GBP/USD May Extend Corrective Decline. Analysis of EUR, JPY, CHF, AUD, Brent, Gold, and S&P 500 Index.

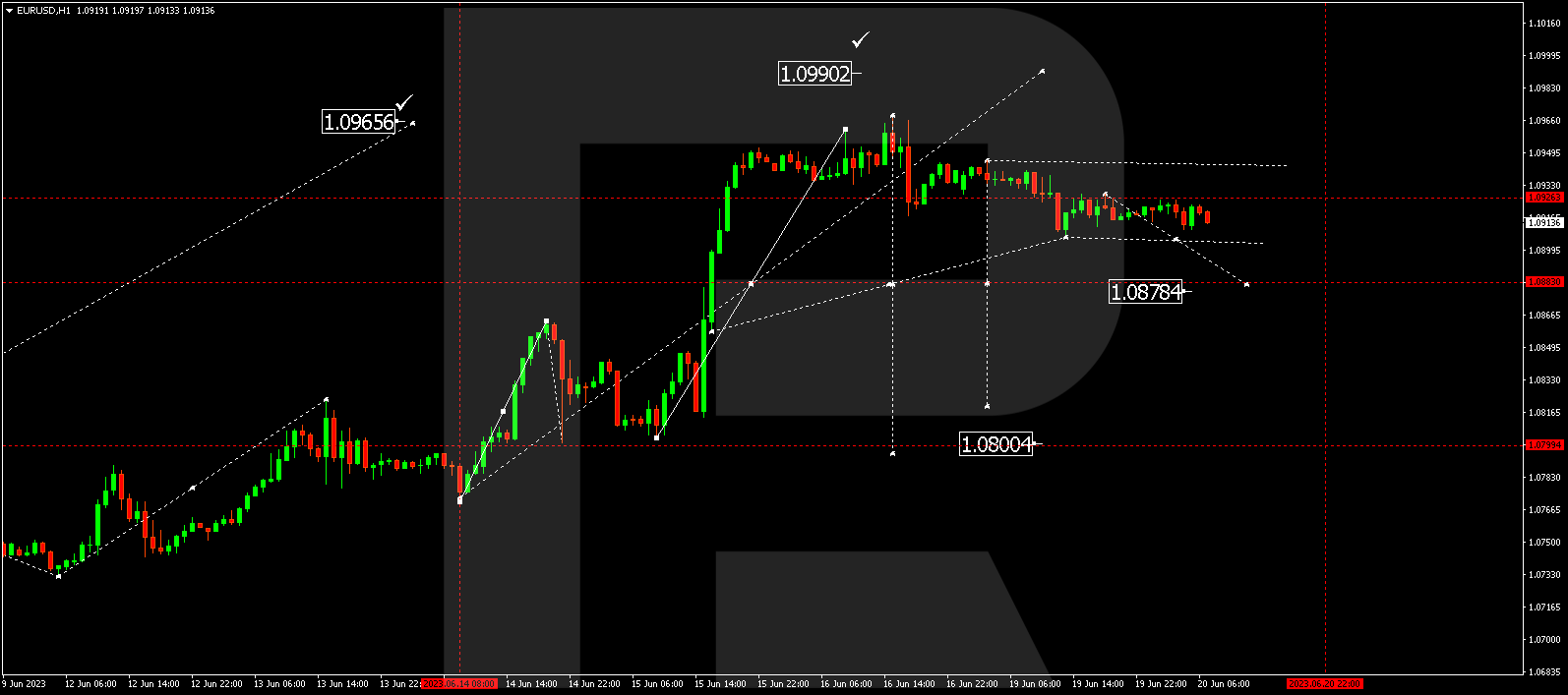

EUR/USD, Euro vs US Dollar

The currency pair has completed a downward wave, reaching 1.0907, followed by a correction to 1.0926. Today, a decline to 1.0878 is anticipated, with a subsequent consolidation range expected to form around this level. If there is a break below this range, it could potentially trigger a decline to 1.0820, which serves as a local target.

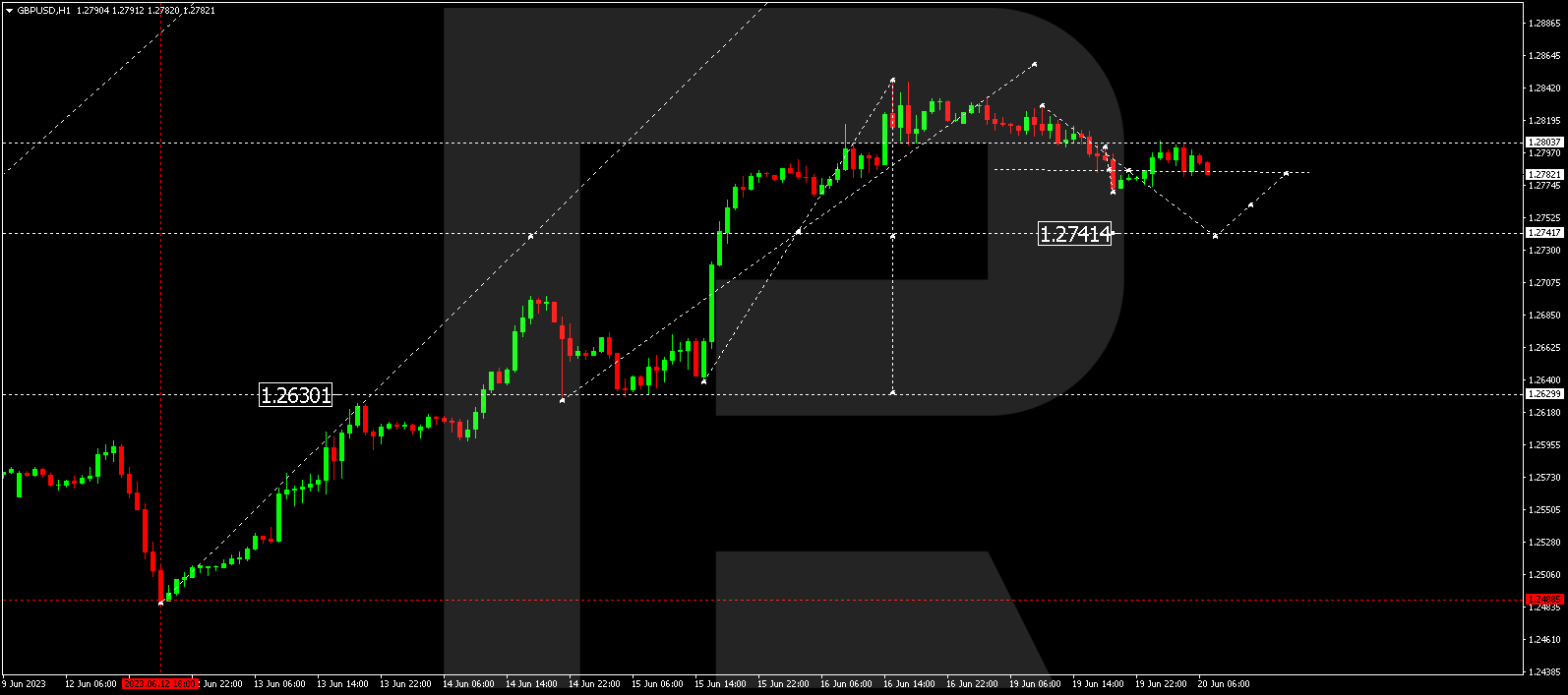

GBP/USD, Great Britain Pound vs US Dollar

The currency pair has finished a downward wave, reaching 1.2770, and then a correction to 1.2804. Today, a decline to 1.2741 is expected, followed by the formation of a consolidation range around this level. A breakout below this range may lead to a wave of decline towards 1.2680, which represents a local target.

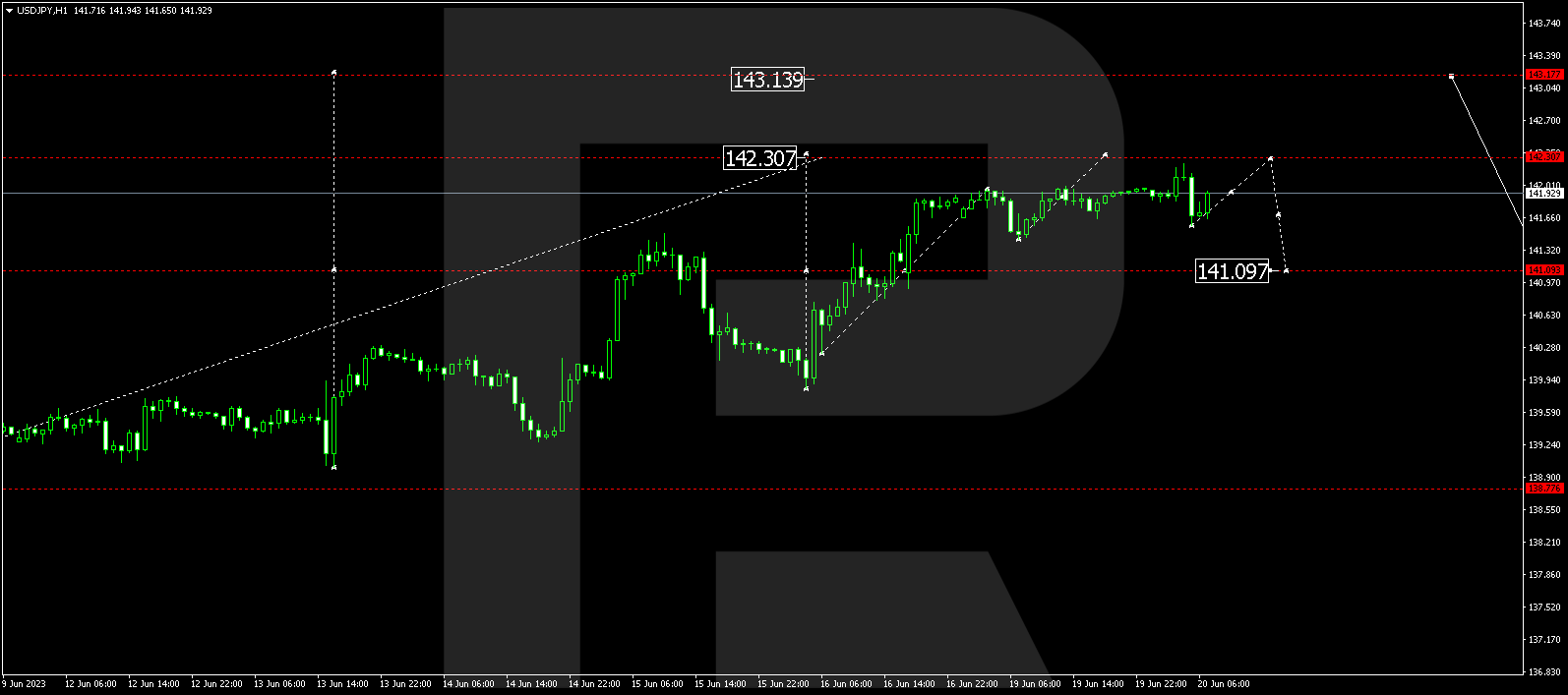

USD/JPY, US Dollar vs Japanese Yen

The currency pair is continuing its upward wave towards 142.30. Once the price reaches this level, a correction to 141.10 might follow. The subsequent movement is expected to be a rise towards 143.17, serving as the initial target.

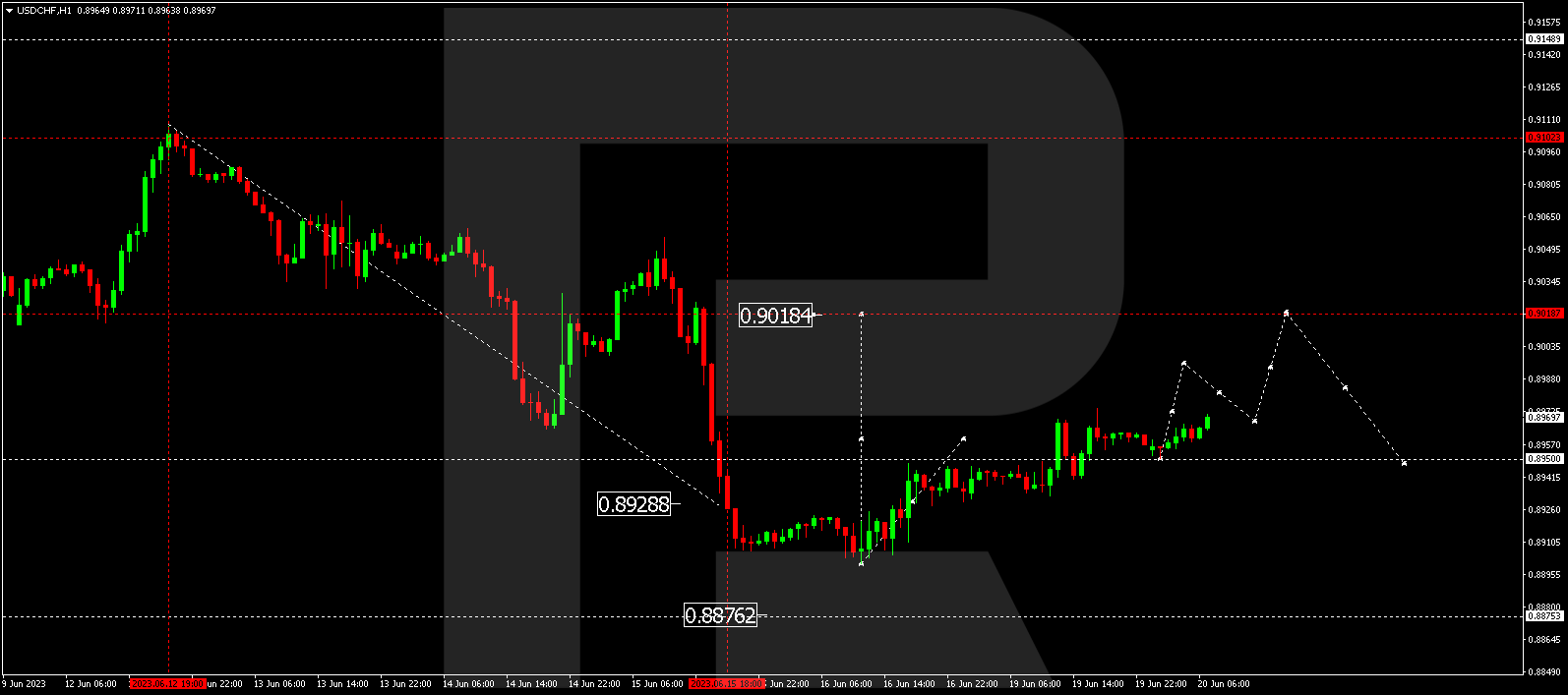

USD/CHF, US Dollar vs Swiss Franc

The currency pair has completed an upward wave, reaching 0.8973, followed by a correction to 0.8950. Today, the market is continuing its upward trend towards 0.9018. After reaching this level, a correction to 0.8950 might occur, followed by a rise towards the target of 0.9100.

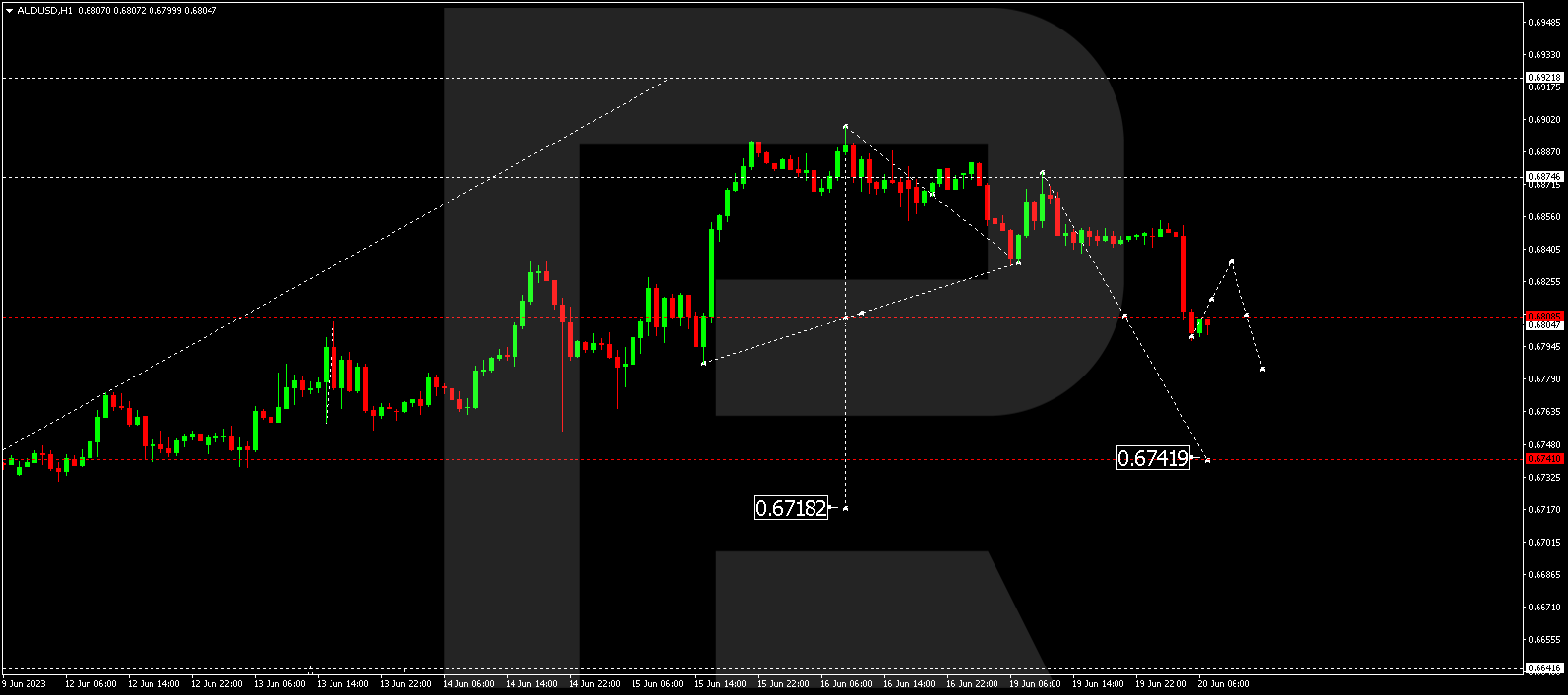

AUD/USD, Australian Dollar vs US Dollar

The currency pair has completed a correction to 0.6874. Today, it is expected to continue its downward wave towards 0.6742. Once this level is reached, a correction to 0.6800 (tested from below) is anticipated, followed by a decline towards the first target of 0.6717.

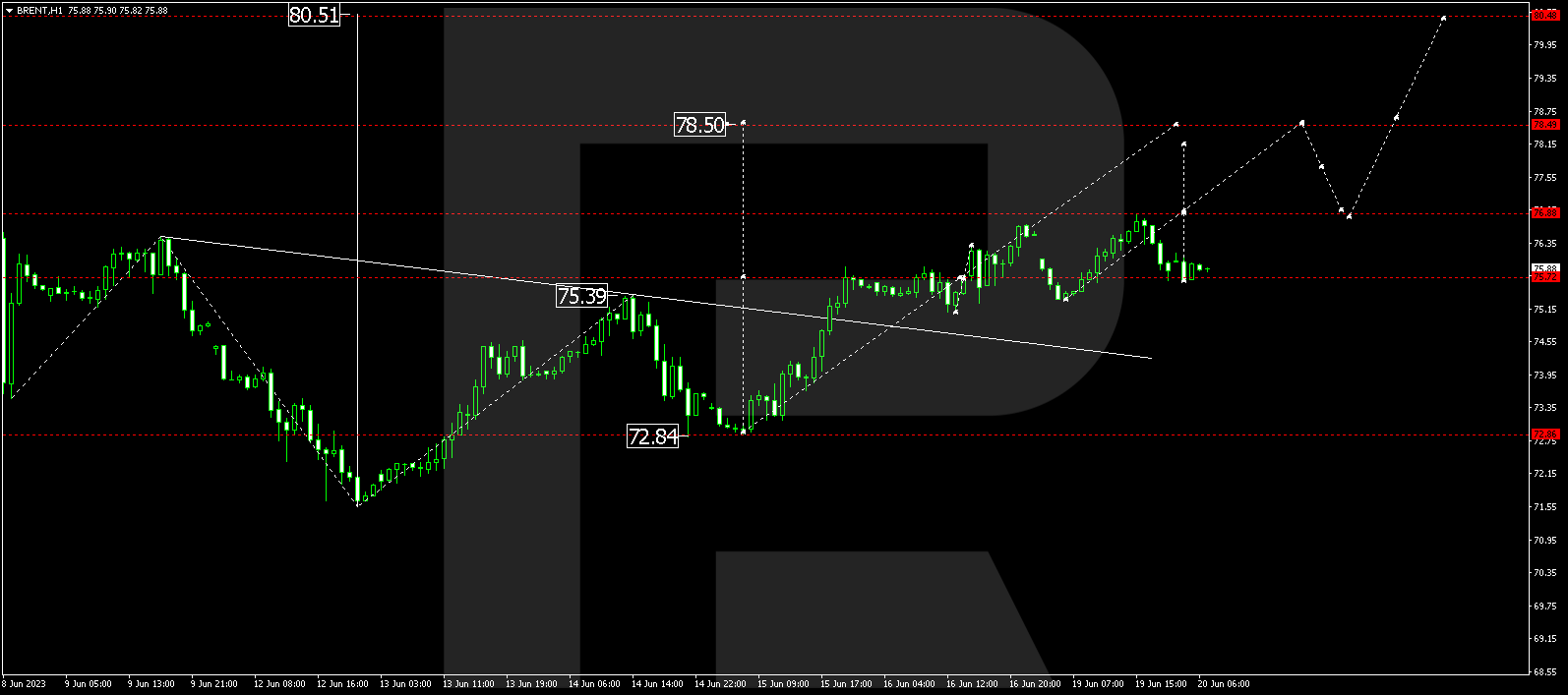

Brent

Brent has completed an upward wave, reaching 76.88. Today, a correction to 74.94 is possible. The subsequent movement could lead to further growth towards 78.50, and from there, the trend may continue towards the local target of 80.50.

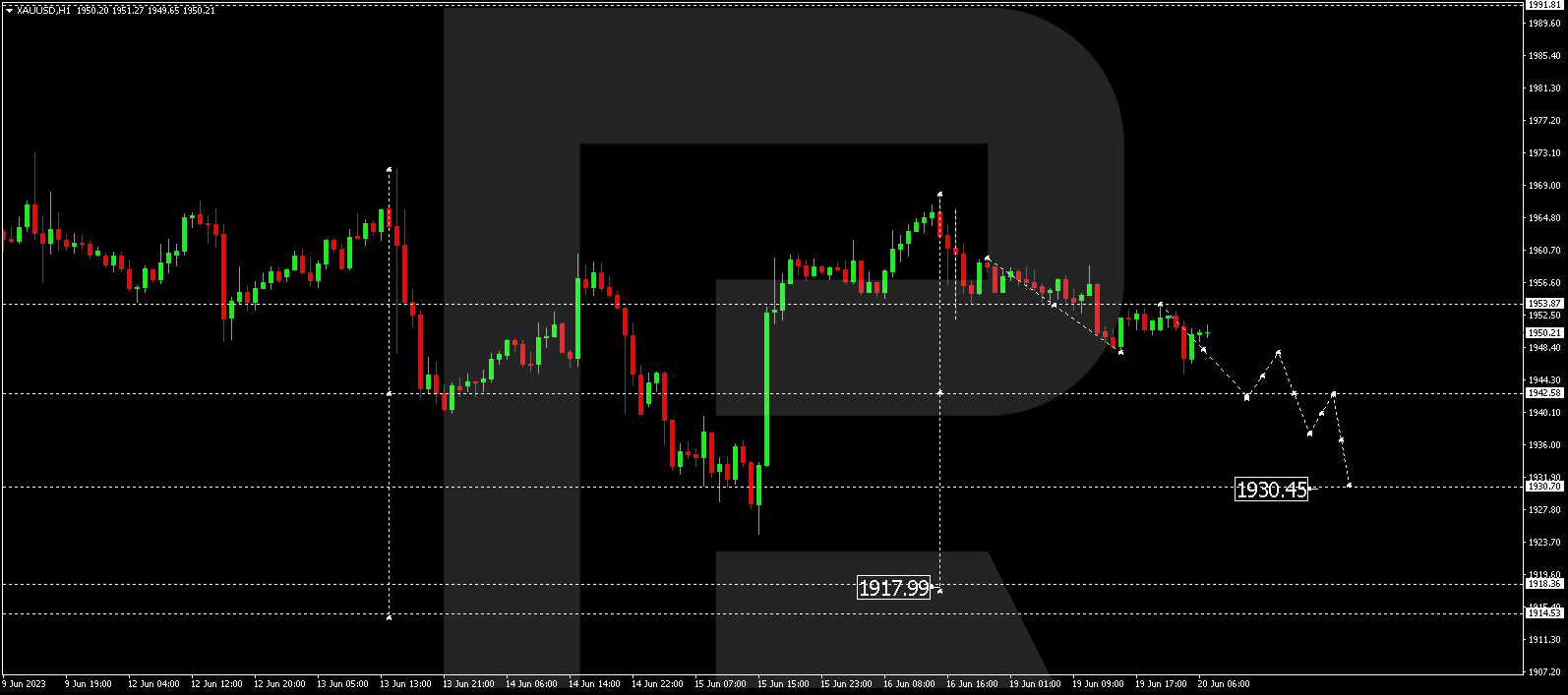

XAU/USD, Gold vs US Dollar

Gold has completed a downward wave, reaching 1947.85, followed by a correction to 1953.88. Today, the market is expected to continue its downward wave towards 1942.55. A consolidation range might develop around this level, and a breakout below this range could potentially trigger a decline to 1930.45. From there, a wave towards 1918.00 might form.

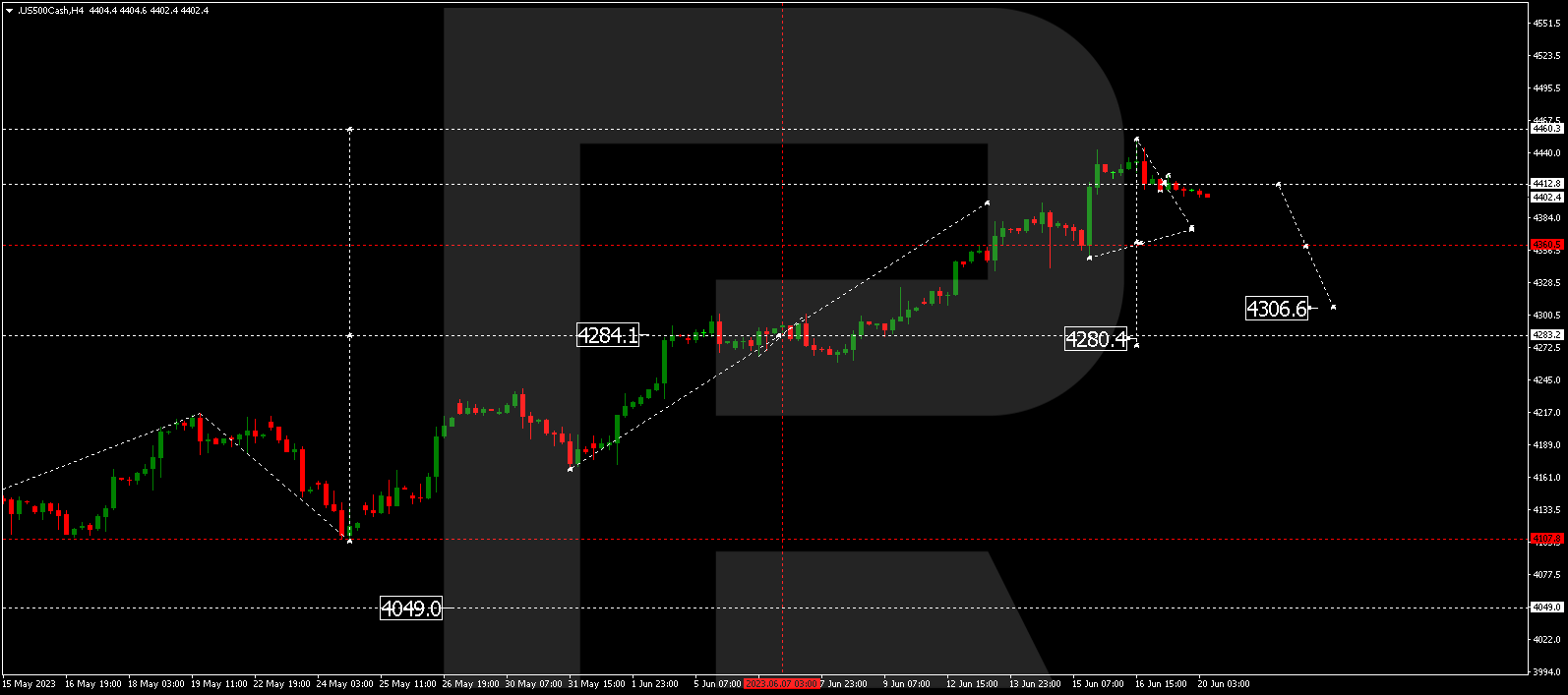

S&P 500

The stock index is continuing its downward wave towards 4374.0. Once this level is reached, a correction to 4410.0 might follow. The subsequent movement is expected to be a decline towards the local target of 4306.6.

The post Technical Analysis & Forecast for 20.06.2023 appeared first at R Blog – RoboForex.