Crisis is opportunity for those who know where they’re going.

I must have been about 13 or 14. Our business-studies teacher brought an unusual guest to speak to our class.

A charismatic entrepreneur and multimillionaire visiting from the US. And he said one thing that was life-changing: ‘Write down your goals.’

Now, keep in mind, this was the late 1980s in small-town Taranaki. I thought goals were in soccer, where you dropped a few jerseys at each end of the field to mark the spot.

Well, this entrepreneur explained to us what life and business goals were. I took his advice and wrote down some big goals.

I still have a record of those.

25 years later, to my surprise, I had not only achieved them — I had achieved them beyond anything I could have imagined.

Don’t bounce from crisis to crisis without goals

Over the past decade, it seems we’ve bounced from crisis to crisis in this country, doesn’t it?

- Housing crisis.

- Covid crisis.

- Cost of living crisis.

- Crime and safety crisis.

- Education crisis.

- Climate crisis.

A lot of money has been invested. But have we made much of a difference?

Maybe a lack of vision has been the problem. If we knew exactly where we were heading, without division, we might have turned some of these crises into opportunity.

Perhaps we should have put differences aside and written up some goals?

Masterful war leader Winston Churchill said, ‘Success is the ability to go from failure to failure without losing enthusiasm.’ He also said, ‘Never let a good crisis go to waste.’

But that was during wartime. People were united around one goal.

Are you united on a goal for your financial future?

Here’s my ultimate investor goal: a financial freedom portfolio

Over many years investing in the markets, I’ve noticed those who do best have a clear vision for their life. They know exactly what they want to achieve and where they’re going. They’ve written down their goals.

This enables them to stay the course and build a resilient portfolio.

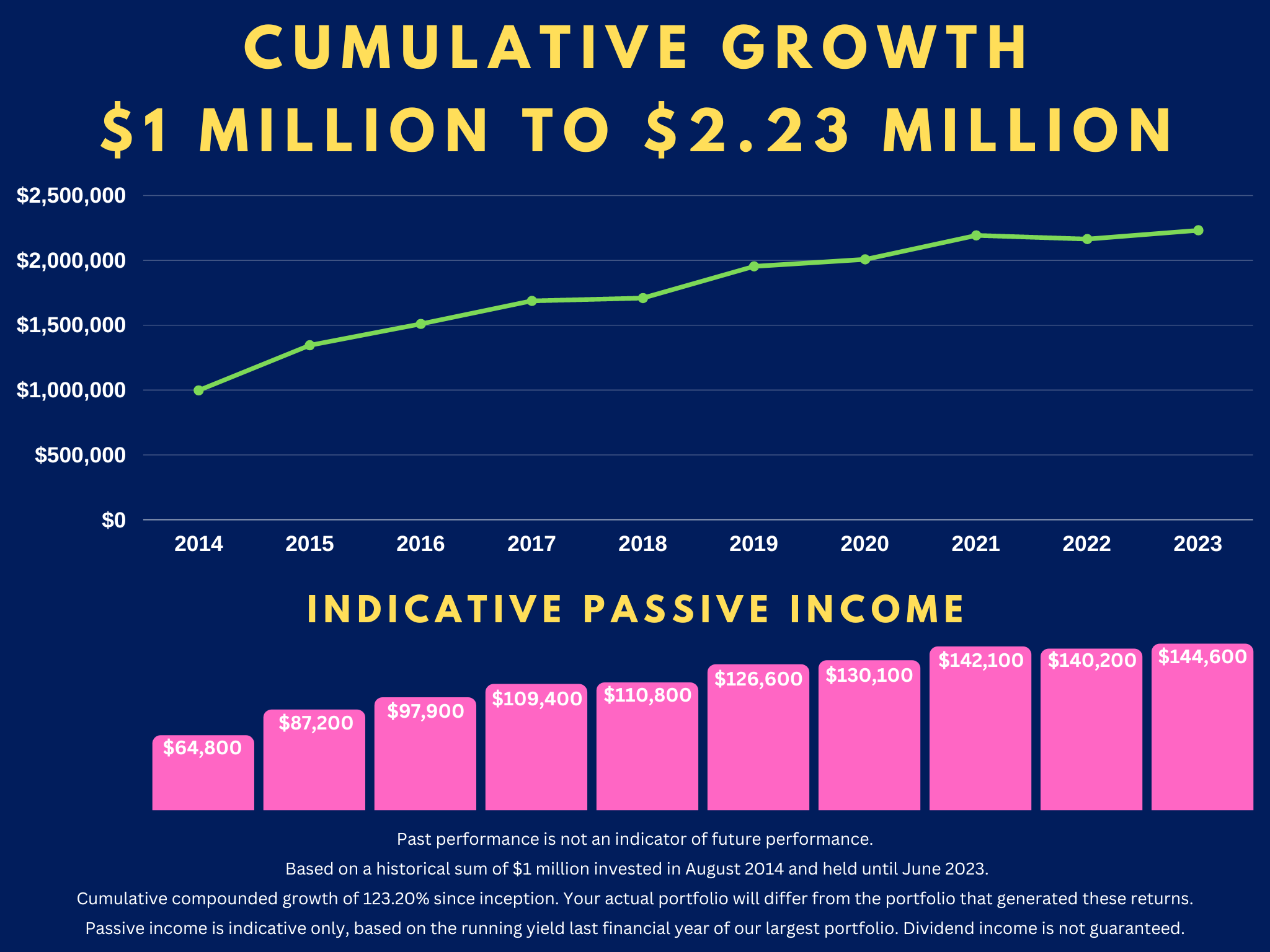

A wholesale portfolio I manage saw its value grow from about $1 million to $2.2 million over 8 years. Dividend income also grew from about $65,000 a year to almost $145,000.

Now, these 8 years were not normal. There was a pandemic, then an inflationary spiral. In both cases, the market panicked and retreated.

Yet that investor had a clear goal: to become financially independent with a passive income of over $100,000 p.a.

They have achieved that beyond expectation. (Though, of course, values can rise and fall in the market. And dividends are not guaranteed).

We had a strategy to try and achieve his goals with global equities. We call it our Quantum Income Strategy:

- About 70% of the portfolio in large, proven businesses with strong assets, dividends, and markets.

- About 20% of the portfolio in key growth commodity businesses with high (but less secure) dividends.

- Up to 10% of the portfolio in more speculative ‘kicker’ areas that could grow very fast. For example: biotechnology, internet technology, emerging markets, new energy, and new transport.

This vision and strategy enabled us to capture value during the 2020 pandemic. It enabled us to stay the course and invest further in the 2022 inflationary meltdown. It enabled us to hold our nerve and make money through some tough times.

Looking out to 2024, we could be about to achieve our goals beyond expectation. The inflation and interest-rate cycle will likely change. We have property assets bought at discount. And some strong dividend flows while we wait.

Further, we’re globally diversified.

I hope New Zealand will build more of a vision and get its mojo back. A stronger dollar would sure help investors. But the value of a wide mandate means you can take the best from a strategic pick of locations and industries.

If you’d like to learn more about our Quantum Income Strategy — and you may qualify as a Wholesale or Eligible Investor — we have an invitation for you:

Until Friday, 1st September, we’re offering free consultations on our Managed Account Service.

This is an institutional-grade solution for private clients, where we help to build a portfolio in your own brokerage account.

For our target client, we seek risk-managed growth with potential dividend income of $60,000 or more per year (depending on capital and market conditions).

Ask yourself: is this something you need to be looking at now?

Come talk to us. We are opening for limited consultations on our Managed Accounts Service. (Available until Friday, 1 September).

Apply for Your Consultation Now.

Apply for Your Consultation Now.

Regards,

Simon Angelo

Editor, Wealth Morning

This article is the editorial content of this periodical. It is general in nature and should not be construed as any financial or investment advice. Wealth Morning Managed Accounts are available to Eligible Investors and Wholesale Investors (not to Retail Investors) as defined in the Financial Markets Conduct Act (2013).

The post The Power of Vision: Your Financial Freedom Portfolio appeared first on Global Opportunities Beyond the Radar.