Brent Crude Oil (BRENT) is undergoing a corrective wave. This report also covers the trends in EUR, GBP, JPY, CHF, AUD, Gold, and the S&P 500 index.

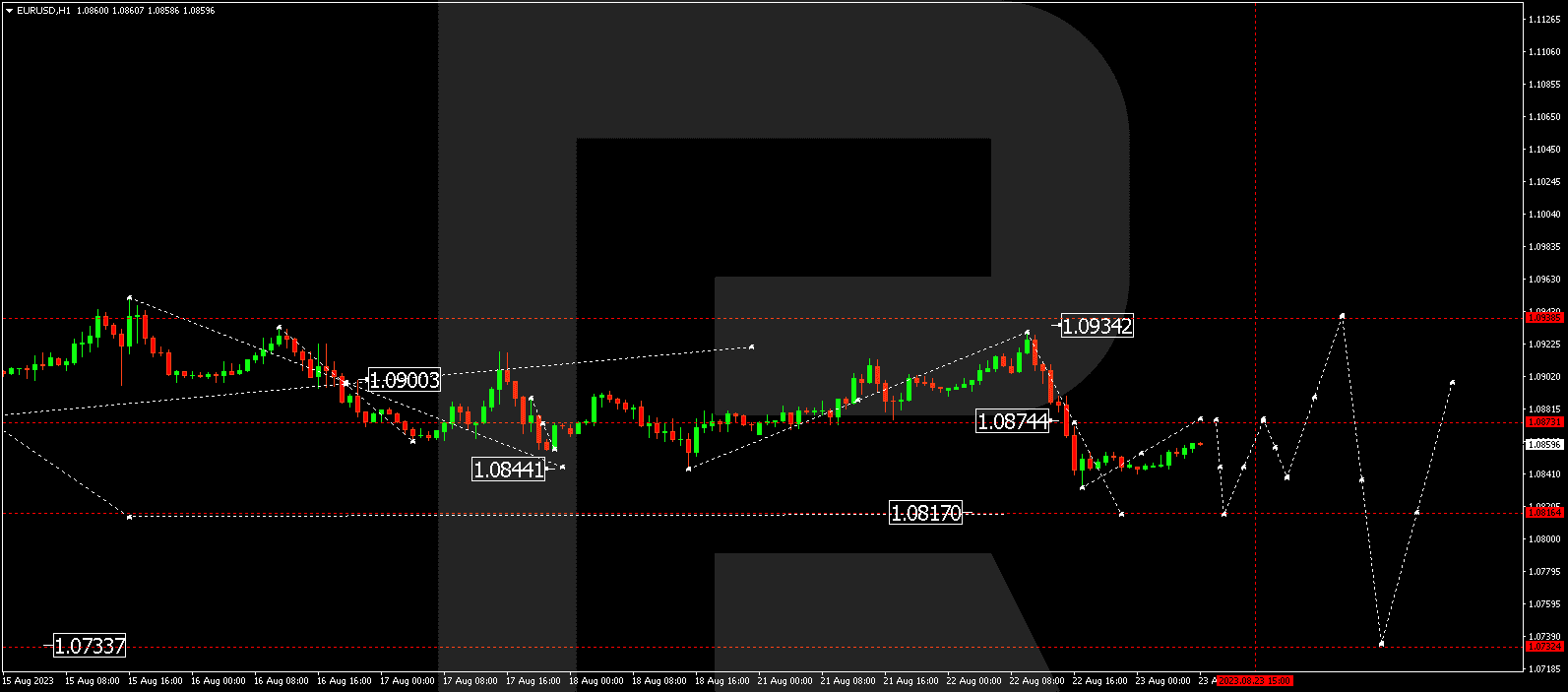

EUR/USD (Euro vs US Dollar)

EUR/USD completed a downward wave reaching 1.0833. Today, the market is in correction mode with a target around 1.0874 (with a test from below). Once the correction concludes, a new downward wave to 1.0816 could begin, followed by a potential upward move to 1.0950.

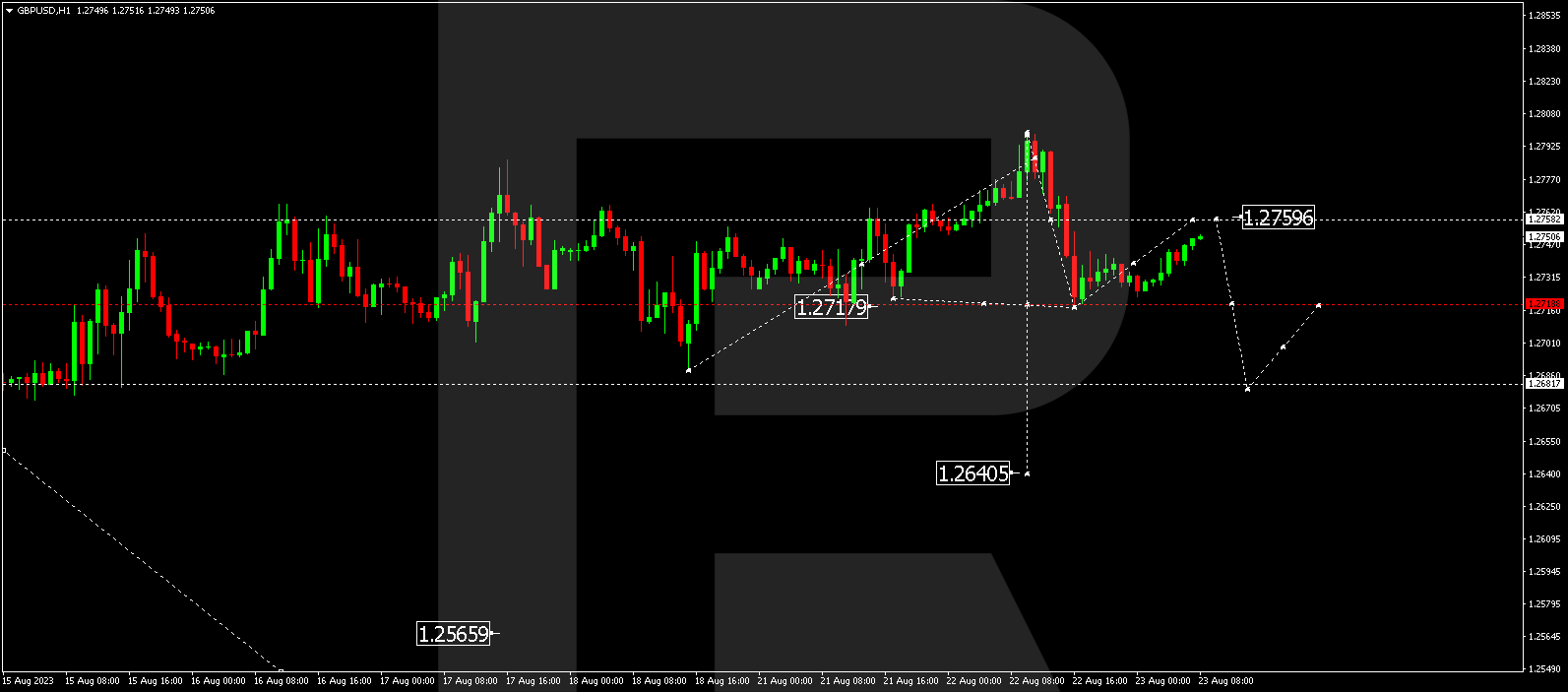

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD experienced a downward impulse to 1.2717. Today, a correction to 1.2759 is expected. After the correction, a new downward wave to 1.2680 might follow, with the potential for a further drop to 1.2640.

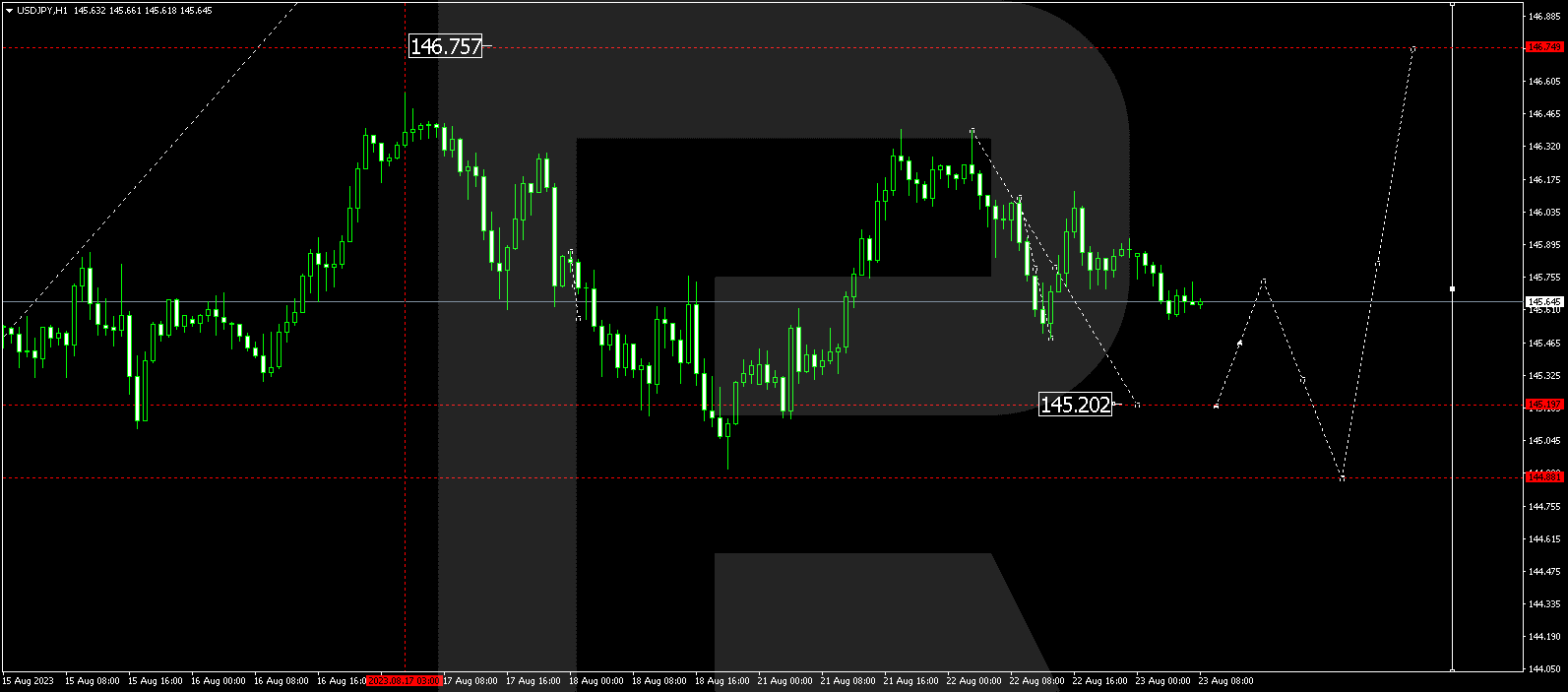

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY is currently in a downward wave targeting 145.30. After reaching this level, a new upward trend to 145.75 might emerge. Following that, another downward wave to 144.88 is possible, followed by a rise to 146.77. This is the local target.

Experience unique trading with R MobileTrader. A comprehensive “workstation” for trading on your phone. Click on the banner and install the application!

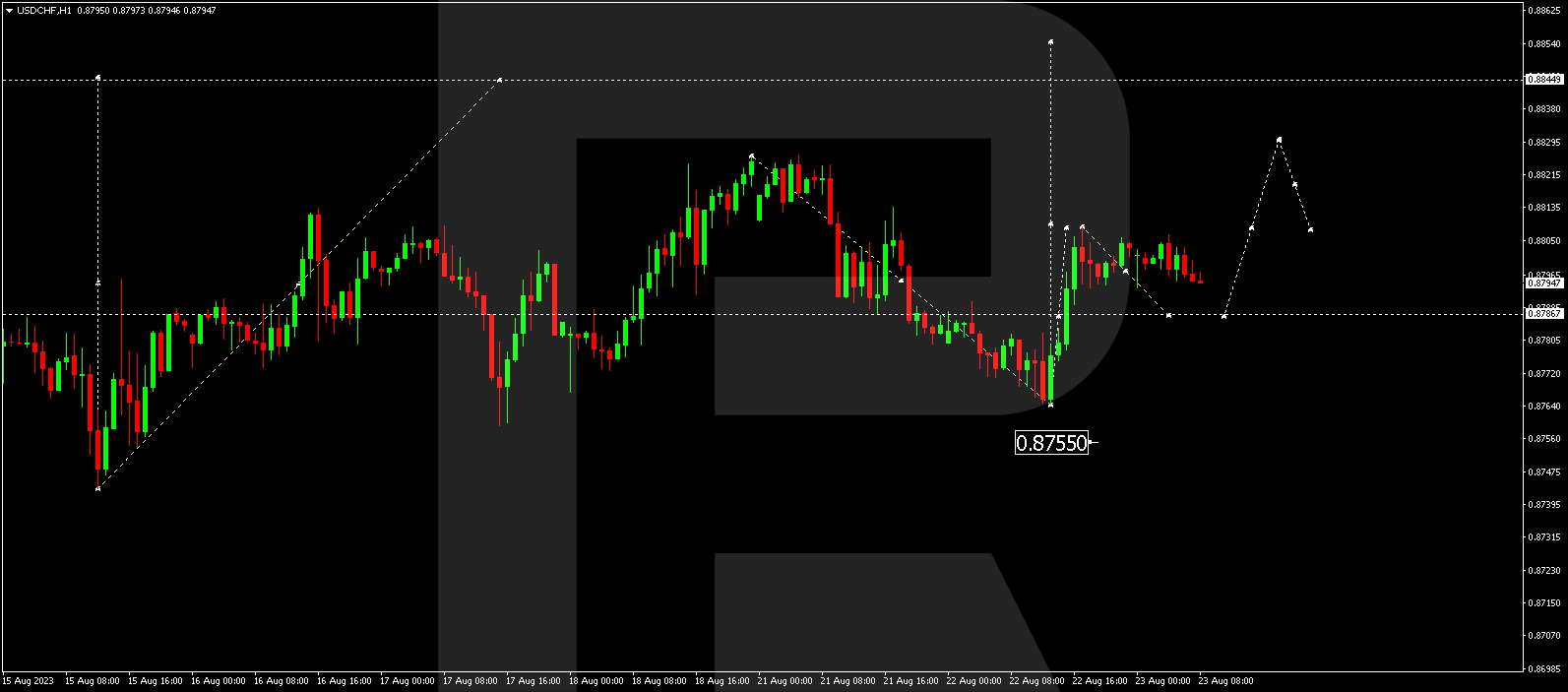

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF completed an upward impulse to 0.8808. Today, the market is forming a narrow consolidation range below this level. An exit from this range downward might lead to a correction to 0.8788, followed by an increase to 0.8825, potentially extending to 0.8888.

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD is currently in a consolidation range around 0.6404. A drop to 0.6340 is expected. With a breakout below this range, the potential for a decline to 0.6277 might open. This is the local target.

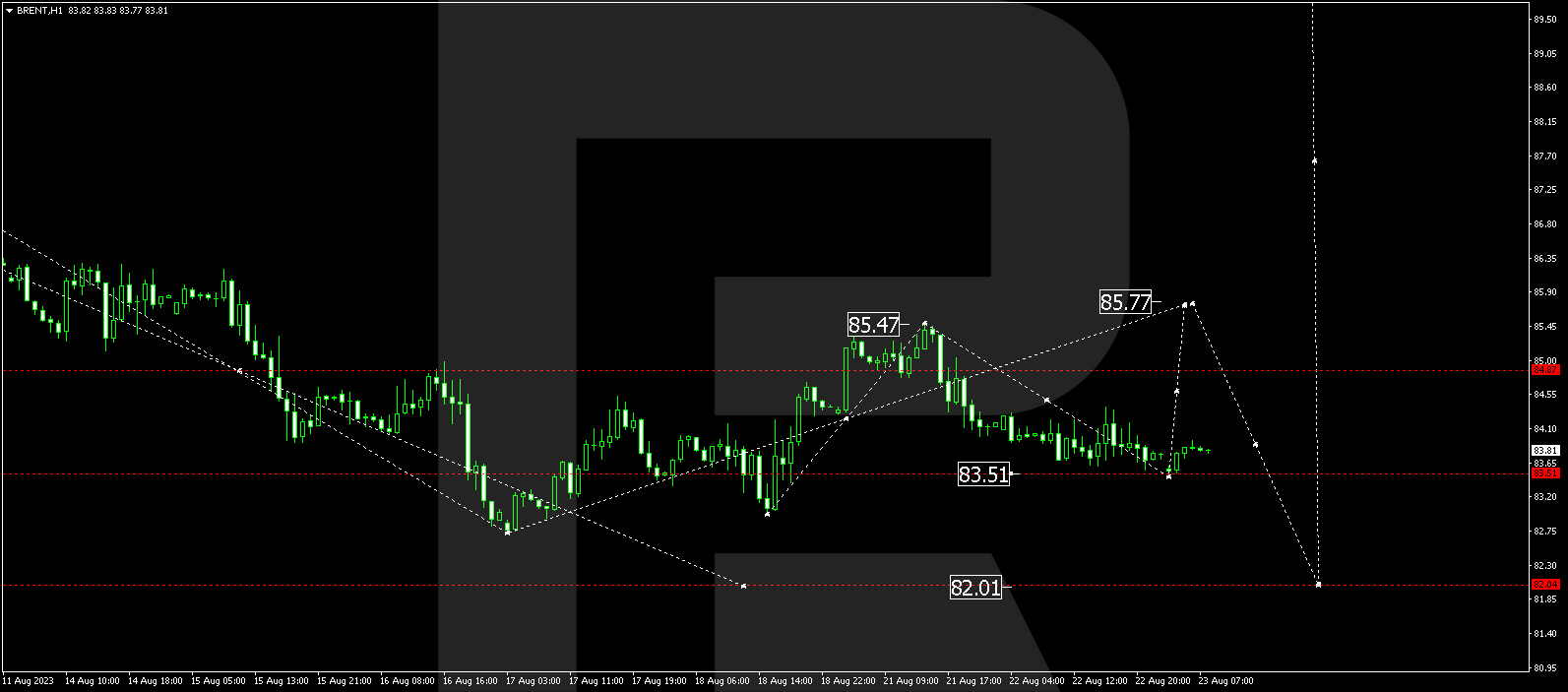

BRENT

Brent is in the midst of forming a consolidation range around 84.20. A new upward move to 85.77 is possible today, followed by a decline to 82.00. This level is where the correction range is likely to conclude. After the correction, a new upward wave to 87.77 might begin. This is the local target.

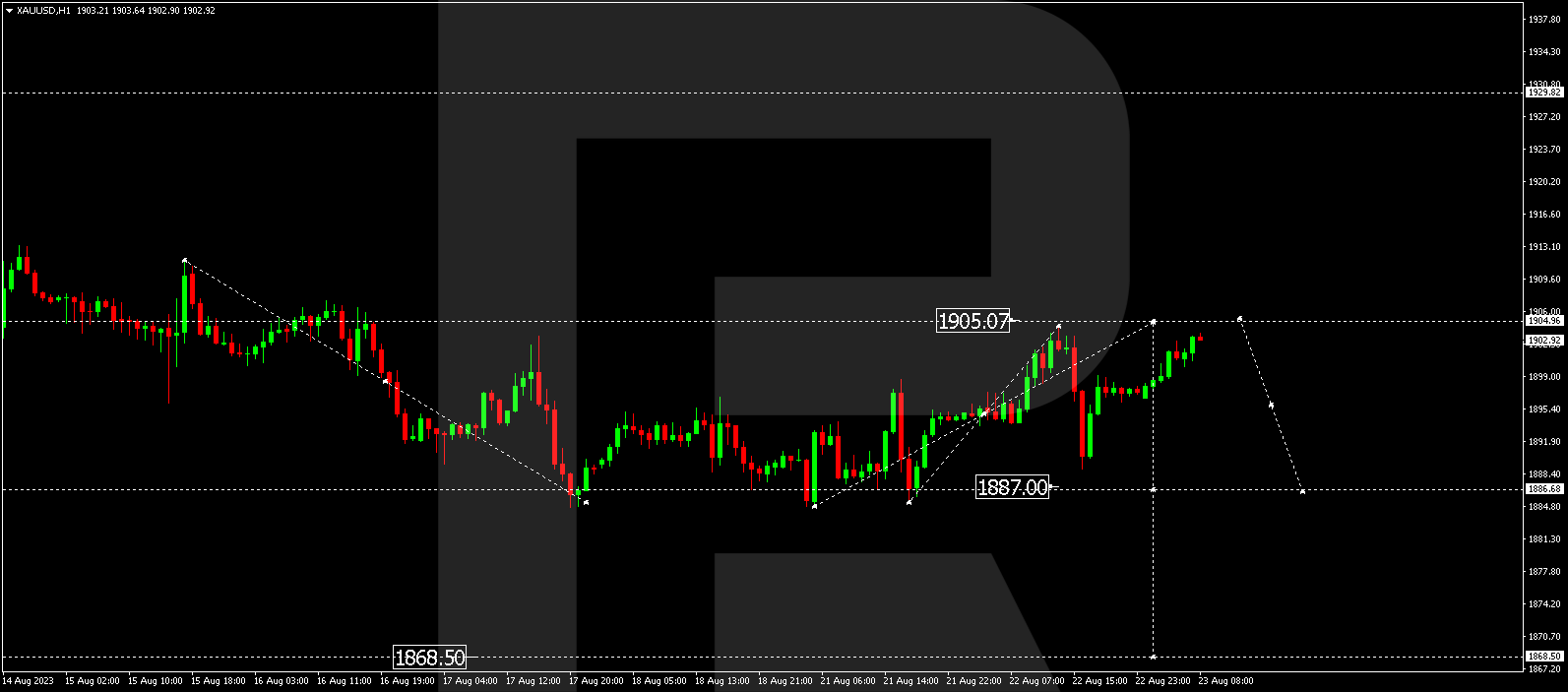

XAU/USD (Gold vs US Dollar)

Gold is developing a consolidation range around 1894.63. A move up to 1904.94 is expected today. Breaking out of this range upwards could lead to further correction towards 1929.00. Conversely, an escape from the range downwards might continue the trend towards 1868.50.

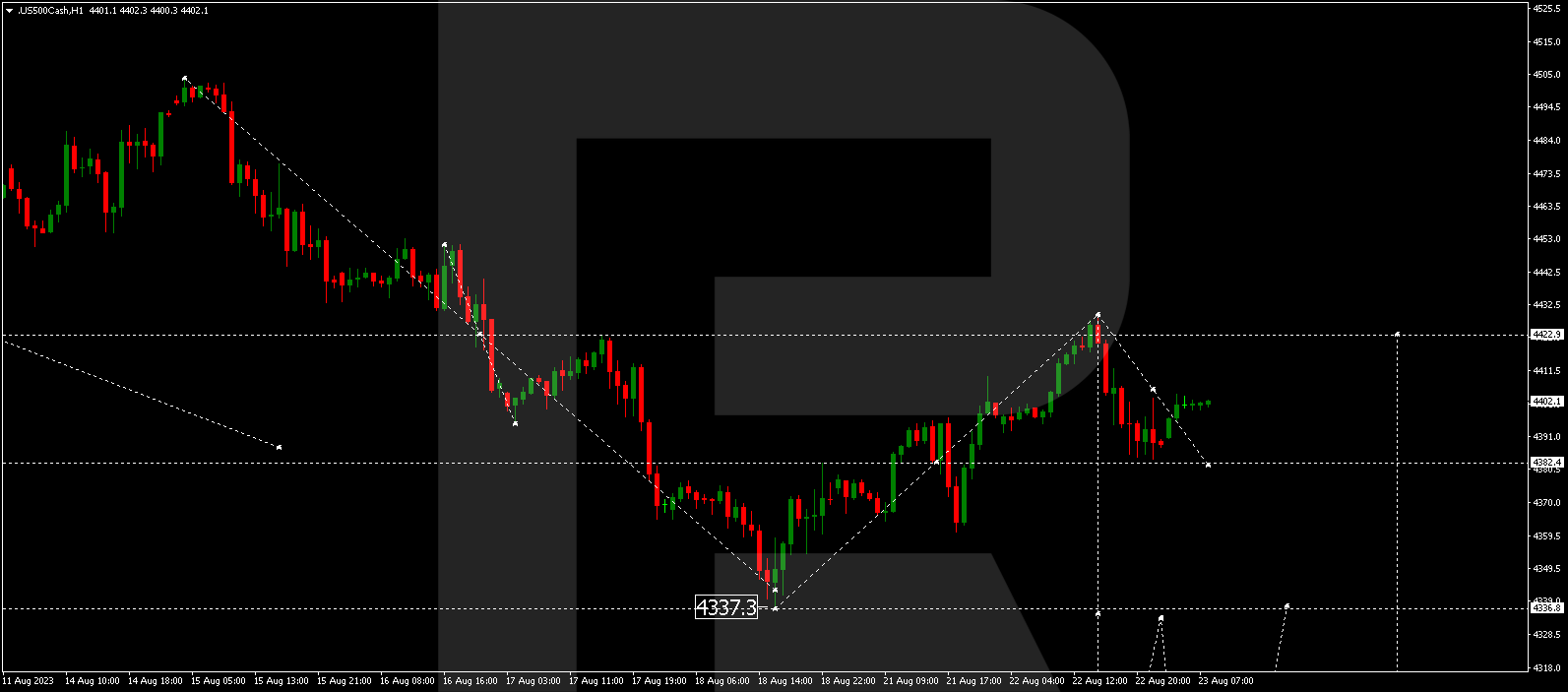

S&P 500

The stock index completed a correction wave reaching 4428.0. Today, a downward move to 4383.3 has occurred, and a consolidation range around this level has formed. An upward breakout from this range might lead to further correction towards 4490.0, while a downward breakout could open the potential for a further decline to 4300.0.

The post Technical Analysis & Forecast for August 23, 2023 appeared first at R Blog – RoboForex.