Welcome to our technical analysis and forecast for various financial markets. In this overview, we will cover the EUR/USD, GBP/USD, USD/JPY, USD/CHF, AUD/USD, Brent, Gold, and the S&P 500 index.

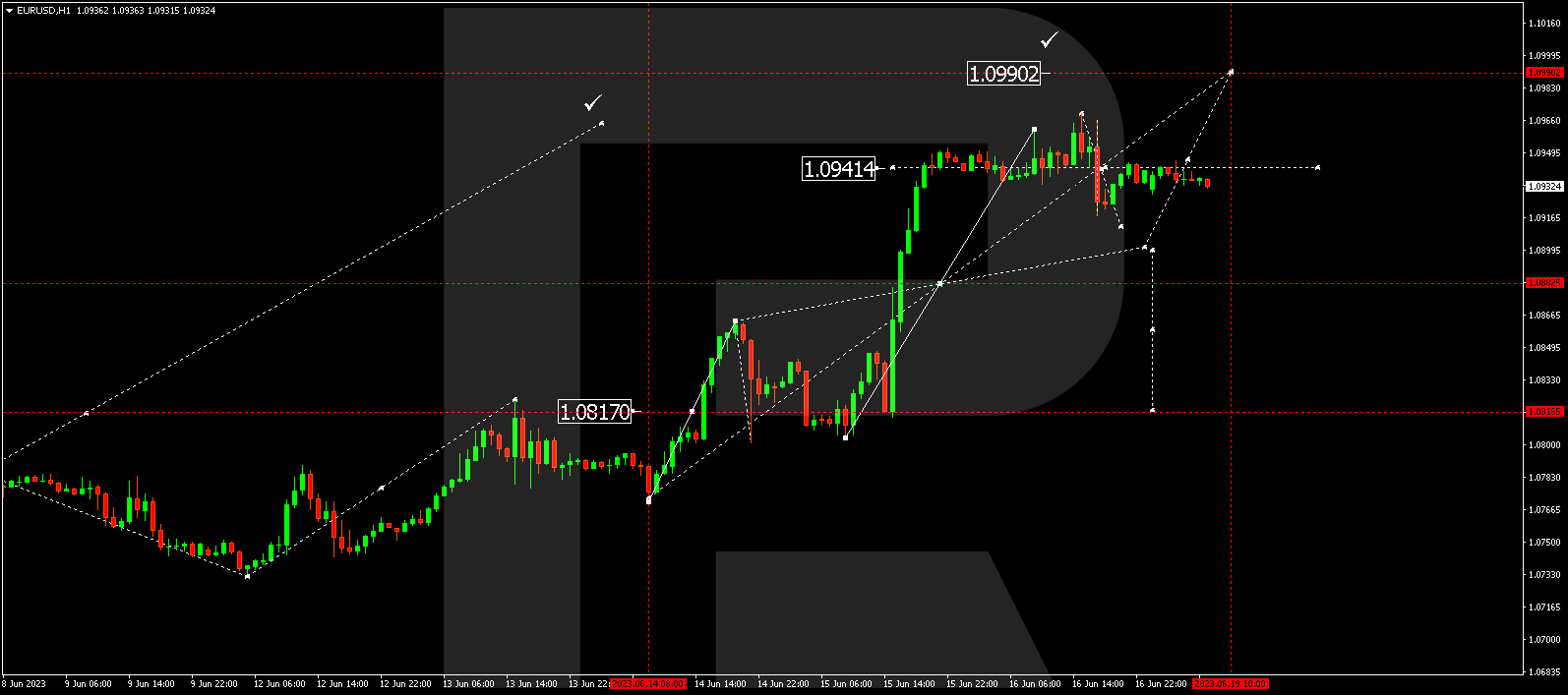

EUR/USD – Euro vs US Dollar

The EURUSD pair is currently in a consolidation phase around 1.0944. We anticipate a downward extension of the range to 1.0910, followed by a potential rise to test the upper boundary at 1.0944. A downside breakout from the range could trigger a corrective decline towards 1.0818. Conversely, an upside breakout might lead to an extension towards 1.0990, followed by a decline towards 1.0800.

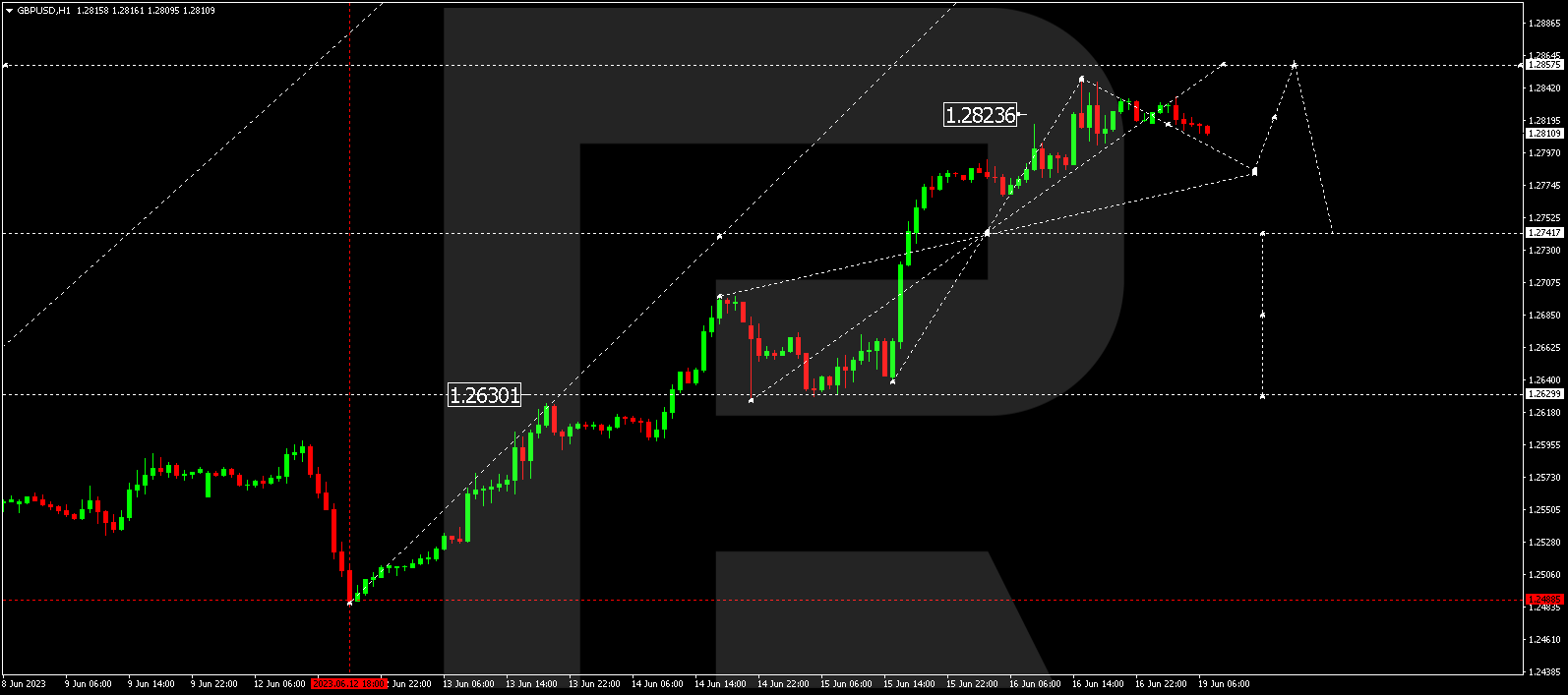

GBP/USD – Great Britain Pound vs US Dollar

The GBPUSD pair is currently consolidating around 1.2823. We expect a downward extension of the range to 1.2782, followed by a potential rise to test the upper boundary at 1.2823. A downside breakout may open the door for further correction towards 1.2630. However, an upside breakout could result in a rally towards 1.2857, followed by a drop to 1.2630.

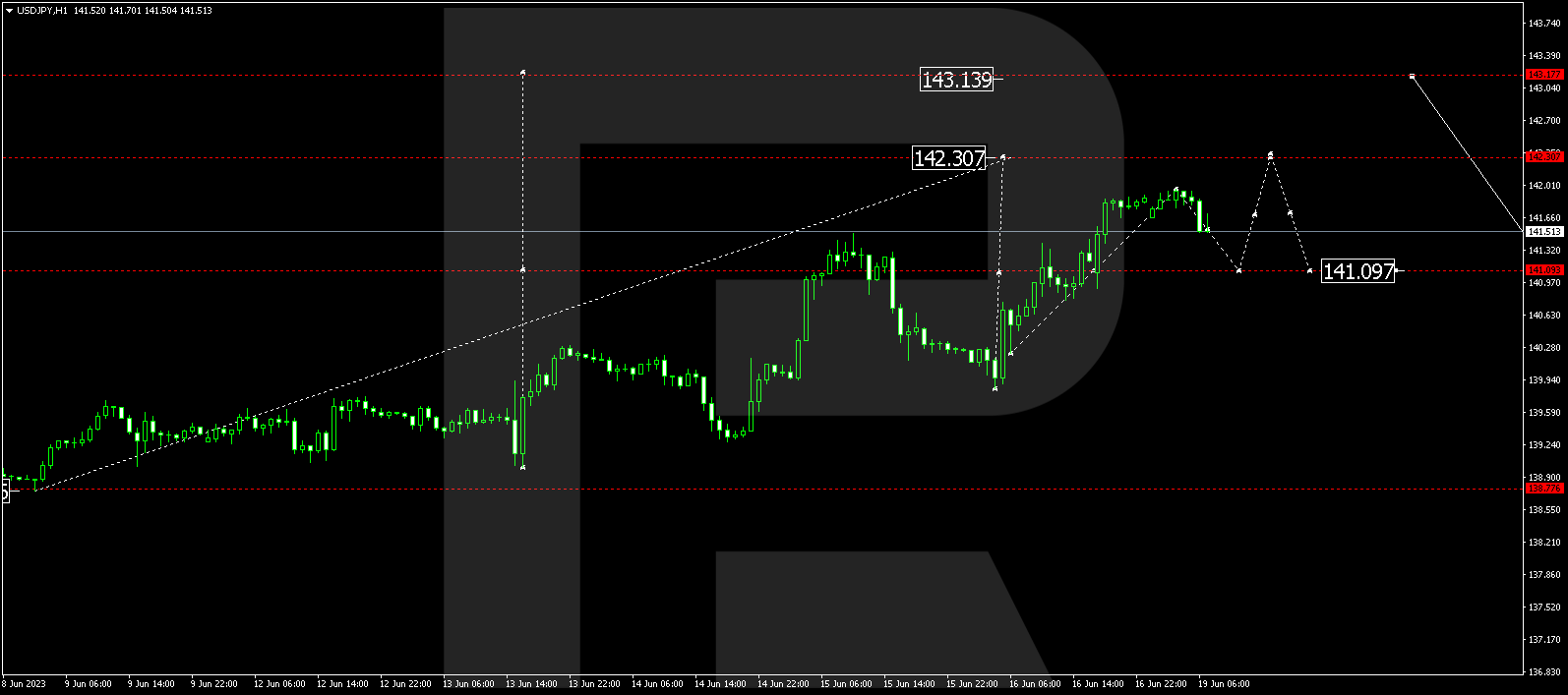

USD/JPY – US Dollar vs Japanese Yen

The USDJPY pair is consolidating around 141.09, with a recent extension to 141.95. We anticipate a decline towards 141.09, followed by a potential rise towards 142.30. After reaching this level, a correction towards 141.00 is expected.

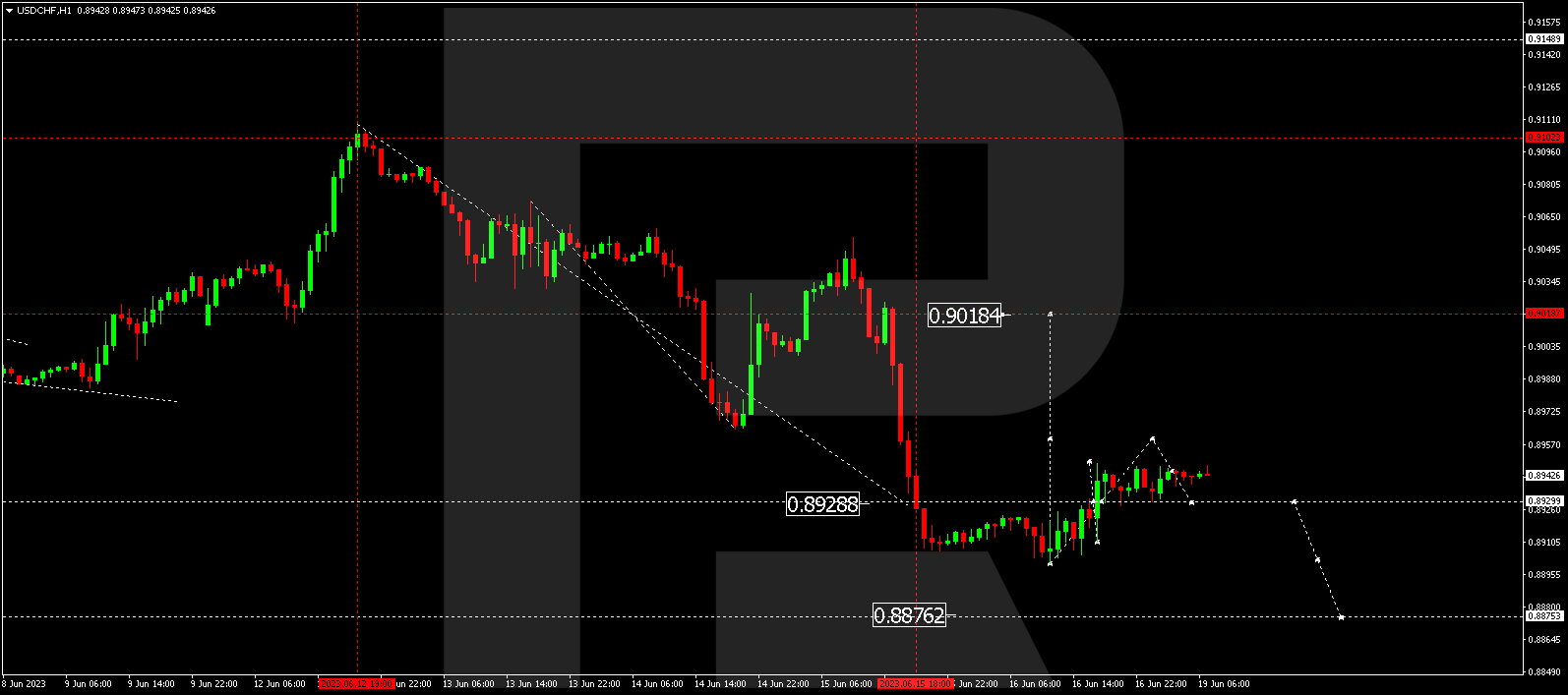

USD/CHF – US Dollar vs Swiss Franc

The USDCHF pair is consolidating around 0.8930, with a projected extension to 0.8960, followed by a decline towards 0.8930. An upside breakout could lead to a wave of growth towards 0.9019, while a downside breakout might result in a decline towards 0.8875, followed by a rise towards 0.9020.

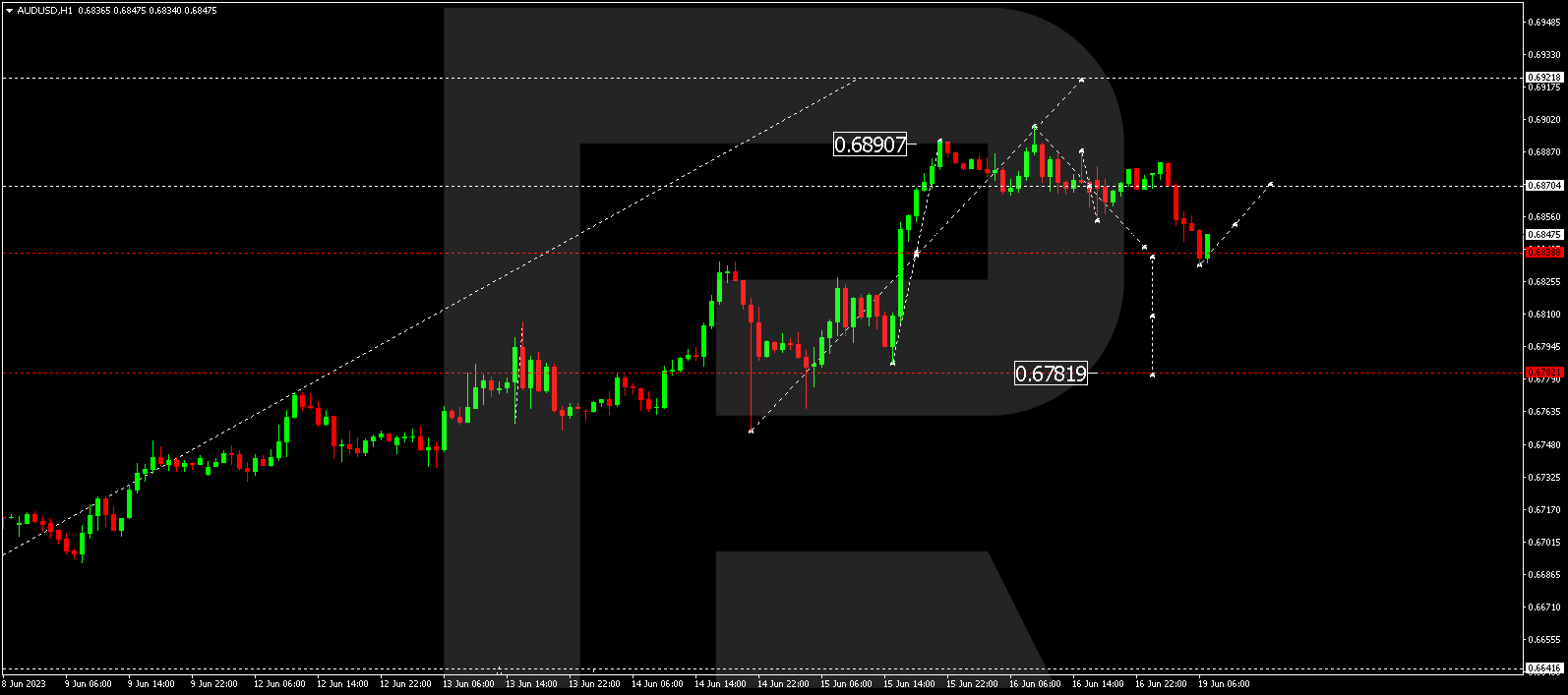

AUD/USD – Australian Dollar vs US Dollar

The AUDUSD pair has formed a declining trend towards 0.6838. Today, we expect a rise towards 0.6870, followed by a potential decline towards 0.6782. Subsequently, a new upward structure towards 0.6922 is possible.

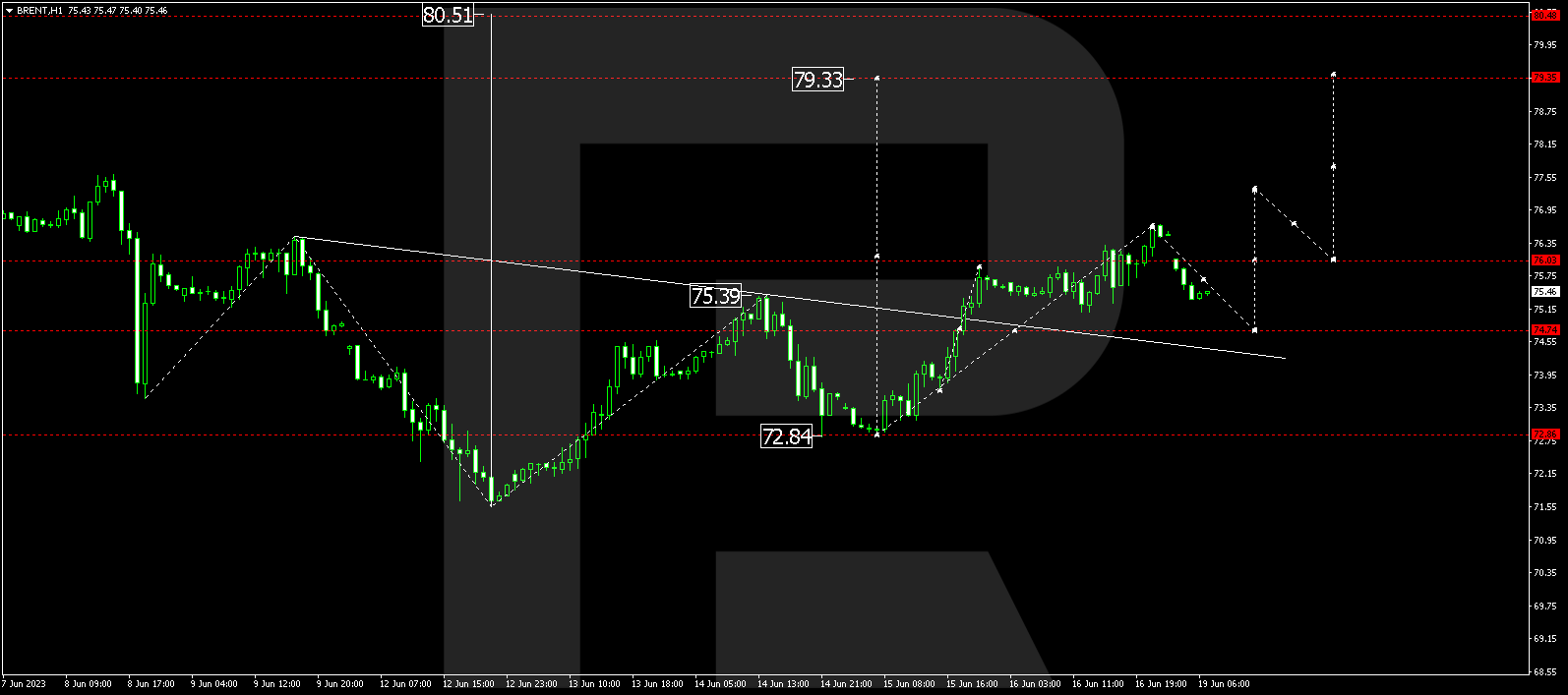

Brent

Brent crude oil has completed a wave of growth towards 76.66. We anticipate a correction towards 74.74, followed by a potential rise towards 77.55. From there, the trend might develop towards 79.35 as a local target.

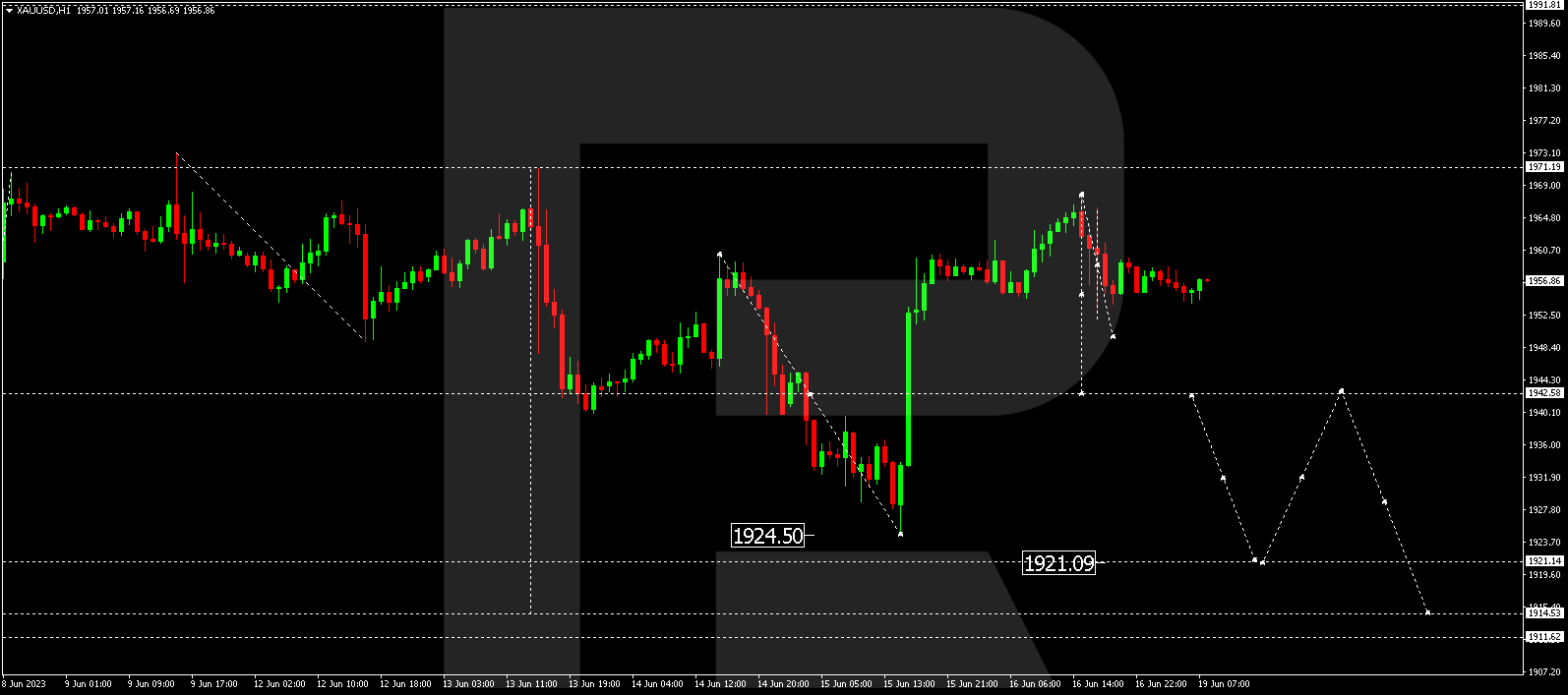

XAU/USD – Gold vs US Dollar

Gold is currently forming a consolidation range around 1958.88. We expect a decline towards 1949.70, followed by a rise to test the upper boundary at 1958.88. A downside breakout might lead to a wave of decline towards 1921.09. Conversely, an upside breakout could result in a rally towards 1971.20, followed by a decline to 1921.09.

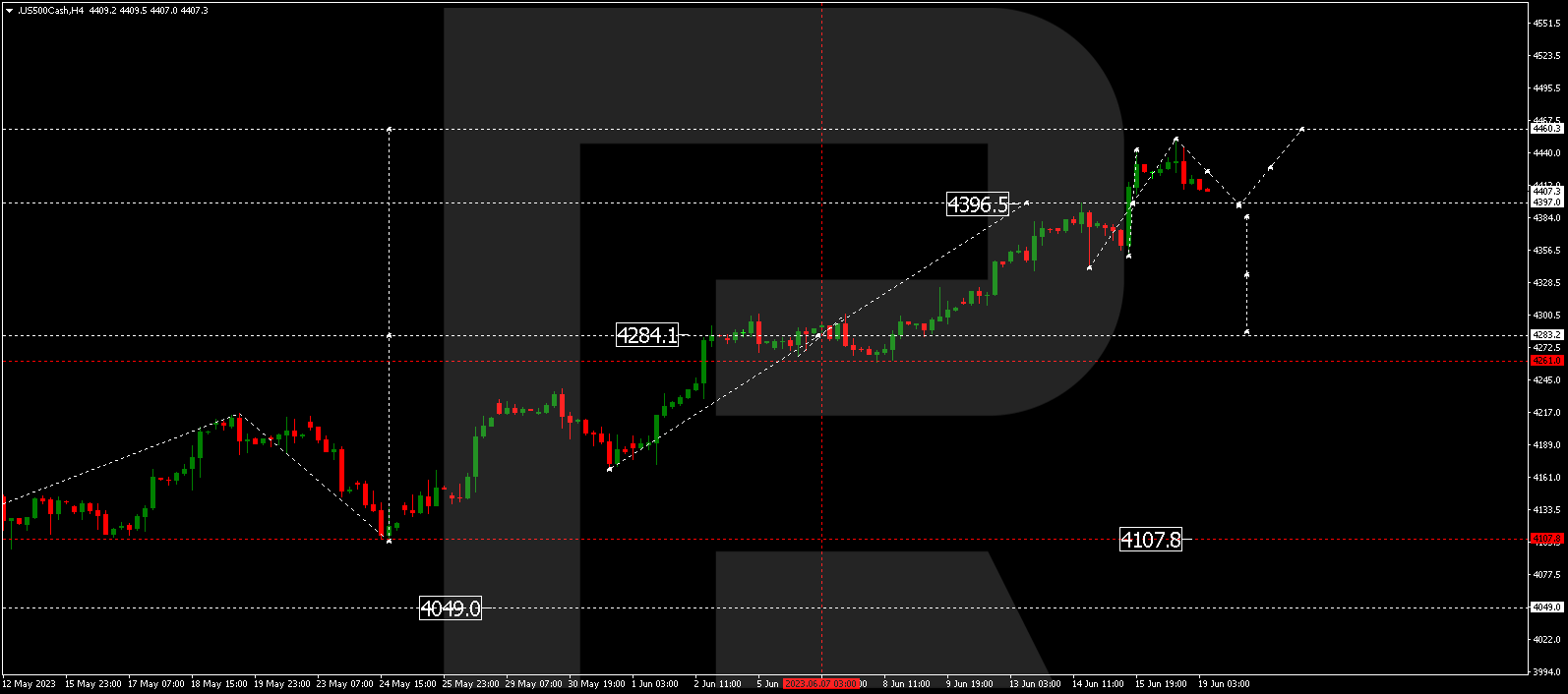

S&P 500

The S&P 500 index is consolidating around 4396.5, with an upward extension to 4451.4. We anticipate a decline towards 4396.5, with a test from above. An upside breakout could lead to a rise towards 4460.2, followed by a decline towards 4282.0, which is the first target level.

The post Technical Analysis & Forecast for June 19, 2023 appeared first at R Blog – RoboForex.