Brent is undergoing a correction before its next upward move. This analysis also covers the dynamics of EUR, GBP, JPY, CHF, AUD, Gold, and the S&P 500 index.

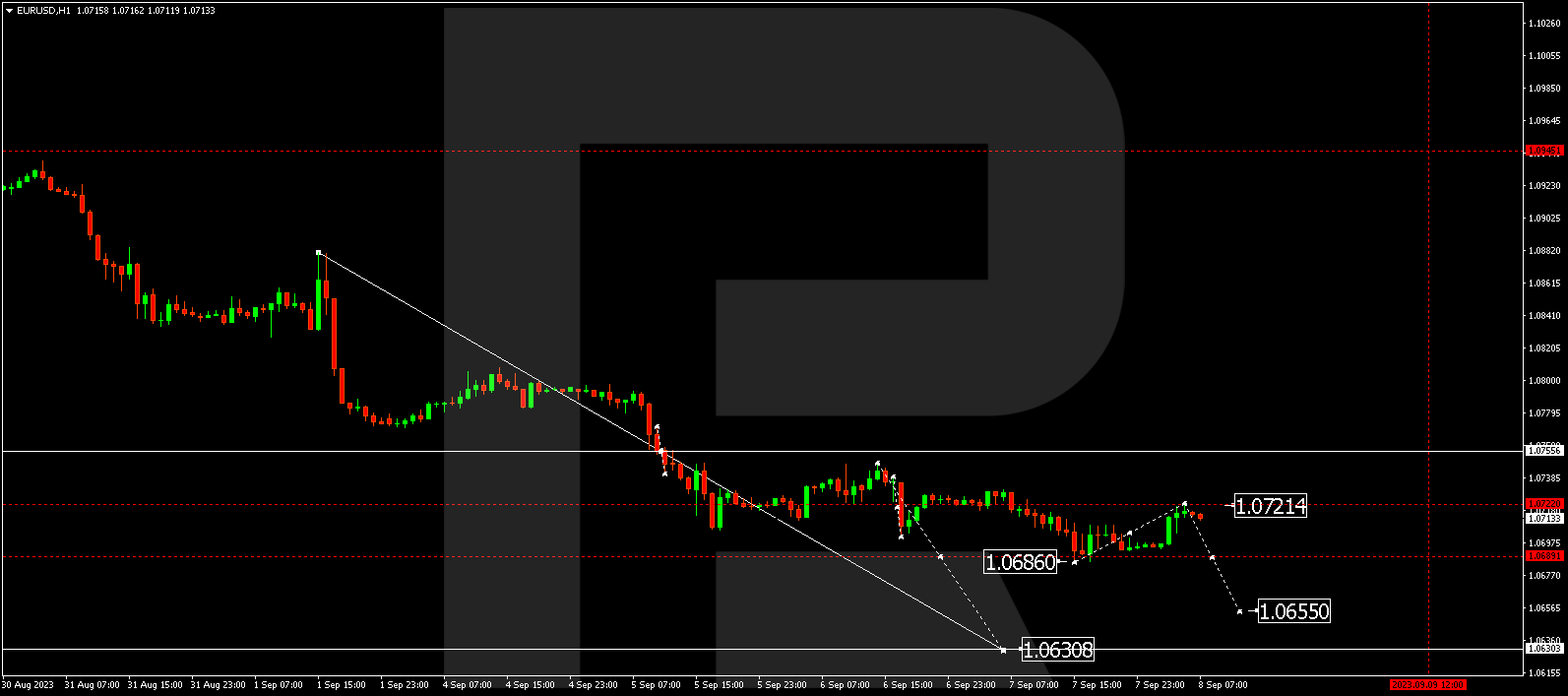

EUR/USD (Euro vs US Dollar)

EUR/USD has recently experienced a decline, reaching 1.0686. Today, the market is in a correction phase towards 1.0728. After this correction, we can anticipate a drop to 1.0670, which is a local target. Subsequently, a correction to 1.0900 might commence.

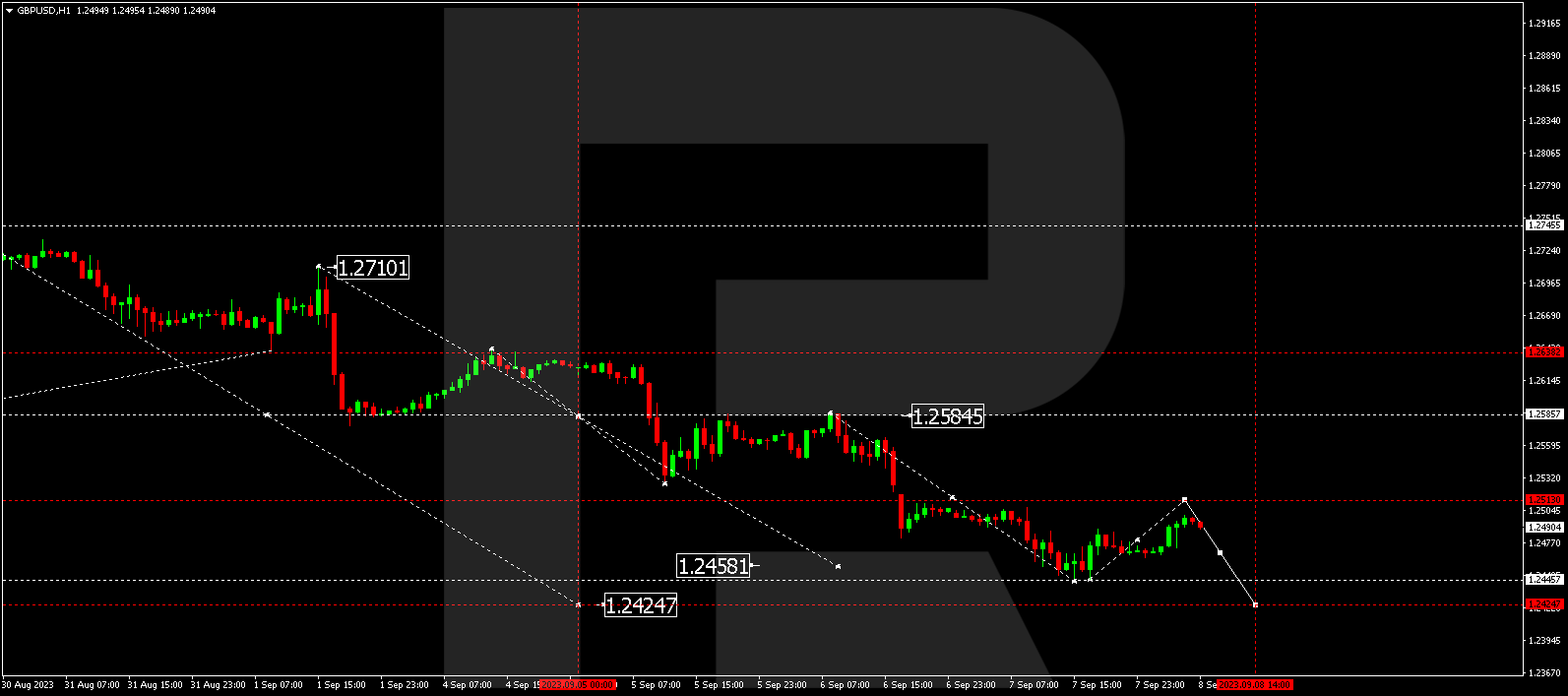

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD has completed a wave down to 1.2446. Today, the market is forming a corrective move towards 1.2513. Following this correction, a decline to 1.2424 is expected, serving as a local target. Next, we could witness a new correction wave targeting 1.2700.

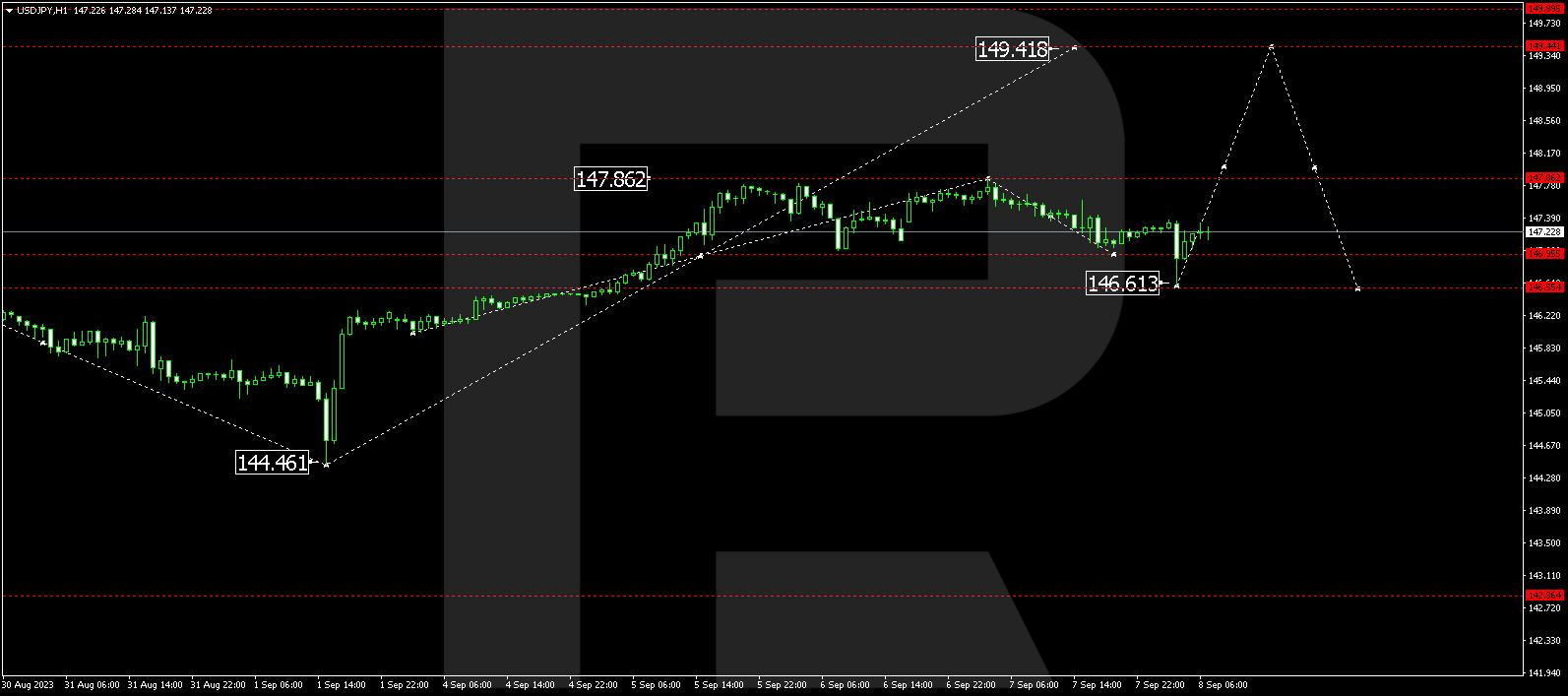

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY recently underwent a corrective movement to 146.62. The upward trend is expected to continue, reaching 147.87 today. If this level is surpassed, the trend could extend to 148.79, which is a local target. Subsequently, a downward wave towards 145.00 may begin.

Do you want to trade on favourable terms? Click on the banner below to access some of the most cost-effective trading conditions in the market!

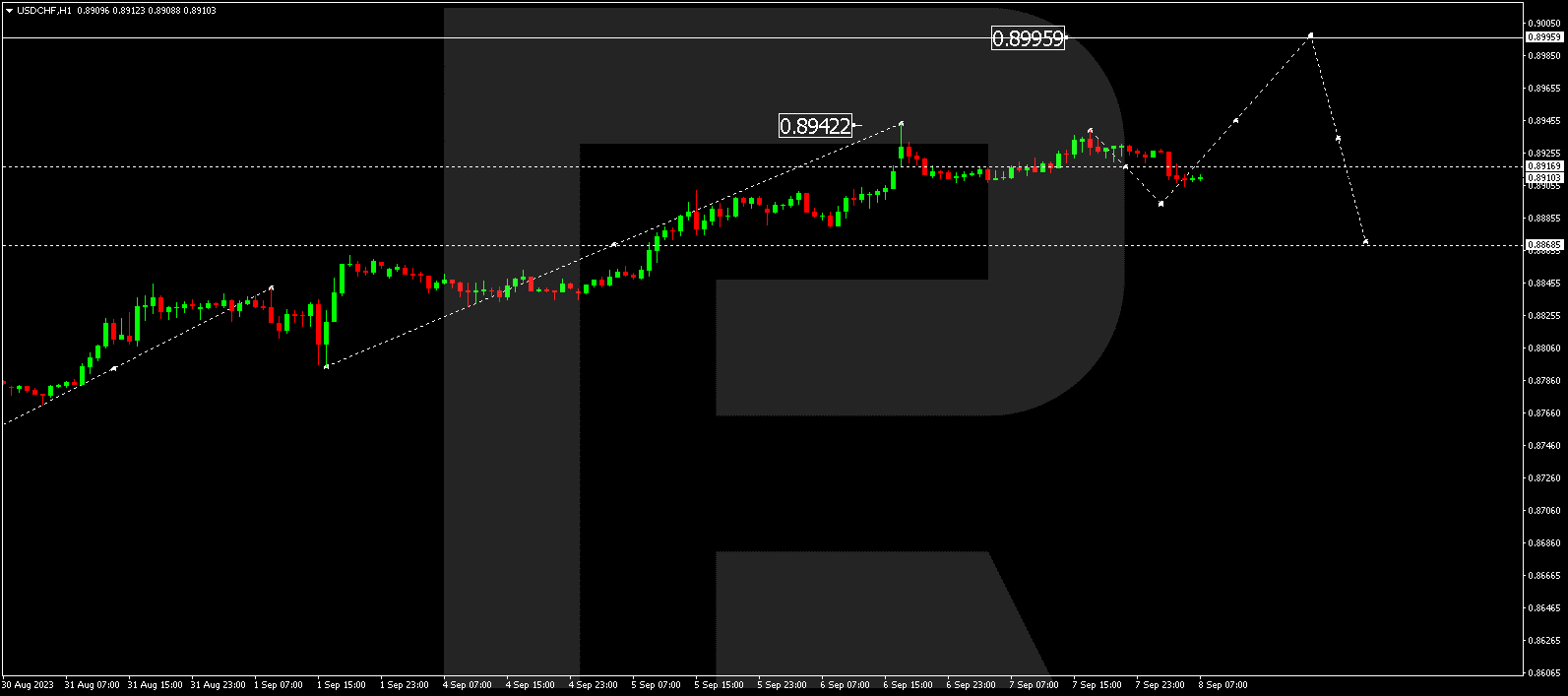

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF is currently forming a consolidation range around 0.8917. Today, the range might extend to 0.8892. After reaching this level, we could observe a rise to 0.8998, followed by the start of a new upward wave towards 0.8800.

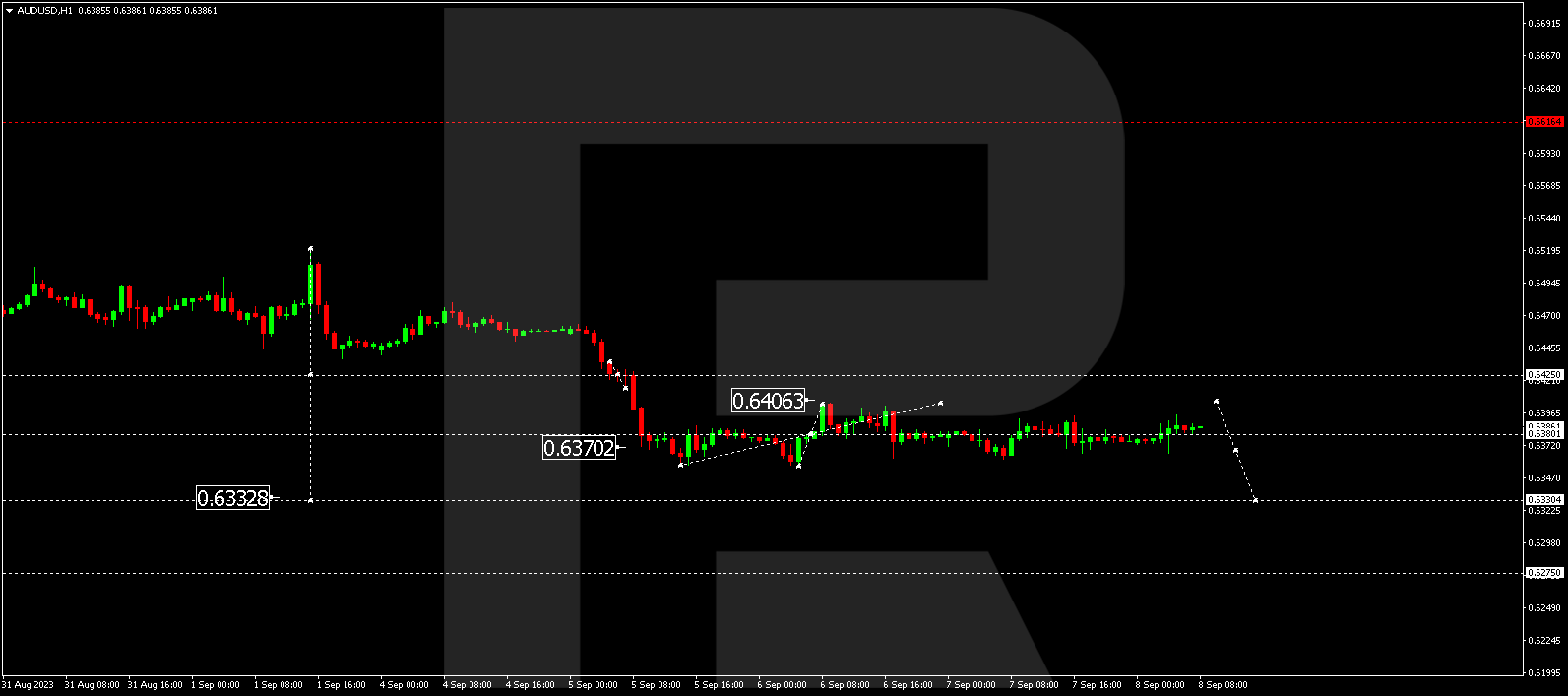

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD continues to develop a consolidation range around 0.6380 without displaying a strong trend. Today, the range might expand to 0.6406. Subsequently, a decline to 0.6333 is possible, followed by a new upward wave towards 0.6600.

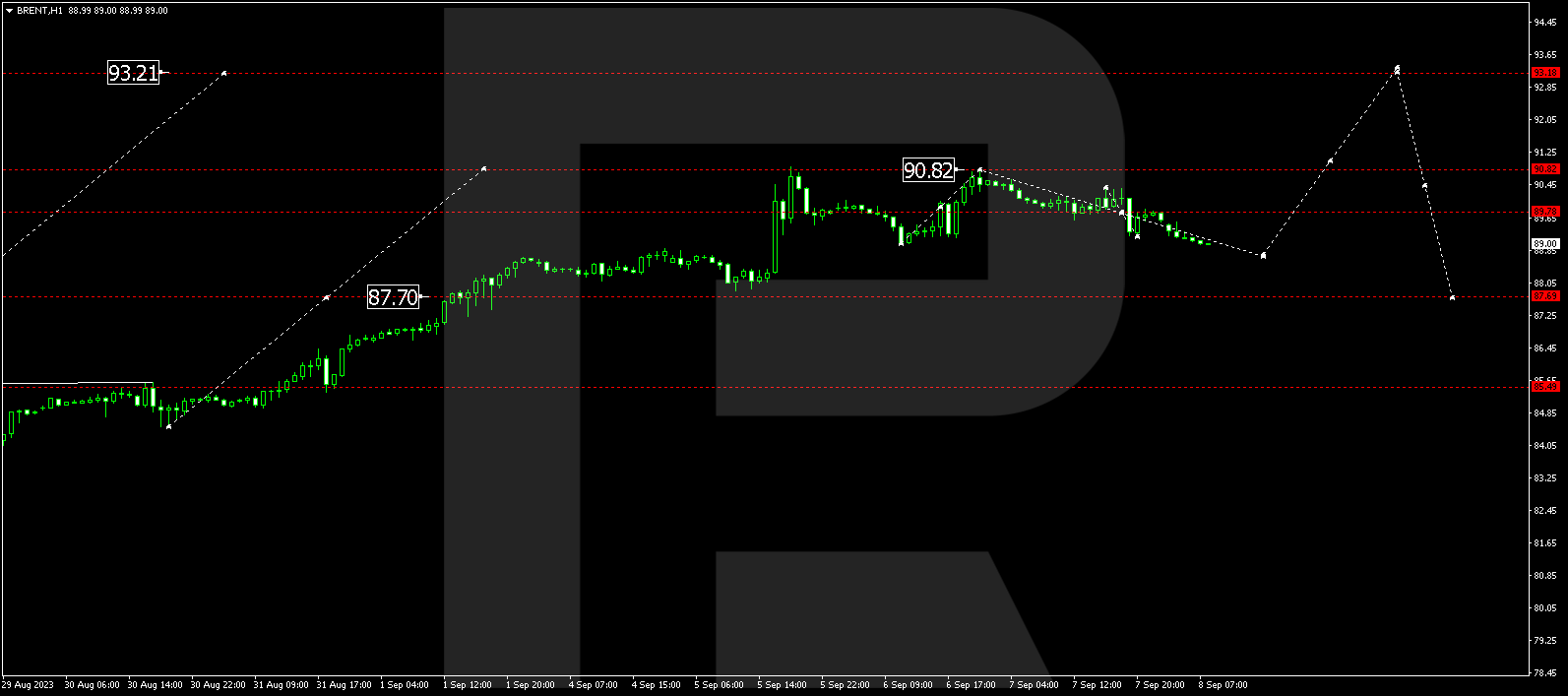

BRENT

Brent crude oil prices are currently forming a consolidation range around 89.80. Today, this range might extend to 88.80, with the potential for a rise to 90.90 if this level is breached. Additionally, if the price surpasses 90.90, it could reach 93.20, which is a local target.

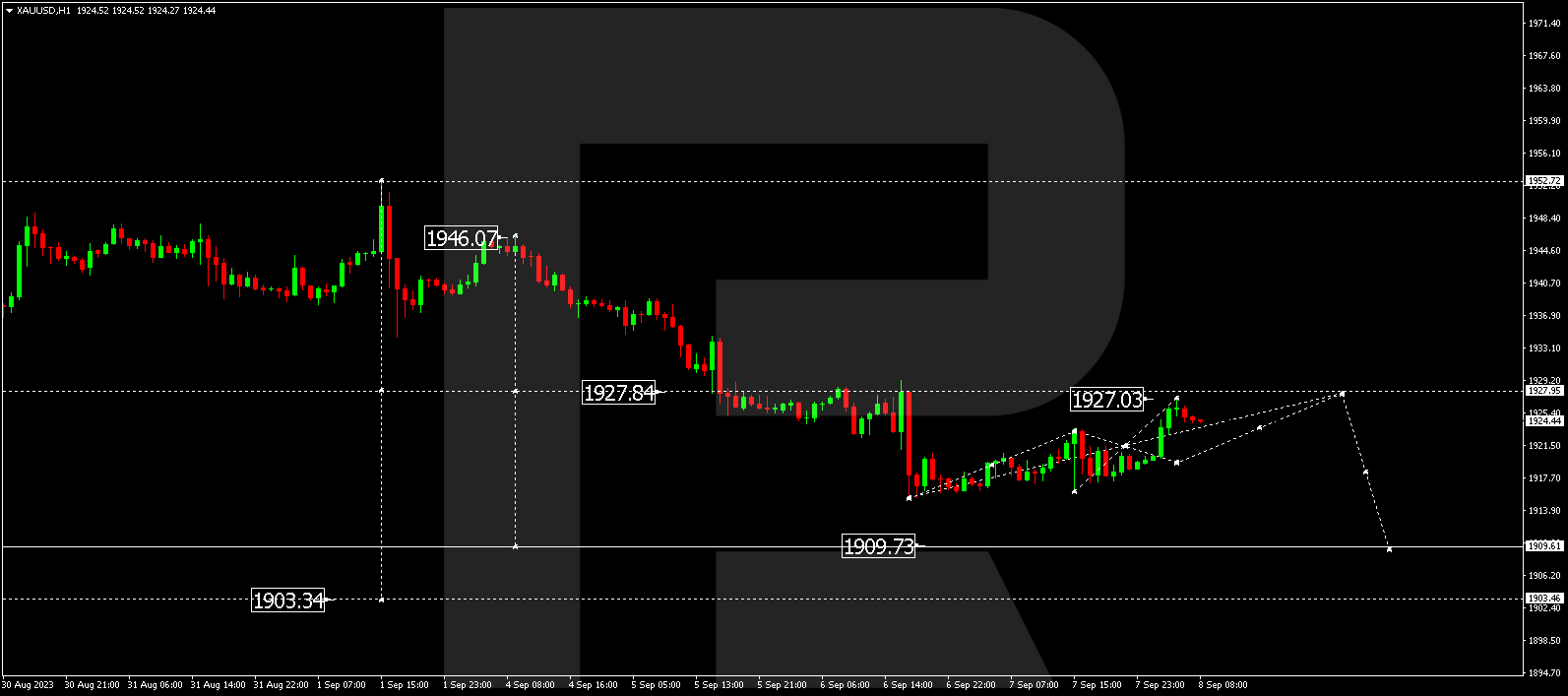

XAU/USD (Gold vs US Dollar)

Gold is still developing a consolidation range around 1921.50. Today, the range might expand to 1927.95, with a possible correction move. Following this correction, a decline to 1909.60 is expected, followed by an increase towards 1950.00.

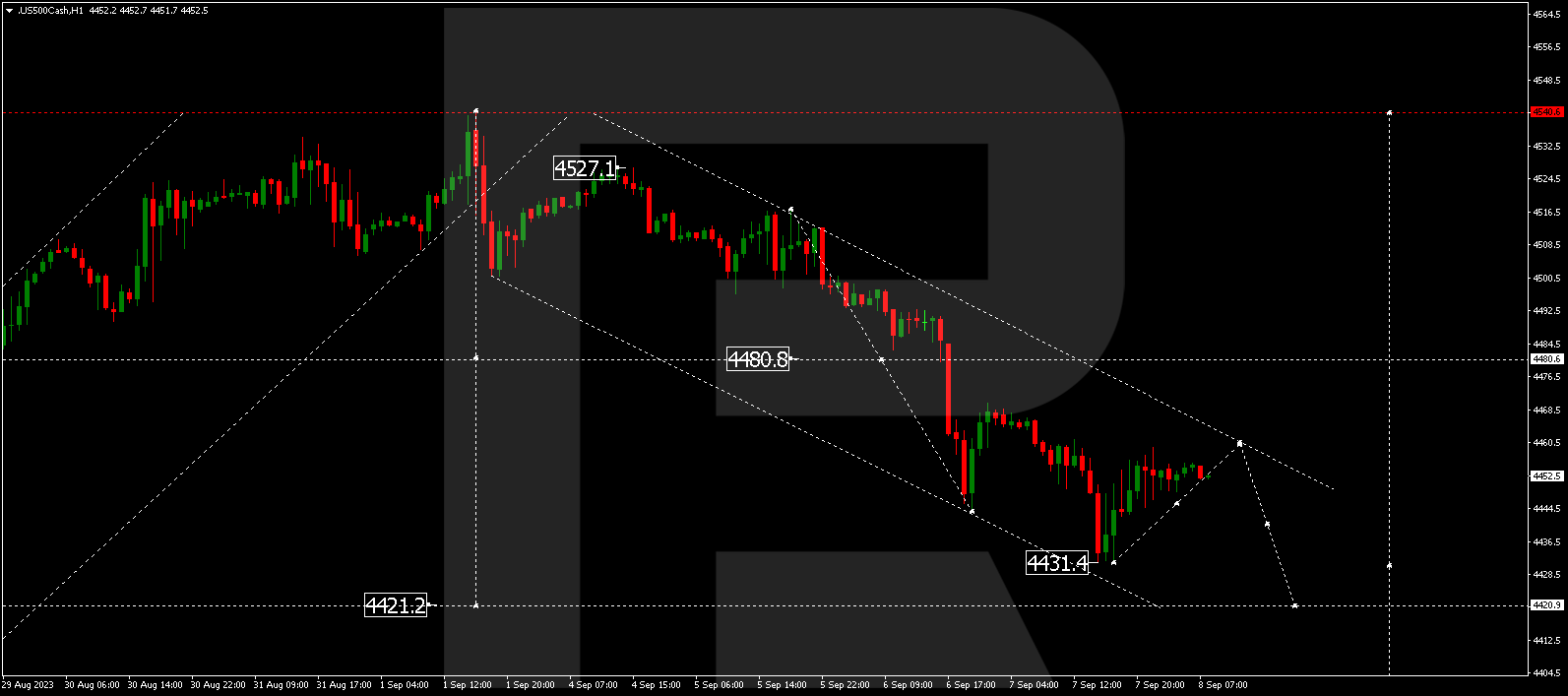

S&P 500

The stock index is currently in a correction phase towards 4468.0. After reaching this level, a decline to 4420.0 is anticipated as the first target. Subsequently, a correction to 4490.0 could follow.

The post Technical Analysis & Forecast September 8, 2023 appeared first at R Blog – RoboForex.