Gold Sees Continued Decline In this report, we provide an analysis of the current dynamics of major currencies and commodities, including EUR, GBP, JPY, CHF, AUD, Brent crude, Gold, and the S&P 500 index.

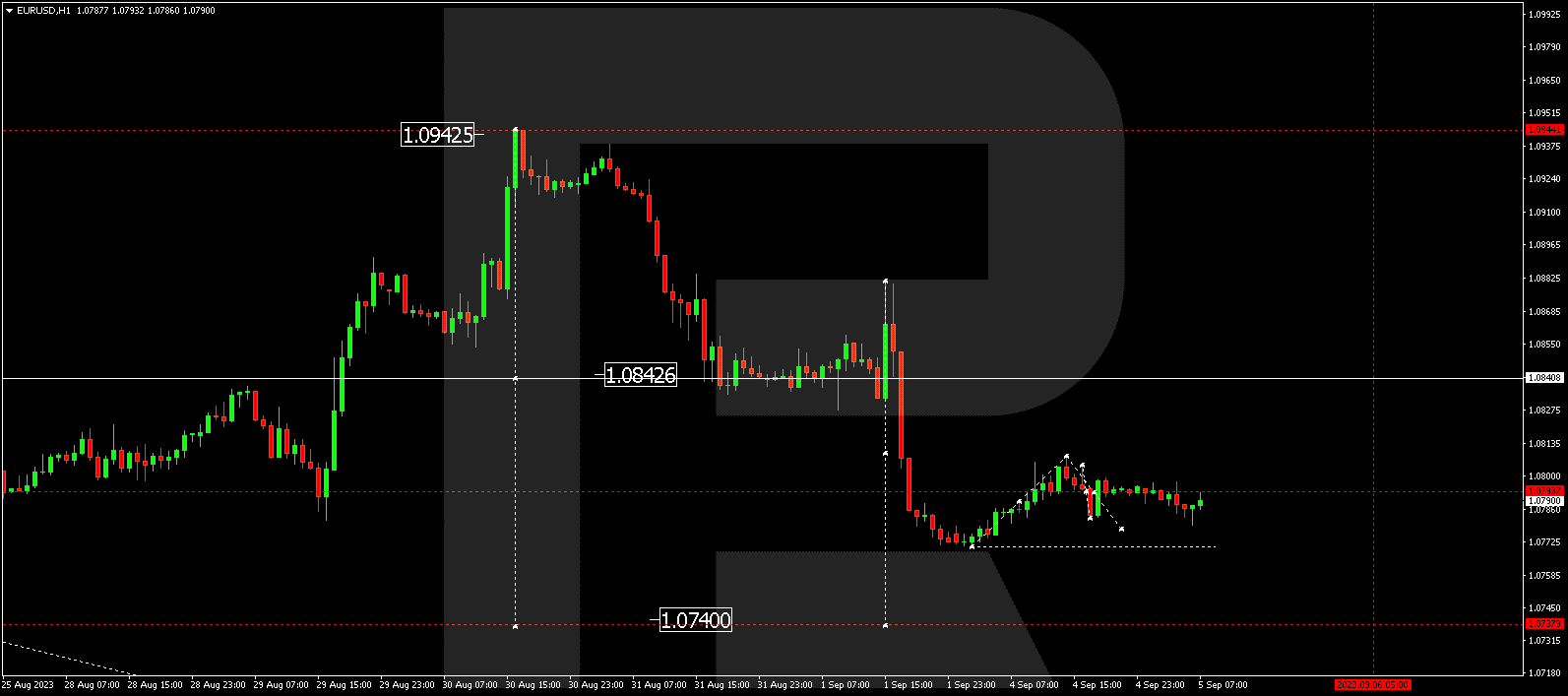

EUR/USD (Euro vs US Dollar)

EUR/USD recently completed a corrective movement, reaching 1.0808. Today, the market is consolidating below this level. There’s a possibility of an upward breakout, potentially leading to a rise to 1.0840. Conversely, a downward breakout could signal a decline to 1.0740, from where the trend might continue to 1.0700. This represents a local target.

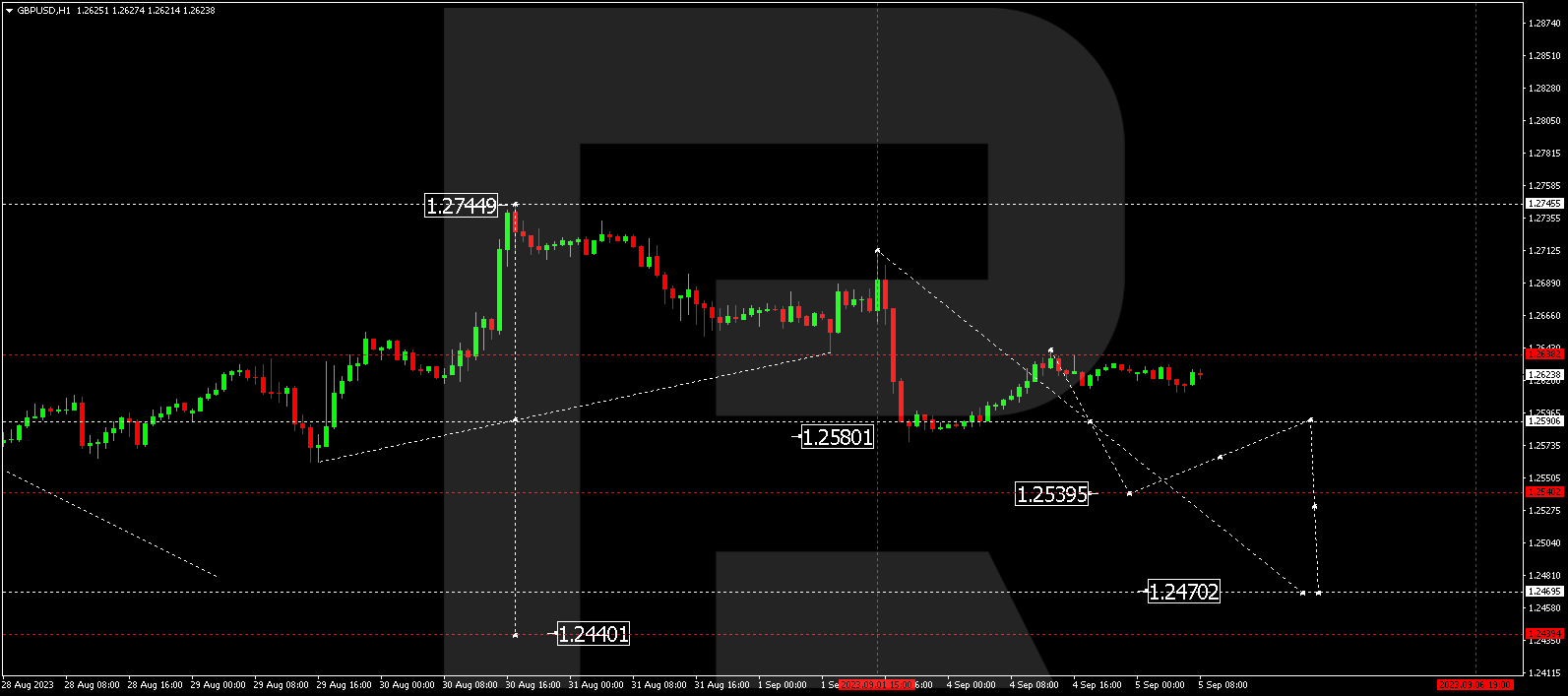

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD has undergone a corrective wave, touching 1.2638. Currently, the market is in a consolidation phase below this level. A breakout to the upside may trigger a correction towards 1.2700. Conversely, a downward breakout could lead to a drop to 1.2540, with further potential for a move to 1.2470. This is considered a local target.

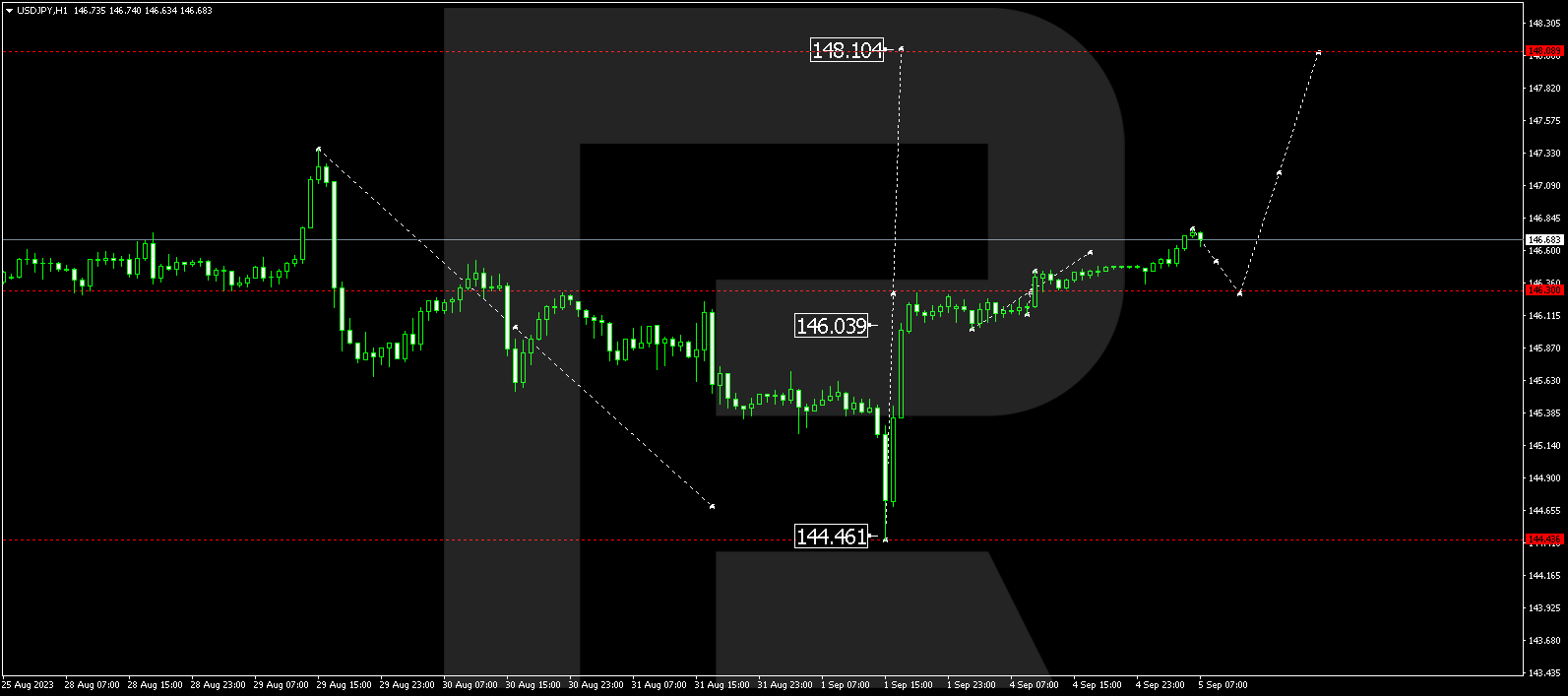

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY has experienced an upward move to 146.76. There’s a possibility of a decline to 146.30 today, followed by a potential rise to 148.08. This represents a local target.

Experience trading in the high-tech R StocksTrader terminal! Real stocks, advanced charts, and a free trading strategy builder. Click on the banner and open an account!

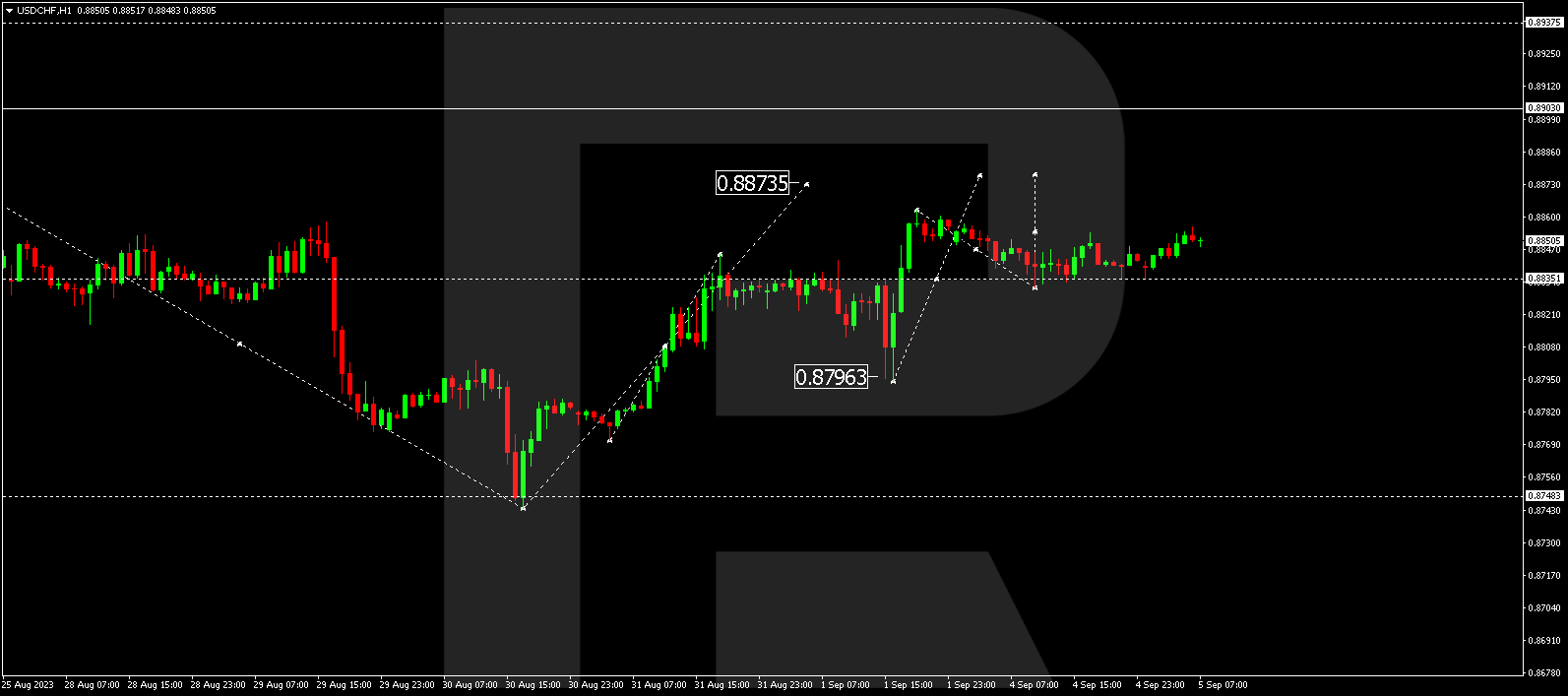

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF recently corrected to 0.8835. Currently, a consolidation range is forming above this level. An upward breakout could pave the way for a rise to 0.8880, with potential for further extension to 0.8903.

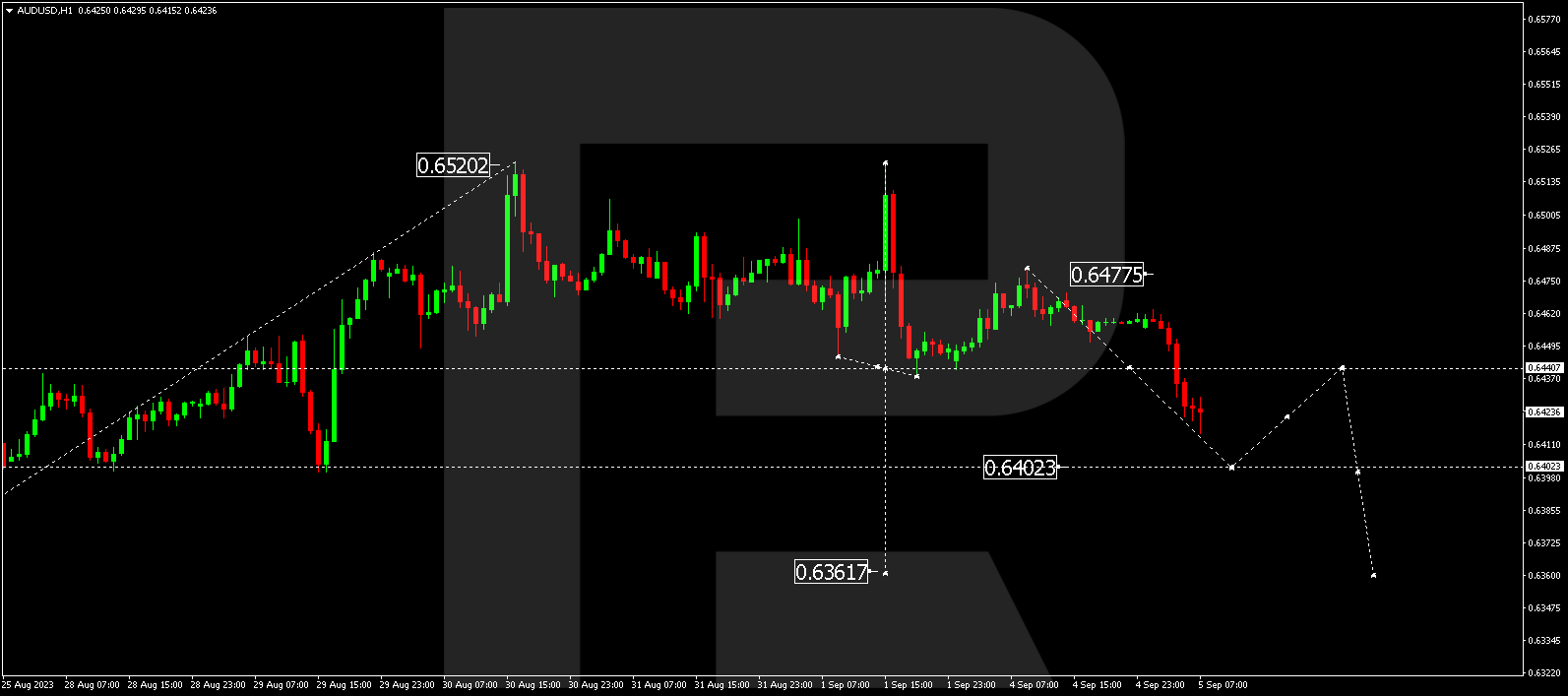

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD saw a correction to 0.6477 before initiating a new downward wave. The market has broken below the 0.6440 level and is currently in the process of developing a decline to 0.6402, which is considered a local target. Following this, there’s a possibility of a correction to 0.6440 (with a test from below) before another decline to 0.6360.

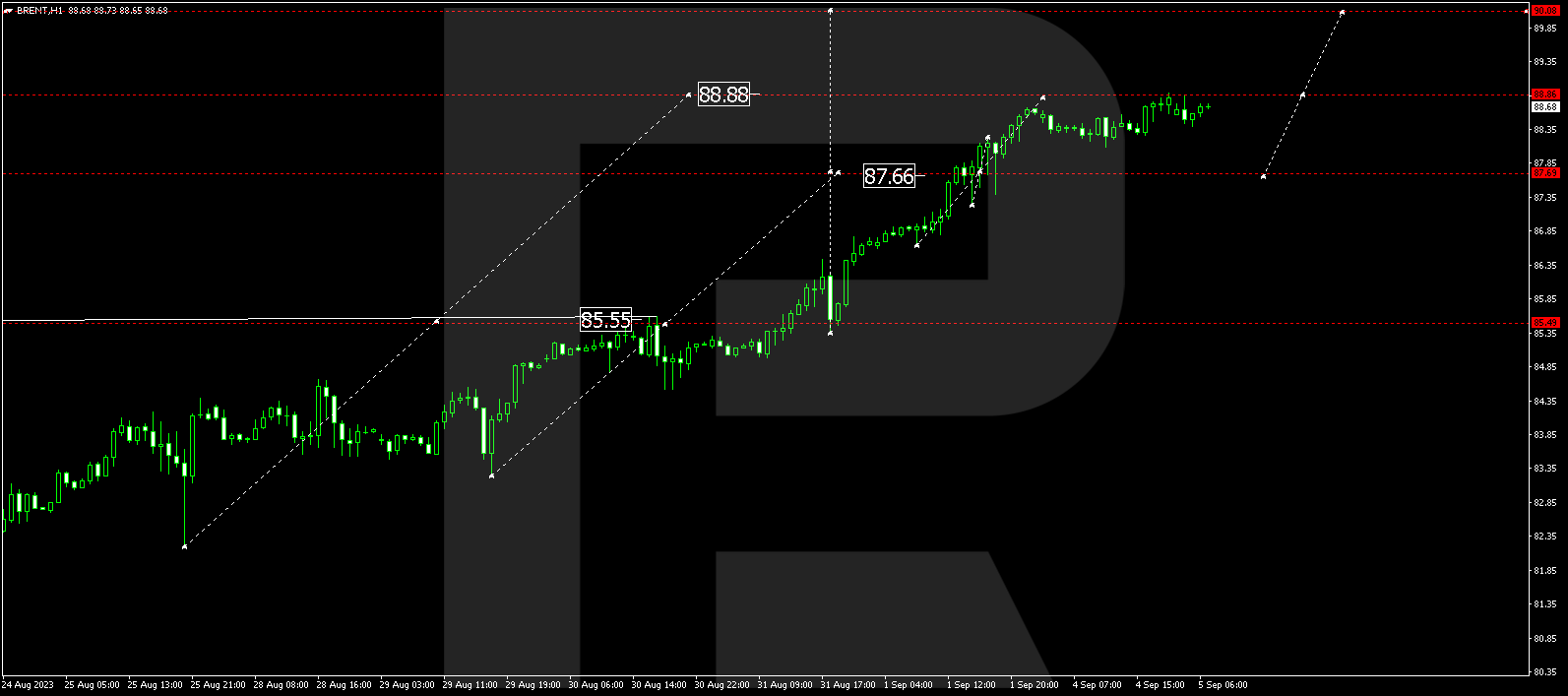

BRENT

Brent crude has completed a wave to 88.88. A consolidation range might form below this level today. In the event of a downward breakout, a decline to 87.70 is possible, with a test from above. An upward breakout could see the wave continuing to 90.00, considered a local target.

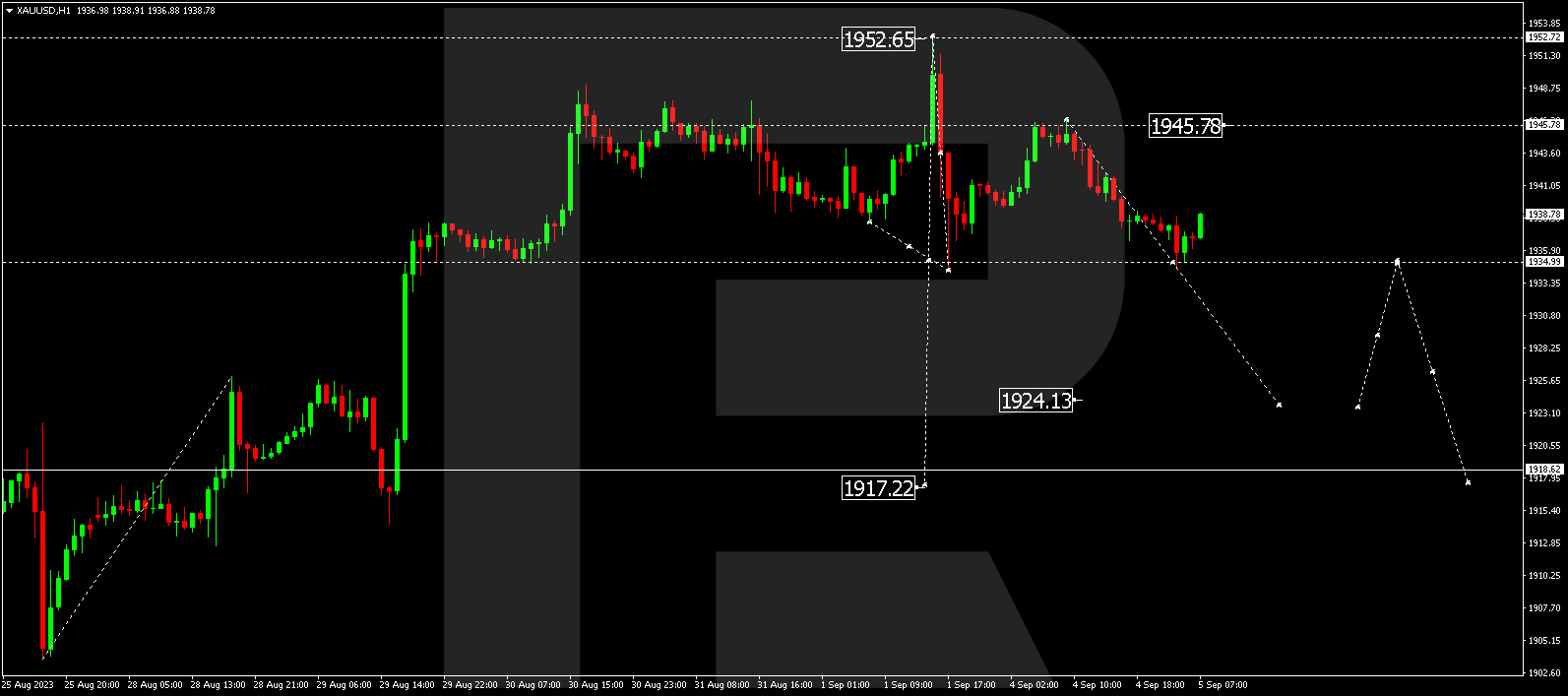

XAU/USD (Gold vs US Dollar)

Gold corrected to 1945.77 and subsequently experienced a decline to 1935.00 today. Currently, a consolidation range is forming above this level. A downward breakout from the range to 1924.15 is anticipated, potentially leading to a continuation of the trend towards 1918.60.

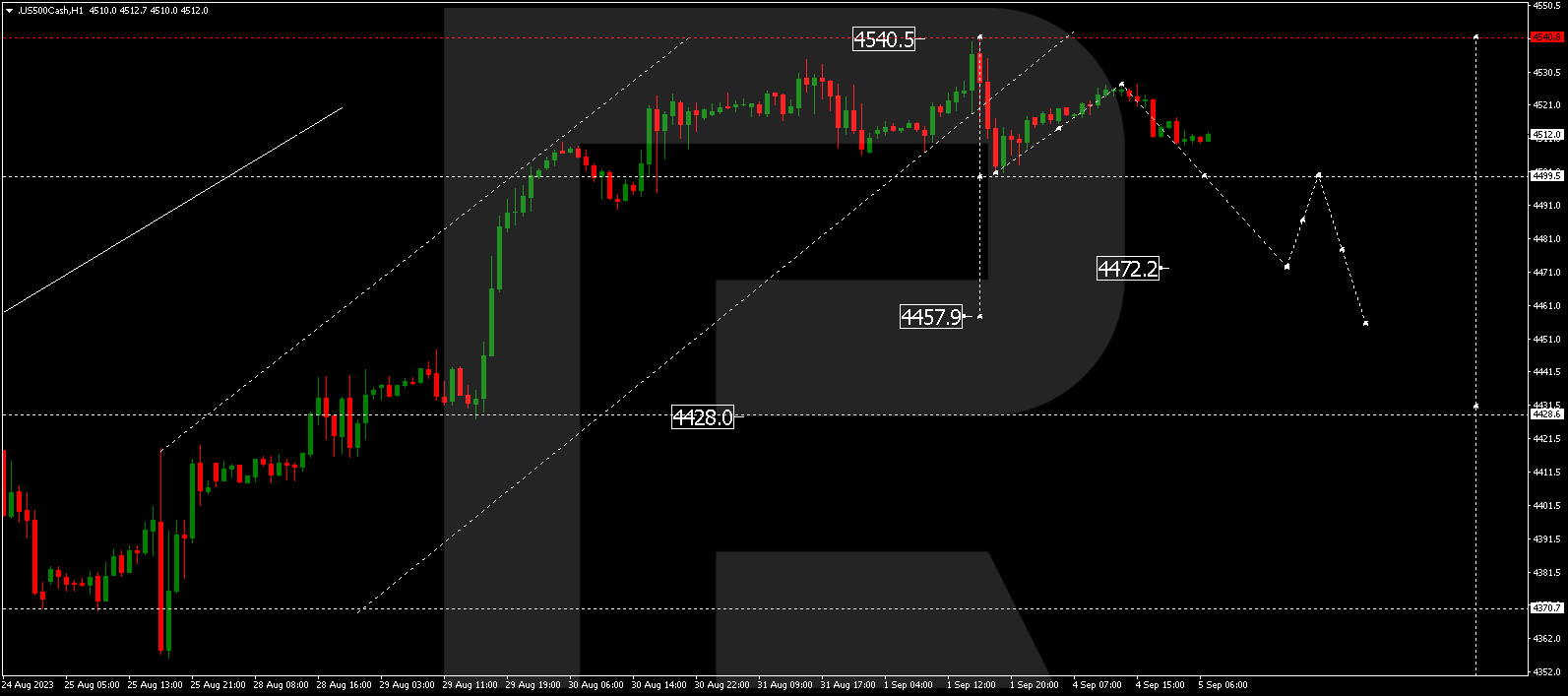

S&P 500

The stock index has undergone a correction to 4526.6. A decline to 4499.0 is expected today, and a breakout of this level could open the potential for a further decline to 4472.2, with the trend possibly continuing to 4458.0. This is considered the first target.

The post Technical Analysis & Forecast September 5, 2023 appeared first at R Blog – RoboForex.