AUD continues its downward trajectory. Also, take a look at the dynamics of EUR, GBP, JPY, CHF, Brent, Gold, and the S&P 500.

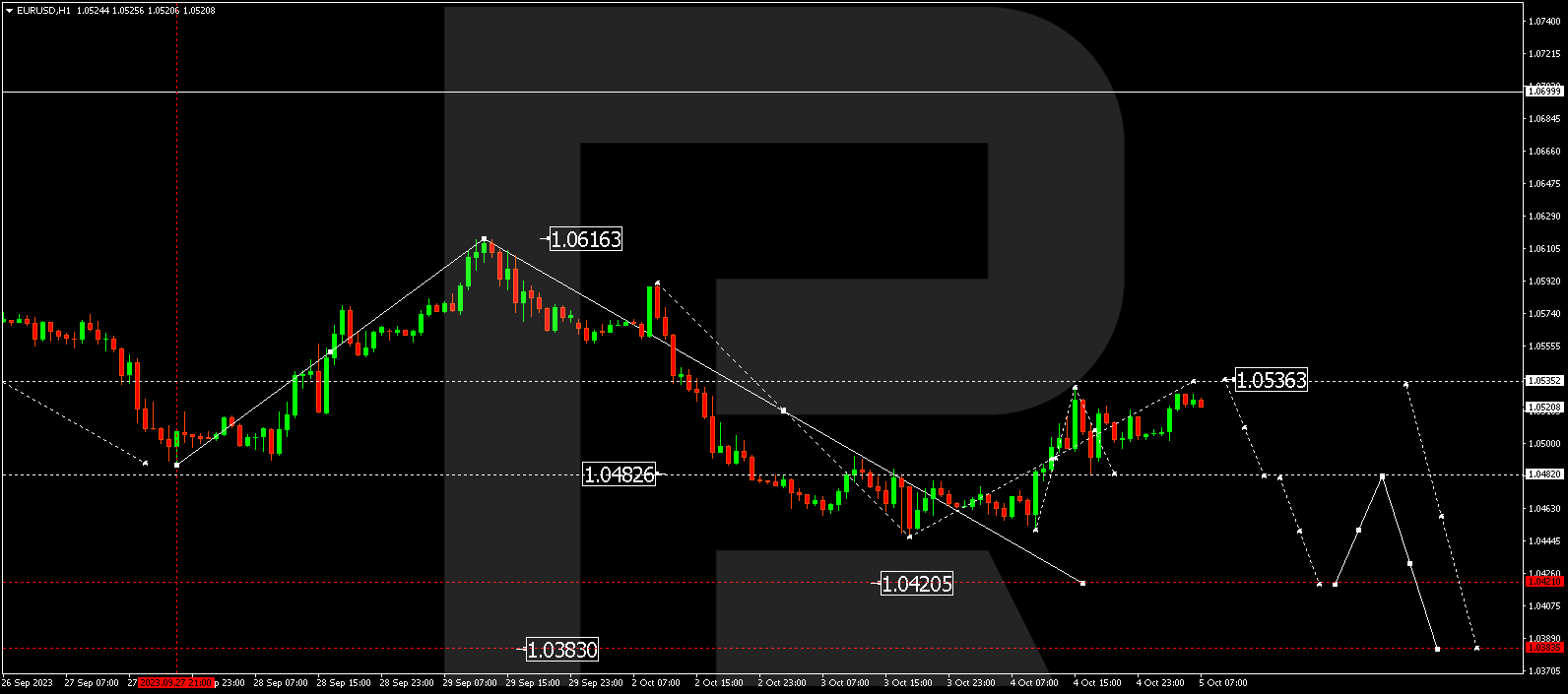

EUR/USD (Euro vs US Dollar)

EUR/USD has undergone a corrective movement to 1.0530. Presently, the market is establishing a consolidation range below this level. An extension to 1.0535 is plausible today. Following this, a new downward wave to 1.0482 is anticipated. If this level is breached, the price may decline to 1.0420, from where the trend could persist towards 1.0383.

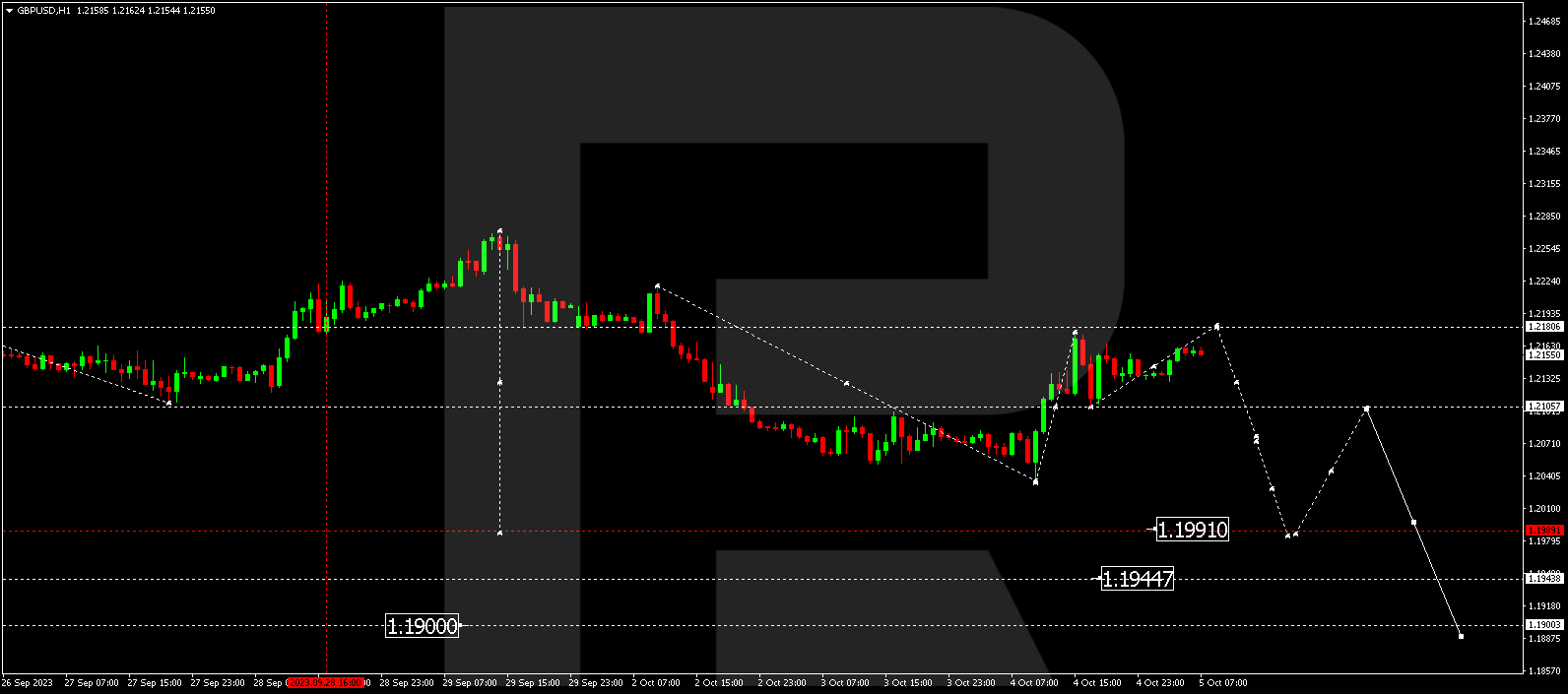

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD has experienced an upward movement to 1.2176. Currently, the market is creating a consolidation range below this level. The potential for a rise to 1.2180 is not discounted today. Subsequently, a downturn to 1.1991 might ensue. If this level is breached downwards, the price might set the stage for a decline to 1.1900. This is a local target.

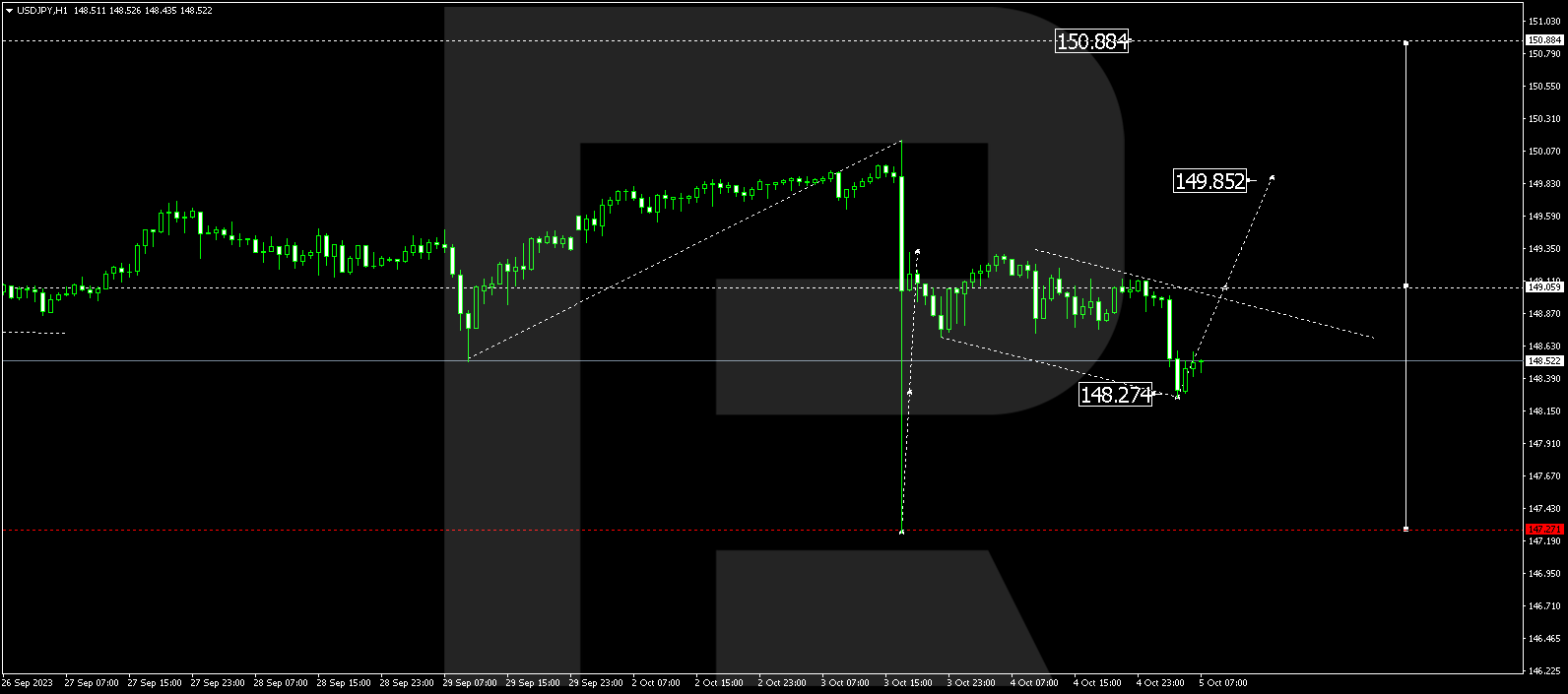

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY has successfully completed a correction wave to 148.30. A rise to 149.85 might follow today. After reaching this level, a decline to 149.06 is conceivable, followed by a surge to 150.88. From there, the trend might extend to 155.00.

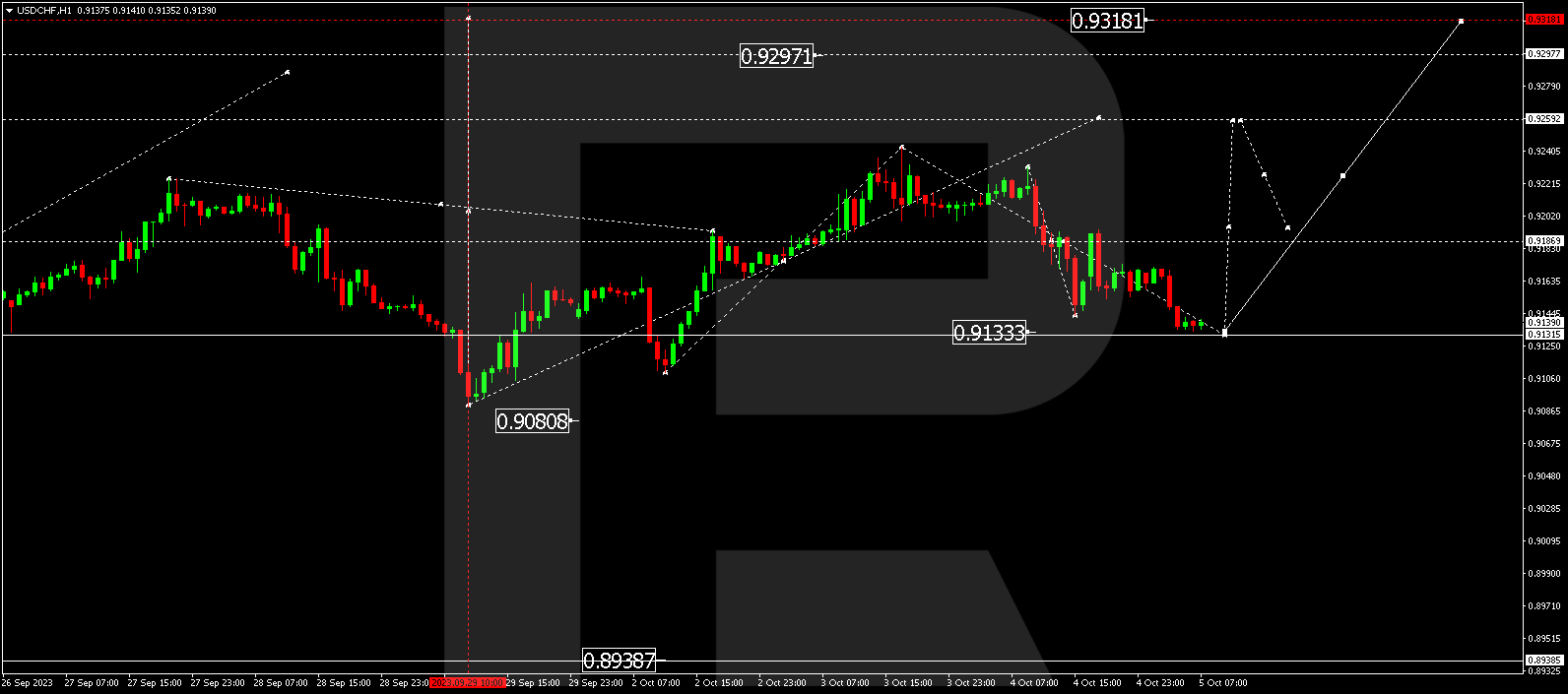

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF has executed a corrective wave to 0.9134. The market is currently in consolidation above this level. An upward breakout from the range is anticipated, potentially extending the wave to 0.9250, with the overall trend proceeding to 0.9318.

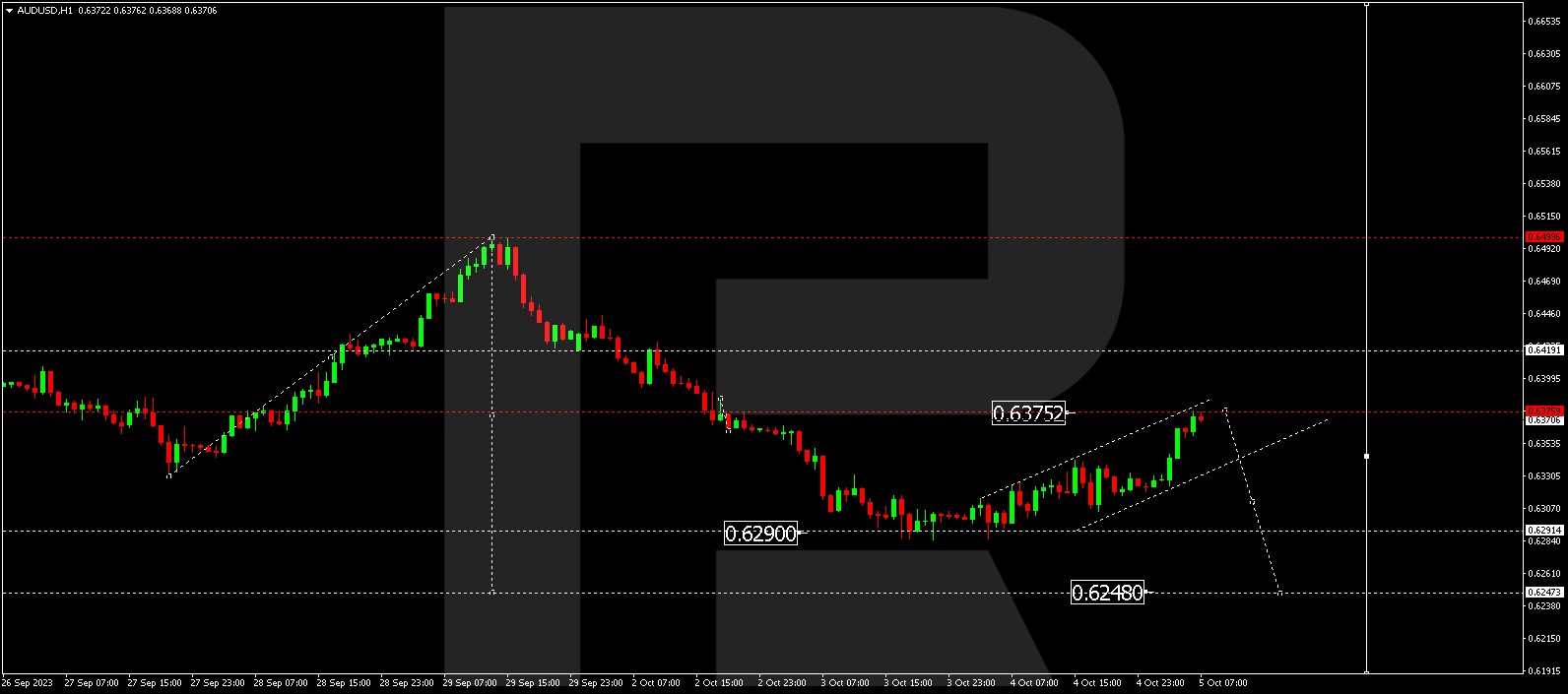

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD has wrapped up a correction wave to 0.6375. A consolidation range is forming below this level today. An anticipated downward breakout could lead to an extension of the wave to 0.6285. If this level is breached, the trend might reach 0.6229.

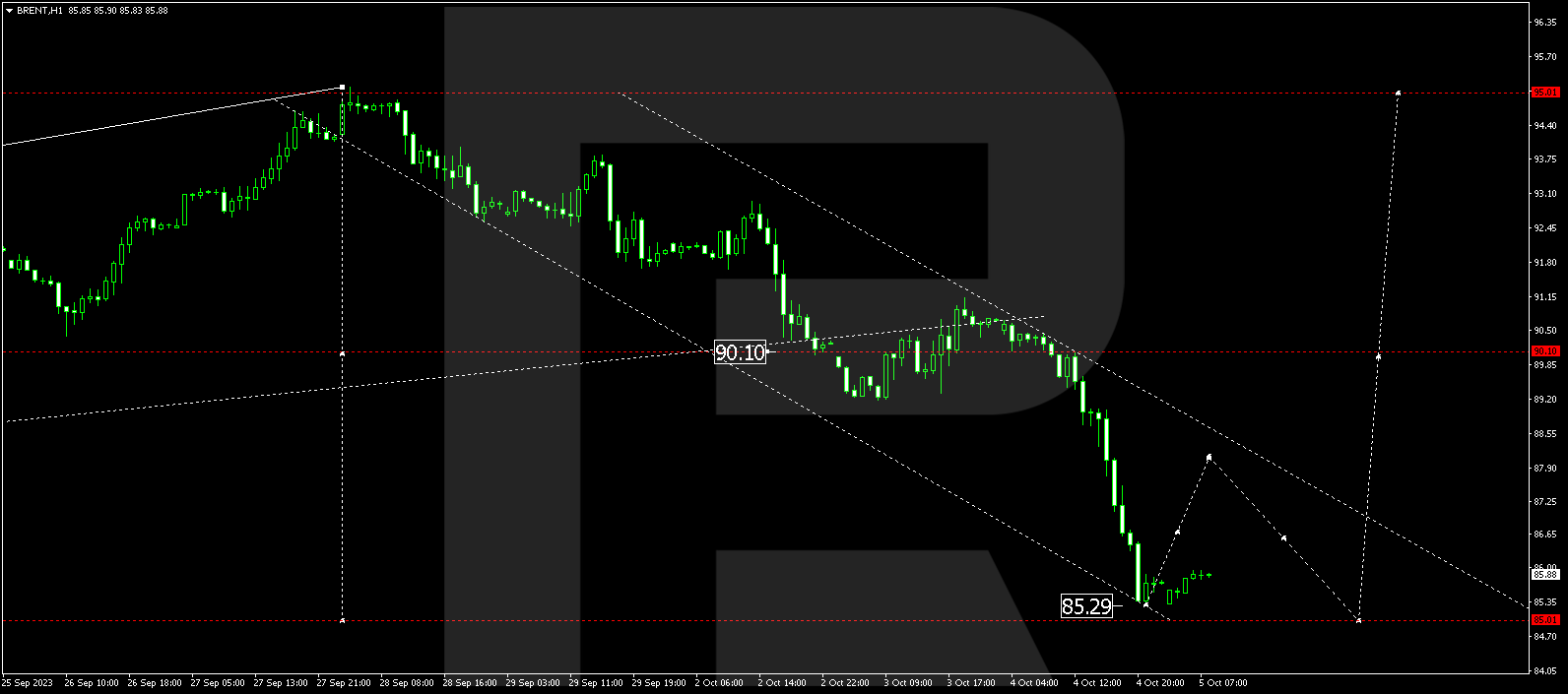

BRENT

Brent is in a phase of correction. A decline structure to 85.30 has been observed today. The market is consolidating above this level. An extension of the range to 85.00 is conceivable. Following this, a fresh wave of growth to 90.10 could initiate. Should this level be breached, the potential for a growth wave to 95.00 could open up, followed by a potential movement to 104.00.

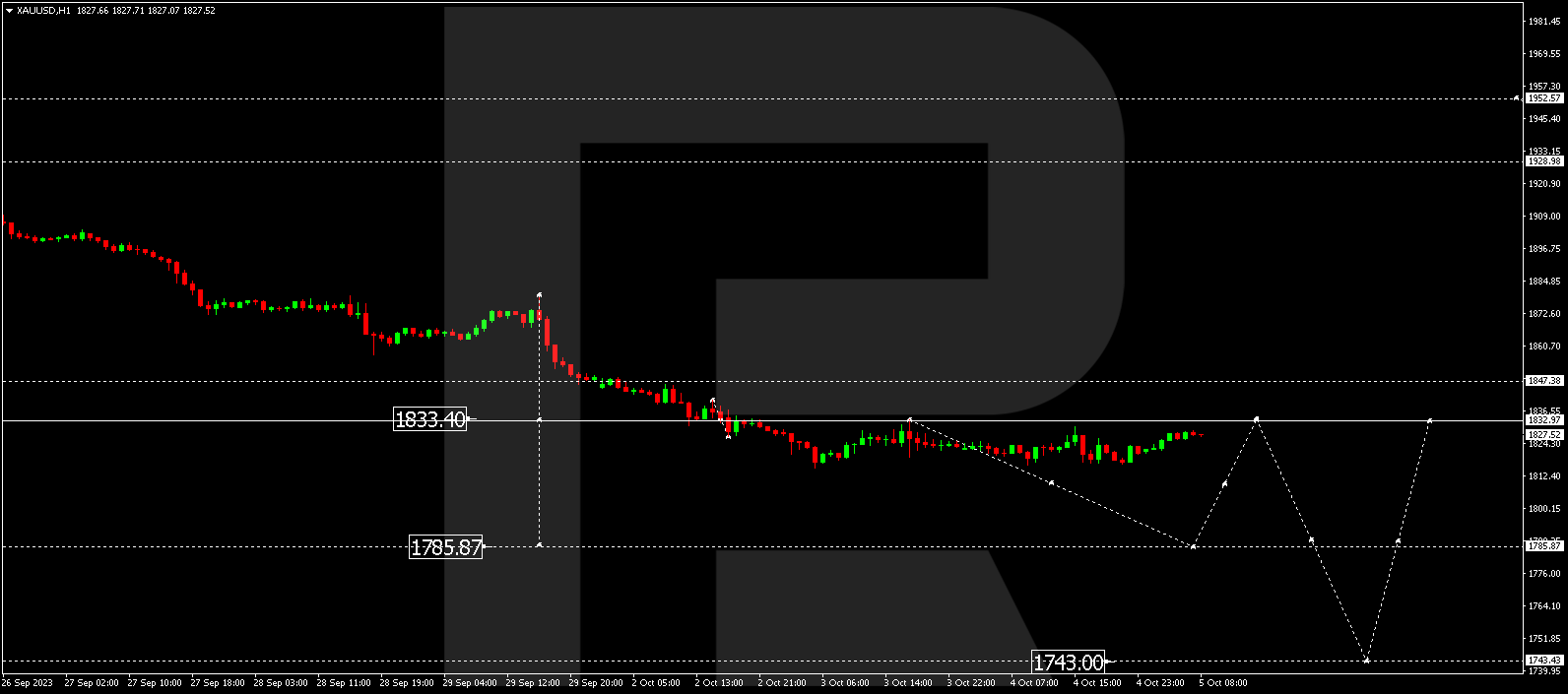

XAU/USD (Gold vs US Dollar)

Gold remains in consolidation below 1833.00. An expected downward breakout from the range to 1785.88 is foreseen. Subsequently, a price correction to 1833.00 (with a test from below) may occur, followed by a decline to 1743.00.

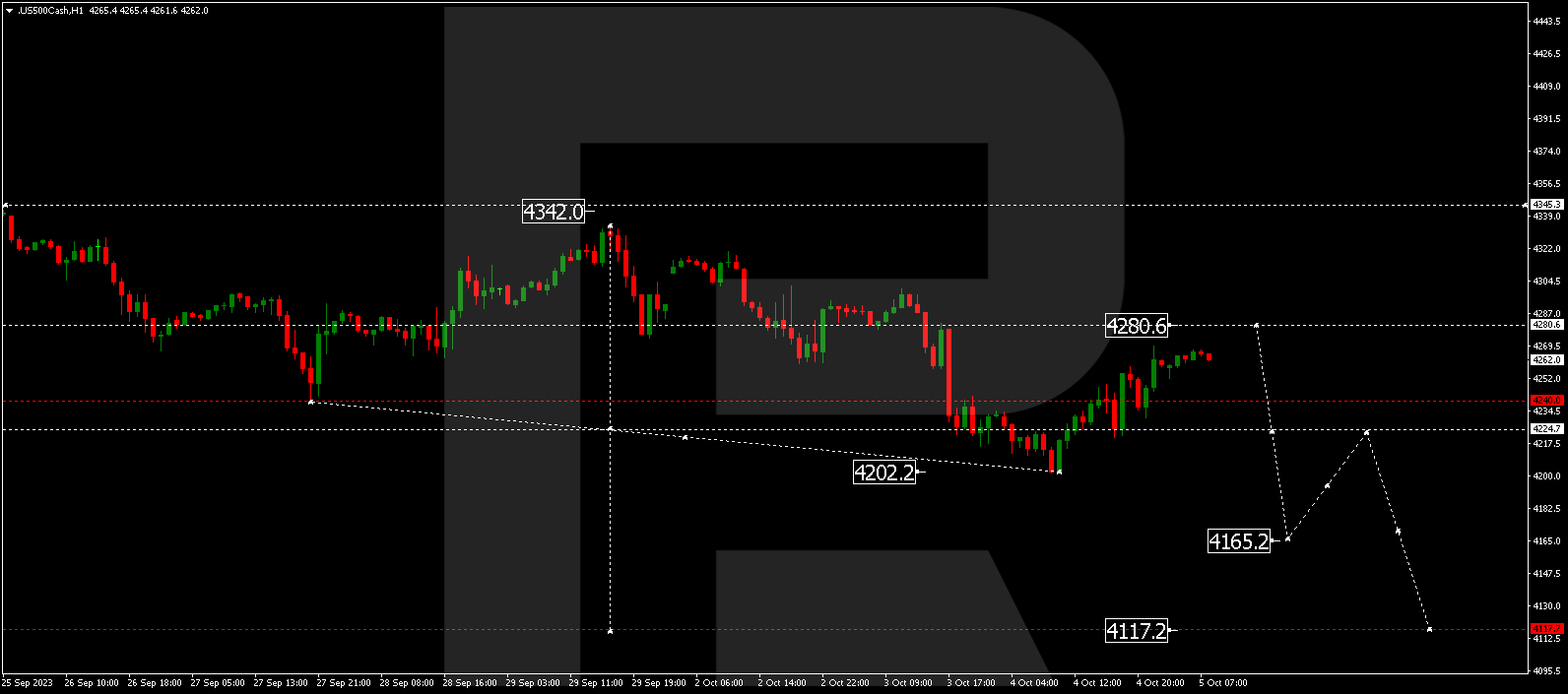

S&P 500

The stock index has established a consolidation range around 4240.0 and may extend the correction to 4280.0 with an upward breakout from the range. Post reaching this level, a new downward movement to 4165.0 could commence, eventually leading the trend to 4117.0. This is a local target.

The post Technical Analysis & Forecast for October 05, 2023 appeared first at R Blog – RoboForex.