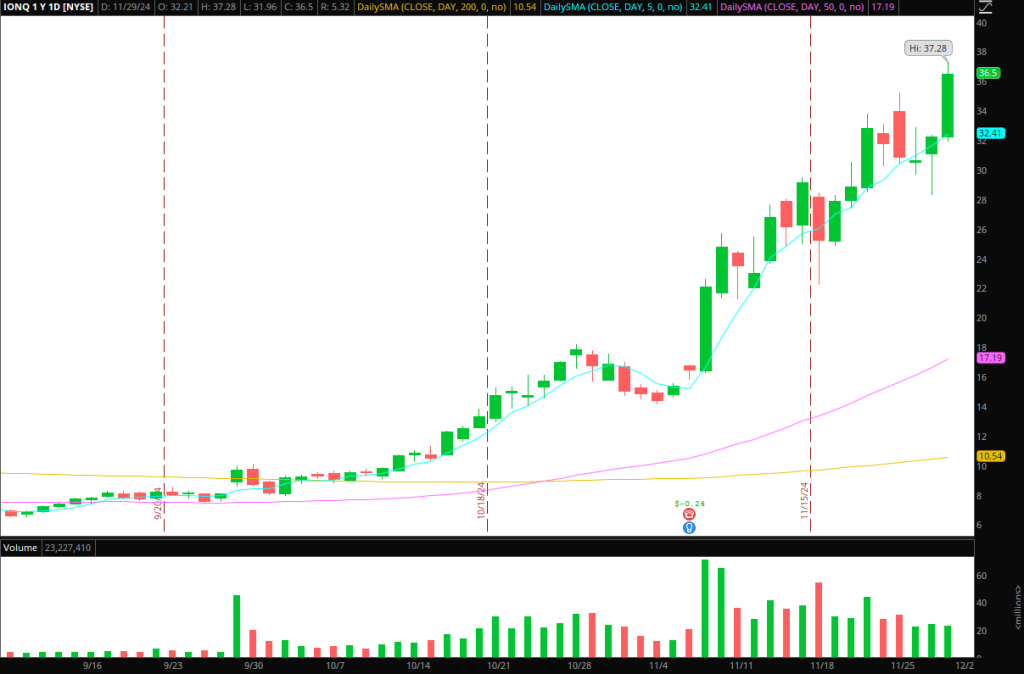

IONQ, QBTS, QUBT: Again, same thoughts as last week. Watching the sector and its leader, IONQ, for signs of exhaust / parabolic and momentum shift for multiple days of profit taking.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

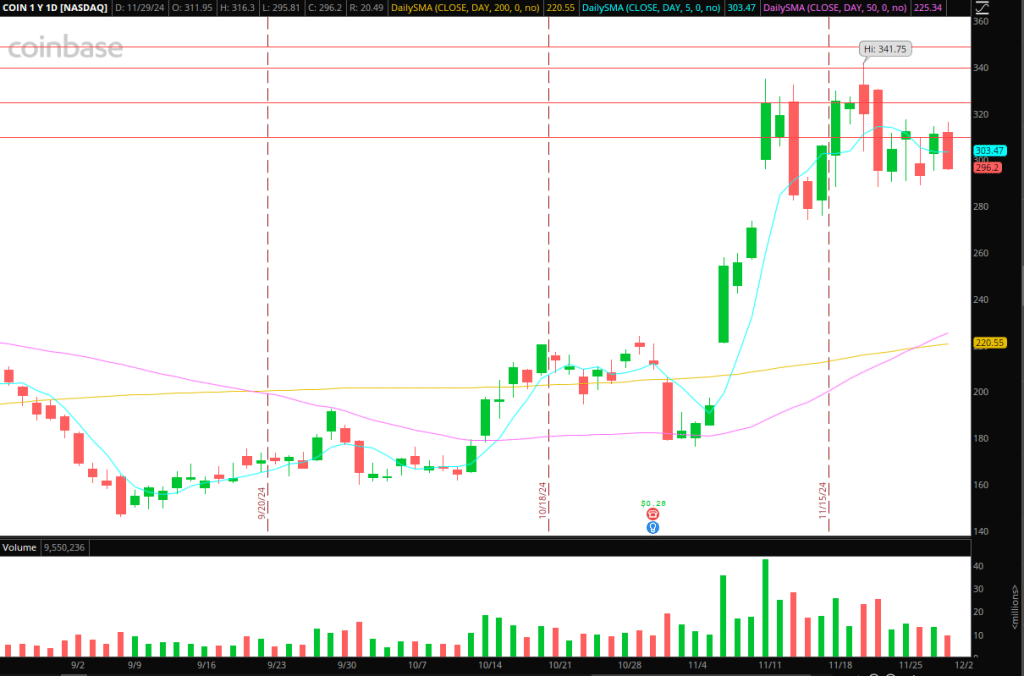

Failed-Follow Through in COIN: Notable rel. Weakness in COIN to other crypto-names, as many anticipated a breakout in the stock. Interested in momentum short opportunities below key support near $290 – $288 for quick flushes.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Get the SMB Swing Trading Evaluation Template Here!

The post The Weekly Trade Plan: Top Stock Ideas & In-Depth Execution Strategy – Week of December 2, 2024 appeared first on SMB Training Blog.