We’re discussing prospects for EUR/USD, GBP/USD, USD/JPY, Brent, Gold, and the S&P 500 index in July.

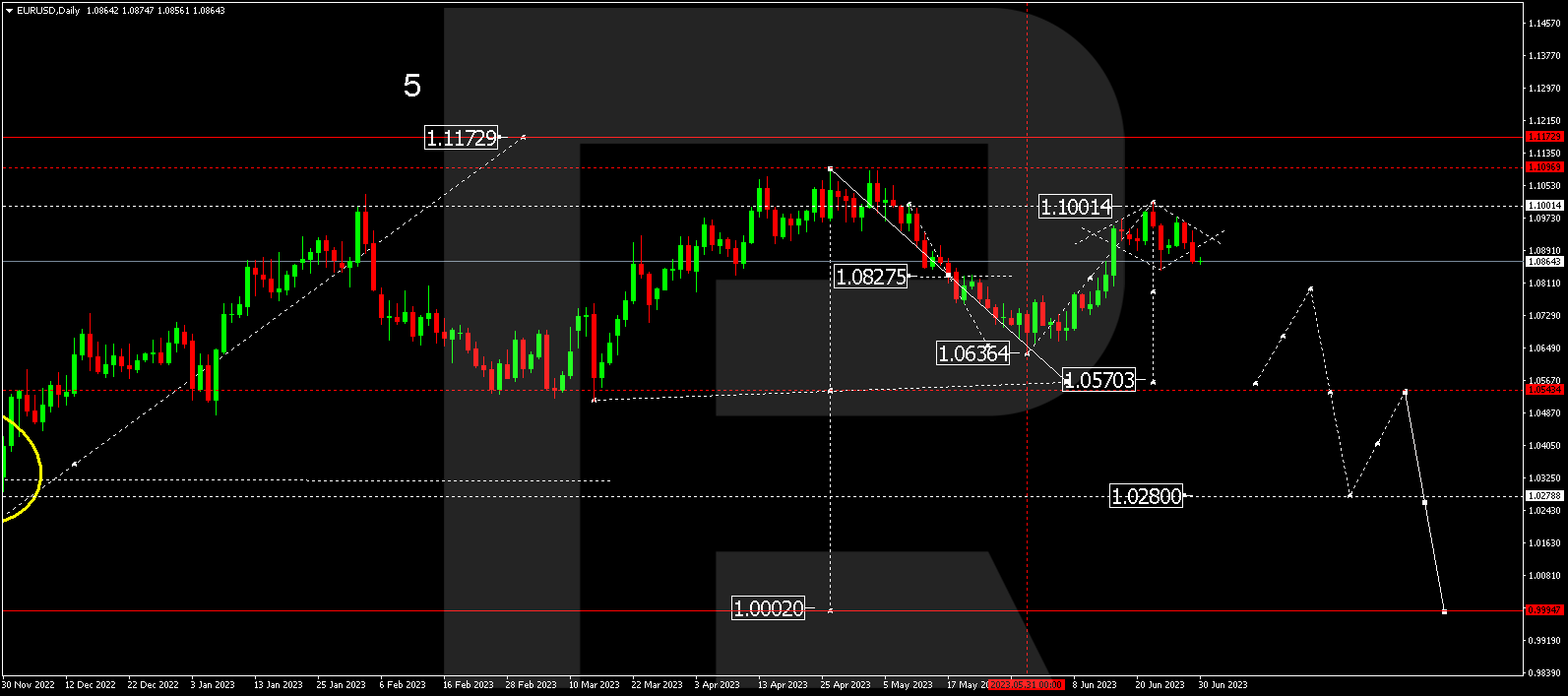

EUR/USD (Euro vs US Dollar)

EUR/USD has recently completed an upward wave, reaching 1.1001. The market has formed a consolidation range below this level and is currently testing the lower border. If the range is broken to the downside, it could trigger another wave of decline towards 1.0570. Once this level is reached, a new correction towards 1.0800 (a bottom-side test) may occur. The overall trend is expected to continue downwards towards 1.0280. However, if the price breaks the consolidation range to the upside, it could signal further growth towards 1.1096, followed by a potential decline to 1.0570. This is the projected target.

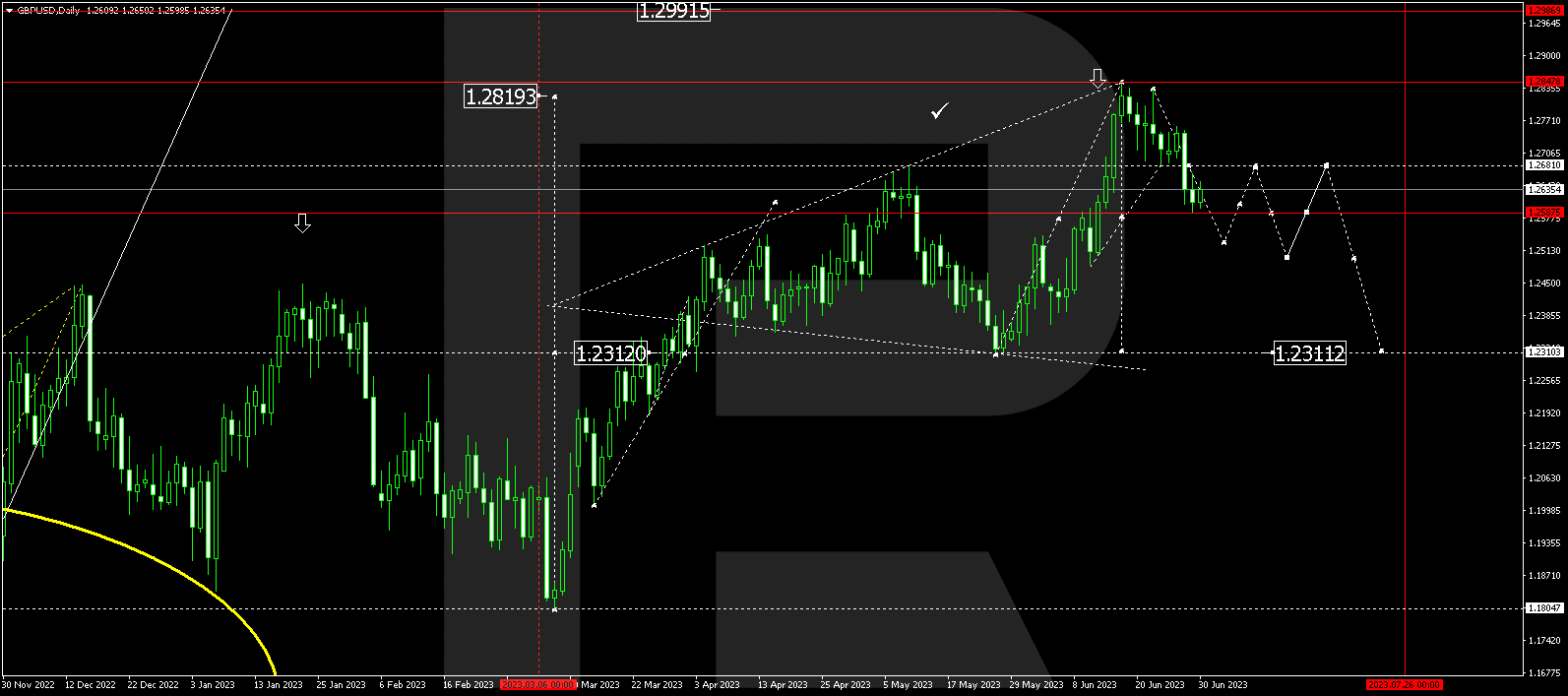

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD has formed a consolidation range around 1.2680 and recently broke below it, completing a downward wave to 1.2590. A correction towards 1.2680 (a test from below) is possible, but a decline to 1.2525 is expected as a local target. After reaching this level, a correction towards 1.2680 may develop, followed by a further decline to 1.2500. From there, the trend might continue towards 1.2310.

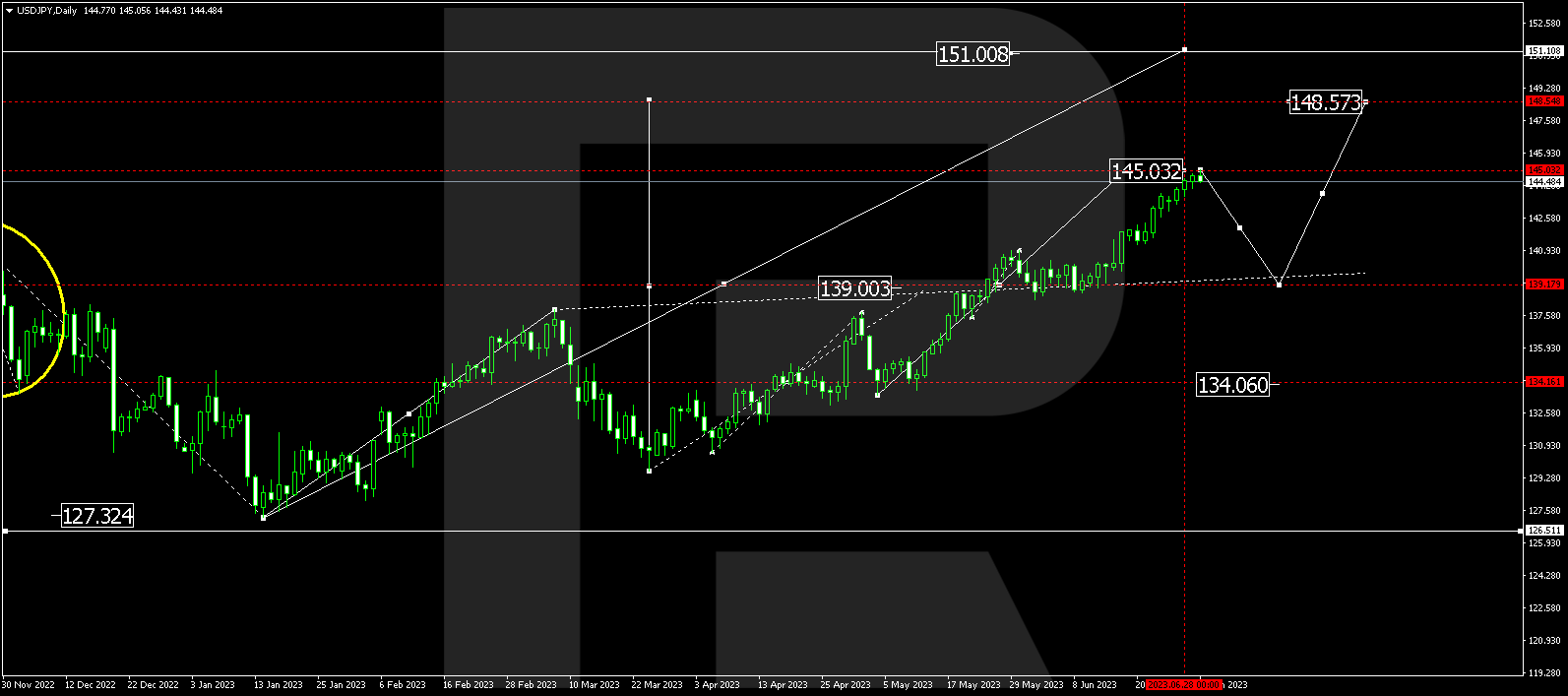

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY has completed an upward wave, reaching 145.03, which is close to the local target. A consolidation range is anticipated to form around this level. If the range is broken to the downside, a correction towards 139.02 could follow. On the other hand, if the price breaks the range to the upside, the upward wave could continue towards the main target of 148.58. A subsequent decline to 139.20 may then occur.

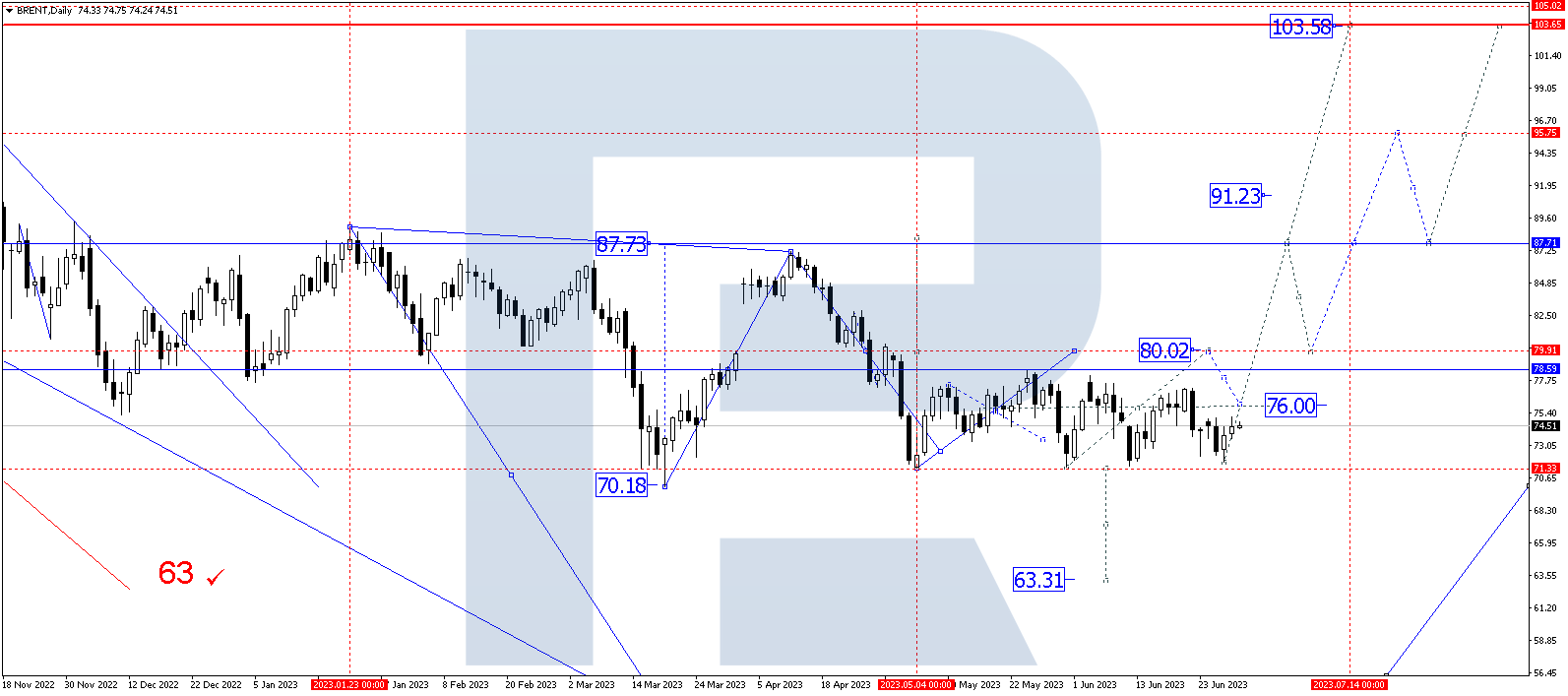

BRENT

Brent crude oil is currently developing a wide consolidation range around 76.00, expanding to 71.50. There is a considerable likelihood of an upward extension towards 80.00. Subsequently, a decline towards 76.00 might follow. Breaking the range to the upside could open the potential for a wave of growth towards 87.77, while breaking it downwards might indicate a wave of decline towards 63.33.

XAU/USD (Gold vs US Dollar)

Gold has reached the target of a downward wave at 1895.00. A consolidation range may form around this level. If the range is broken to the upside, a correction towards 1941.50 is possible. Conversely, if the range is broken to the downside, a decline towards 1846.00 may follow. This represents a local target.

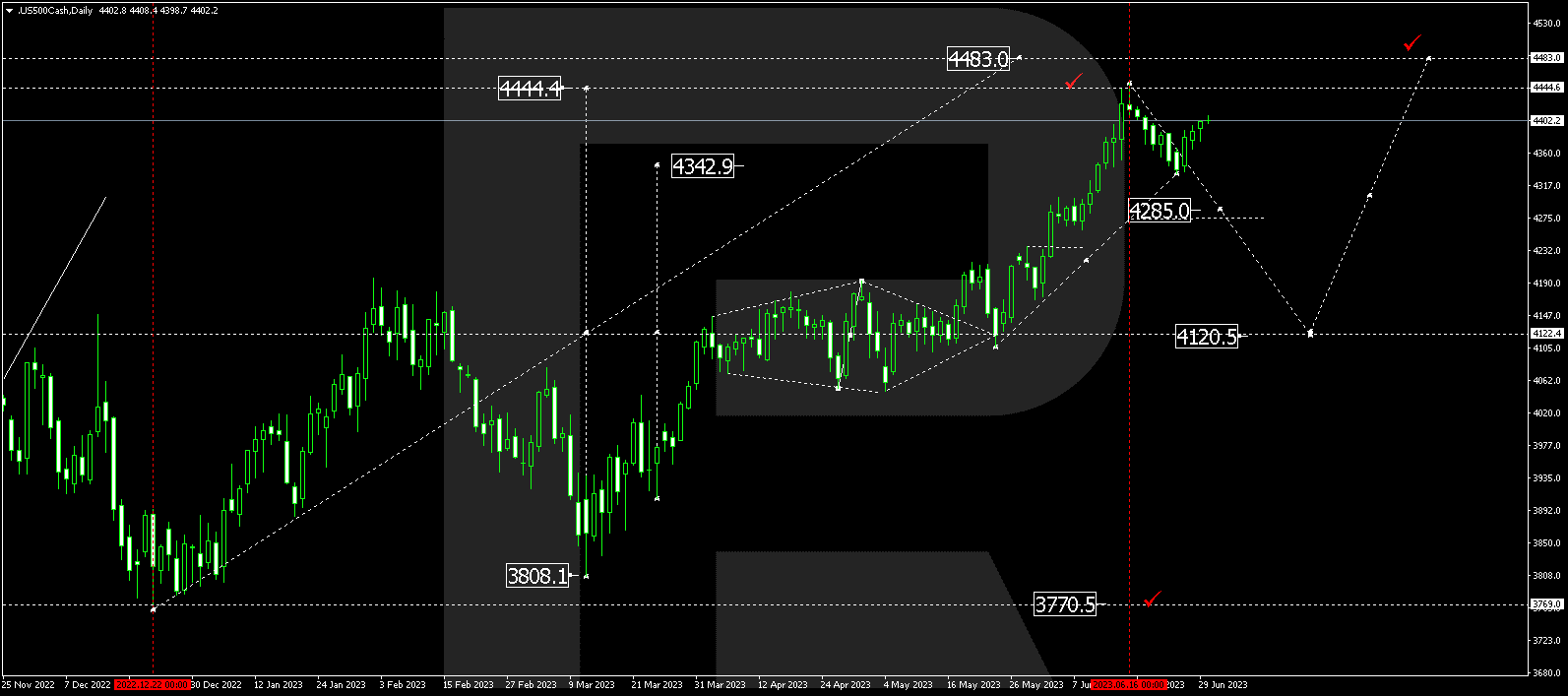

S&P 500

The S&P 500 index has achieved the local target of an upward wave at 4444.4. However, there was a subsequent downward impulse towards 4333.3. The market is currently in a correction phase towards 4423.0, forming a consolidation range. Breaking the range to the downside could lead to a continuation of the wave towards 4120.5 (a test from above). Conversely, a rise towards 4484.0 may follow if the range is broken to the upside. Breaking above the range could extend the wave to 4484.0 before a potential drop towards 4120.0.

The post Technical Analysis & Forecast for July 2023 appeared first at R Blog – RoboForex.