AUD Continues Its Decline – An Overview Including EUR, GBP, JPY, CHF, Brent, Gold, and the S&P 500 Index

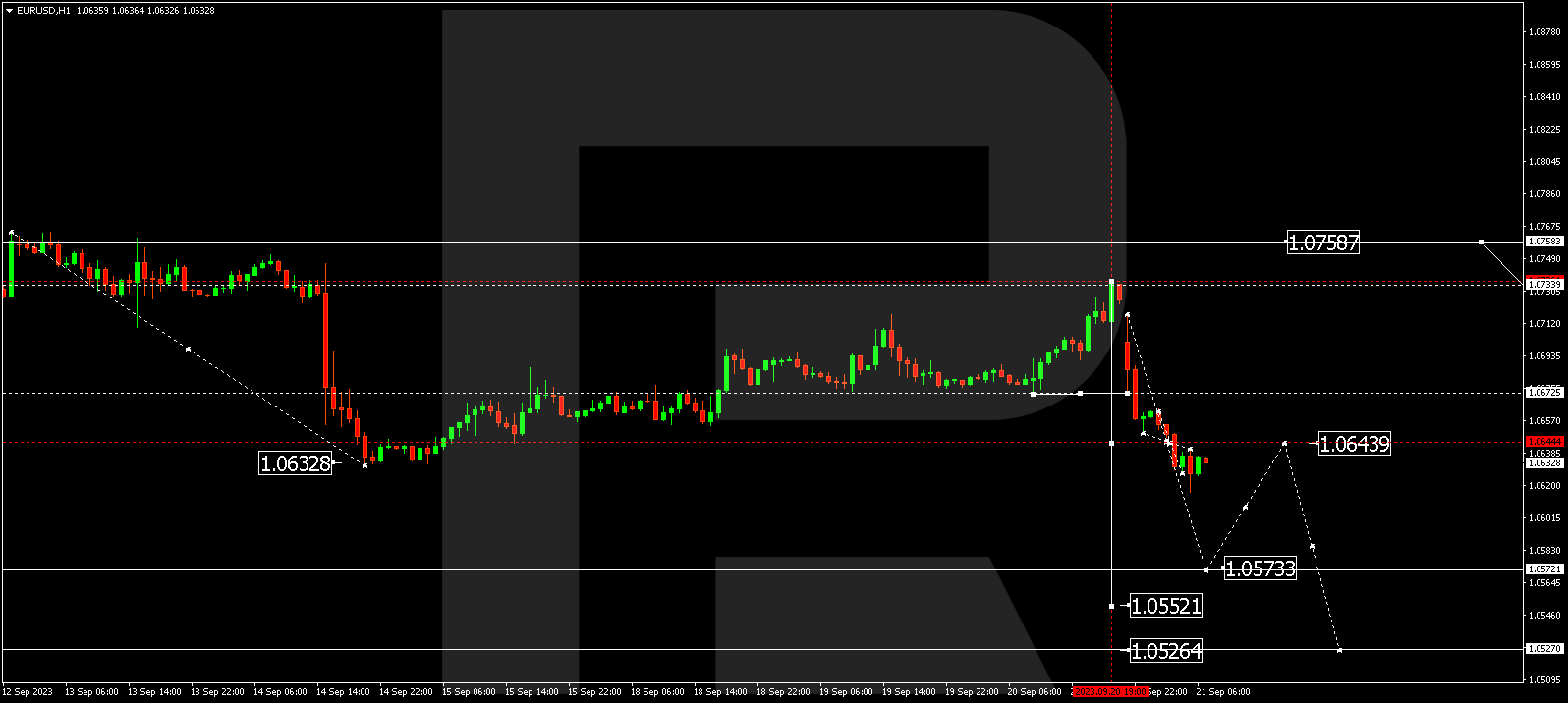

EUR/USD (Euro vs US Dollar)

EUR/USD found support at 1.0670 and experienced a corrective rise to 1.0735. After reaching this level, considering the current fundamental background, the market initiated a new downward wave in line with the downtrend. The quotes have completed a downward impulse to 1.0616. Presently, the market is consolidating above this level. A downward breakout from this range to 1.0575 is anticipated, from where the trend may continue to 1.0555.

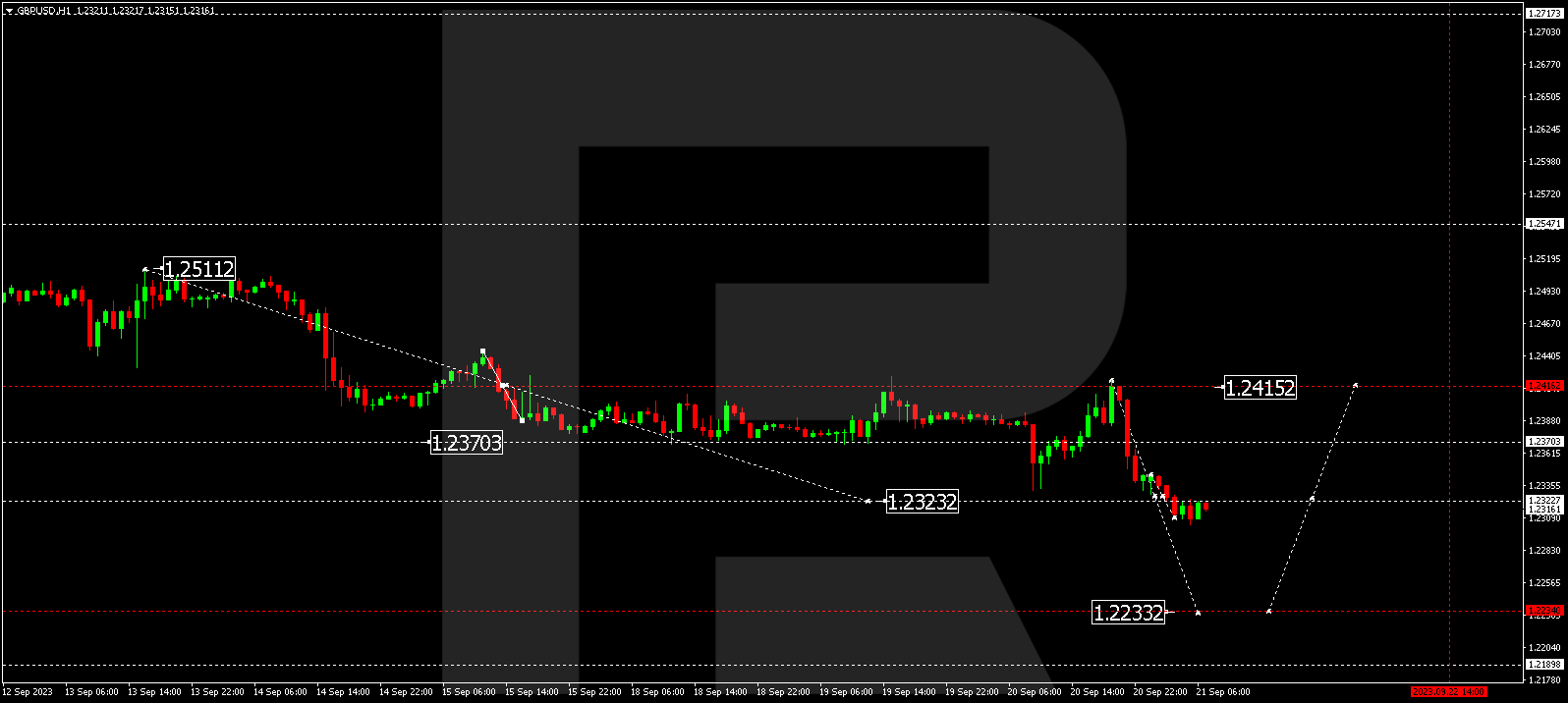

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD completed a correction to 1.2415 and began a downtrend. The quotes have currently reached the 1.2304 level. The market is forming a consolidation range above it today. The quotes are expected to break the range downwards and extend it to 1.2233, from where the wave could progress to 1.2188.

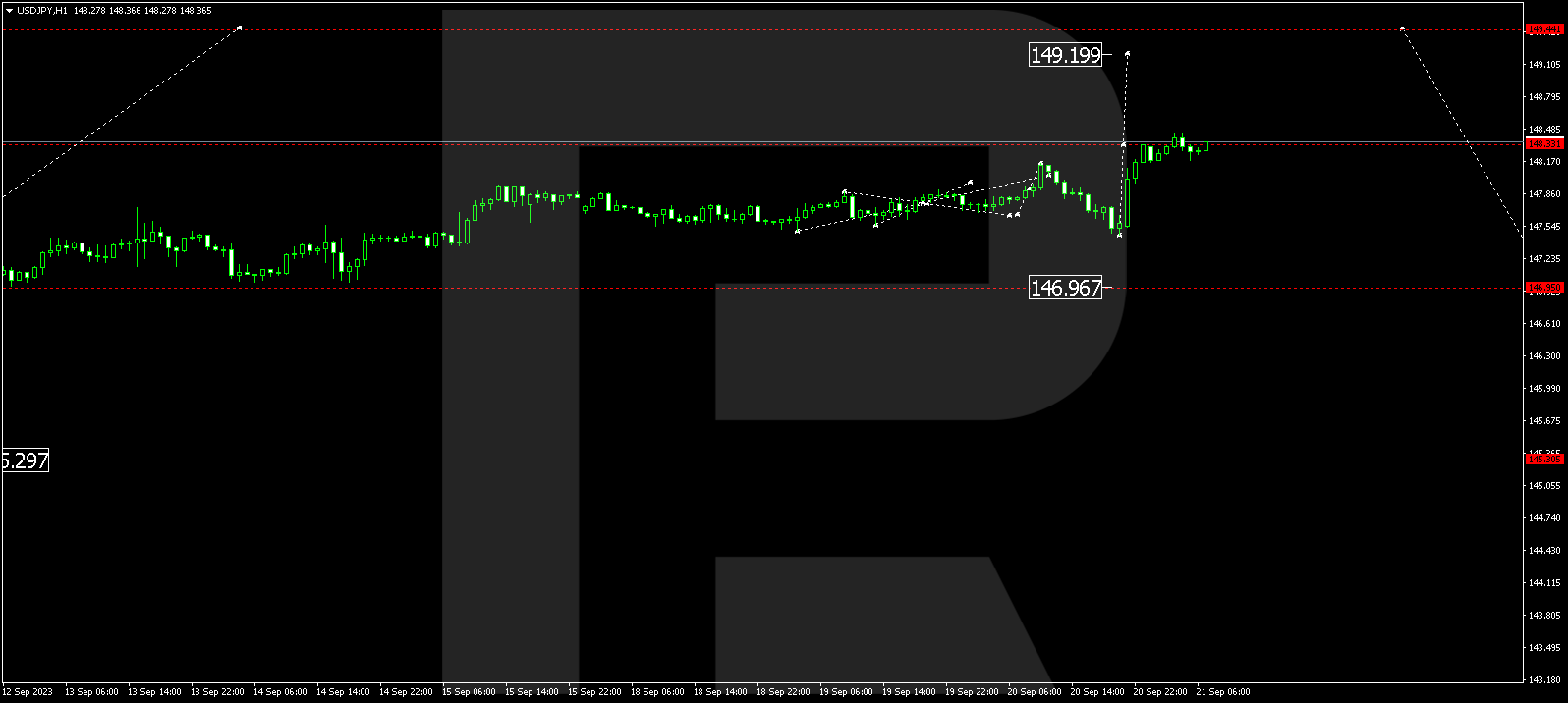

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY completed an upward link to 148.33. Presently, the market is forming a consolidation range around this level. The quotes are expected to break the range upwards to 149.19, from where the trend could continue to 149.44.

Want to increase your income? Become a partner of RoboForex and receive partner rewards from the trading activity of the clients you refer.

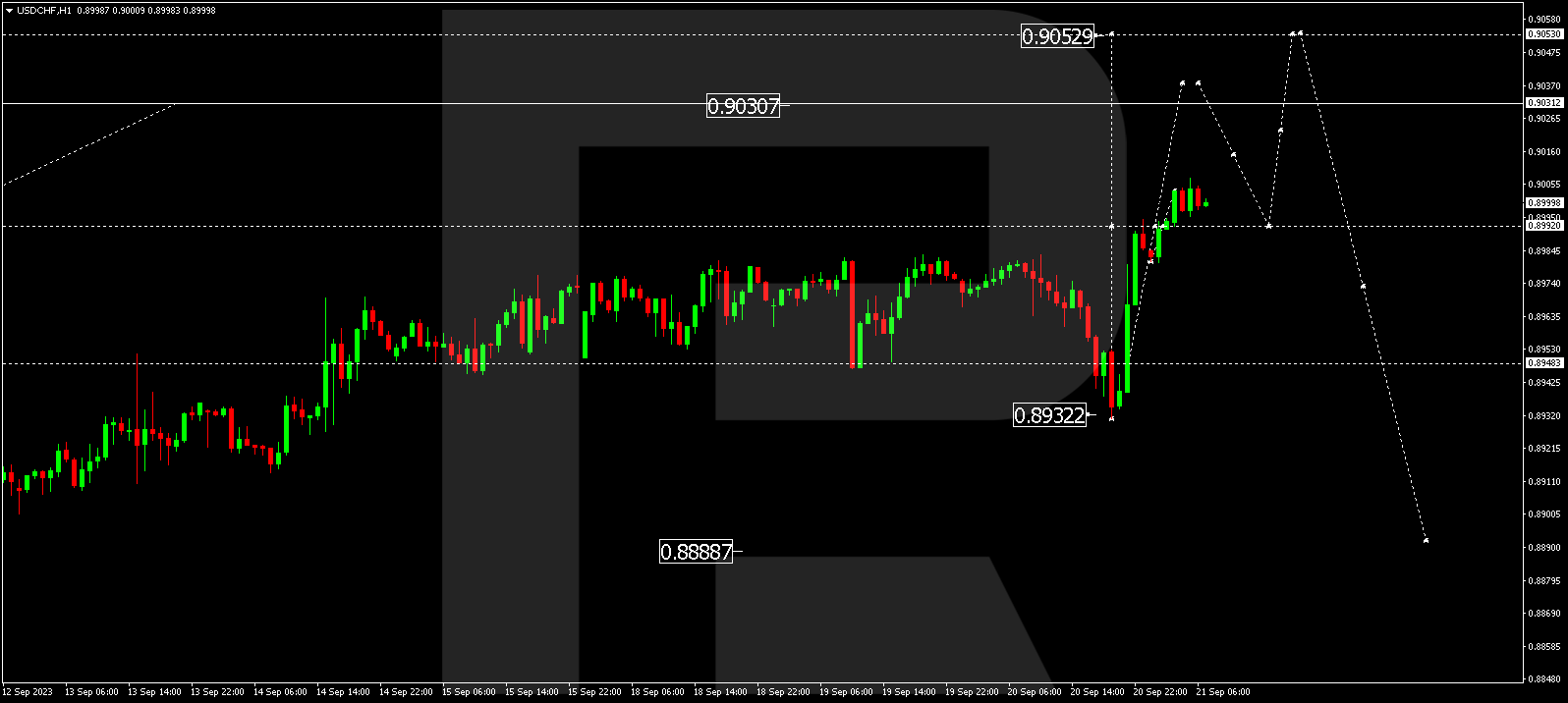

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF completed a correction wave to 0.8933. Next, the price underwent a growth wave to 0.9000. The market is currently forming a consolidation range under this level. An upward breakout from the range to 0.9035 is expected, from where the trend could extend to 0.9053. Subsequently, a correction to 0.8933 might initiate.

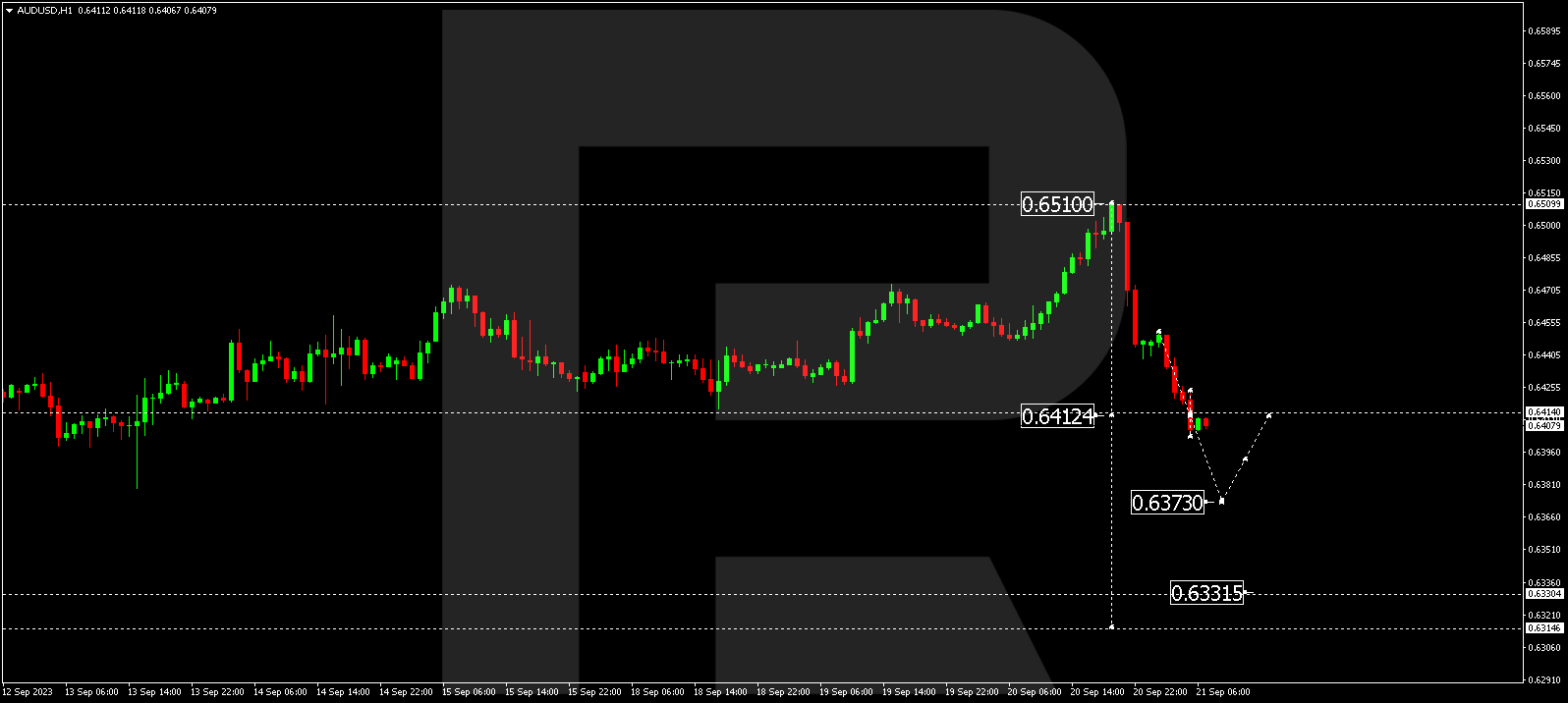

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD completed a correction at 0.6510. Today, the market continues to develop a new downward wave. Presently, the market has completed a downward impulse to 0.6404. The decline might extend to 0.6373, from where the trend could proceed to 0.6333.

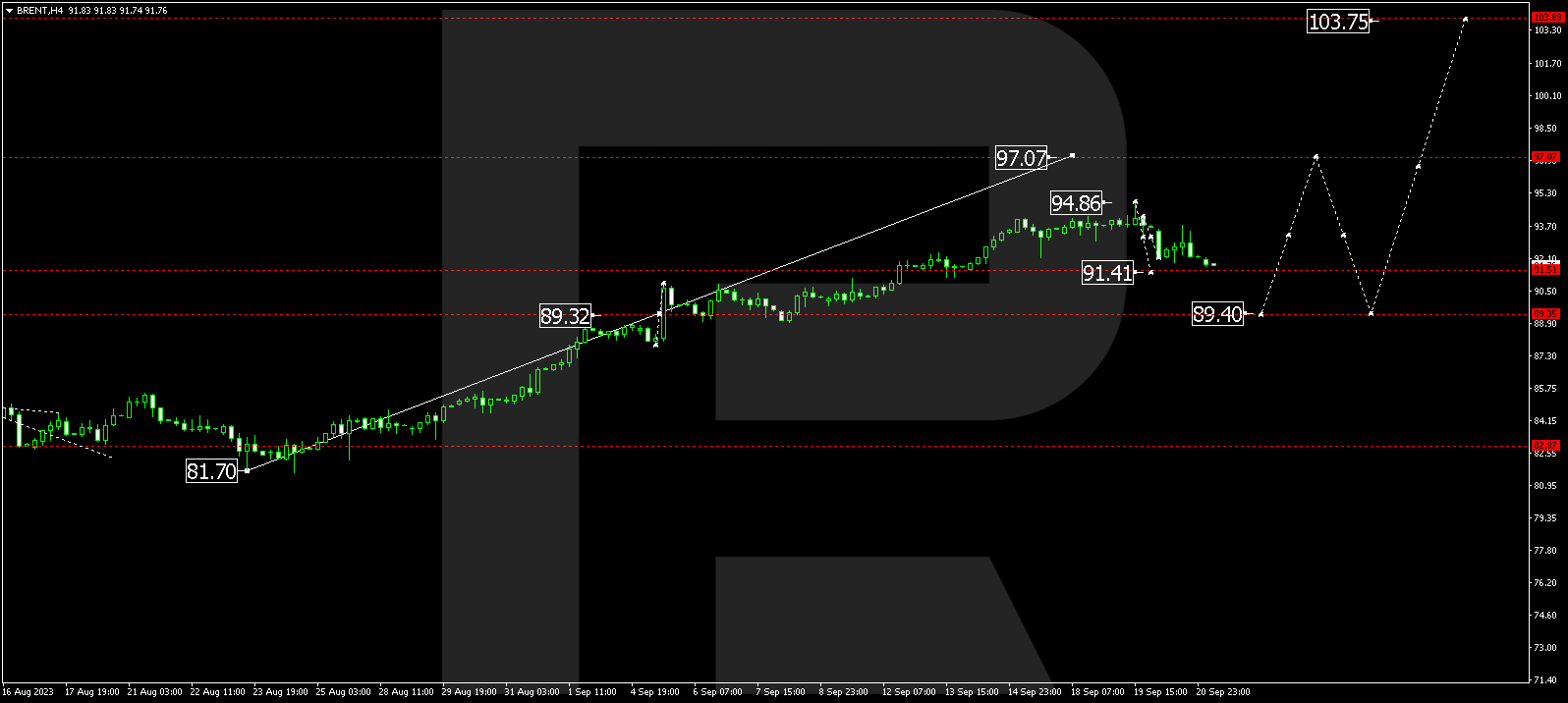

BRENT

Brent is continuing its correction to 91.41. Following this level, a new upward wave to 97.07 could commence, from where the trend might extend to 103.75.

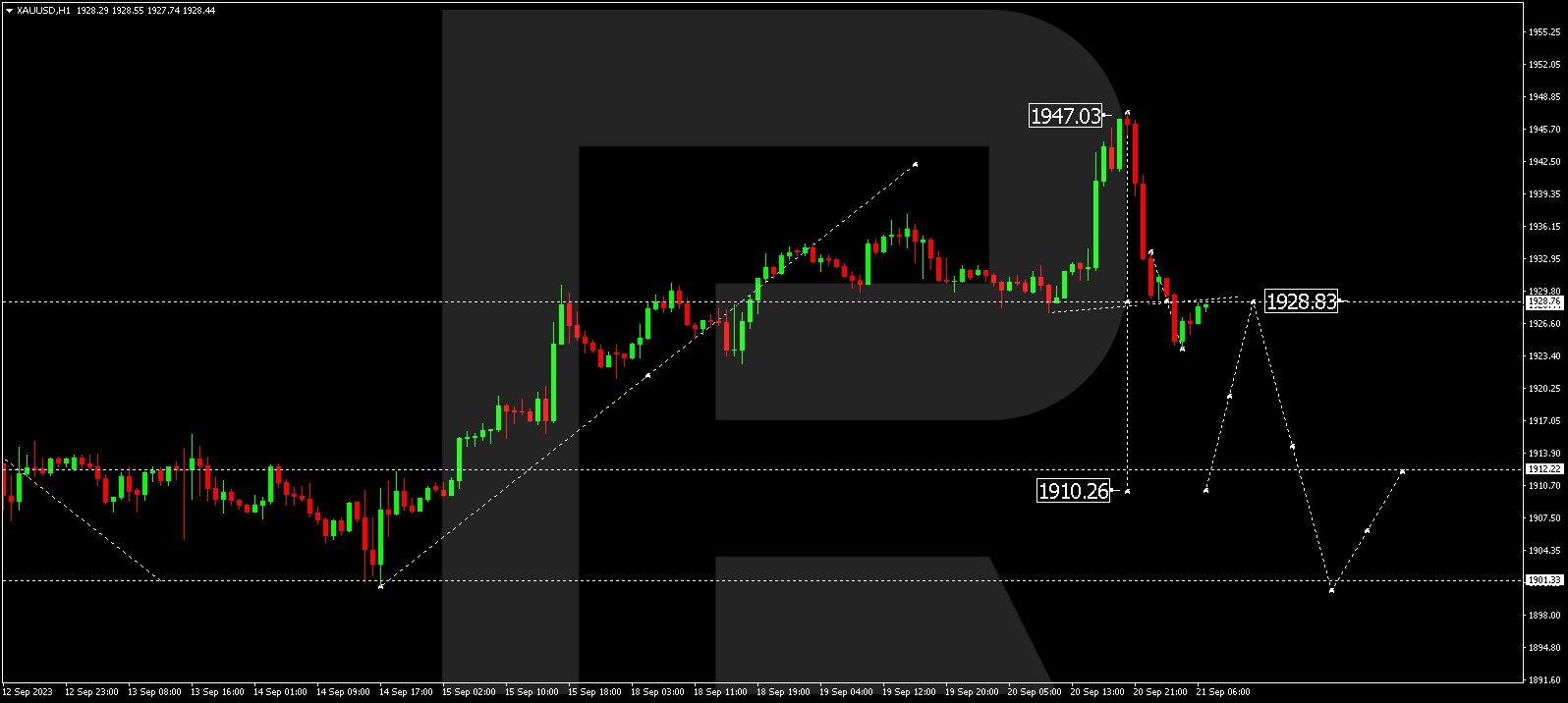

XAU/USD (Gold vs US Dollar)

Gold completed a correction to 1947.00. Presently, the market has completed a downward impulse to 1924.14. At the moment, a consolidation range is forming above this level. A downward breakout from the range to 1910.30 is expected, from where the trend could continue to 1901.33.

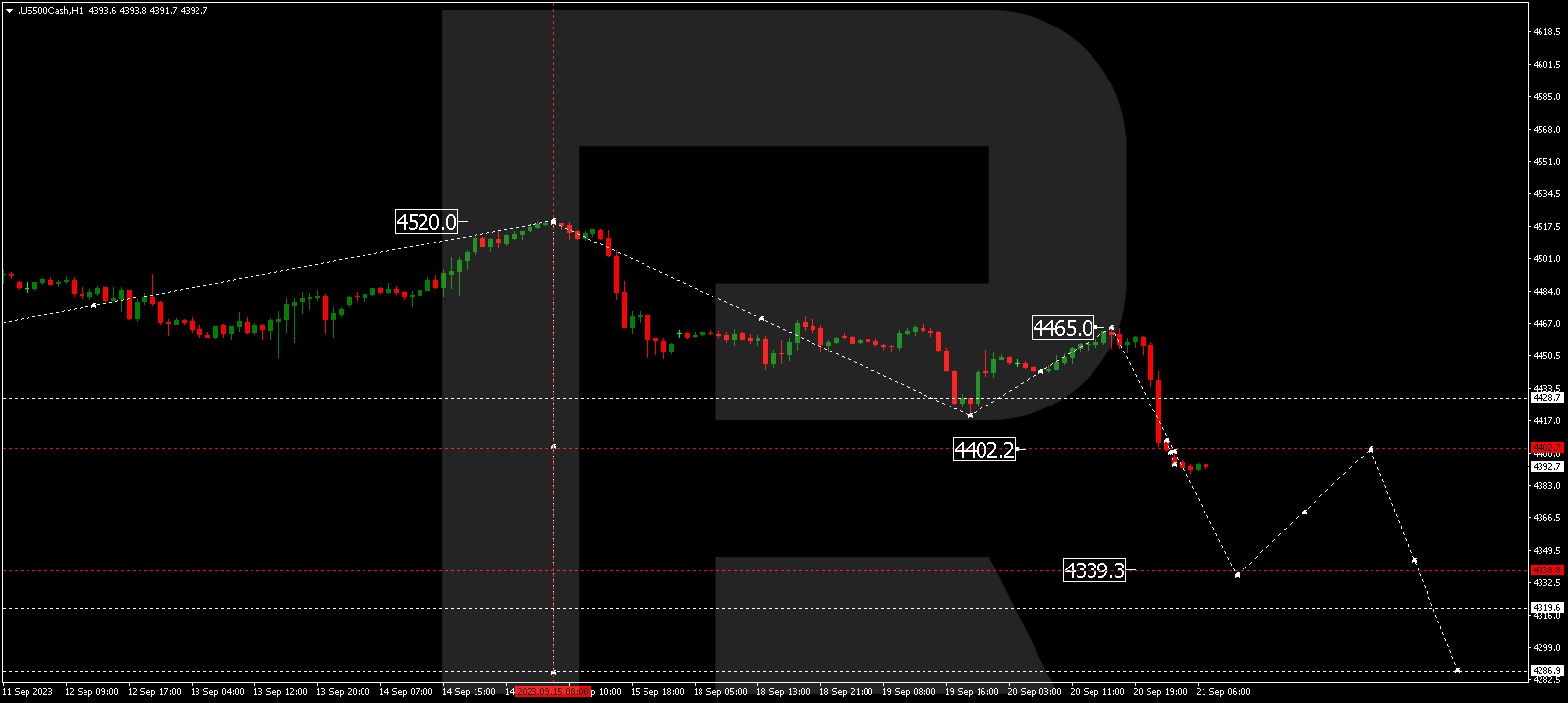

S&P 500

The stock index corrected to 4465.0 and initiated a new downward wave. As of now, the pair has completed a declining impulse to 4402.2. A consolidation range is forming around this level today. A downward breakout from the range to 4339.3 is expected, from where the trend might extend to 4286.9. This is a local target.

The post Technical Analysis & Forecast September 21, 2023 appeared first at R Blog – RoboForex.