Do you consider yourself to be a rational person?

Are you sensible? Are you steady?

Or…is your judgement clouded by emotion? Do you find yourself being swayed by what you see? By what you hear?

Well, here’s the strange thing about human nature: the subconscious is more powerful than the conscious. Our emotional impulses drive our decision-making. And this happens more often than we dare to admit.

Source: Radio New Zealand

Source: Newstalk ZB

Source: Stuff

For example, just take a look at these headlines here:

- They’re attention-grabbing, aren’t they? There’s a suggestion of underlying anxiety. Perhaps even simmering panic.

- This happened during the opening stretch of the recent Paris Olympics. There was a lot of chatter about New Zealand’s lack of visible progress in the Games.

I noticed that the media started grumbling as early as three days in:

- During this time, when I listened to talkback radio, I encountered a flood of negativity. The critics seemed to suggest that New Zealand was a failed sporting nation. Our athletes were underperforming. Our coaches ought to be sacked.

- The mood was defeatist. Everything felt like doom and gloom.

- But then…suddenly…the storyline changed.

Source: NZ Herald

Source: NZ Herald

Wow, what an epic turnaround:

- Our athletes delivered a record haul of 20 medals. Smashing all expectations. This ended up being New Zealand’s most successful Olympics ever.

- As our Lord Jesus once said: ‘Why are ye fearful, O ye of little faith?’

Now, for me, this raises several questions:

- First of all, why was there such a huge gap between perception and reality? Why was there a disconnect between what the critics thought our athletes were capable of *versus* how they actually performed?

- Secondly, as a society, why have we become so impulsive? Why is it that we can no longer wait for a sporting competition to actually finish before passing judgment?

Shrinking attention spans

Source: Image generated by OpenAI’s DALL-E

A while back, I came across some controversial research. It goes like this:

- In the year 2000, the average attention span of a human was 12 seconds.

- However, by the year 2015, that number had dropped to just 8 seconds.

- Meanwhile, the average attention span of a goldfish is 9 seconds.

Good grief. Our ability to focus and concentrate does appear to be shrinking:

- What’s the cause of this? Well, perhaps the problem is that our media landscape has become increasingly fractured and splintered. This means that broadcasting no longer exists. Instead, what we have today is narrowcasting.

- Our news has been ‘gamified’, with content being sliced and diced. Dumbed down into junk food. Then pushed out on a conveyer belt at high speed. In this way, our brains are continuously bombarded with FEAR (False Emotions Appearing Real).

- All this is making us anxious and twitchy. We can only stay engaged for brief snatches of time. We can only consume bite-sized content for instant gratification. We no longer have time to think; only time to react. Click, click, click!

- What’s the end result here? Well, you might argue that our ability to reason has been totally compromised. Our reality has become distorted like a funhouse mirror. We can no longer see the big picture.

As proof of this, just think about our recent experience with the Paris Olympics:

- One moment, we were losing big. Then suddenly — dramatically — we were winning big. The transition was jarring. As a nation, it felt like we suffered whiplash as the storyline changed. But ask yourself: were we actually losing at all? Or was this simply an implanted suggestion?

- Also, consider this: before the media changed the storyline, were our Kiwi athletes any less capable? Were they any less talented? Was the criticism hurled against them actually justified? Or was it simply angertainment?

- This is no longer just clickbait. This is about ‘rage-baiting’. But is this actually healthy?

It’s time to fight back against goldfish thinking

Source: Image generated by OpenAI’s DALL-E

As a rational investor, you already know this:

- We live in a very noisy world. It’s filled to the brim with negative people. Their pessimistic messaging threatens to lead us astray.

- Indeed, it takes a great deal of focus to mute out these negative voices. It takes discipline and willpower to form a positive conviction of our own.

So, how exactly do we free our minds? Well, perhaps we can start by looking beyond the narrow confines of the media fishbowl:

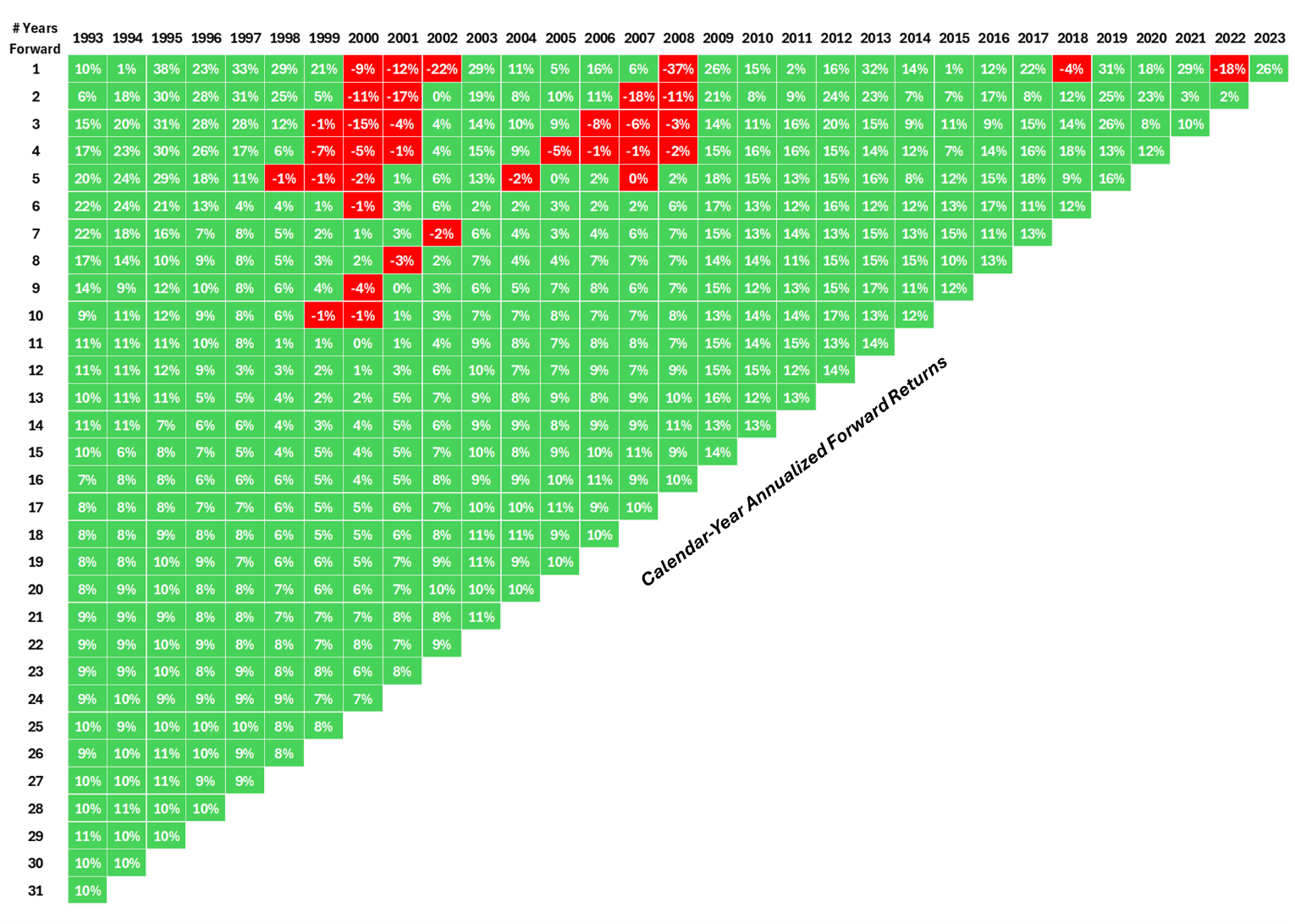

- For example, take a look at this chart here, put together by asset manager Ben Carlson.

- This is a list of annualised forward returns for the S&P 500. It runs from 1993 to 2023, covering 31 years of investment data.

Source: A Wealth of Common Sense

The media always has a negative tone. They will tell you about those isolated times when the stock market has been in decline. But watch out. What the media doesn’t give you is a sense of context. Nor do they give you a sense of scale:

- Just by looking at the chart above, you can see that there’s been a lot more green than red in the market.

- Indeed, the market’s ability to climb a wall of worry has been profound. Between 1993 and 2023, the world endured the dot-com bubble, the War on Terror, the Global Financial Crisis, the Covid pandemic, and the highest inflationary surge in two generations.

- Nonetheless, despite all these challenges, you could randomly pick any given year to start investing in. And, still, there’s an 80% chance that you’d end up with a green year.

- Of course, a pessimist might say, ‘What if I started investing during a horrible year like 2000? I would experience a terrible drawdown.’

- But an optimist might say, ‘What if I started investing during a fantastic year like 1995? If I get strong forward returns, a drawdown might be totally irrelevant in the long run.’

Certainly, past performance is no promise of the future:

- However, on the balance of probabilities, it’s worth betting on optimism rather than pessimism.

- Just like our Kiwi athletes at the Paris Olympics, I strongly believe that human resilience will overcome FEAR (False Emotions Appearing Real).

- It’s simply a matter of looking beyond the media fishbowl.

We want to hear from you

Your prosperity is our focus — which is why we are always working hard to uncover new opportunities beyond the radar for you. We’re eager for your feedback:

- If you have enjoyed this article, please consider leaving us a review.

- Let us know what you liked. Let us know what inspired you. Let us know if it’s made you a better investor.

Regards,

John Ling

Analyst, Wealth Morning

(This article is the author’s personal opinion and commentary only. It is general in nature and should not be construed as any financial or investment advice. Past performance does not indicate the future. Wealth Morning offers Managed Account Services for Wholesale or Eligible Investors as defined in the Financial Markets Conduct Act 2013.)

The post The Goldfish Problem: How to Invest Beyond Information Whiplash appeared first on Global Opportunities Beyond the Radar.