Traders, I look forward to sharing my top ideas for the upcoming week, including my entry and exit targets.

This will likely be my final weekly watchlist for the year, so stick around as I go over my top ideas, including plans for SOFI, TSLA, and RIVN.

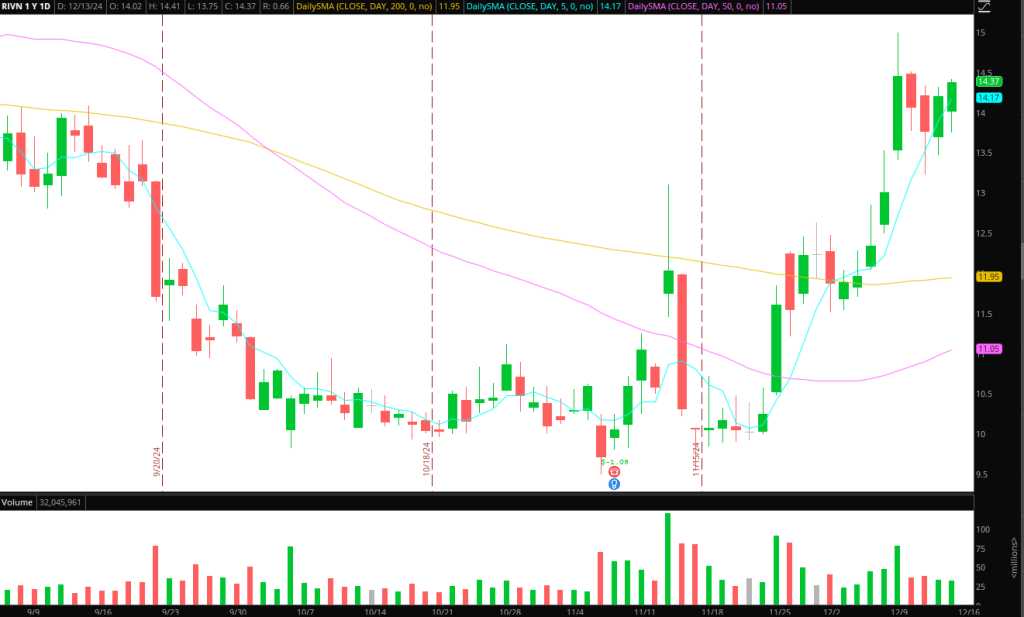

Consolidation Breakout RIVN

There’s been a nice turnaround in several EV names, and with Tesla now beginning to extend to the upside, it’s possible some FOMO and excitement trickle down into RIVN, especially as this is setup well for continuation from a technical perspective.

Previous support near $13 from mid-year has now again formed as support as the stock consolidates in a bullish formation over rising key SMAs. Along with that bullish formation is a supportive market, sector, and elevated short interest.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

So, keeping it simple with entries and exits, I am looking for $ 14.50 to firm up with elevated RVOL, which would get me long versus the LOD initially. Thereafter, I’d be targeting an initial move over $15, toward $15.30s, to scale out a portion of the position into a 1 ATR upmove. From that point, I would trail my position on the 15-minute timeframe using higher lows, targeting a move toward 2 ATRs and $16, which might act as resistance as there is likely some overheard in that region.

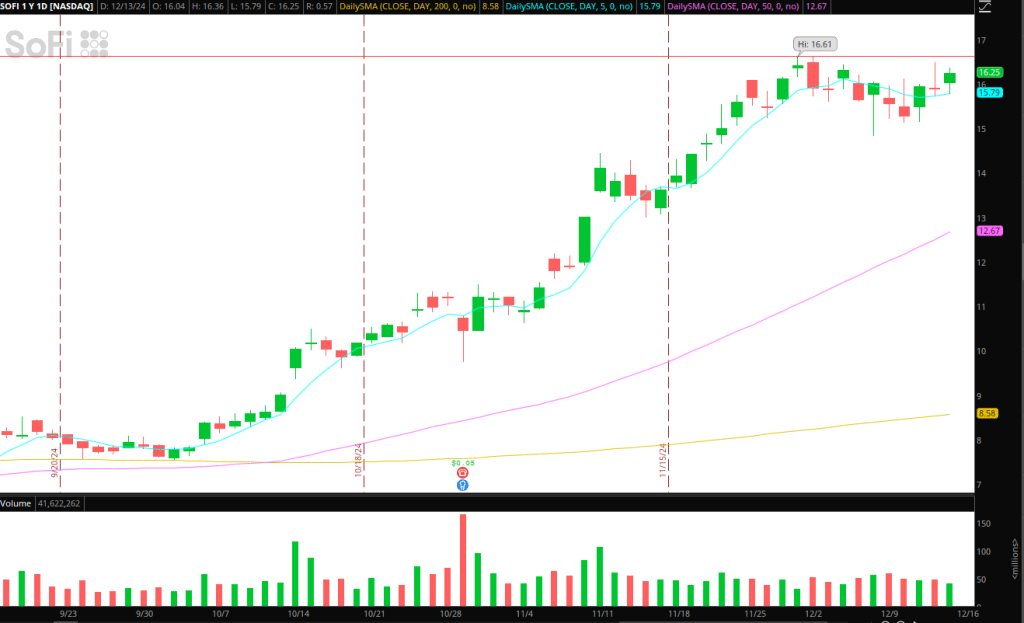

Consolidation Breakout SOFI

While SOFI is extended from its rising 200d and 50d, it spent several weeks consolidating at 52-week highs and previous resistance on a much higher timeframe. Now, with the stock firming up over $16 on Friday, I’m interested in continuation to the upside for a multi-day swing long.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

If SOFI can take out last week’s high and firm up near the 52-week highs or present a strong opening drive on volume, I will get long versus the LOD for a multi-day long. Given the setup and momentum on a higher timeframe, looking to hold for up to 3 days momentum as long as the previous day’s low does not get taken out. I will be scaling out of the position on intraday extensions to the upside, totaling 1 ATR.

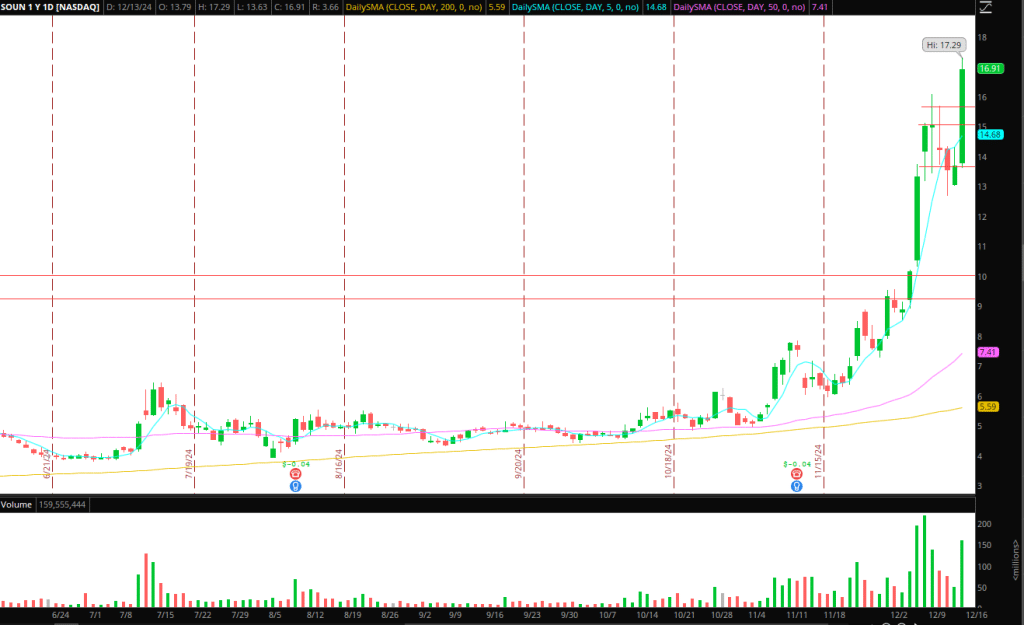

SOUN on Watch for Blowoff

After pulling back for most of last week, shorts that failed to cover into support got wrong-sided on Friday. Given the price action in the afternoon I’d imagine there are still many short-term shorts left yet to be blown out.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Therefore, the ideal scenario, which stands out with the highest grading for me, would be further continuation early next week to the upside, over $18 and closer to $20. Specifically, I’d like to see high volume churn in the high end of the range or an intraday blowoff pattern, both of which would signal a significant exchange to weak hands. If that move is followed by a failure / engulfing downside candle, I will position short on a lower high versus the HOD. From that moment forward, I’d trade around a core position for up to two days, holding the core position for a reversion back toward $16 – $14.

Additional Names on Watch

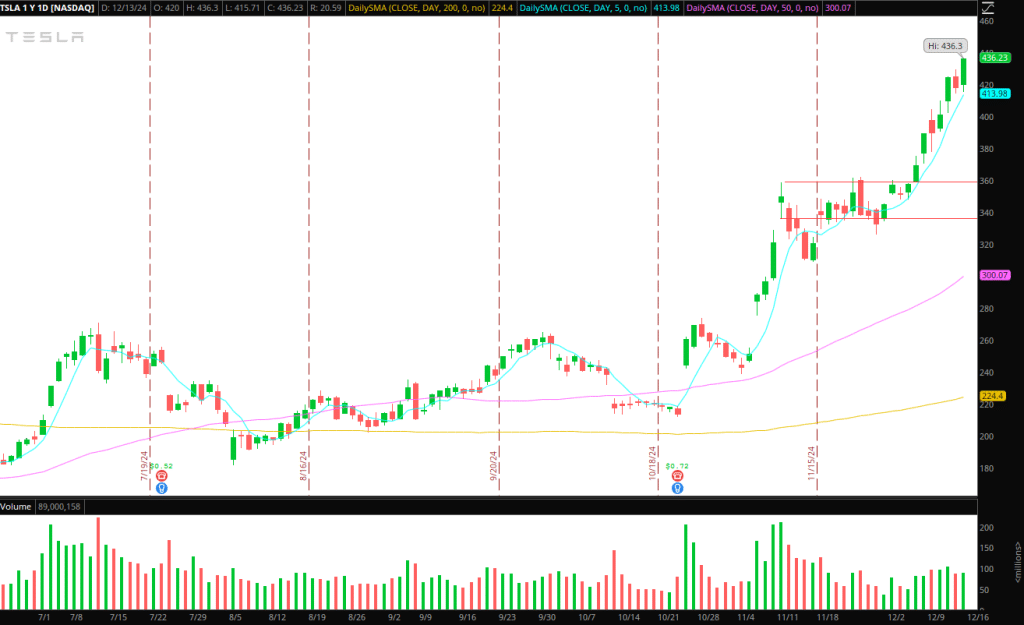

TSLA on Watch for Extension Higher: Similar to what I mentioned in my recent Inside Access meeting, I’m not short-biased Tesla, nor am I looking to be short right now. I’ve seen numerous comments/posts online calling for a reversion in the name. Ask yourself, what is the difference between the reversion we saw in PLTR, or MSTR, or even SMCI earlier in the year? Here’s a hint: look at ATR, consecutive gap days, range expansion, vol expansion, and ATR and % expanded from key SMAs. Along with the fact that TSLA just broke out to new all-time highs after consolidating. TSLA isn’t there yet. But if TSLA experiences those mentioned above and trades in the high $400s, it might be.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

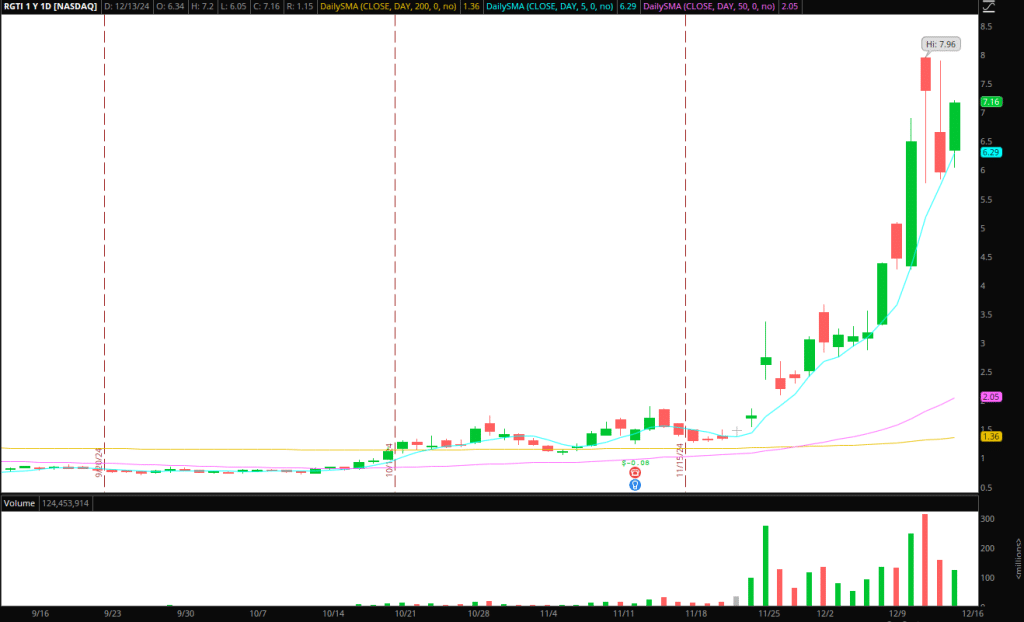

Reversion in RGTI: After topping out, similar to SOUN last week, with the help of SSR and being a crowded name, the stock has firmed up to over $6s. So, going forward, if RGTI pushes back toward $8 and fails, I would be interested in a short versusHOD. However, if it breaks through that level, i’ll be hands-off and even interested in momentum-long scalps. With that being said, the more significant opportunity in the days to come would be an outlier short squeeze exhausting stubborn short swings on a move toward $10 +.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

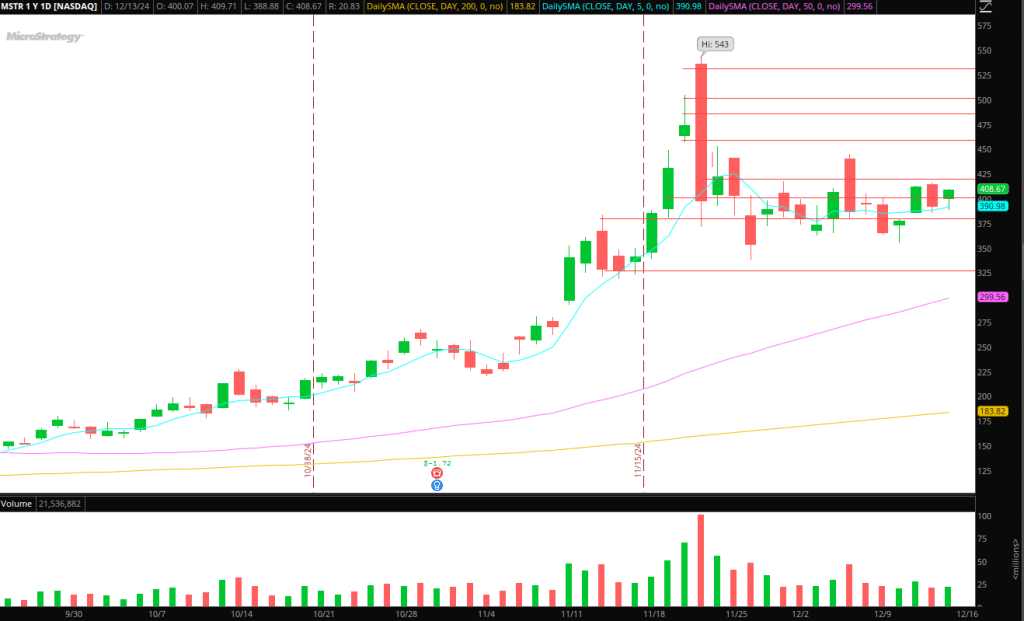

Continuation in MSTR: If Bitcoin continues to firm up over $100k and specifically $102 – $104k, I’d be interested in MSTR over $420 resistance and last week’s high. I’d need to gauge price action to see whether the persistent selling and ATM selling have subsided. If it bases over $420 with an intraday uptrend forming and shifting to relative strength, I’d consider a long swing versus the days low.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

DXYZ: Same thoughts as last week in the name. It remains on watch for either a reactive trade on breaking news (form: EFFECT), or a major relative weakness and consolidation breakdown through lows for momentum and core as a swing.

Get the SMB Swing Trading Evaluation Template Here!

The post The Weekly Trade Plan: Top Stock Ideas & In-Depth Execution Strategy – Week of December 16, 2024 appeared first on SMB Training Blog.