Gold Poised for New High. Overview includes EUR, GBP, JPY, CHF, AUD, Brent, and S&P 500 index.

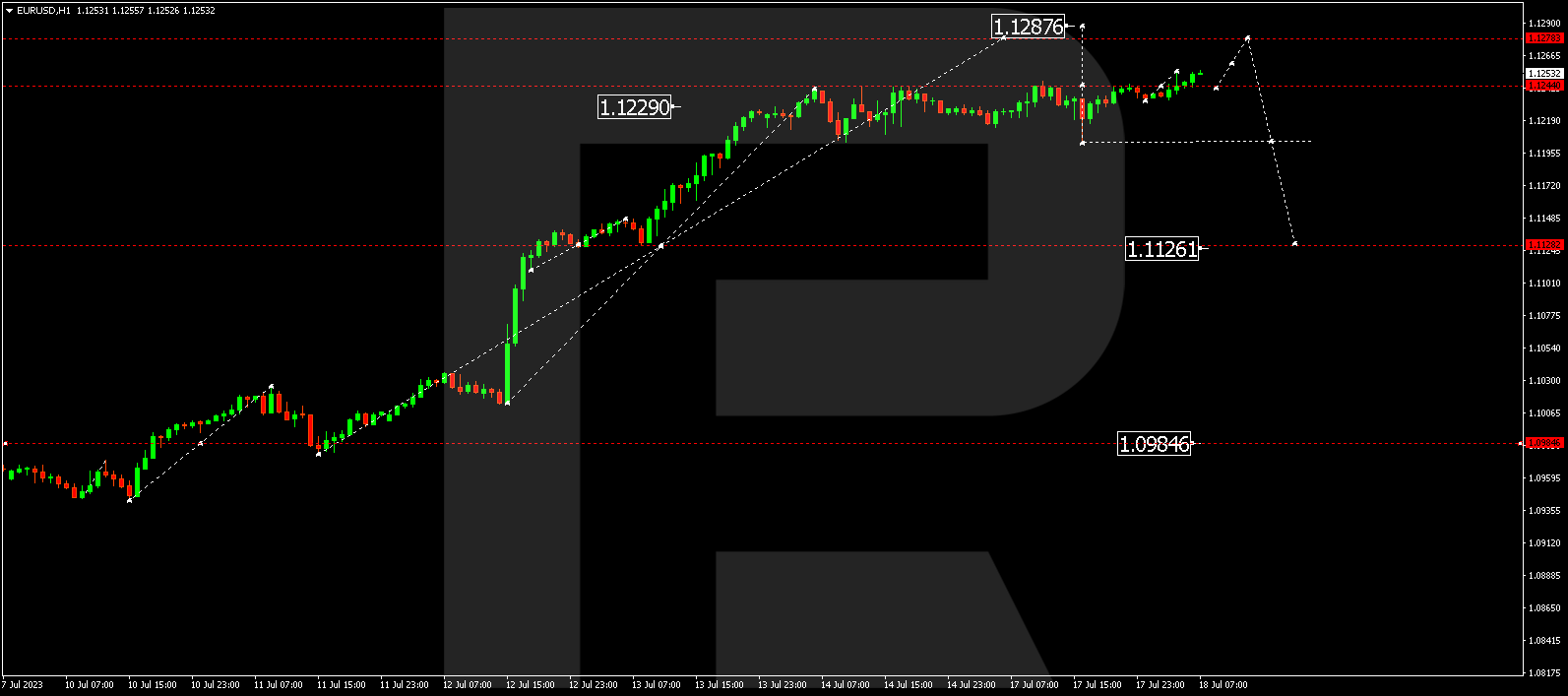

EUR/USD (Euro vs US Dollar)

The currency pair has broken above the consolidation range high, suggesting potential extension to 1.1288. After reaching this level, quotes could drop to 1.1200. A further downward break might open the potential for a decline wave towards 1.1000.

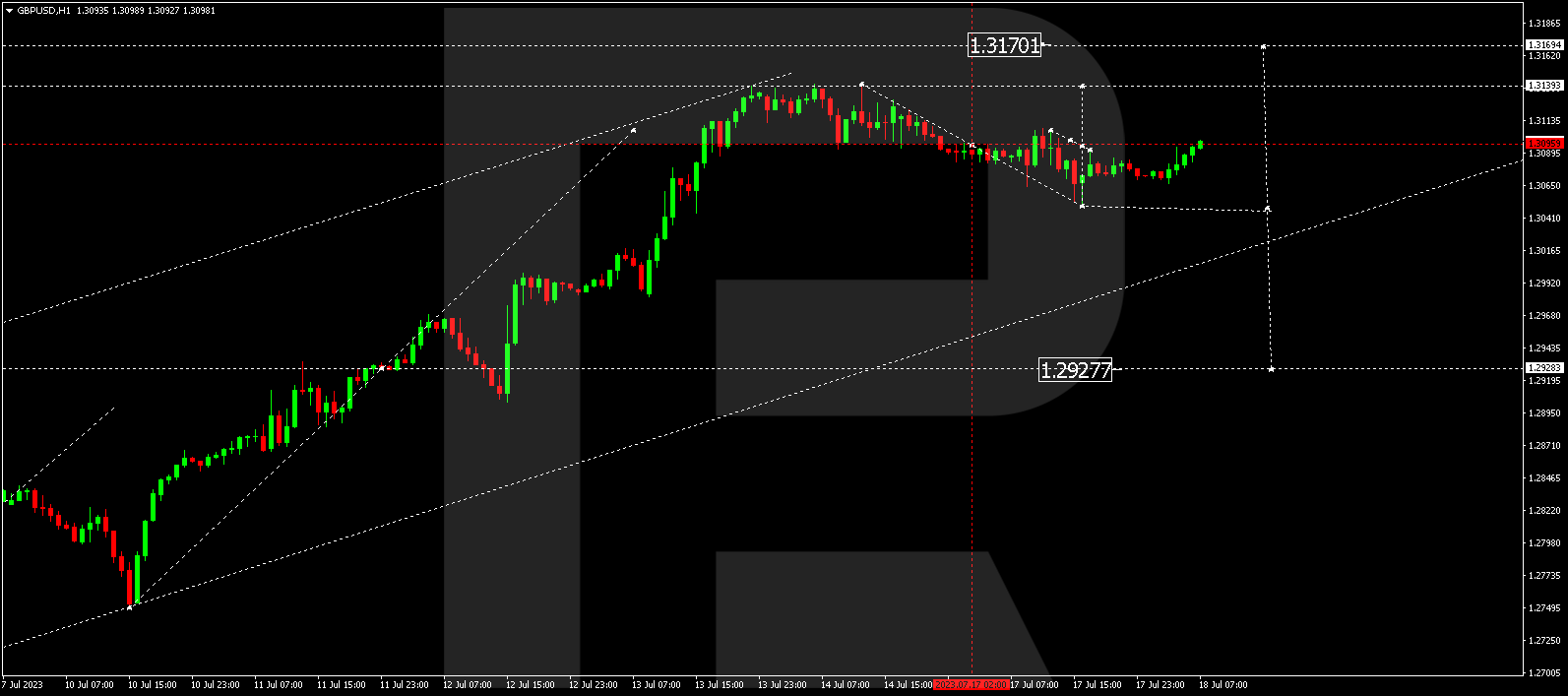

GBP/USD (Great Britain Pound vs US Dollar)

The currency pair has completed a corrective structure to 1.3050. Currently, the market is forming an upward structure towards 1.3133, with a possibility of extension to 1.3170. Once this level is reached, a new wave of decline to 1.2929 might begin, representing the first target.

Want to trade with the best conditions? Open a Prime account and enjoy fast trade execution, low commissions, and spreads from 0 pips. Click on the banner to open an account!

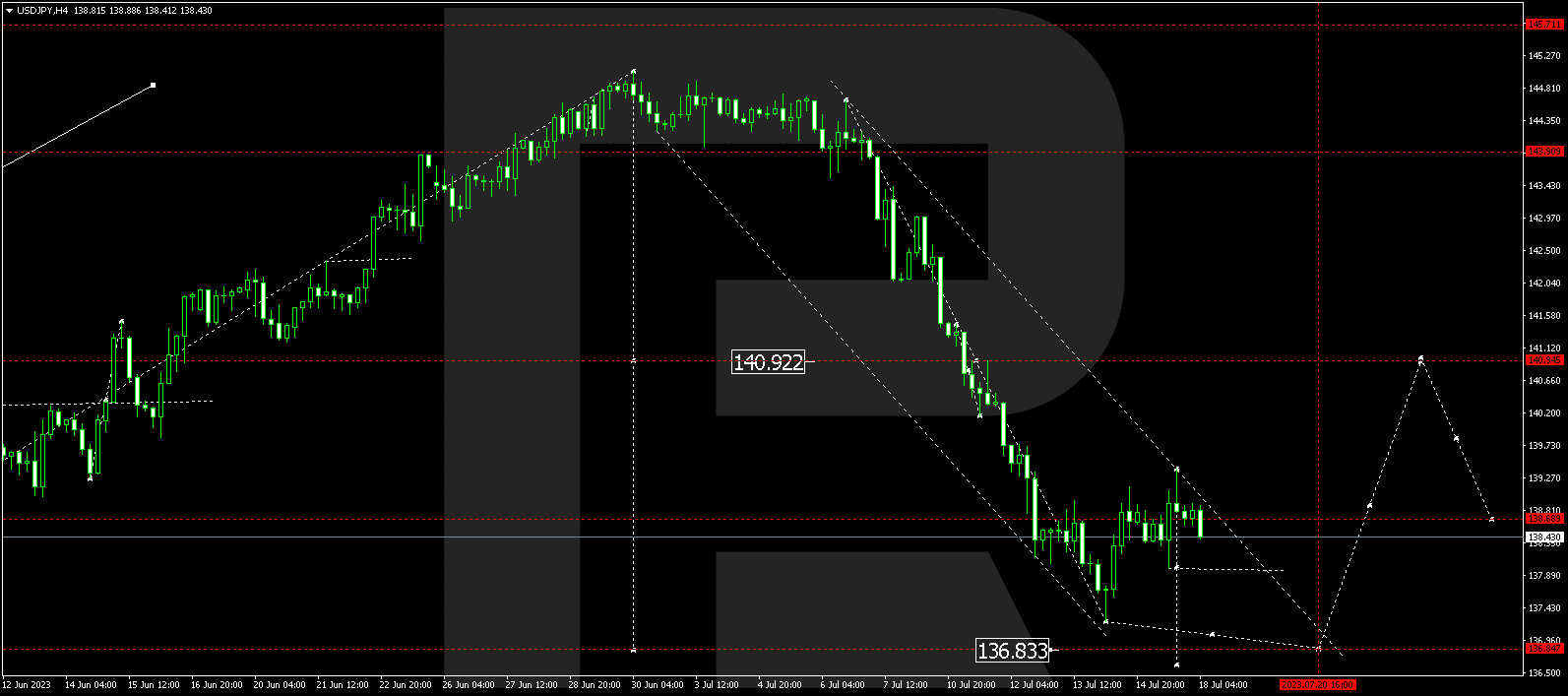

USD/JPY (US Dollar vs Japanese Yen)

The currency pair has completed a correction wave to 139.39. Today it might drop to 137.95. An upward breakout from this range could open the potential for further correction to 140.94. On the other hand, a downward breakout might form a new decline wave towards 136.83, followed by a rise to 140.94.

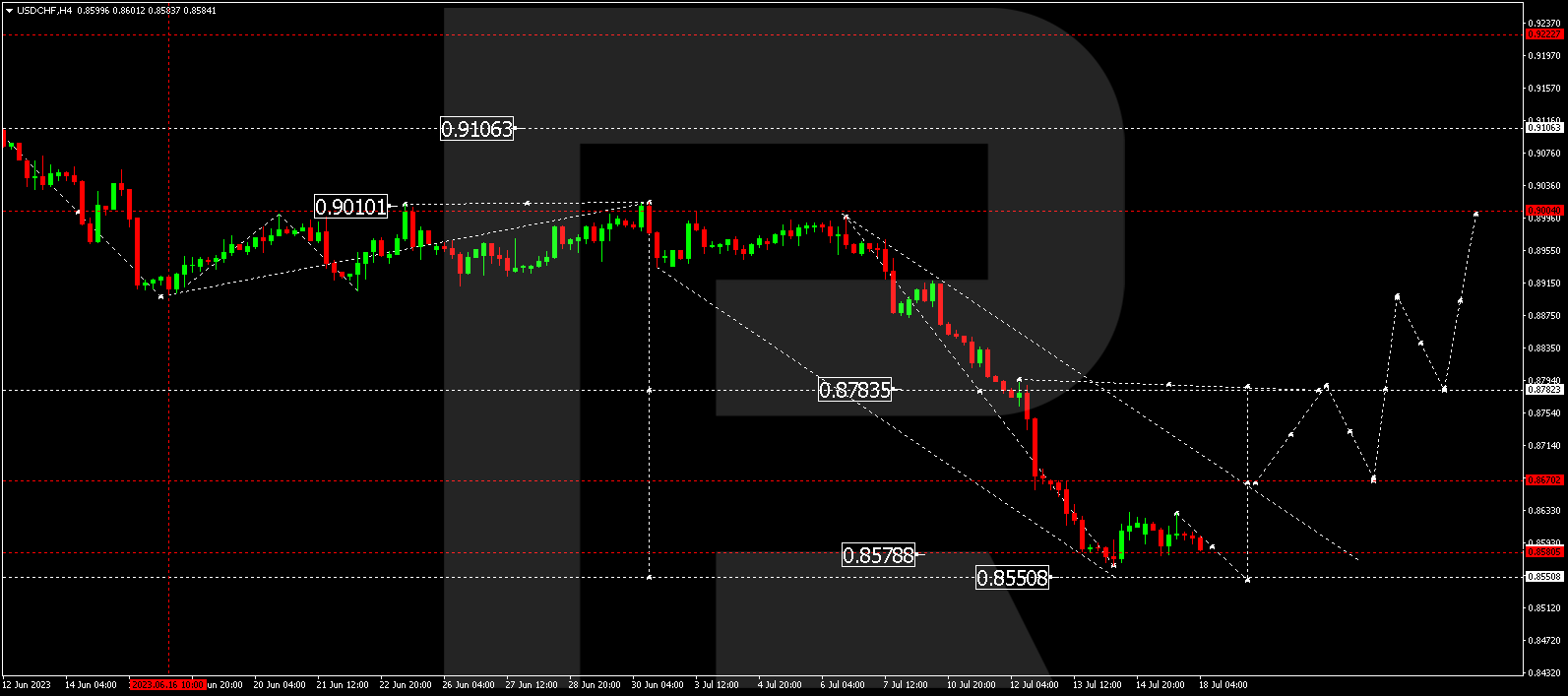

USD/CHF (US Dollar vs Swiss Franc)

The currency pair continues forming a consolidation range around 0.8580, possibly expanding to 0.8550. After reaching this level, a growth wave to 0.8782 could begin, representing the first target.

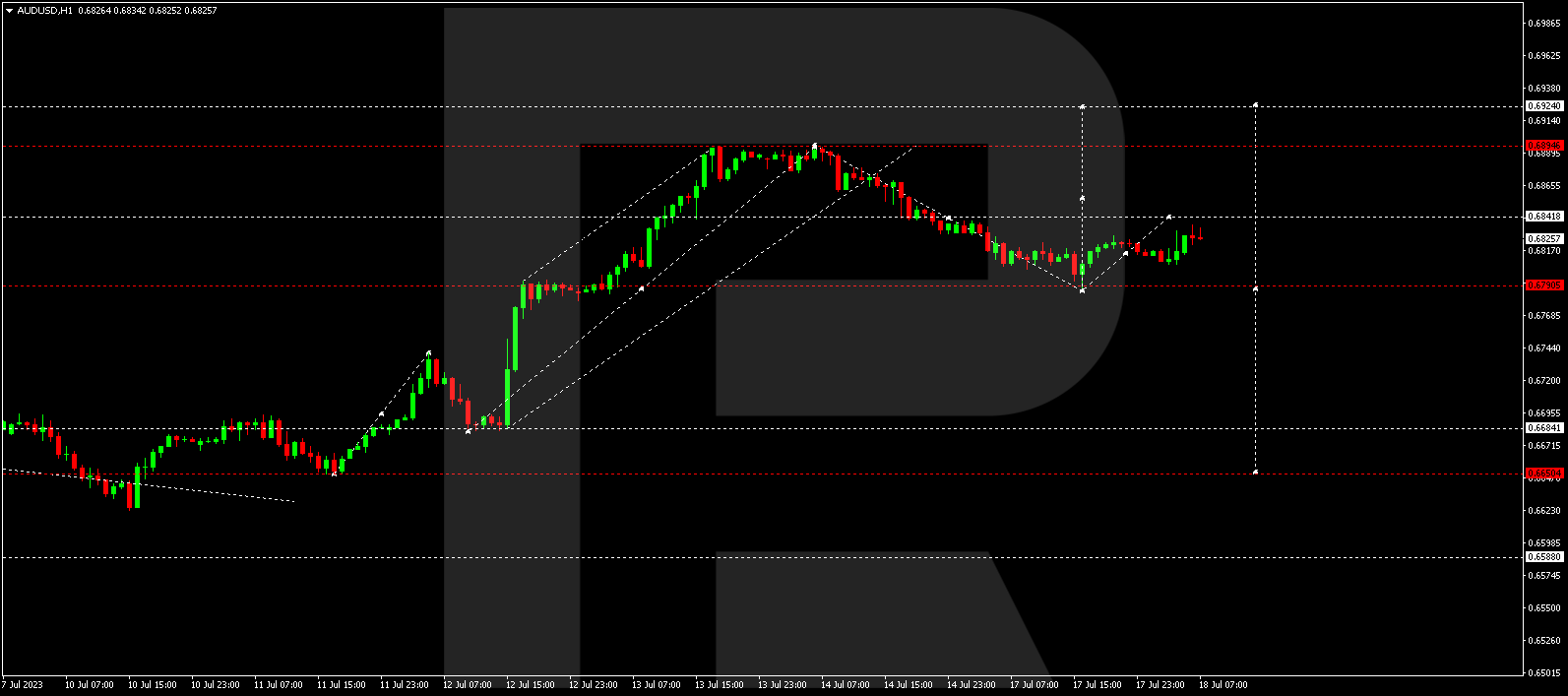

AUD/USD (Australian Dollar vs US Dollar)

The currency pair has reached the correction target at 0.6790. Today, the market is forming an upward structure towards 0.6841. An upward breakout from this range might form a new growth wave towards 0.6924. Conversely, a downward breakout might open the potential for a decline wave towards 0.6650.

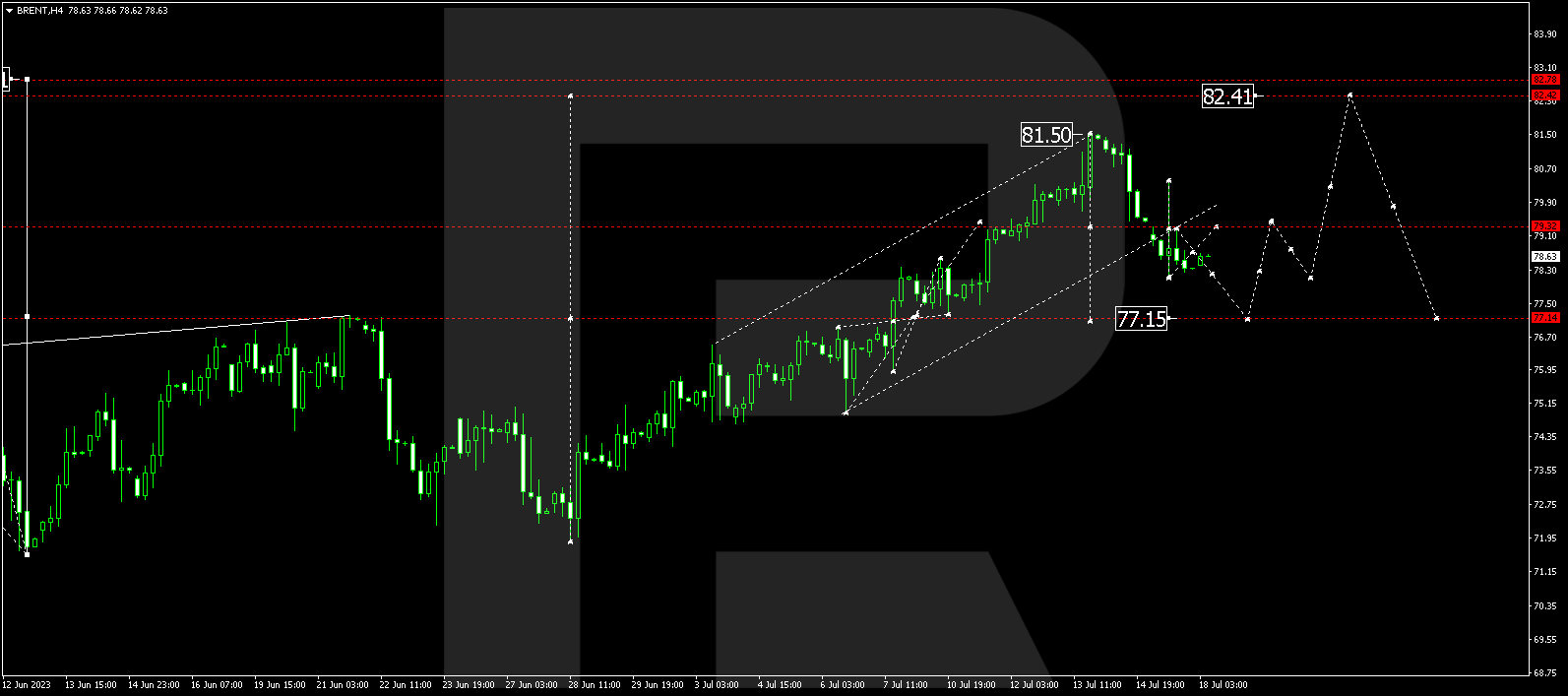

BRENT

Brent is forming a consolidation range around 79.33. A corrective decline to 77.15, with a test of the level from above, is possible. After the correction concludes, a new growth wave to 82.42 could begin, representing a local target.

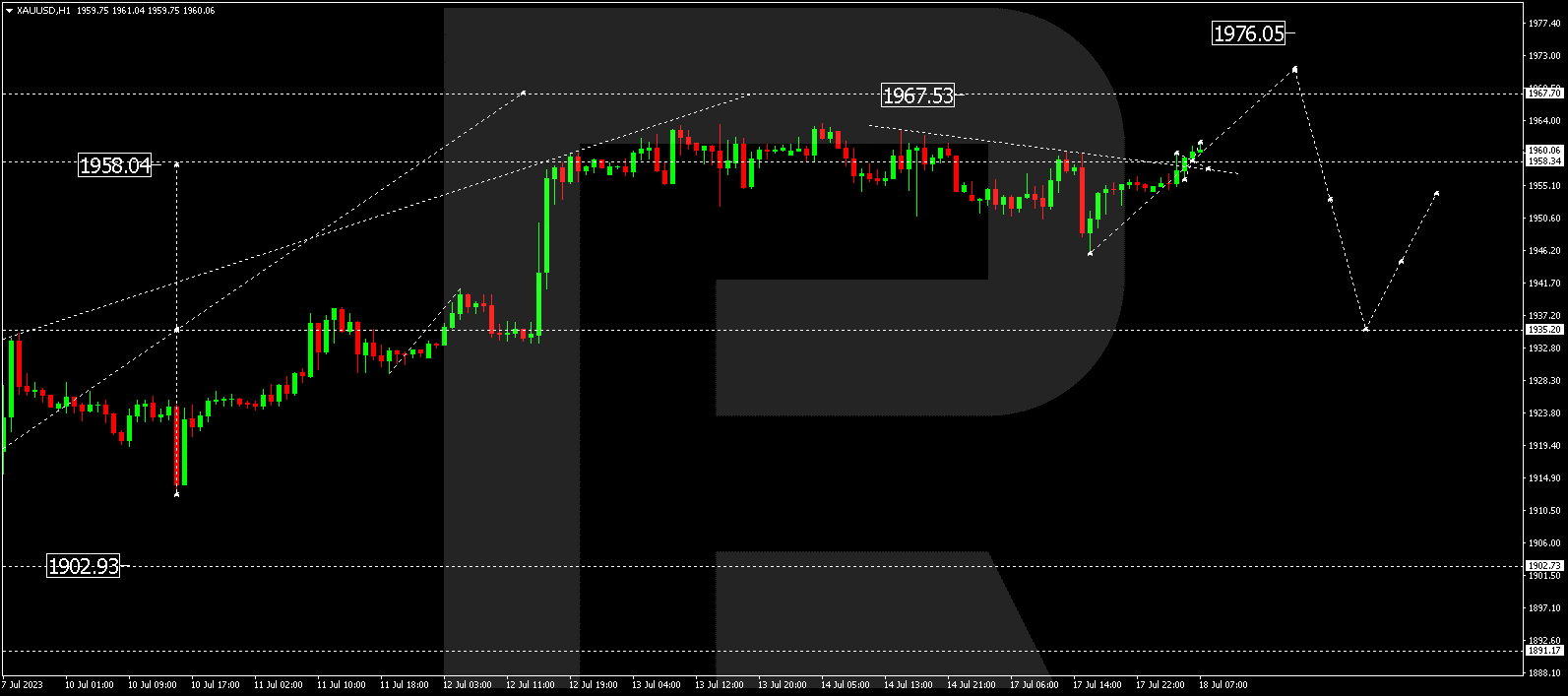

XAU/USD (Gold vs US Dollar)

Gold has completed a correction to 1945.75. Today, the market is forming an upward structure towards 1970.70, with a possibility of extension to 1976.00. After reaching this level, a new decline wave to 1935.25 might start, representing the first target.

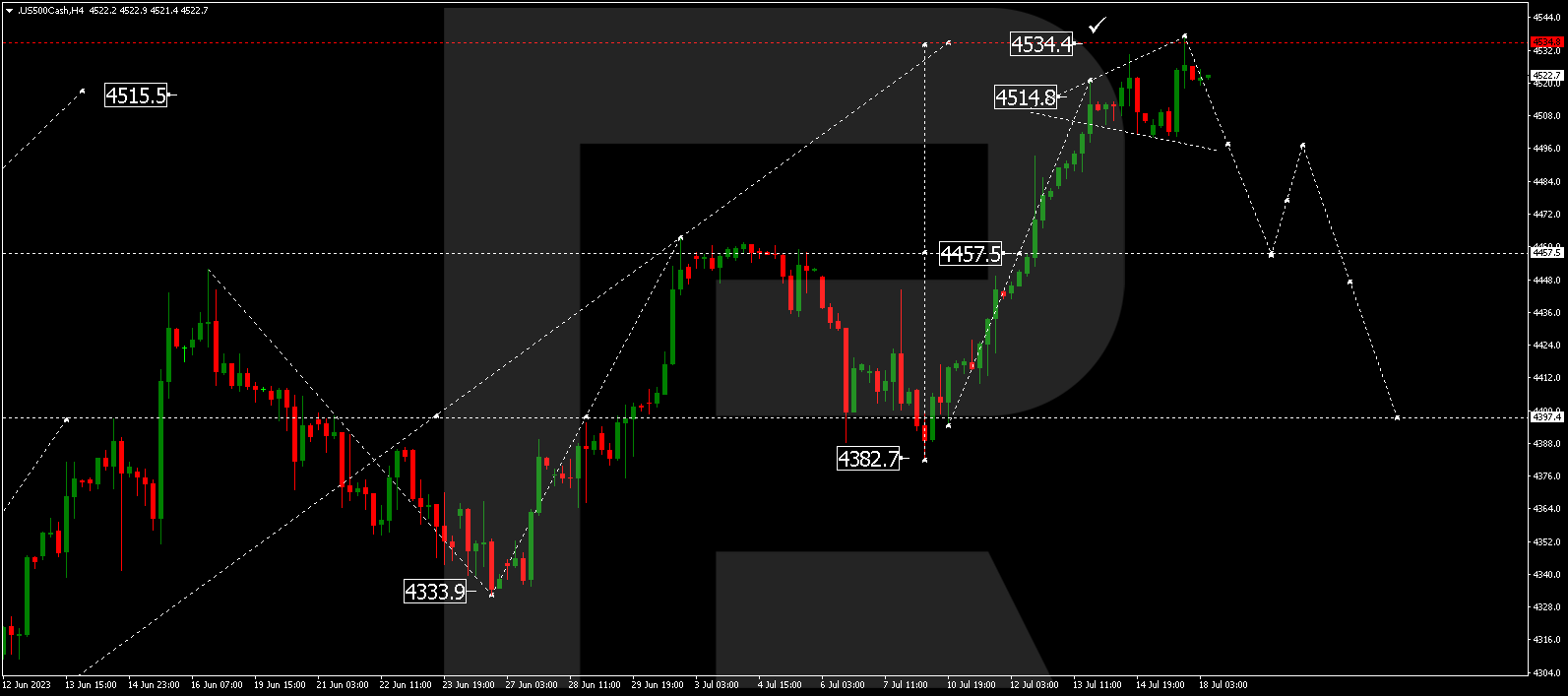

S&P 500

The stock index continues forming a consolidation range around 4515.0, and it has expanded to 4534.4 today. Next, a decline structure might develop towards 4494.0. A downward breakout from this range could open the potential for a decline wave towards 4457.5, representing the first target.

The post Technical Analysis & Forecast for July 18, 2023 appeared first at R Blog – RoboForex.