CHF Continues to Surge – Overview of EUR, GBP, JPY, AUD, Brent, Gold, and S&P 500 Index

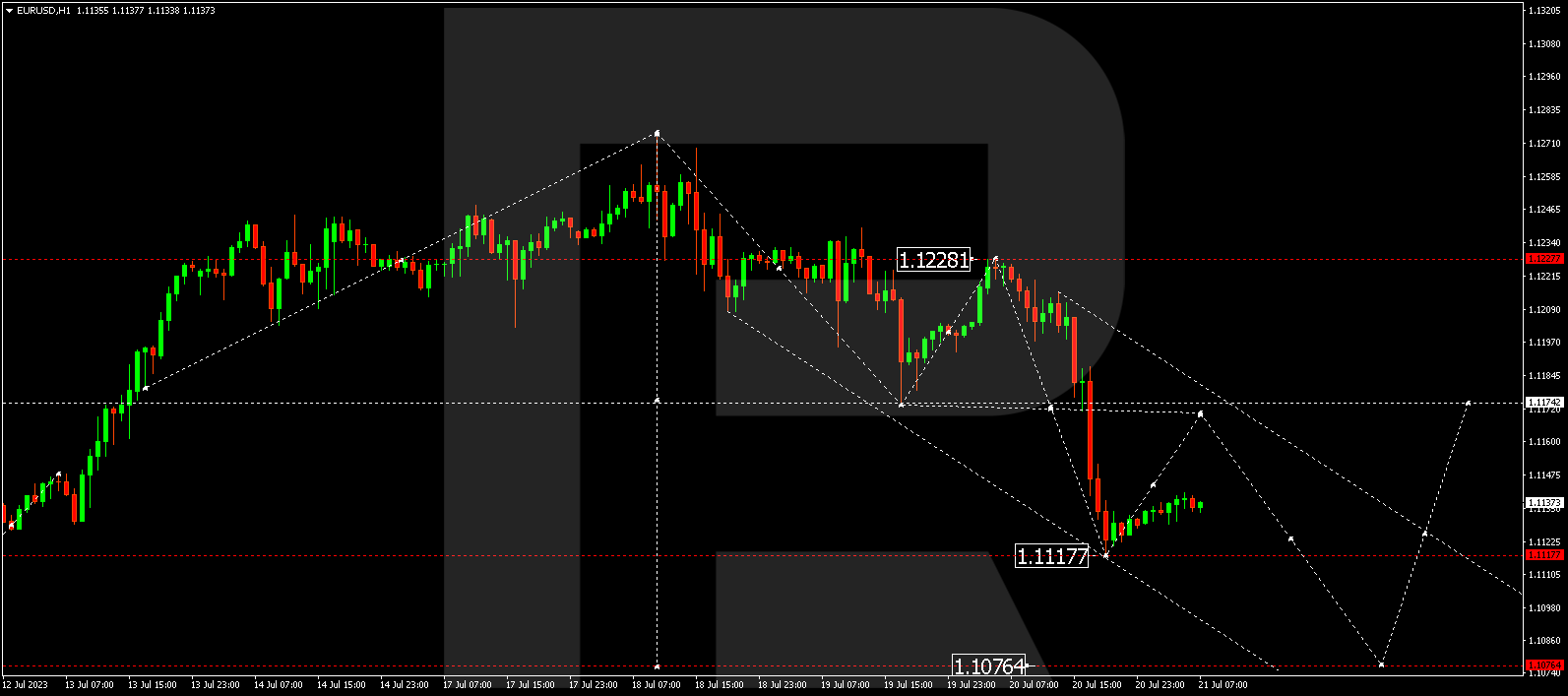

EUR/USD (Euro vs US Dollar)

EUR/USD has completed its correction at 1.1228 and experienced another wave of decline to 1.1118, reaching a local target. A corrective phase to 1.1170 is likely to develop today. After the correction is over, a new wave of decline to 1.1077 might begin.

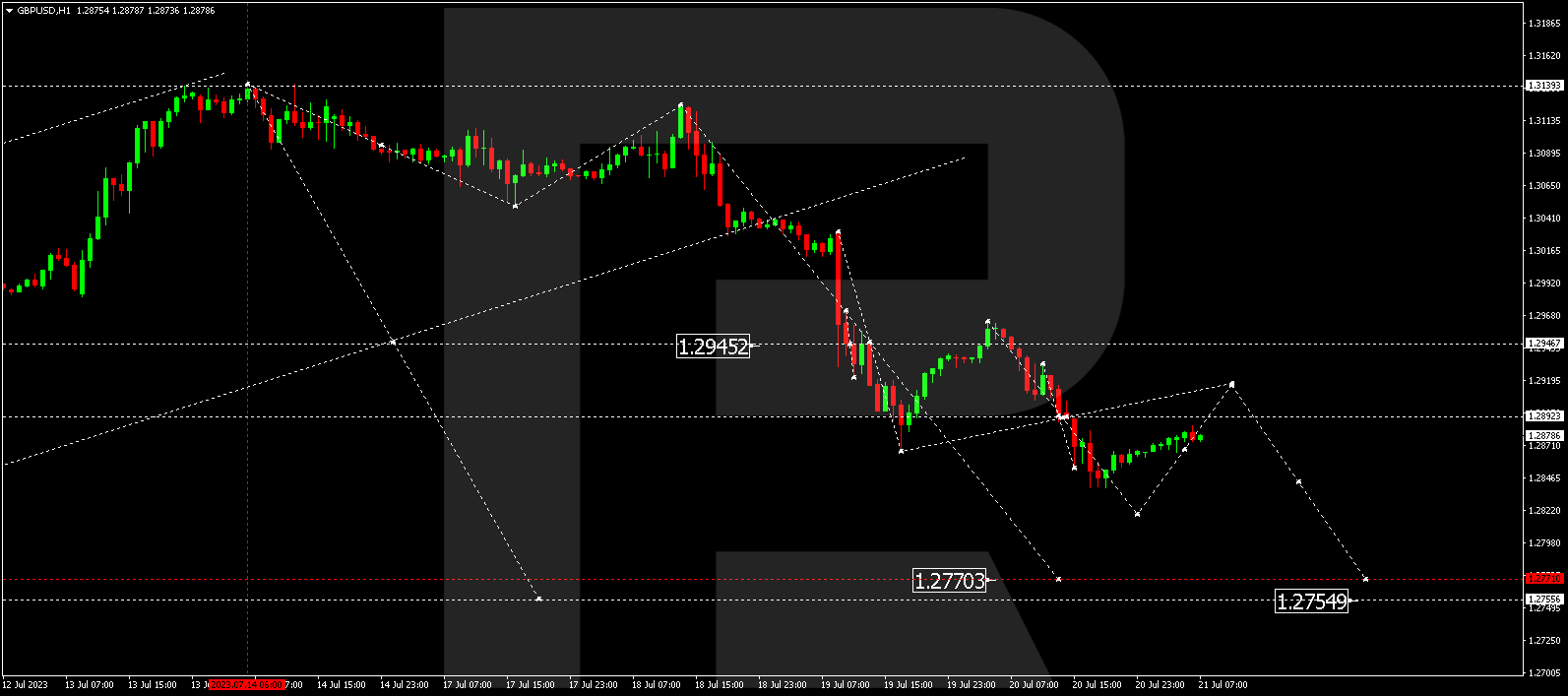

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD has undergone a corrective structure to 1.2962 and then continued its decline to 1.2840. A correction to 1.2915 is possible today. After the correction, the wave might continue to 1.2770, which is a local target.

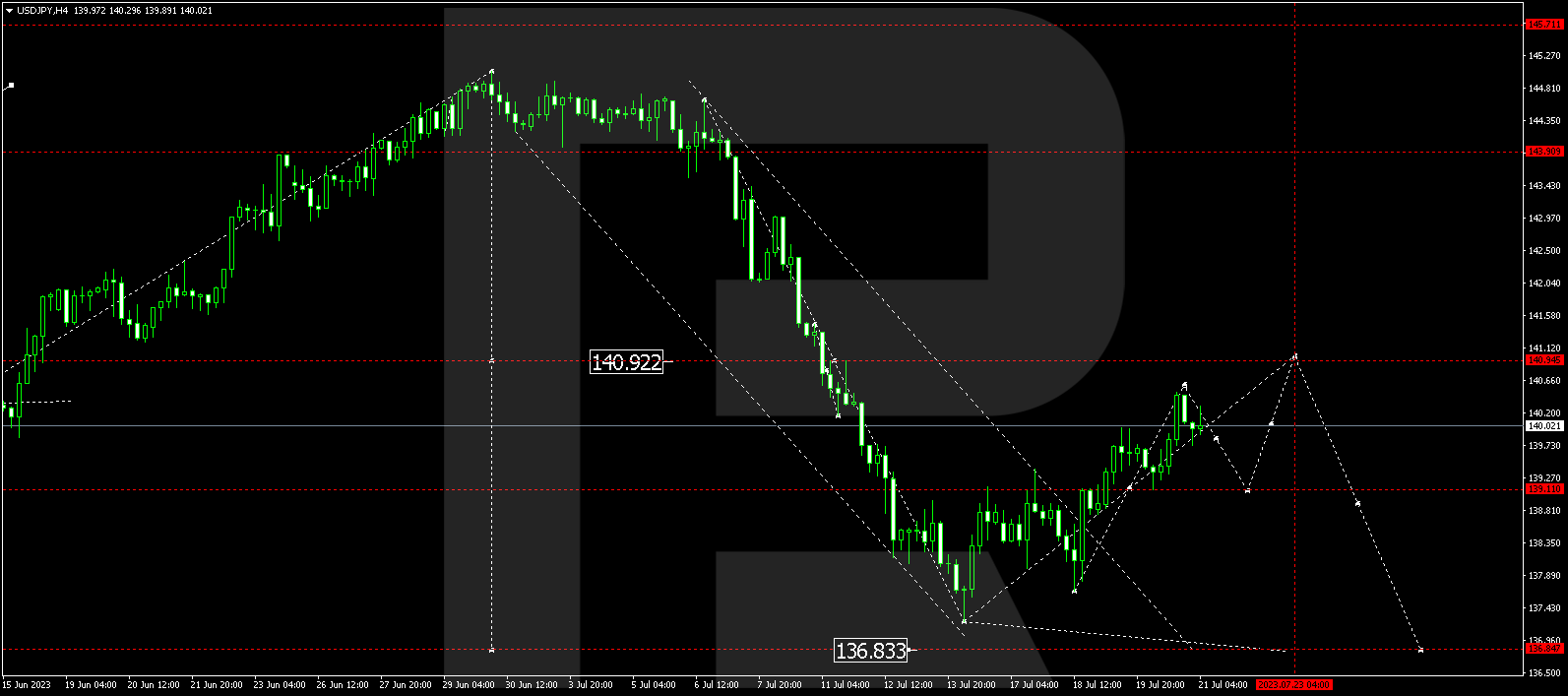

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY is still forming a growth structure aiming for 140.55. After reaching this level, a correction to 139.11 is expected. Next, the wave of growth might continue to 140.95, followed by a decline to 139.00.

Do you want to trade on favourable terms? Click on the banner below to access some of the most cost-effective trading conditions in the market!

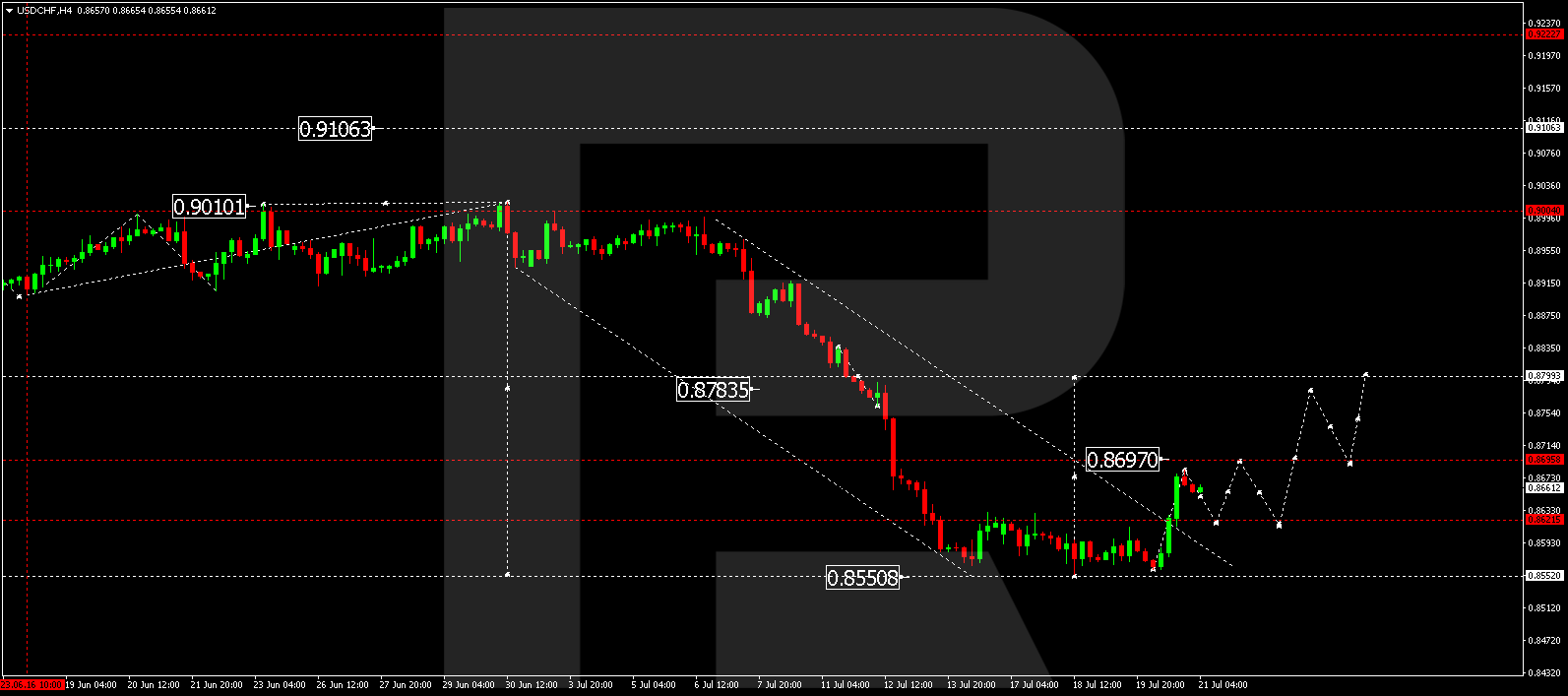

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF has broken the 0.8622 level upwards and continues its wave of growth to 0.8697. After reaching this level, a correction to 0.8620 is expected, followed by a rise to 0.8799.

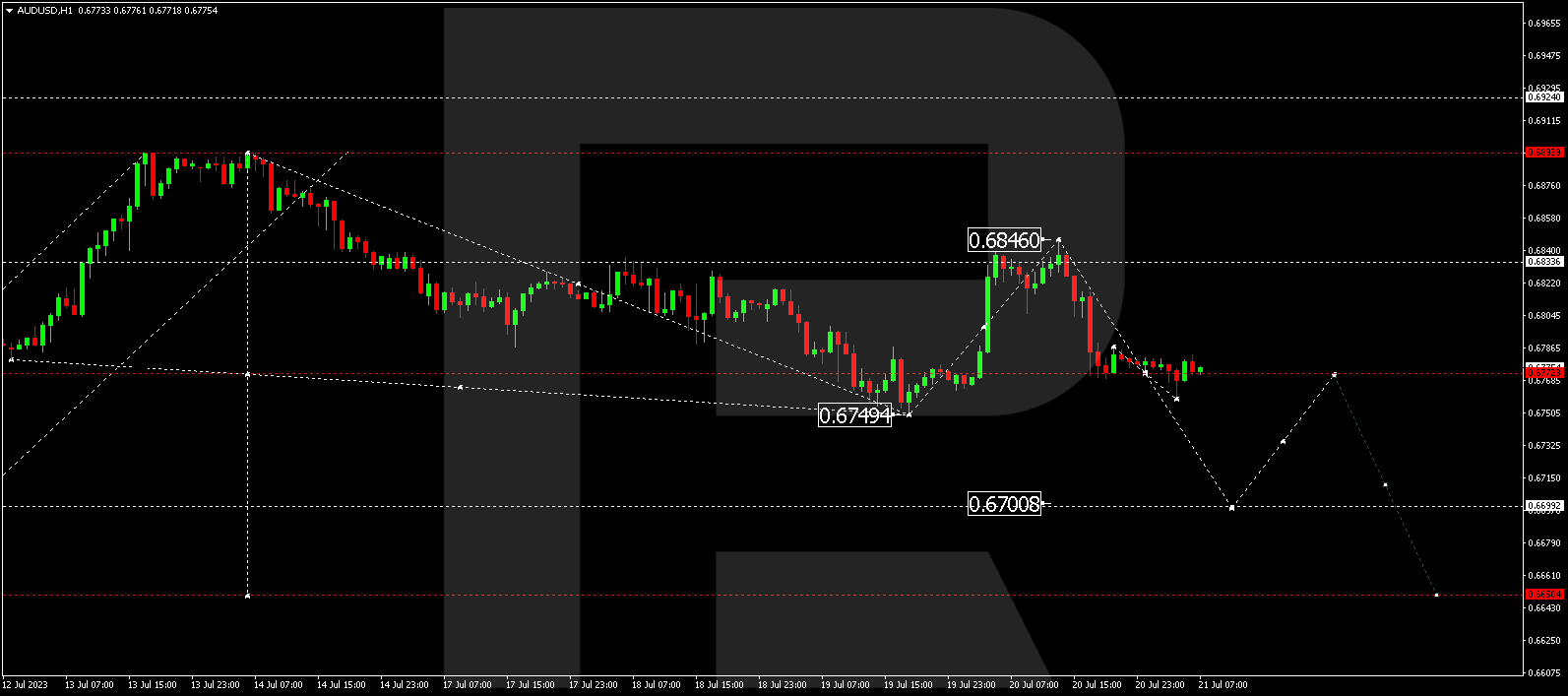

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD has reached its correction target at 0.6846 and experienced a declining impulse to 0.6777. Currently, a consolidation range is forming around this level. The price is expected to break the range downwards and extend the wave to 0.6700, which is a local target.

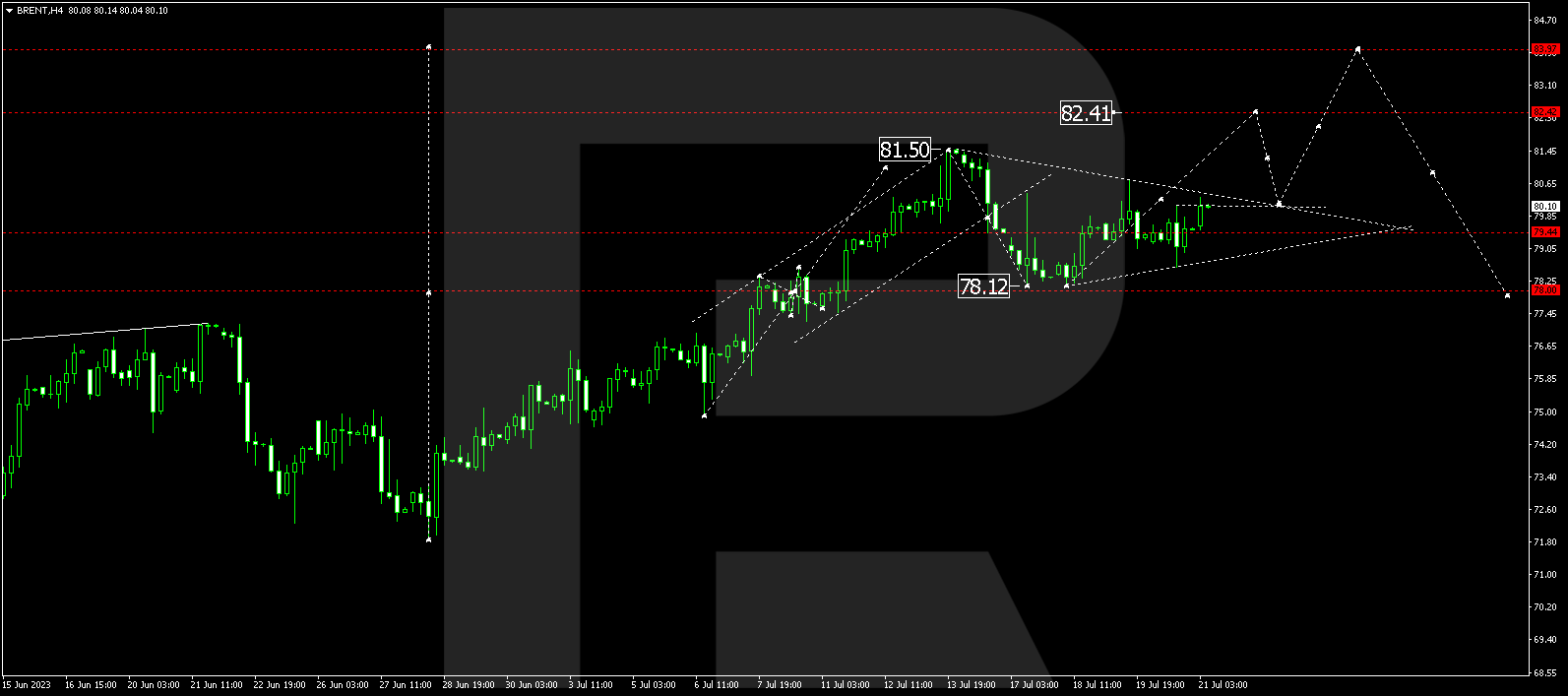

BRENT

Brent continues to form a consolidation range around 79.71 with no expressed trend. Today, a breakout of 80.00 is expected, after which the wave might extend to 82.42, and the trend might continue to 84.00, which is a local target. After reaching this level, a correction to 78.00 could start.

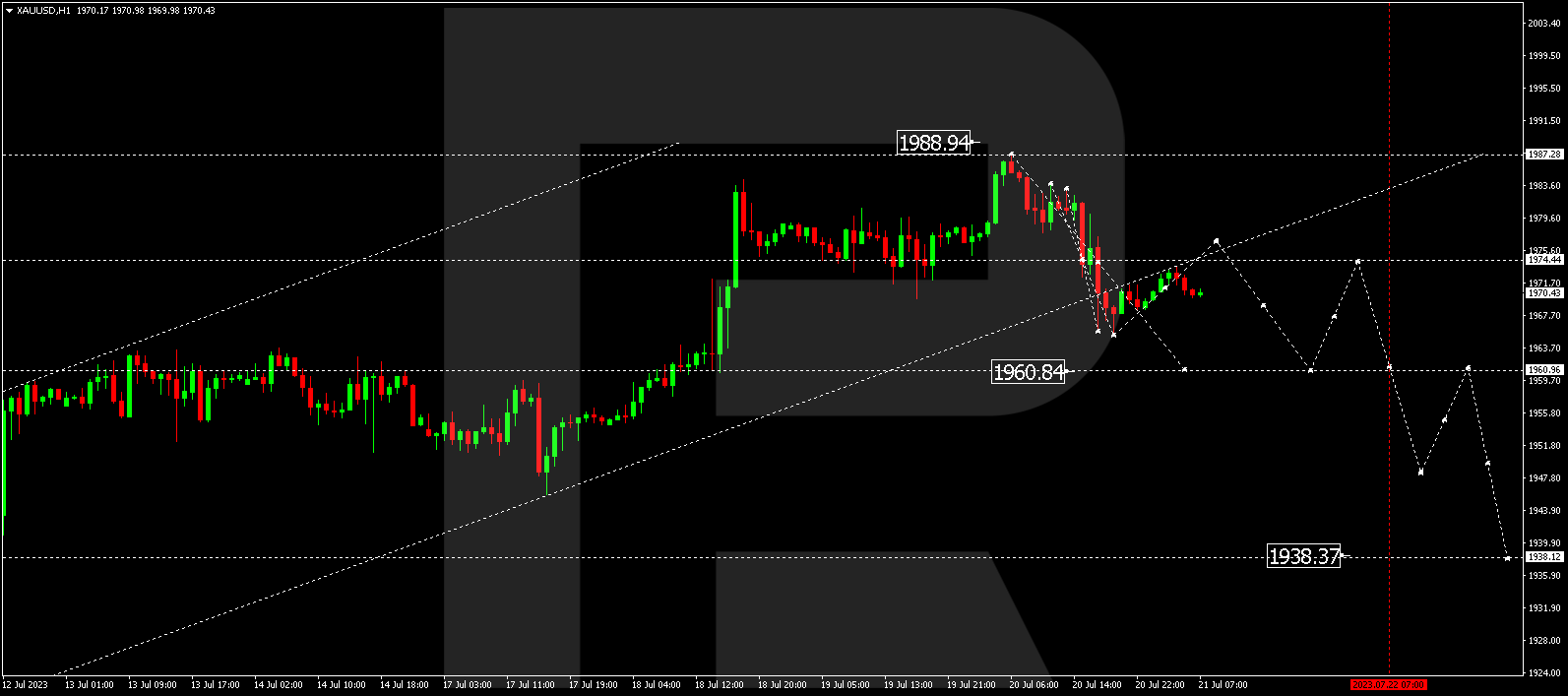

XAU/USD (Gold vs US Dollar)

Gold has completed its decline to 1965.25. A correction to 1976.40 is possible today. Next, a decline to 1960.85 is likely to follow, which is the first target. After the price reaches this level, a correction to 1974.44 could start, followed by a decline to 1948.00.

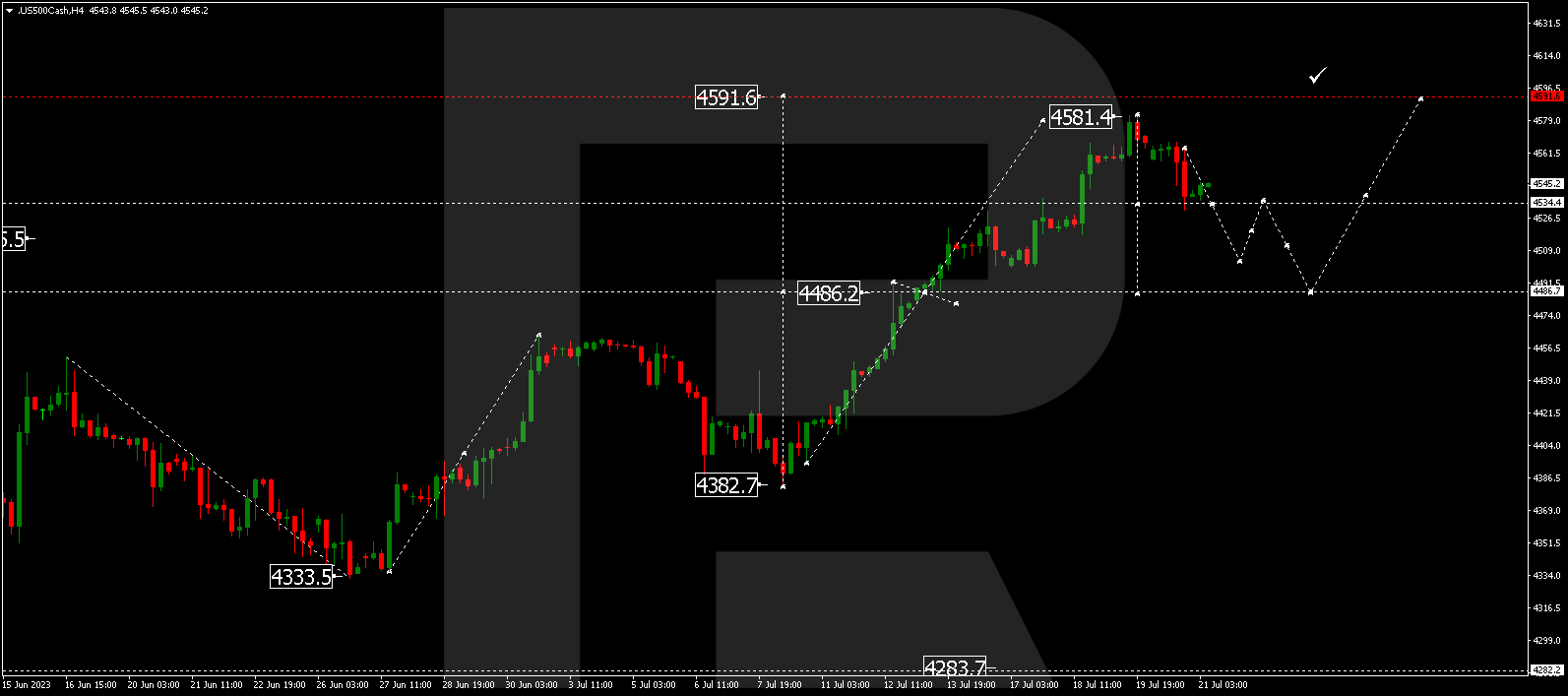

S&P 500

The stock index is forming a structure of a declining wave to 4503.0 today. After reaching this level, a correction to 4534.4 is not excluded, followed by a decline to 4486.6, which is the first target.

The post Technical Analysis & Forecast for July 21, 2023 appeared first at R Blog – RoboForex.