Rachel had been trading forex for a few months and was struggling to find a strategy that worked for her. She relied on technical analysis on pairs like EURUSD, GBP pairs at first, carefully studying charts and looking for patterns. But she often missed the bigger picture and found herself entering at the wrong times. On the advice of a trading mentor, she started incorporating fundamental analysis as well.

Now Rachel analyzes economic reports, interest rate changes, and geopolitical events to understand the overall market sentiment. She uses technical tools for timing trade entries and exits. The combination of technical and fundamental analysis has improved Rachel’s trading results tremendously. She finally feels like she has a complete trading approach.

When it comes to trading in the foreign exchange market and currency pairs like GBP pairs or EURUSD, there are two primary methods traders use to make decisions:

Technical Analysis and Fundamental Analysis

Both have their strengths and weaknesses, and many traders use a combination of the two just like Rachel did. Technical analysis focuses on the past and present price movements of a currency pair (EURUSD, GBPUSD, XAUUSD) to predict future movements, while fundamental analysis focuses on economic factors that can affect the value of a currency.

Technical Analysis

Technical Analysis is like studying a charts and trends to predict future price movements. It’s a bit like looking at a weather forecast, where you examine past weather data (price and volume) to make predictions about future weather (EURUSD, GBPUSD, etc currency prices).

Technical analysis is a popular approach to forex trading because it is relatively easy to learn and use. However, technical analysis is not a perfect science, and it is important to remember that past performance is not indicative of future results.

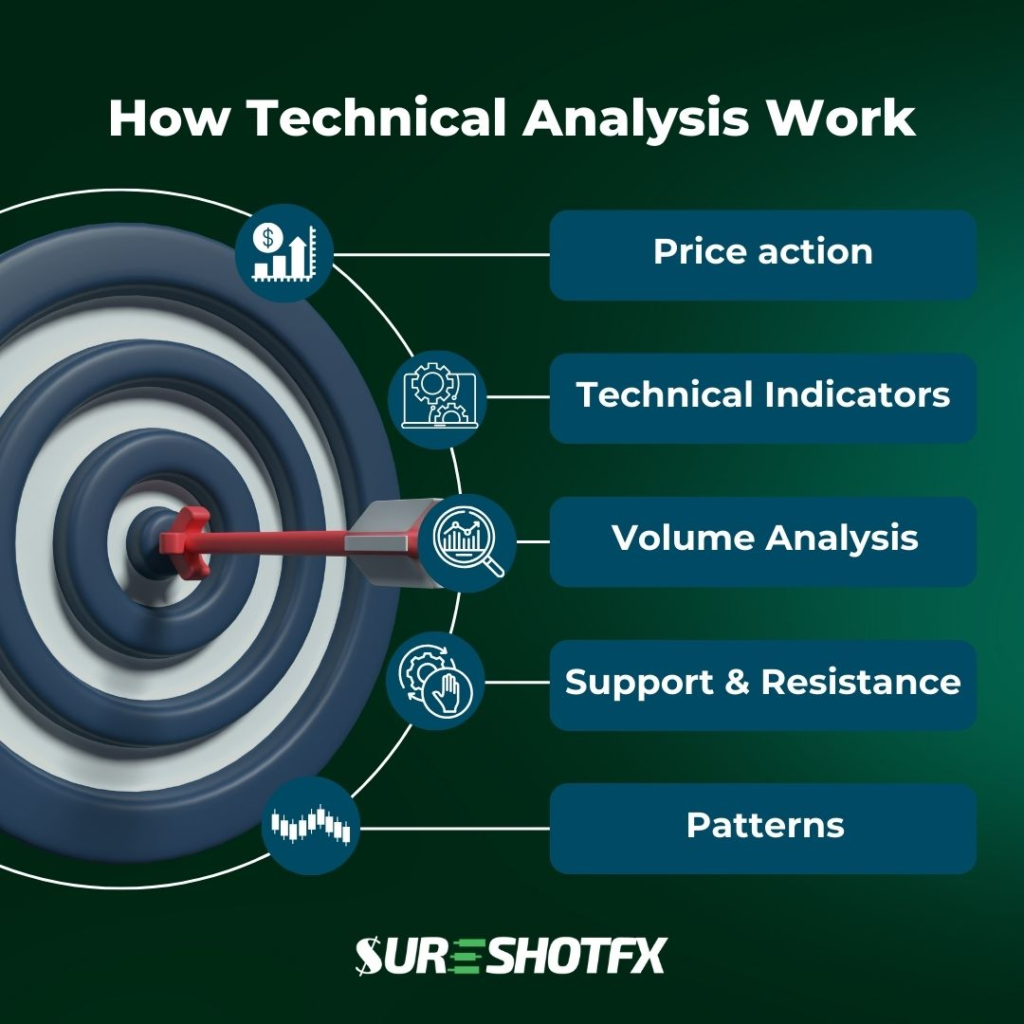

Here’s how it works:

- Price action: Analyzing zigzag charts and trends to spot support, resistance, and patterns that may indicate future price movements. Traders use price charts to plot the historical price movements of a currency pair. Popular techniques are trend lines, moving averages, and chart patterns.

- Technical indicators: Applying mathematical formulas to price data to calculate indicators like RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands. These quantify momentum, volatility, and potential overbought/oversold conditions.

- Volume analysis: Higher volume generally indicates more interest in a price movement. Volume can confirm breakouts and signal reversals.

- Support and Resistance: Traders pay attention to price levels where a currency pair has historically struggled to move past (resistance) or where it has bounced back from (support).

- Patterns: Technical analysts look for chart patterns like head and shoulders, double tops, and triangles. These patterns can signal potential price reversals or continuations.

For example, here are some of our weekly analysis shared on our FREE channel every week.

🔹 EURUSD’s this week bias is potentially Bearish.

🔹 Last week, we saw massive drop on EURUSD with the High impact news release & leaving huge imbalance to fillup.

🔹 So, if you’re going to take short setups, wait for Monday to play out then enter with LTF confirmations.

Advantages of Technical Analysis:

-It’s straightforward and doesn’t require extensive economic or financial knowledge.

-Technical Analysis can be applied to short-term trading, making it suitable for day traders.

-Early identification of momentum, reversals, and breakouts.

-Flexible approach with many different indicators and tools.

-Easy to learn and use.

Limitations of Technical Analysis:

– It doesn’t consider the underlying reasons for price movements, which can sometimes lead to incorrect predictions.

-It might not be as useful during major news events or economic announcements.

-Past performance does not guarantee future results.

Fundamental Analysis

Fundamental analysis is a more complex approach to forex trading than technical analysis. It requires a good understanding of economics and the ability to interpret economic data. It’s basically the assumption that the value of a currency (for example EURUSD) is determined by the economic and financial factors that influence supply and demand and impact currency valuations.

However, fundamental analysis can be a very powerful tool for identifying long-term trends in the currency market.

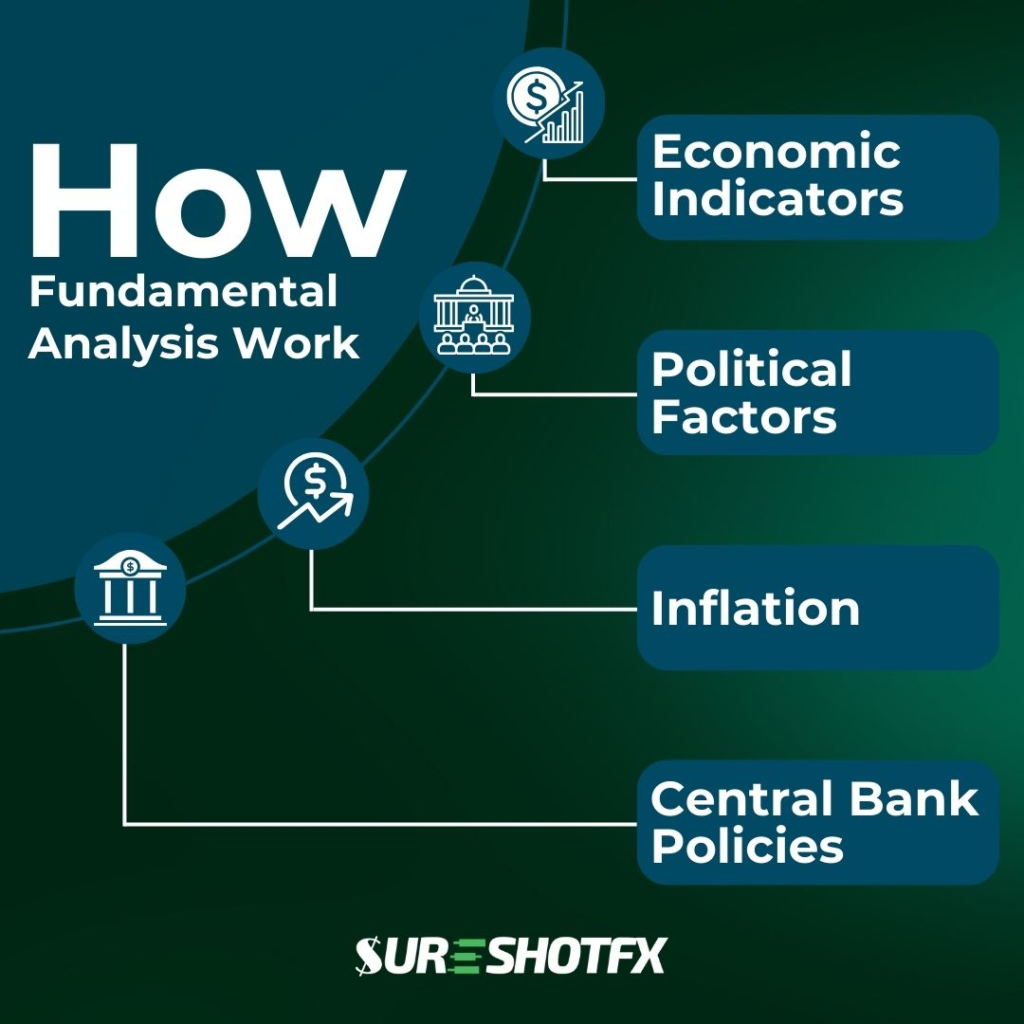

Here’s how it works:

- Economic Indicators: Fundamental analysts examine economic indicators like Gross Domestic Product (GDP), inflation rates, employment figures, and interest rates. These indicators provide insights into a country’s economic health.

- Political Factors: Political stability, government policies, Elections, wars, trade relationships can greatly affect a country’s currency value. Fundamental analysts keep an eye on political developments and their potential impact on currency markets.

- Inflation: Inflation is the rate at which prices for goods and services are rising. High inflation can erode the value of a currency, as it makes it less attractive to investors.

- Central Bank Policies: Central banks often change interest rates to control inflation and economic growth. These rate changes can significantly impact currency values. Again monetary policy, quantitative easing policy imposed by the central bank makes a huge difference.

Advantages of Fundamental Analysis:

– Analyzes the factors that actually change prices

– It provides a more comprehensive understanding of the factors influencing currency prices.

– Helps determine the big picture direction of a currency pair

– Fundamental Analysis is better suited for long-term investors who are looking at the big picture.

Disadvantages of Fundamental Analysis:

– It requires a deeper understanding of economic and political factors, which can be overwhelming for beginners.

– Fundamental picture changes in a second.

– Hard to quantify and make objective trading decisions

– May miss short-term counter-trend price movements

– Currency markets can sometimes react in unexpected ways to news events.

Which Approach is Better?

There is no one-size-fits-all answer to the question of which approach to forex trading is better. The best approach for you will depend on your individual trading style, risk tolerance, and time horizon. But:

- Short-Term vs. Long-Term: If you’re looking to make quick trades and profit from small price movements, Technical Analysis is often the preferred choice. However, if you’re in it for the long haul and want to invest based on a country’s economic health, Fundamental Analysis might be more appropriate.

- Simplicity vs. Complexity: Technical Analysis is simpler to grasp for beginners because it relies on charts and patterns. Fundamental Analysis, on the other hand, can be complex and requires a deeper understanding of economics and politics.

- Event-Based Trading: If you want to trade around specific events like interest rate decisions or major economic announcements, Fundamental Analysis is essential. These events can have a significant impact on currency markets, and Technical Analysis might not provide enough context

- A Balanced Approach: Some traders use a combination of both approaches to make their trading decisions. This is known as a “Hybrid” approach and can provide a more comprehensive view of the market as well as can help them to reduce their risk.

| Characteristics | Technical Analysis | Fundamental Analysis |

| Focus | Past and Present Movements | Economic Factors |

| Time Horizon | Short Term | Long Term |

| Complexity | Easy To Learn | Complex To Learn |

| Risk | Higher Risk | Lower Risk |

Tips for Beginners: Here’s our beginners friendly curated heads up

- Start by learning the basics of technical and fundamental analysis. There are many resources available online and in libraries that can teach you the basics.

- Practice using technical and fundamental analysis on a demo account before you start trading with real money. This will help you to learn how to use these tools and to develop your trading strategy.

- Start with small trades and gradually increase your risk as you gain experience.

- Remember that there is no guaranteed way to make money in forex trading. All trading involves risk, so it is important to trade with caution.

- You can find out more about How to Create a Good Trading Plan

Conclusion

In the world of Forex trading, choosing between Technical Analysis and Fundamental Analysis depends on your trading style, goals, and level of expertise. Technical analysis can help traders to identify short-term trading opportunities, while fundamental analysis can help traders to identify long-term trends in the currency market.

The best approach to forex trading for you will depend on your individual trading style, risk tolerance, and time horizon. If you are a beginner, it is important to start by learning the basics of both technical and fundamental analysis.

The post Technical vs Fundamental Analysis in Forex appeared first on SureShotFX.