GBP is still in a downward trend, and in this overview, we’ll also examine EUR, JPY, CHF, AUD, Brent, Gold, and the S&P 500 index.

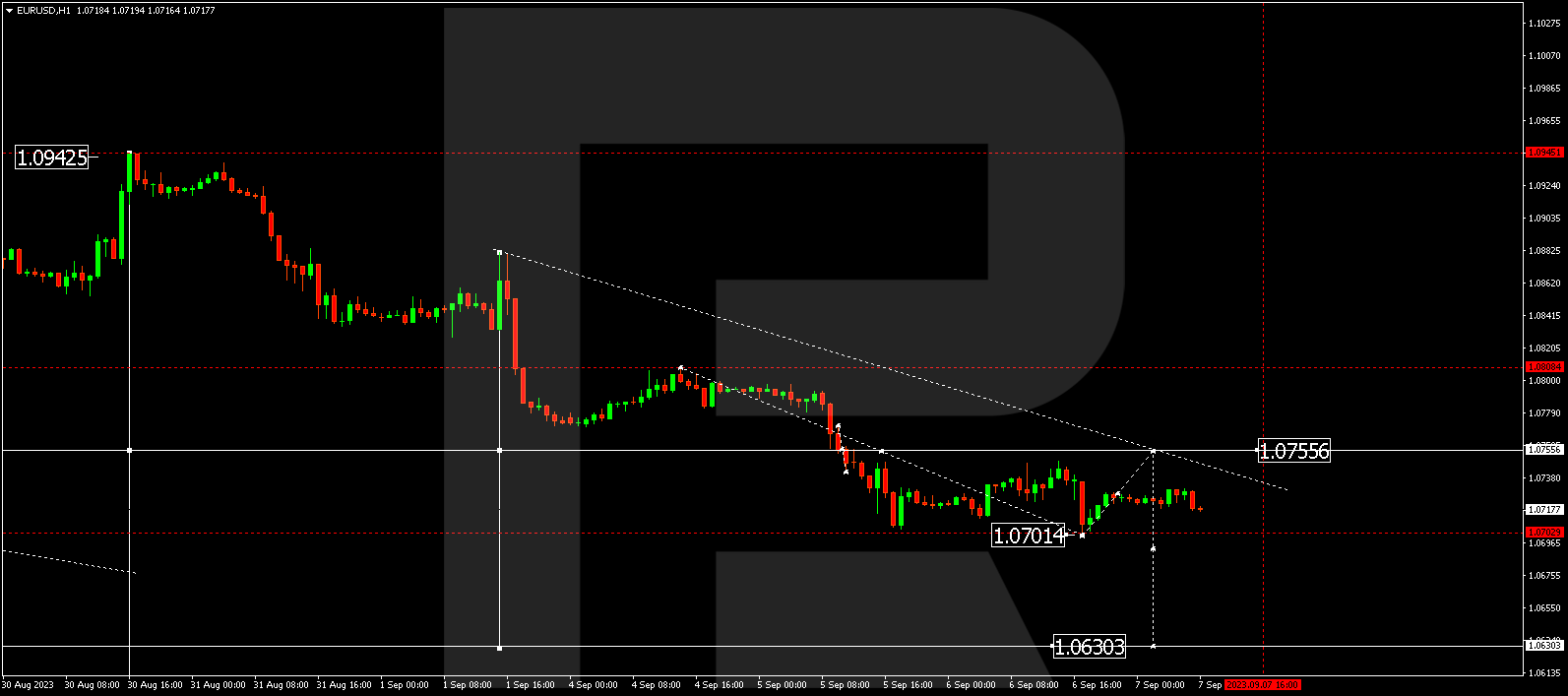

EUR/USD (Euro vs US Dollar)

EUR/USD has experienced a downward movement to 1.0701. Today, the market is establishing a consolidation range above this level. If it breaks out of this range upwards, there might be an upward movement to 1.0755 (after a test from below), followed by a decline to 1.0630, from where the trend could extend to 1.0566.

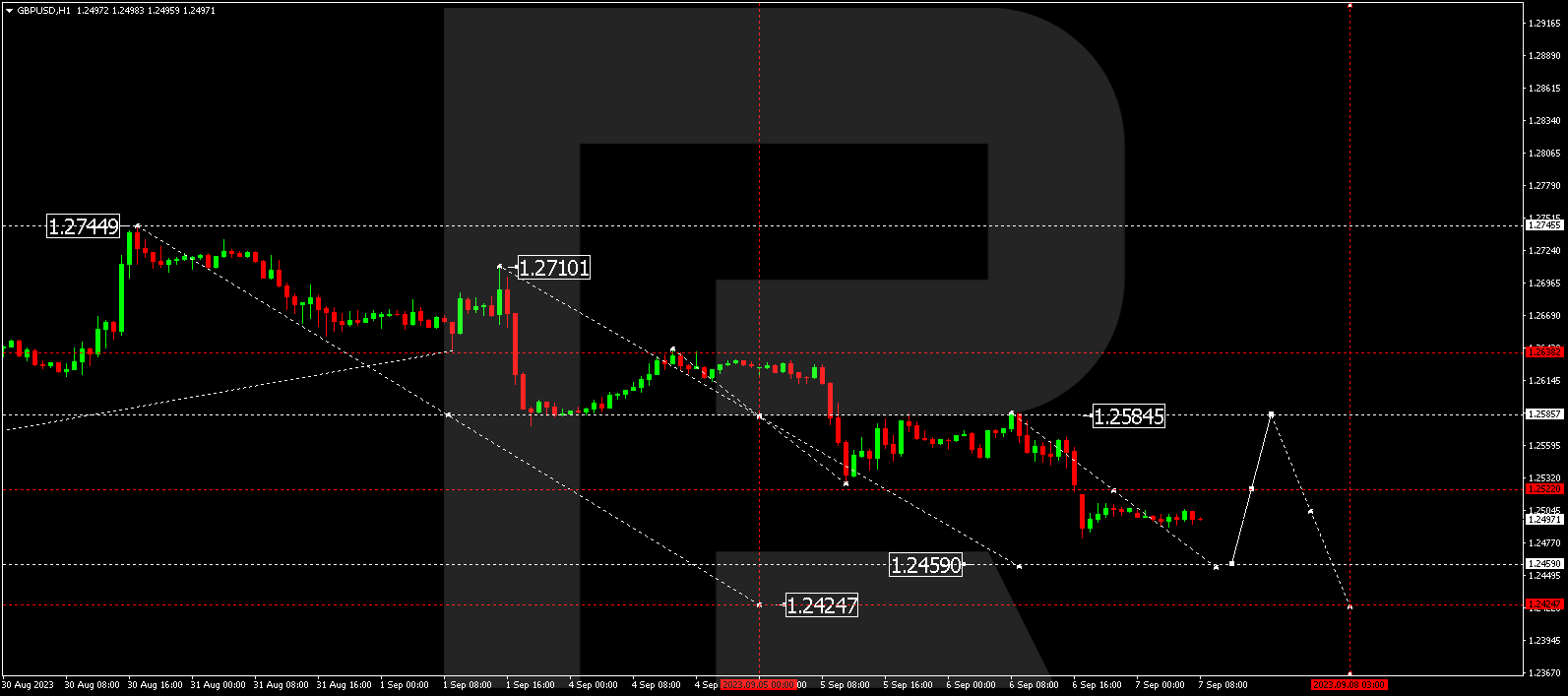

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD has broken below the 1.2522 level and continues its downward trajectory to 1.2459. After reaching this level, a correction to 1.2585 (after testing from below) is expected, followed by another decline to 1.2424. This is a local target.

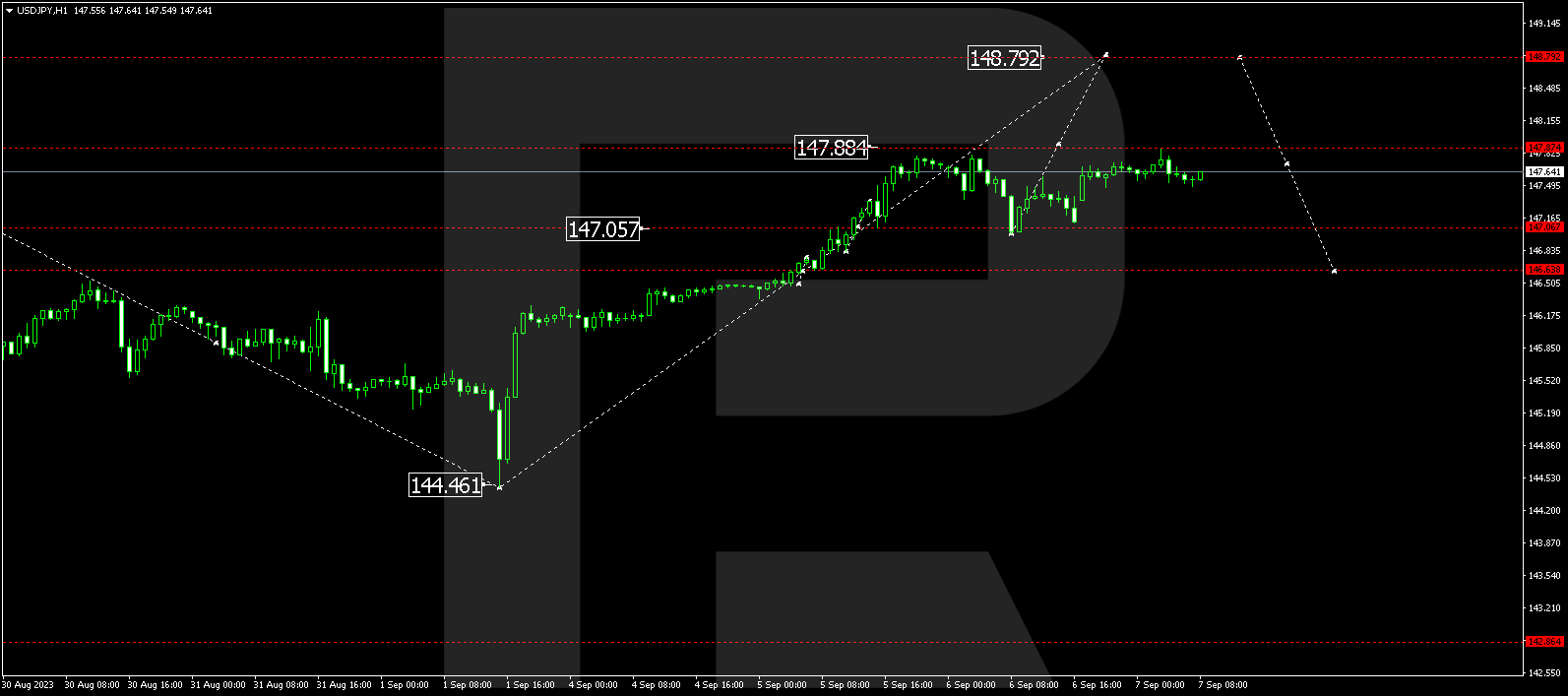

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY has completed a correction to 147.00. Today, it’s expected to continue rising to 147.87. If it breaks above this level as well, the trend might extend to 148.79. This is a local target.

Short on time for full-fledged trading? Register in the CopyFX copy trading system and start copying the trading strategies of top-ranking traders right now!

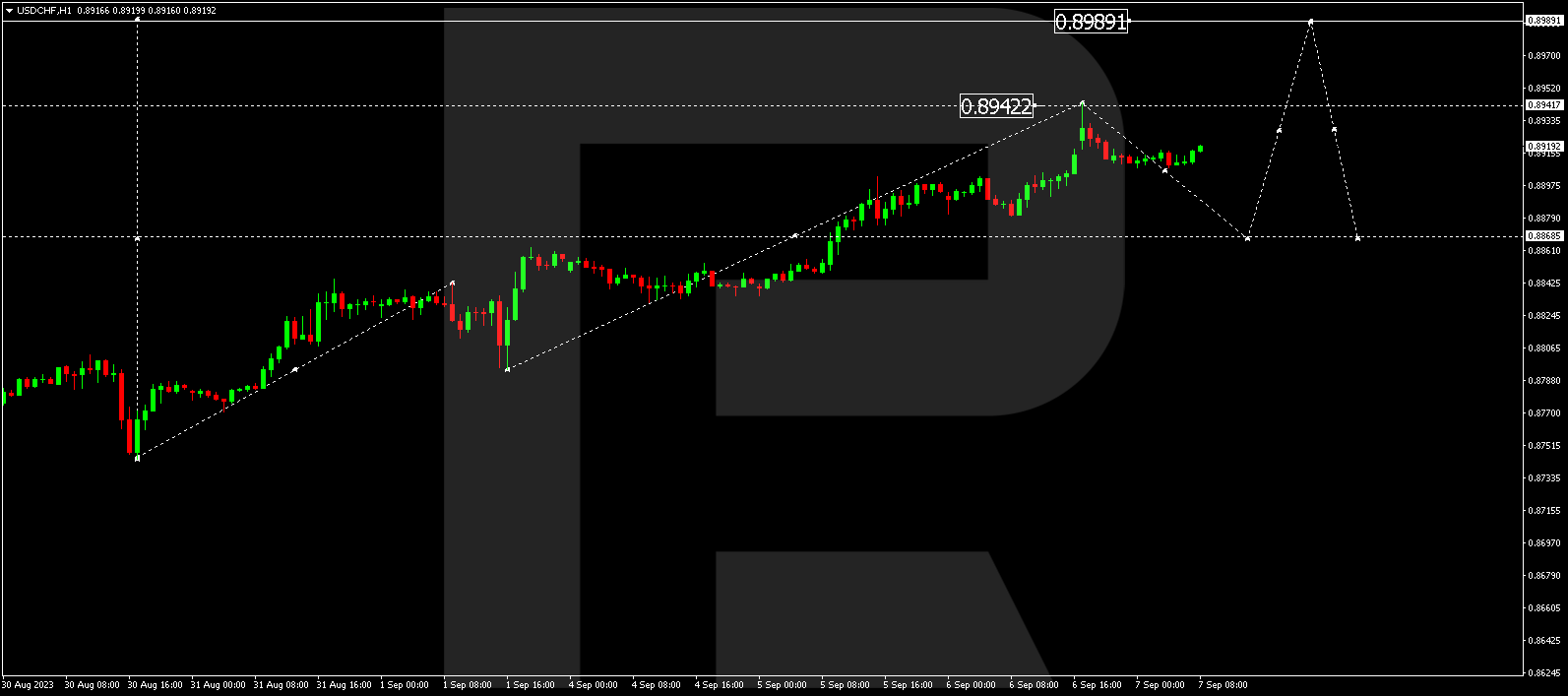

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF has completed a bullish wave to 0.8942. A consolidation range is forming below this level today. If it breaks out of the range upwards, the price could rise to 0.8989, from where it might continue to 0.9000. If it breaks out downwards, a correction to 0.8868 is possible, followed by another rise to 0.8989.

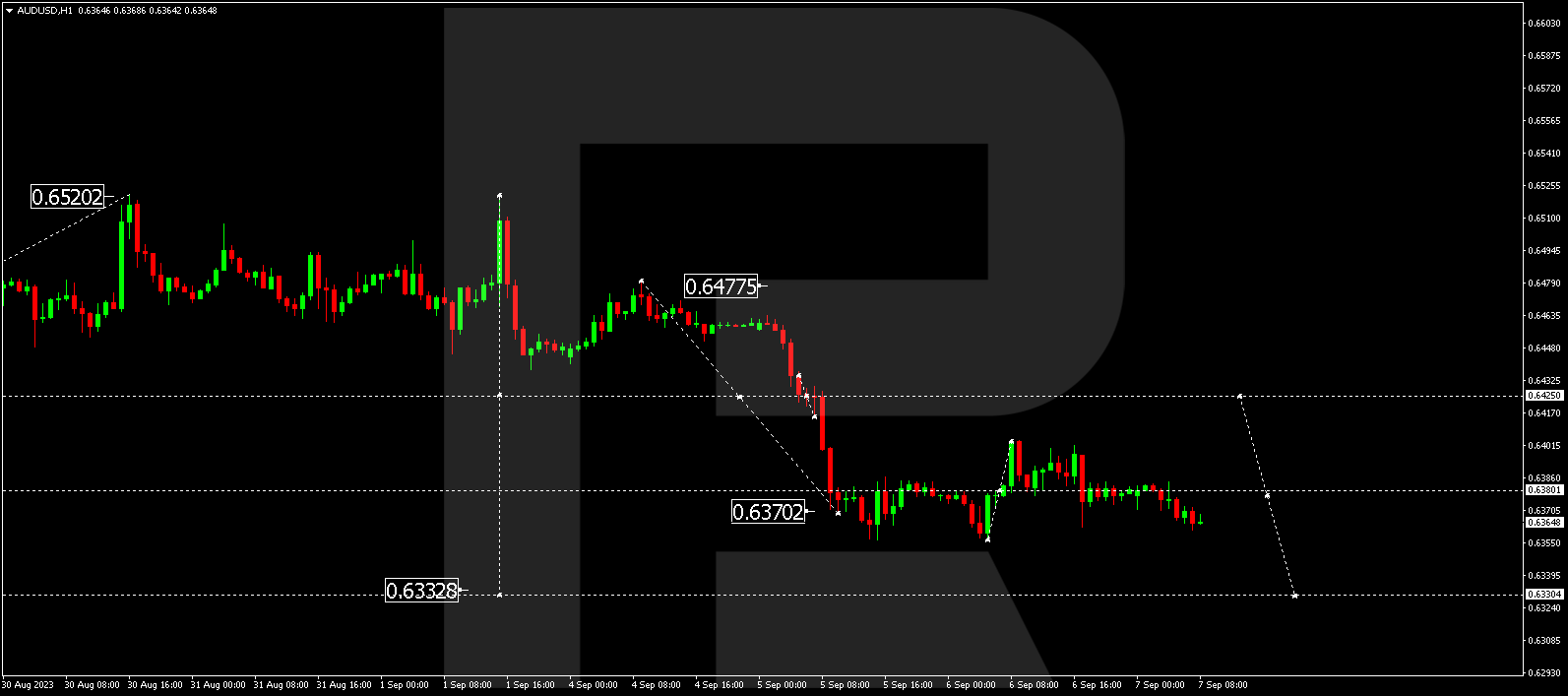

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD continues to consolidate around 0.6380. If it breaks out of the range upwards, there’s a possibility of a correction to 0.6425. If it breaks out downwards, the downward wave might continue to 0.6330, and from there, the trend could extend to 0.6275.

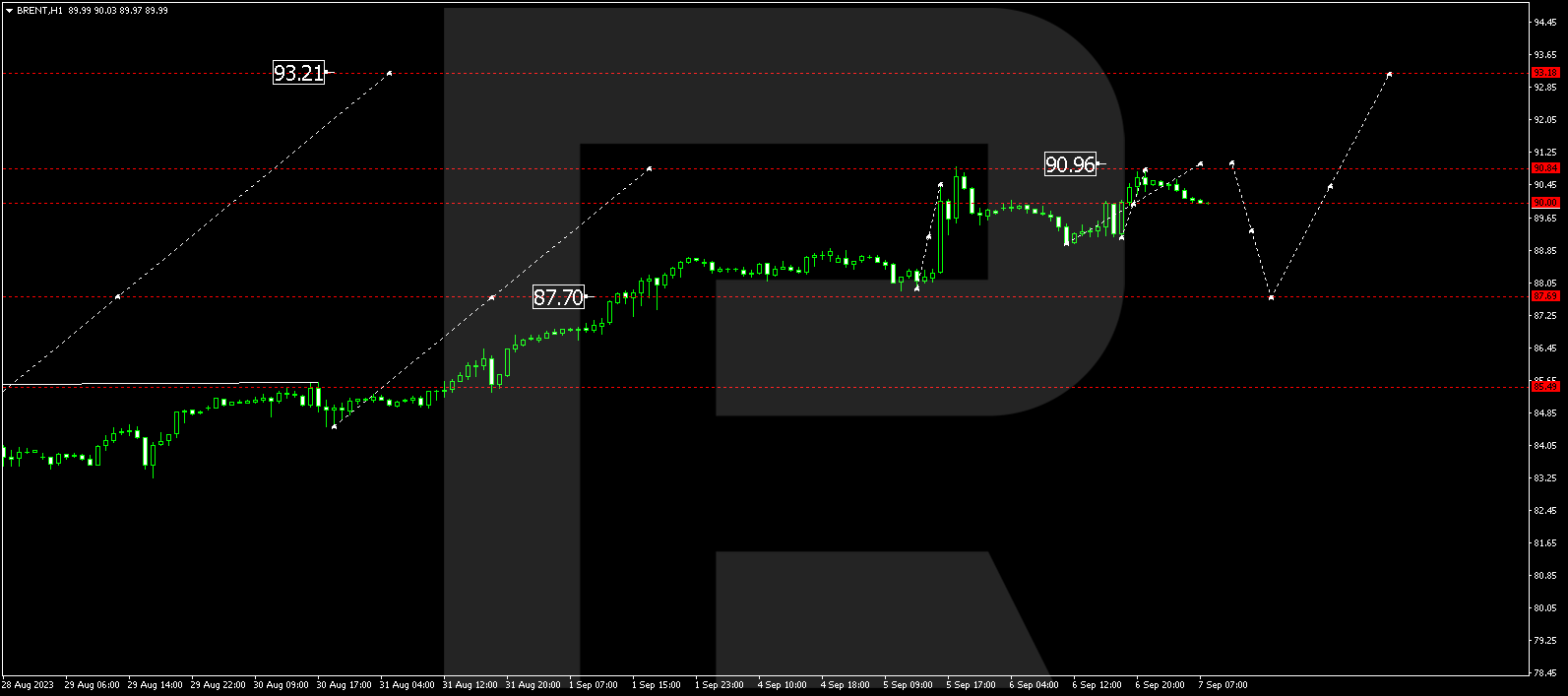

BRENT

Brent is still in an upward wave towards 90.96. After reaching this level, a correction to 87.70 is possible. After the correction, the upward wave could continue to 93.18, and from there, the trend might extend to 93.93. This is a local target.

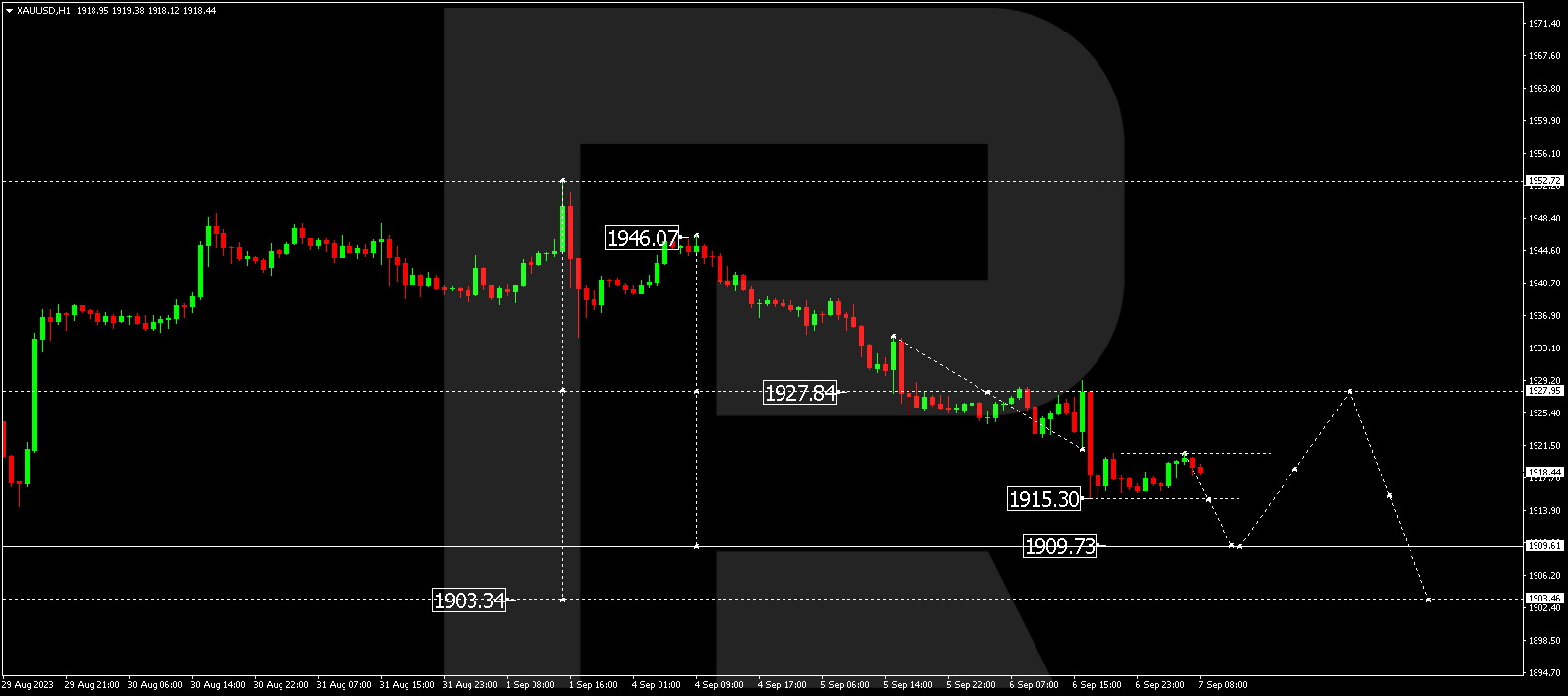

XAU/USD (Gold vs US Dollar)

Gold has formed a consolidation range around 1927.95, followed by a downward movement to 1915.30 after breaking out of the range. Today, the market is creating a new consolidation area above this level. If it breaks out upwards, there’s a possibility of a correction to 1927.00 (after testing from below). If it breaks out downwards, there’s potential for a downward movement to 1909.70, and from there, the trend could continue to 1903.33. This is a local target.

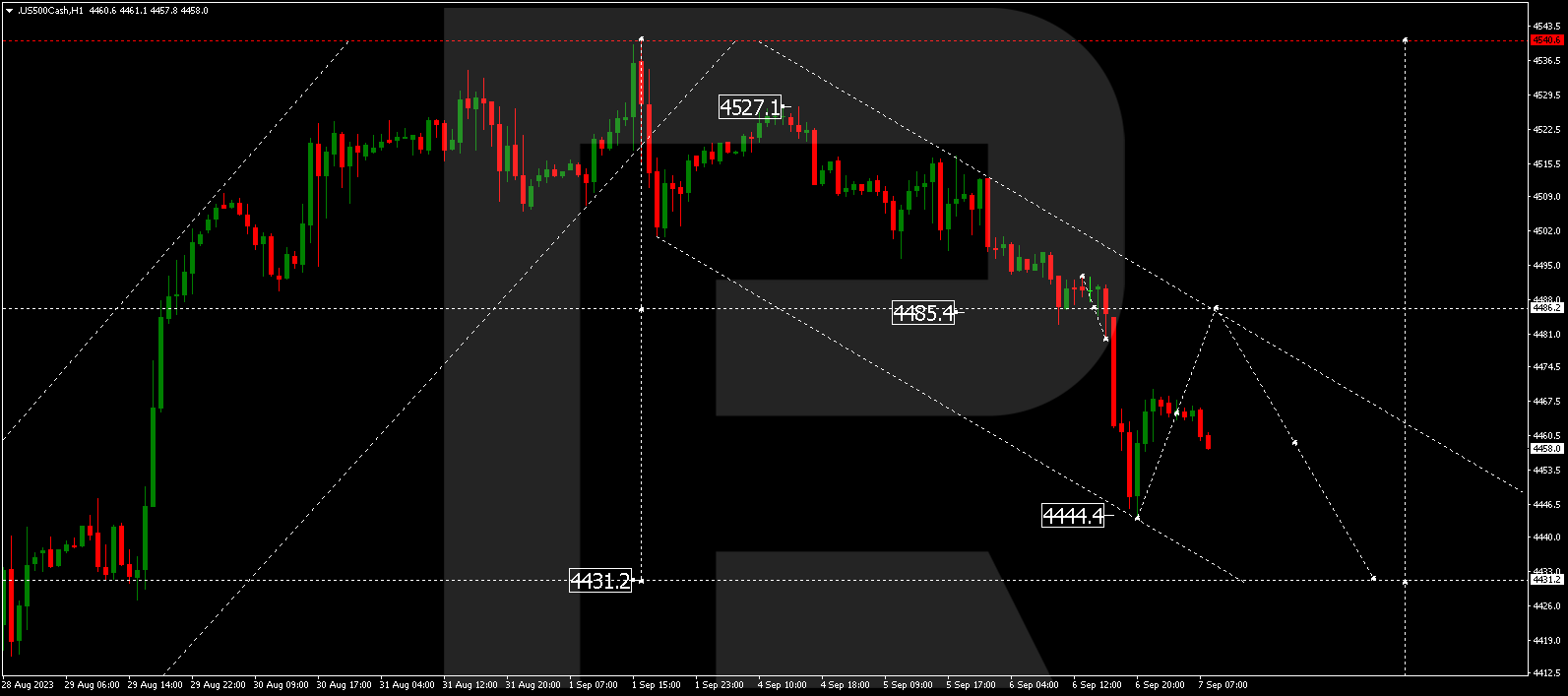

S&P 500

The stock index has completed a downward wave to 4444.4. A consolidation range is forming above this level today. If it breaks out of this range upwards with a correction to 4485.0 (after testing from below), there might be a decline to 4430.0. If it breaks out downwards, there’s potential for a downward wave to 4430.0, and from there, the trend could extend to 4325.0. This is a local target.

The post Technical Analysis & Forecast September 7, 2023 appeared first at R Blog – RoboForex.