In today’s technical analysis, we will explore the potential movements of various currency pairs and assets including EUR, GBP, JPY, CHF, AUD, Brent, Gold, and the S&P 500 index.

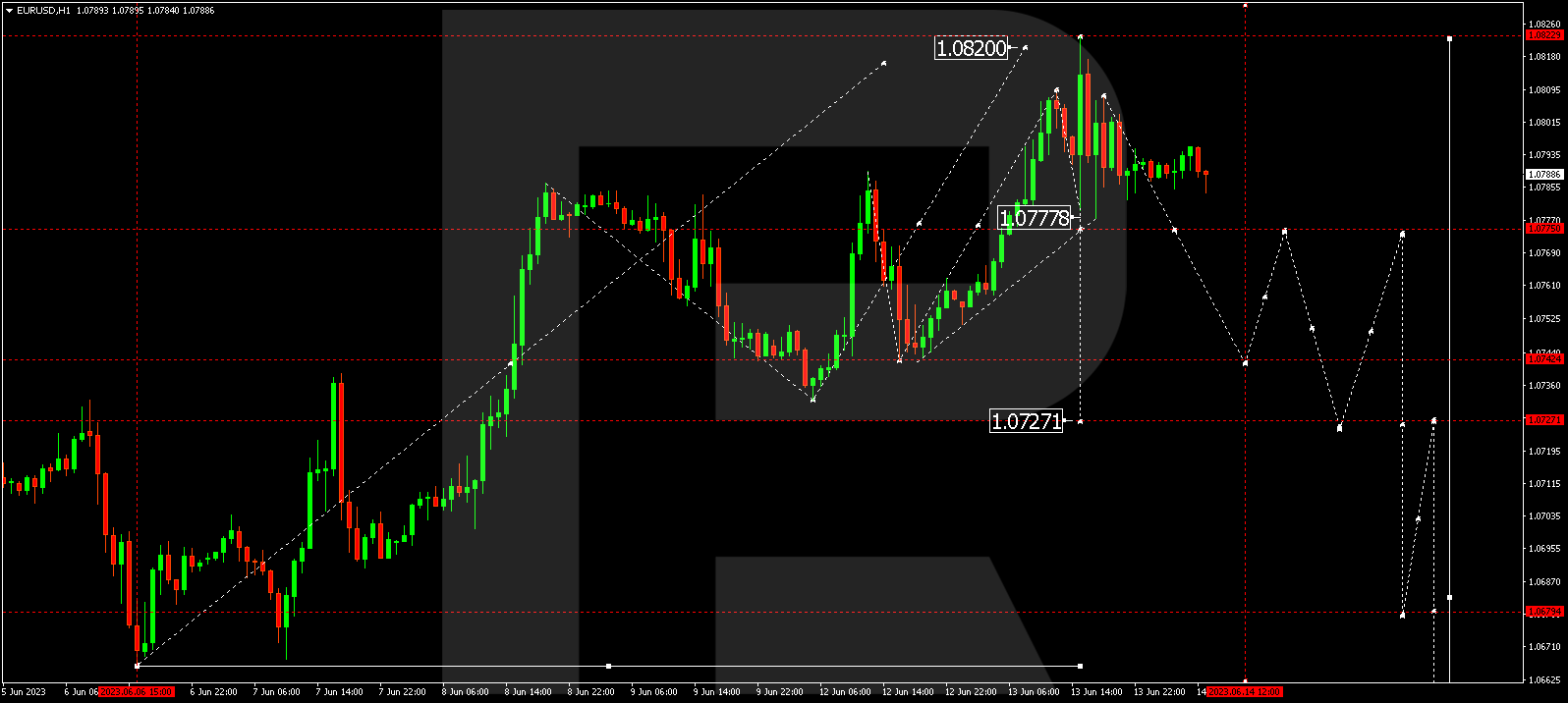

EUR/USD – Euro vs US Dollar

The EUR/USD currency pair is currently consolidating within a wide range around 1.0770. The market has recently extended this range to 1.0820. Today, there was a downward impulse to 1.0777, followed by a correction to 1.0808. The market is currently forming a new downward structure towards 1.0777. It is anticipated that this level will break, extending the range to 1.0744, which serves as a local target.

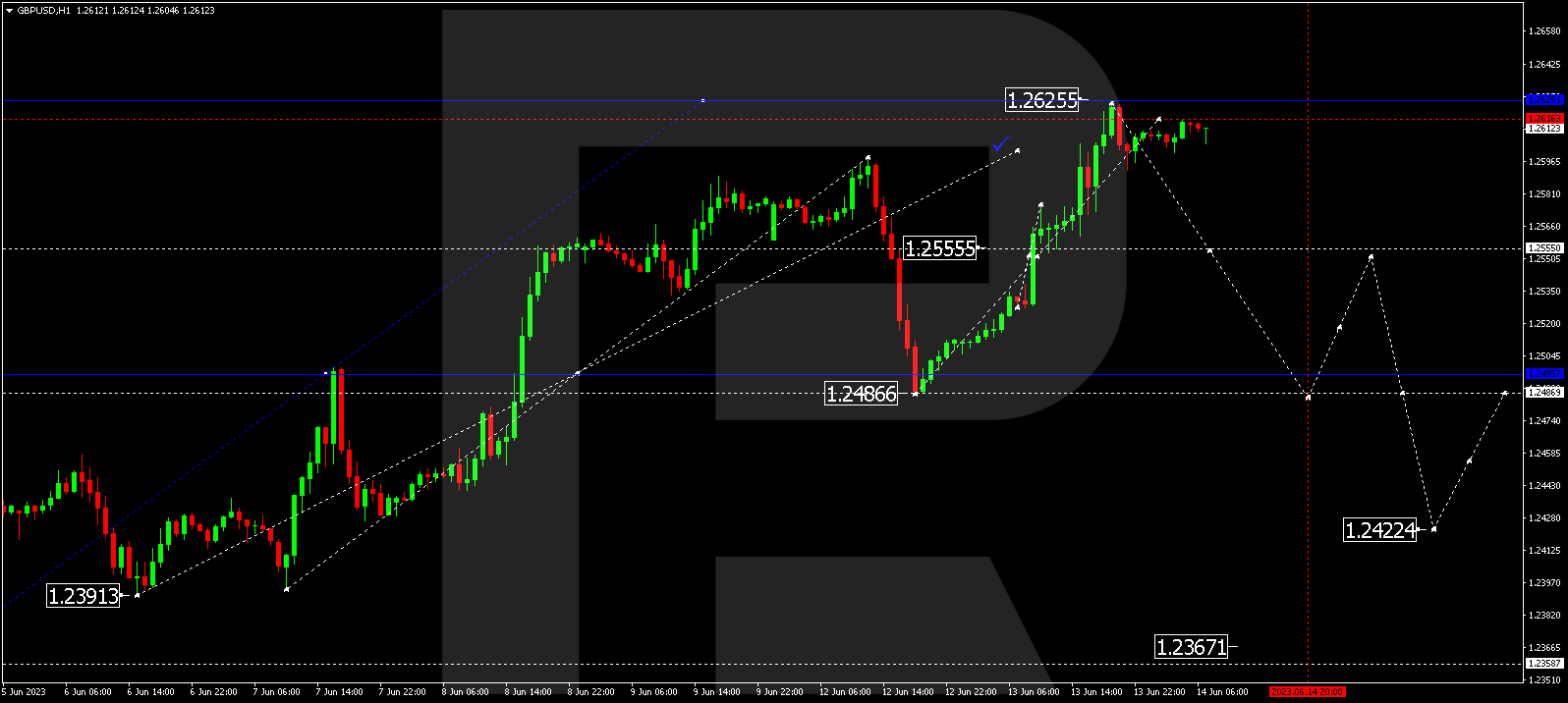

GBP/USD – Great Britain Pound vs US Dollar

GBP/USD is forming a wide consolidation range around 1.2555, which has recently extended to 1.2620. A decline to 1.2555 is expected today (a test from above). Subsequently, a new upward movement to 1.2625 cannot be ruled out, followed by a decline to 1.2488, which serves as a local target.

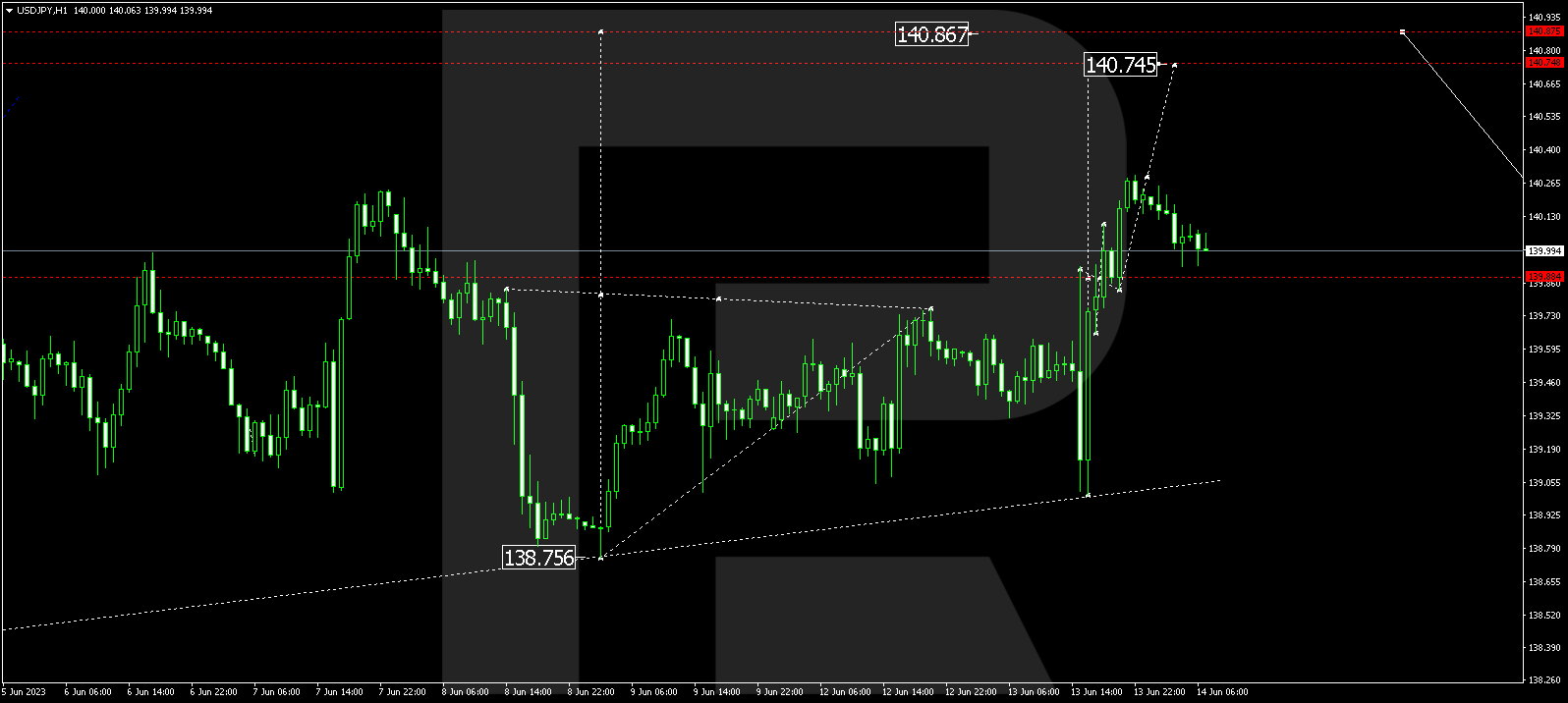

USD/JPY – US Dollar vs Japanese Yen

The USD/JPY currency pair has completed an upward impulse to 139.90. Currently, the market is consolidating around this level. An upward breakout from the consolidation range is expected, with the wave of growth continuing towards 140.74, serving as a local target. After reaching this level, a correction to 139.88 might occur.

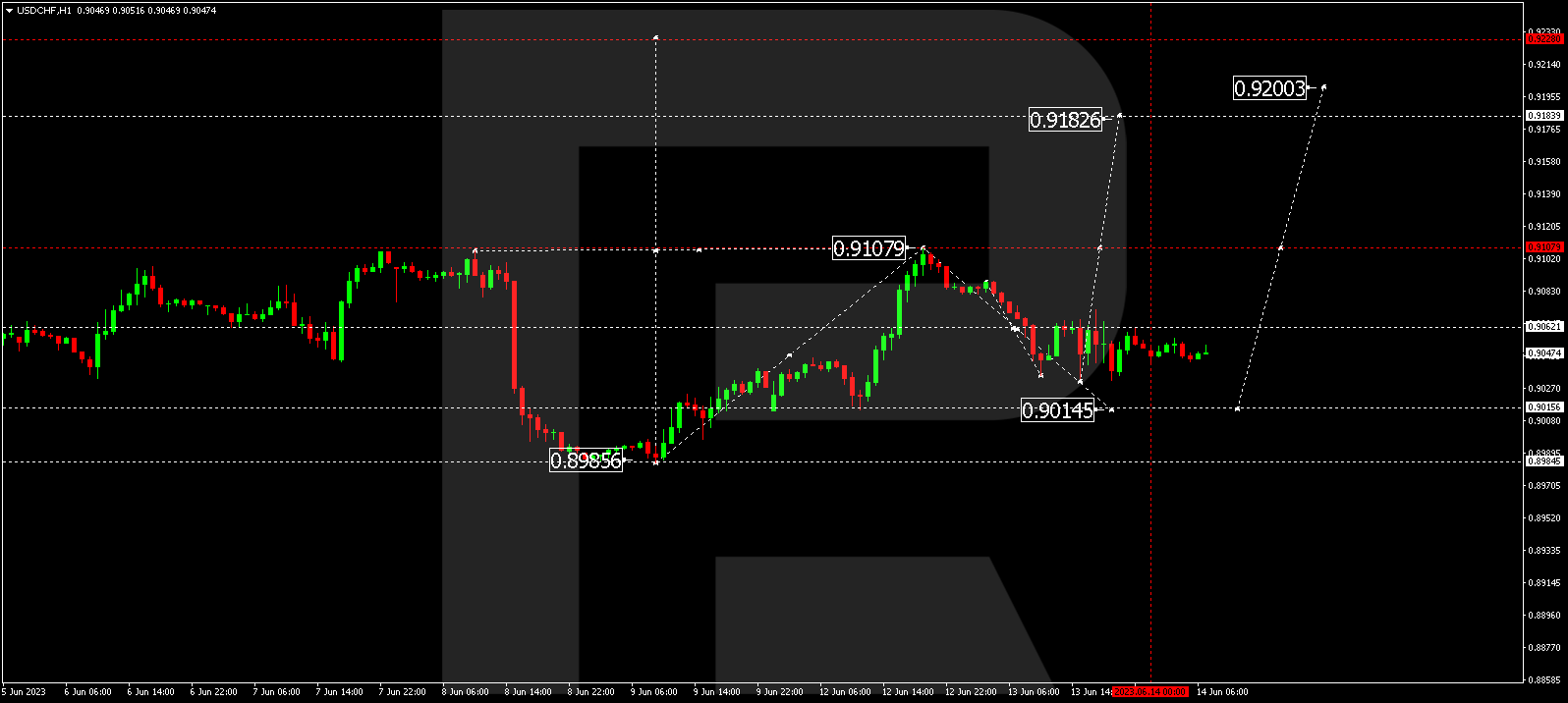

USD/CHF – US Dollar vs Swiss Franc

USD/CHF continues to develop a consolidation range around 0.9030. A potential decline to 0.9015 is possible today, followed by a rise to 0.9108. If this level is also broken to the upside, it could open the potential for a wave of growth towards 0.9182, which is a local target.

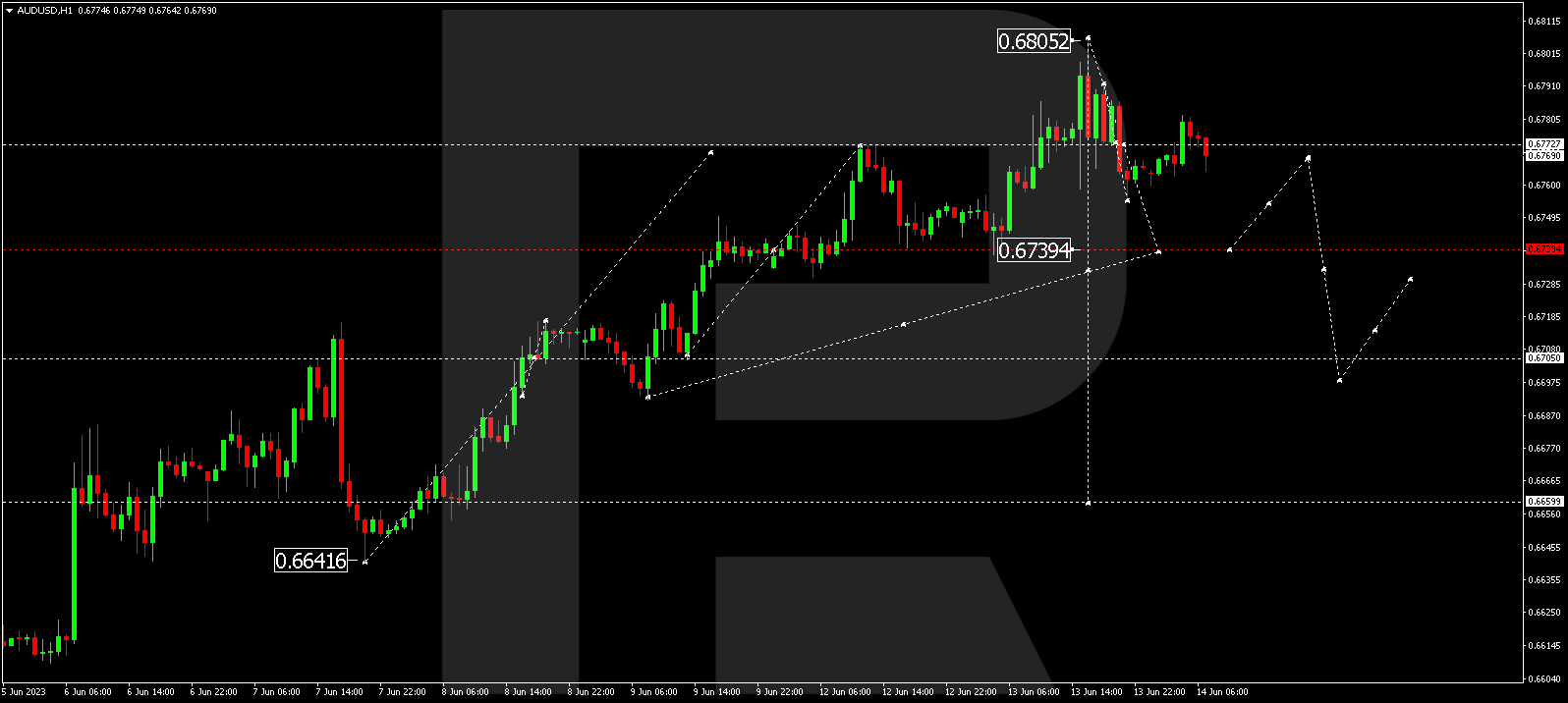

AUD/USD – Australian Dollar vs US Dollar

The AUD/USD currency pair is forming a structure of a declining wave towards 0.6740. After reaching this level, a correction to 0.6777 might follow. Subsequently, a new wave of decline towards 0.6700 could initiate, serving as a local target.

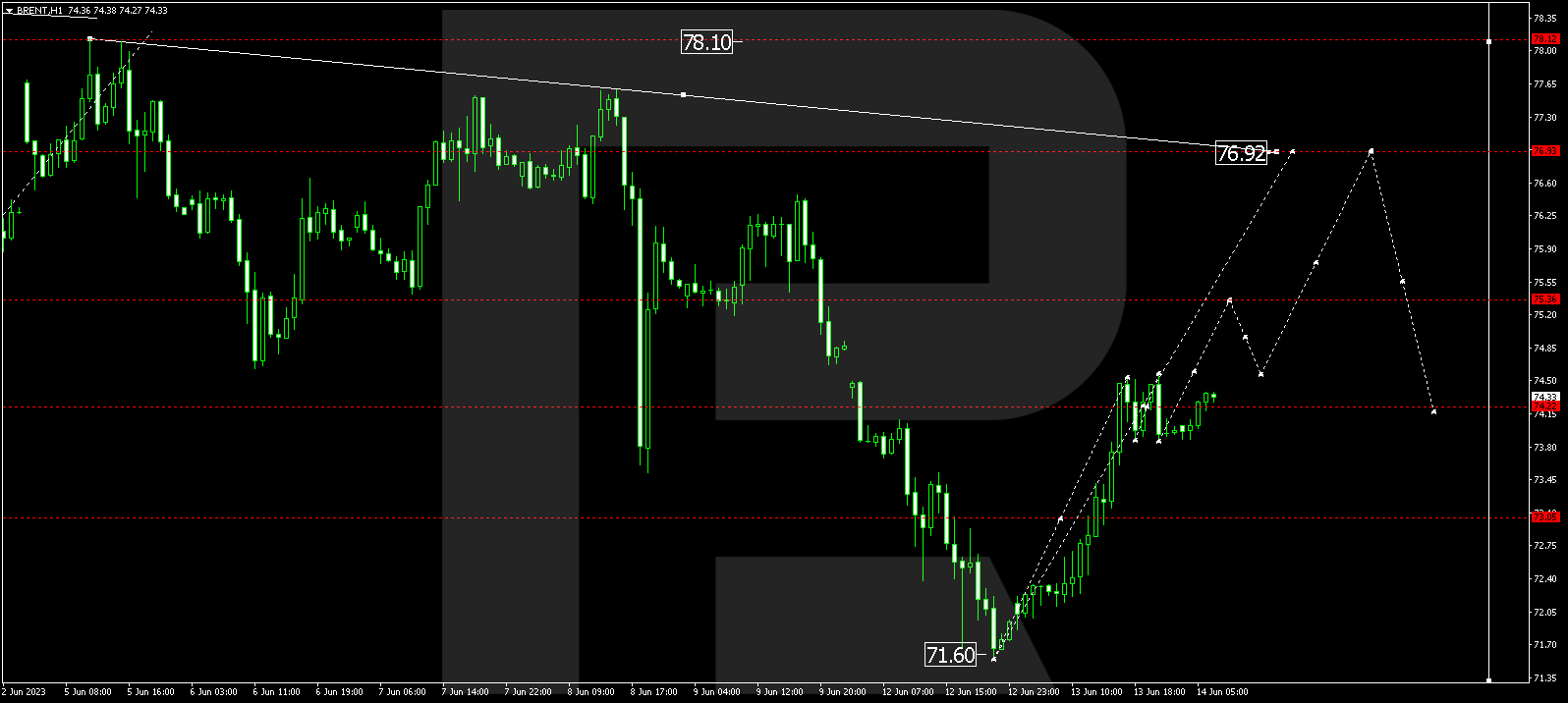

Brent

Brent crude oil has completed an upward impulse to 74.22. The market is currently forming a consolidation range around this level. If there is an upward breakout from the range, it could open the potential for an extension of the wave towards 76.90. However, it is important to note that the price might undergo a correction to 74.22 (a test from above) after reaching the first target.

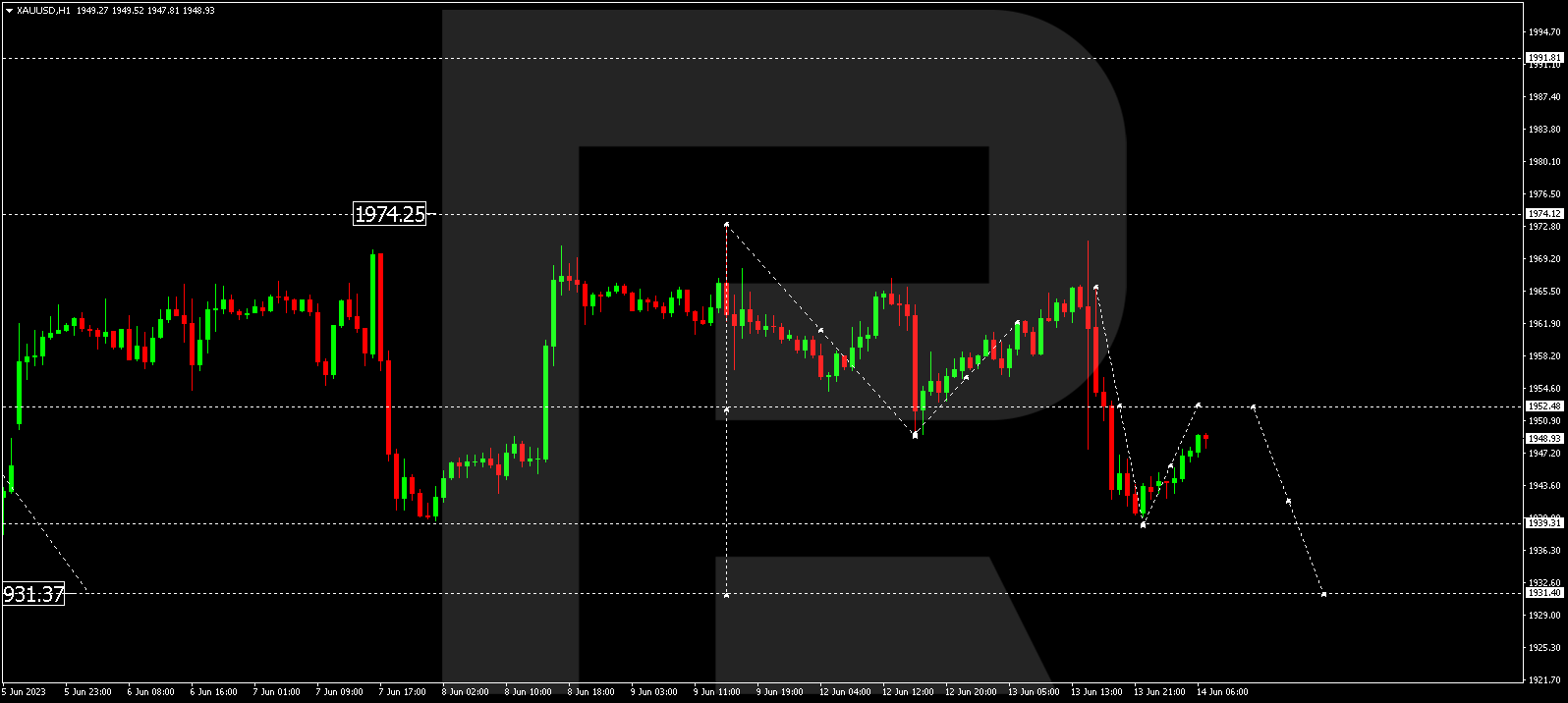

XAU/USD – Gold vs US Dollar

Gold is forming a structure of a declining wave towards 1931.40. After reaching this level, a correction towards 1952.50 might develop (a test from below), followed by a decline to 1921.10, serving as a local target.

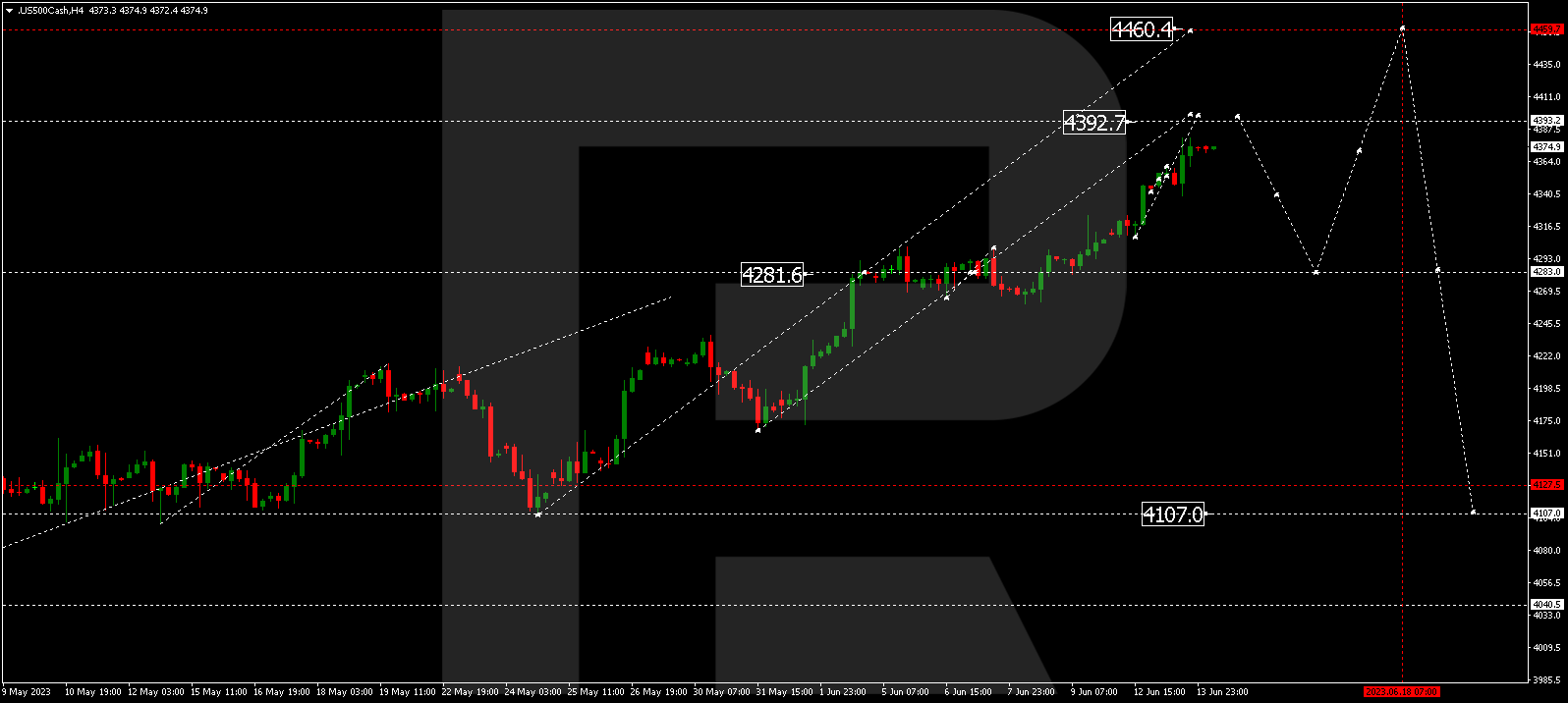

S&P 500

The S&P 500 stock index continues its wave of growth towards 4392.7. After reaching this level, a potential correction towards 4283.0 cannot be ruled out. Subsequently, a new upward structure towards 4460.0 might develop. Once this level is reached, a new wave of decline towards 4107.0 is expected to start.

The post Technical Analysis & Forecast – June 14, 2023 appeared first at R Blog – RoboForex.