GBP Continues Its Upward Momentum. This overview also encompasses the movements of EUR, JPY, CHF, AUD, Brent, Gold, and the S&P 500 index.

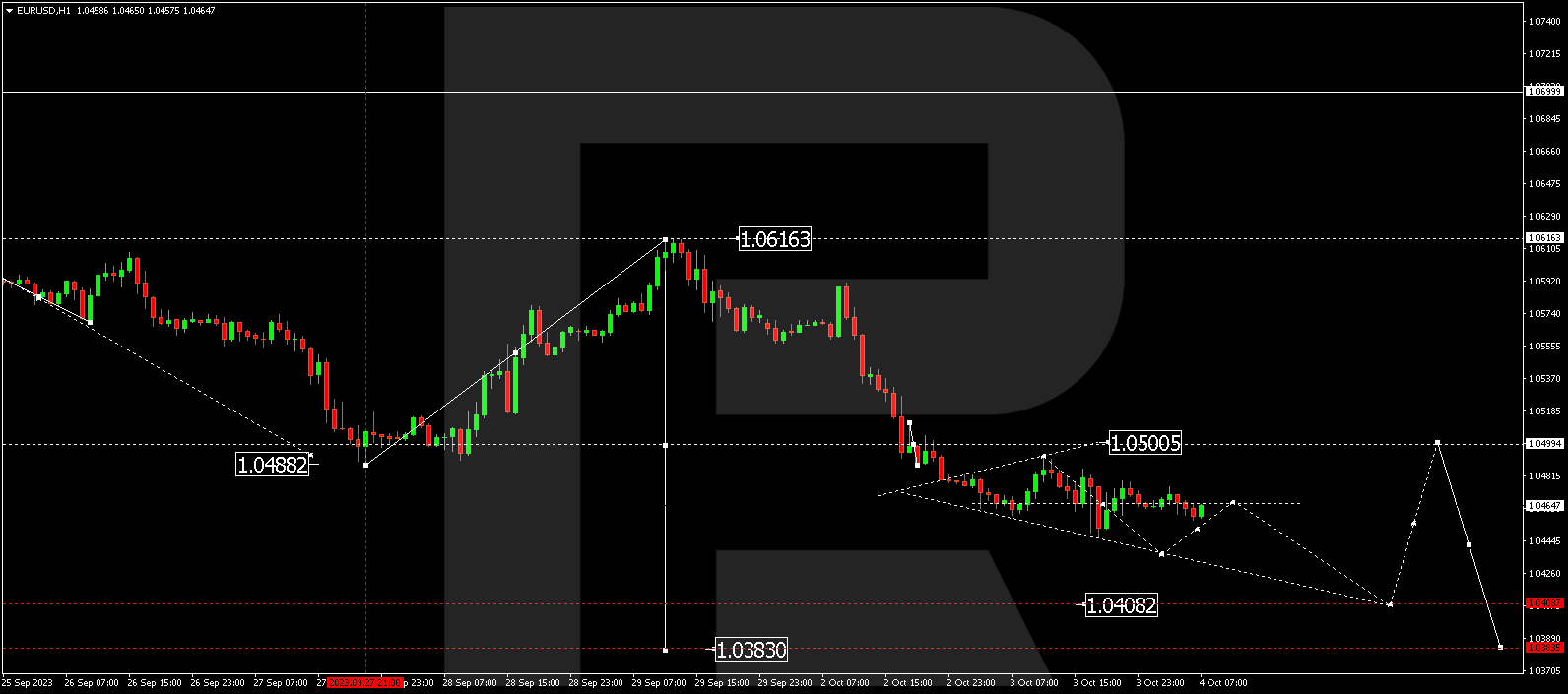

EUR/USD (Euro vs US Dollar)

EUR/USD experienced a downward movement to 1.0447. Currently, the market is establishing a consolidation range around 1.0465. A breakout above this range might initiate a corrective phase towards 1.0500. Conversely, breaking below could lead to a decline to 1.0408. Following this, a correction to 1.0500 might occur (with a test from below), eventually leading to a decline to 1.0383, which is a local target.

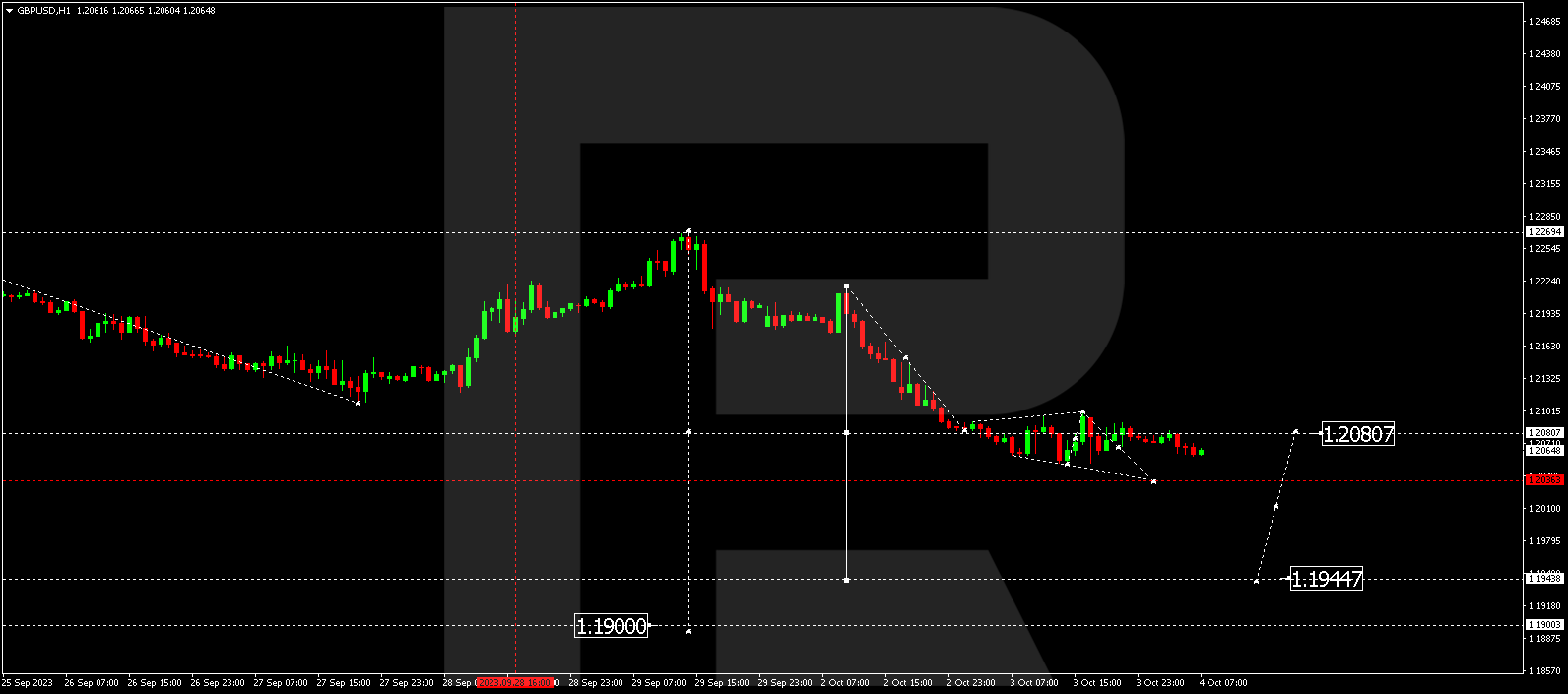

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD observed a downward movement to 1.2052. Currently, the market is consolidating around 1.2080. An upward breakout could trigger a growth phase to 1.2112. Conversely, a downward breakout may lead the market to continue the wave down to 1.1947. If this level is breached, a potential decline to 1.1900 might occur, which is a local target.

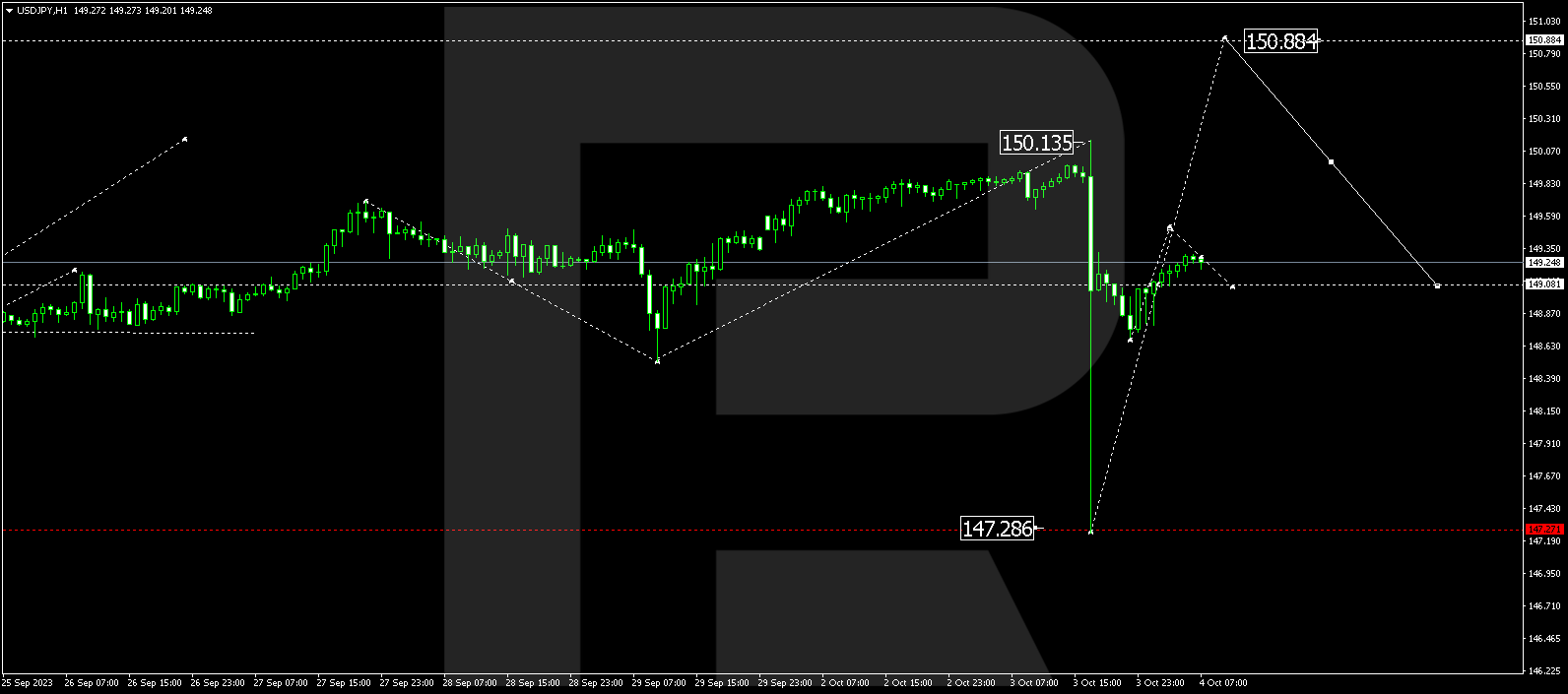

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY completed a growth wave to 150.13 and corrected to 147.30. Today, the market initiated an upward impulse to 149.32. Presently, the market is establishing a consolidation range around 149.08. An extension to 149.60 is expected, followed by a decline to 149.08 (with a test from above). A subsequent rise to 150.90 is also possible.

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF completed an upward wave to 0.9242. Today, the market experienced a downward movement to 0.9204 (with a test from above). A consolidation range has formed around this level. An upward breakout might lead to a growth wave to 0.9297, extending the trend to 0.9318.

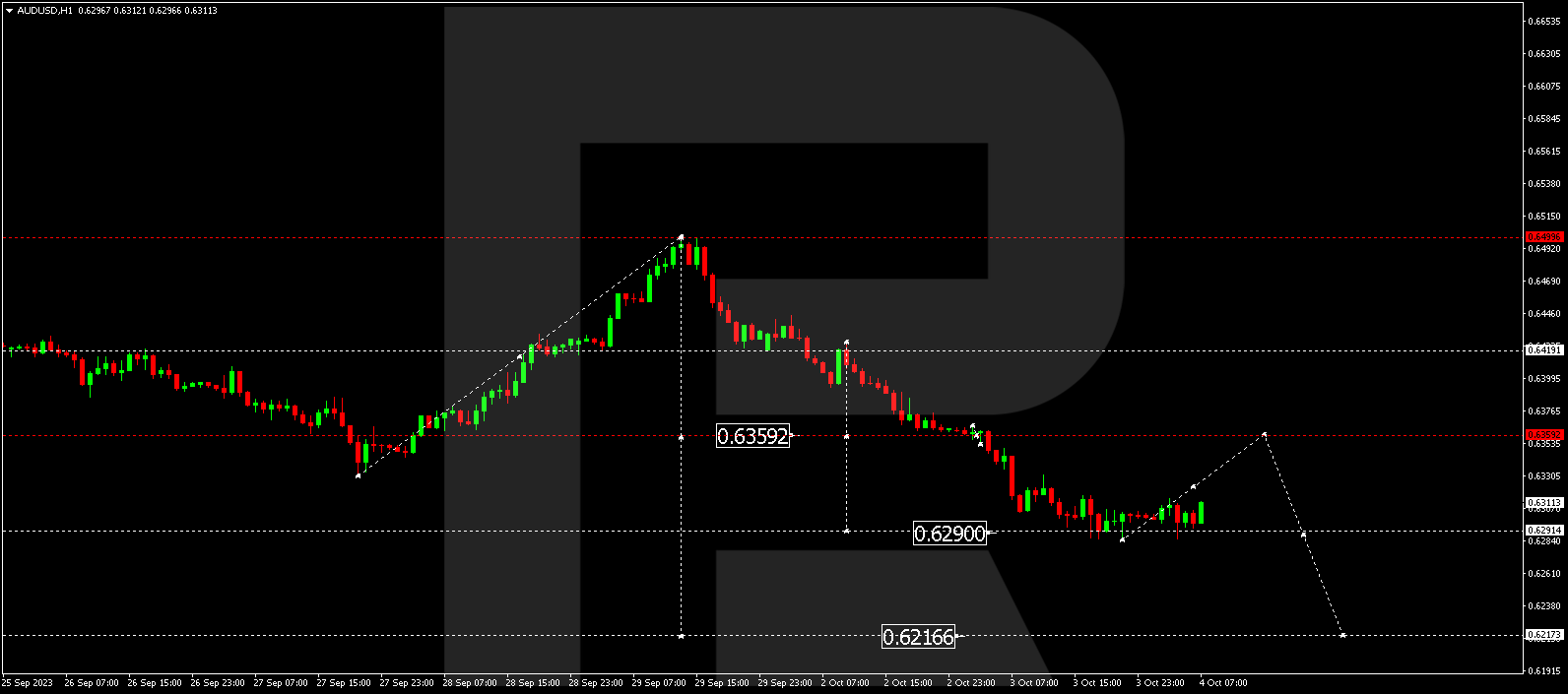

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD completed a decline wave to 0.6290. A consolidation range has now formed above this level. Breaking upwards could potentially lead to a rise to 0.6355 (with a test from below), while a downward breakout might continue the trend to 0.6250, further extending the wave to 0.6216.

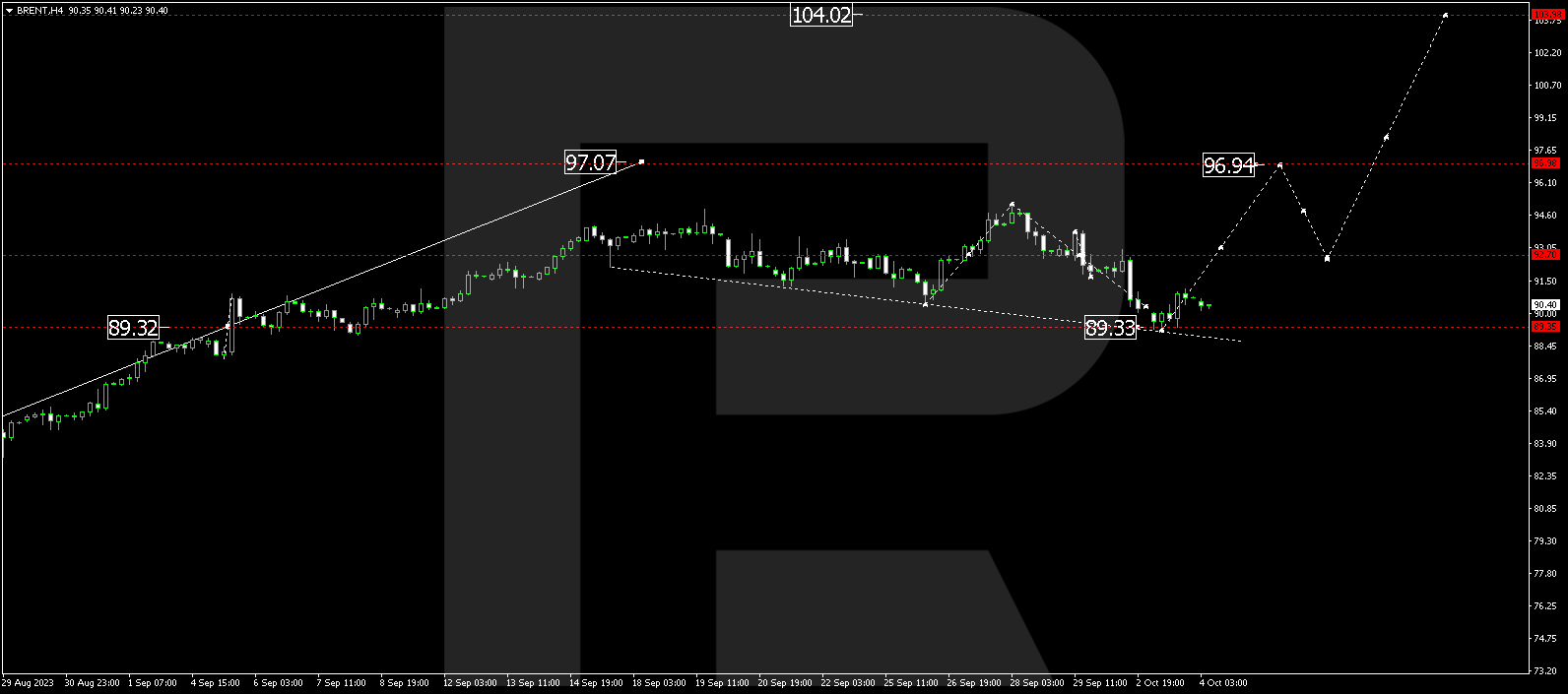

BRENT

Brent corrected to 89.33 and is currently forming a consolidation range above this level. A breakout above this range could continue the growth wave to 96.96, a local target. After reaching this level, a correction to 92.70 is plausible, followed by a rise to 104.00.

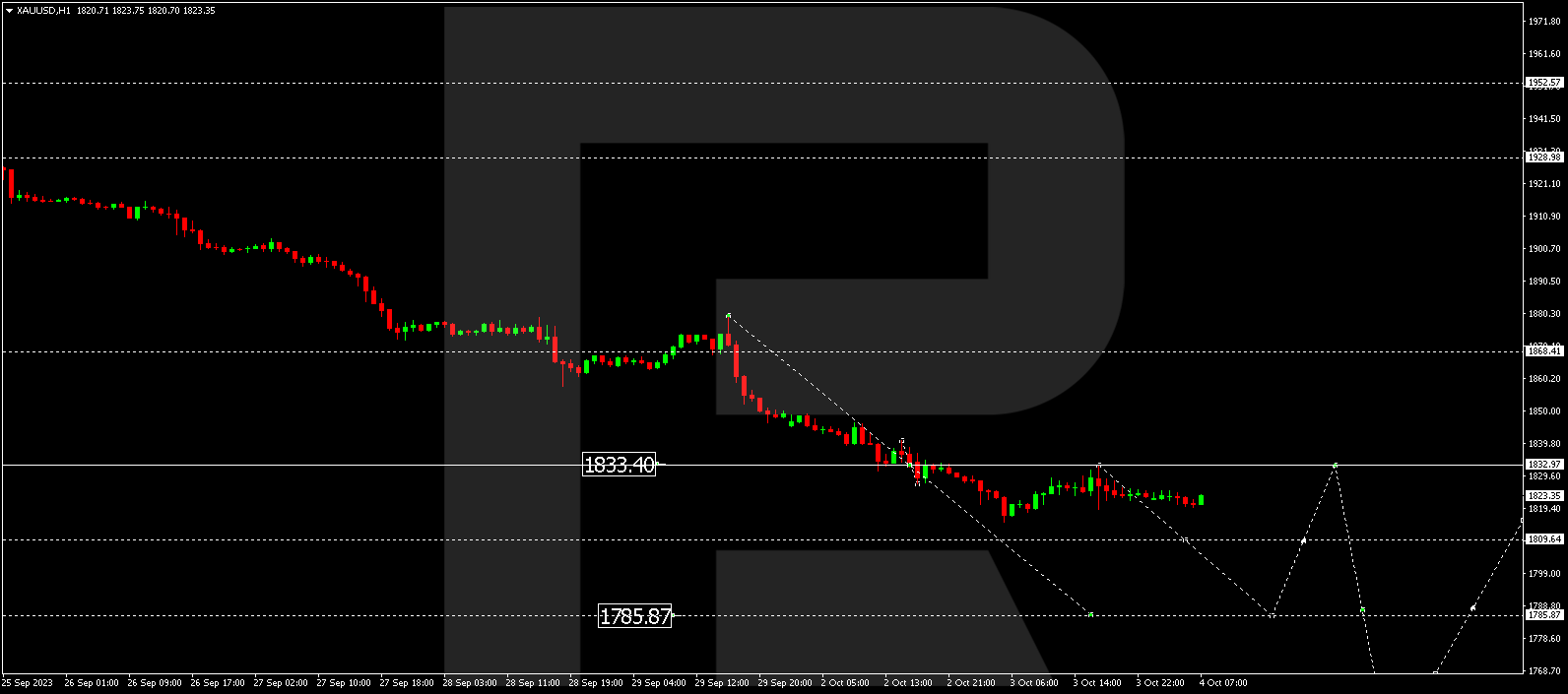

XAU/USD (Gold vs US Dollar)

Gold completed a decline wave to 1815.15. Today, the market experienced a growth wave to 1833.00 (with a test from below). A decline to 1809.00 is expected next. If this level is breached, a potential decline to 1785.85 might occur, marking a local target.

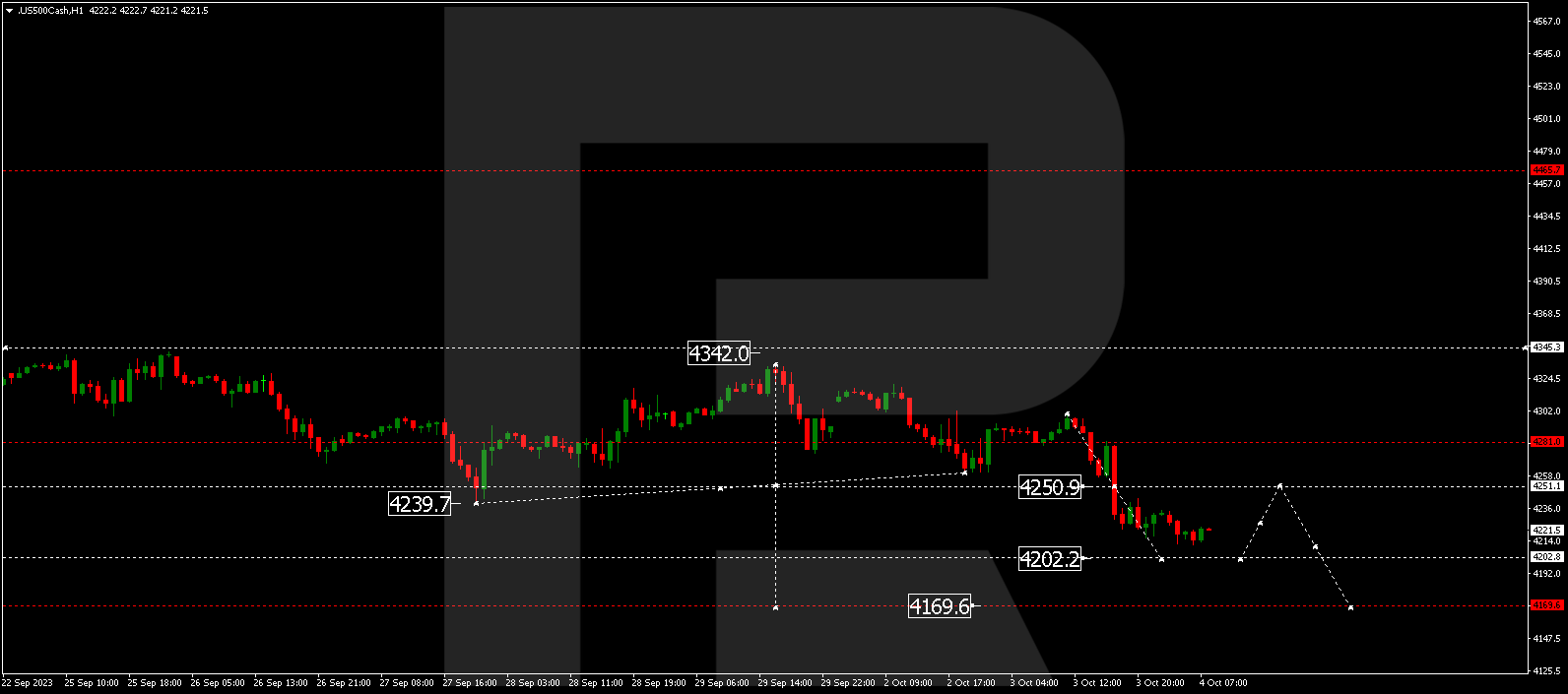

S&P 500

The stock index is currently in a decline wave towards 4202.2. Following this, a rise to 4250.0 is expected (with a test from below). A subsequent decline to 4170.0 might follow, which is a local target.

The post Technical Analysis & Forecast October 04, 2023 appeared first at R Blog – RoboForex.