Gold Poised for Continued Decline: Overview of EUR, GBP, JPY, CHF, AUD, Brent, and S&P 500 Index.

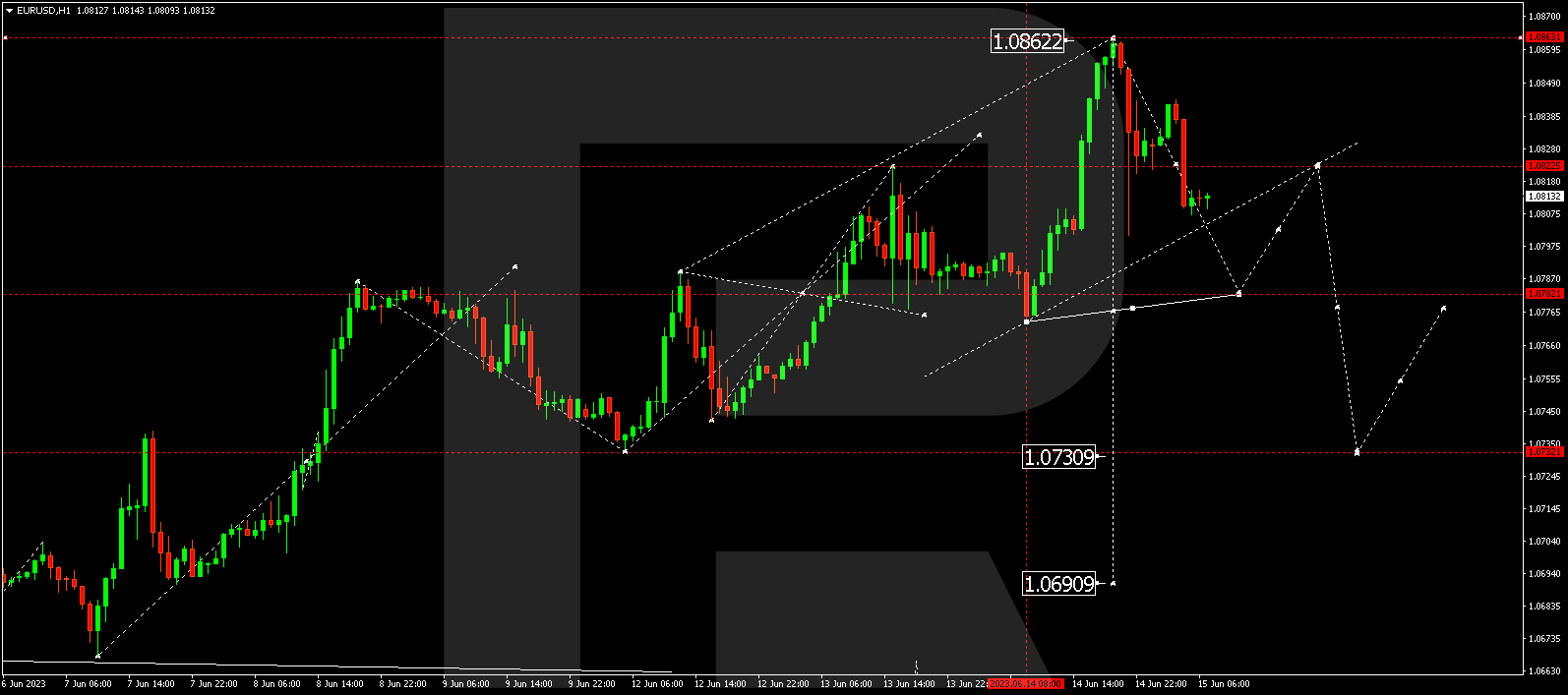

EUR/USD – Euro vs US Dollar

The currency pair has extended its consolidation range upwards to 1.0862. However, recent news has triggered a sharp decline to 1.0782, which serves as the initial target. Following this level, a correction towards 1.0822 may occur, followed by a potential wave of decline to 1.0730.

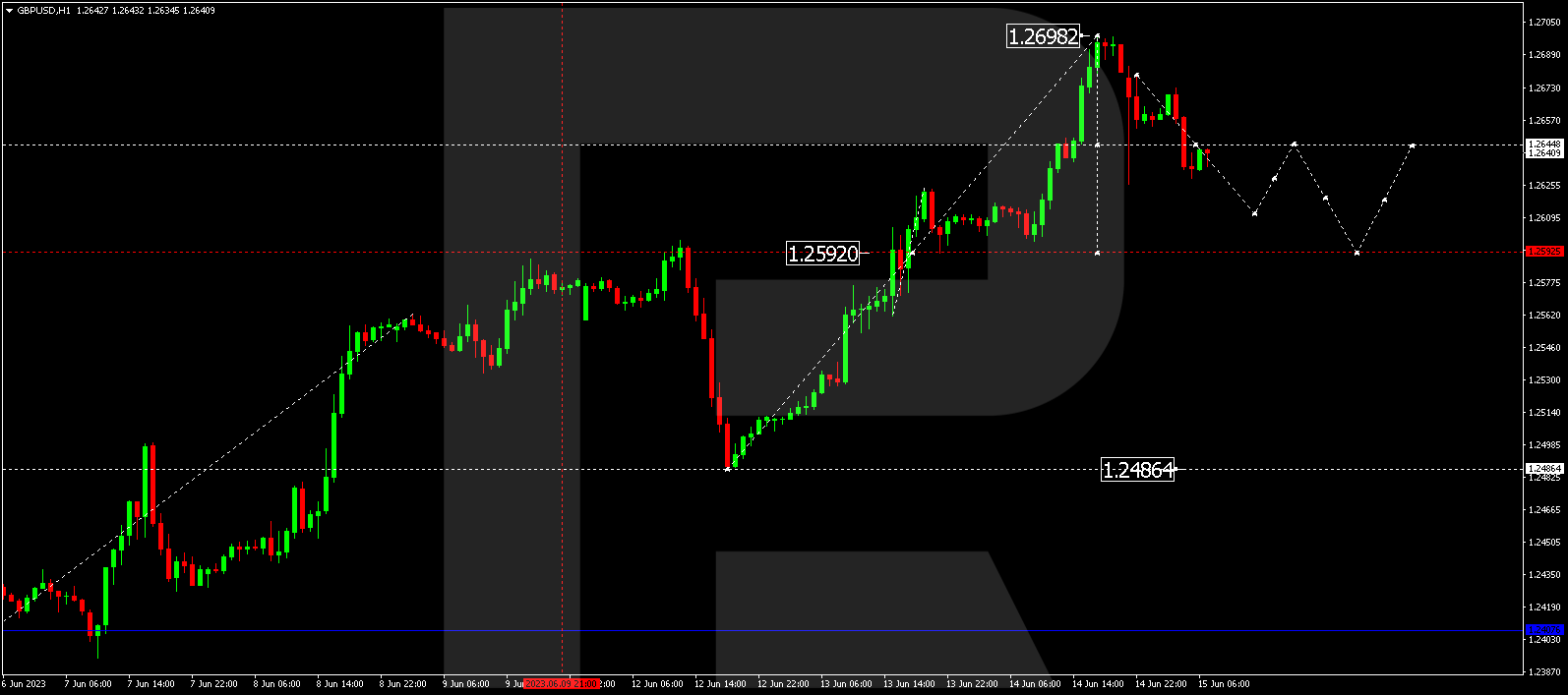

GBP/USD – Great Britain Pound vs US Dollar

GBP/USD has expanded its consolidation range upwards to 1.2698. However, in response to recent news, a descending wave structure to 1.2592 may commence, representing the first target. Once this level is reached, a correction towards 1.2644 might follow, followed by a decline to 1.2468.

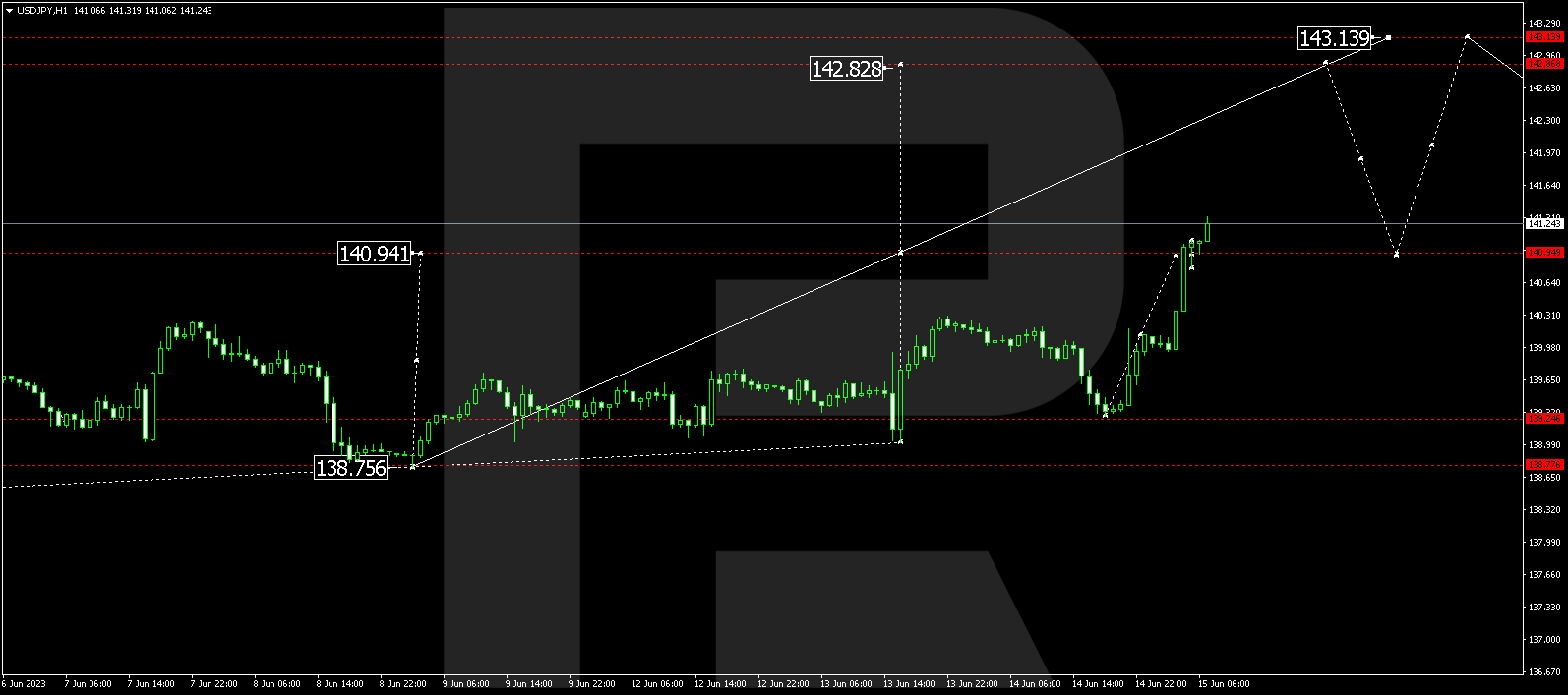

USD/JPY – US Dollar vs Japanese Yen

The currency pair has completed an upward impulse, reaching 140.95. Currently, the market is forming a consolidation range around this level. It is expected that the market will break upwards from this range and continue the upward wave to 142.85, serving as a local target. Subsequently, a correction towards 140.95 may ensue.

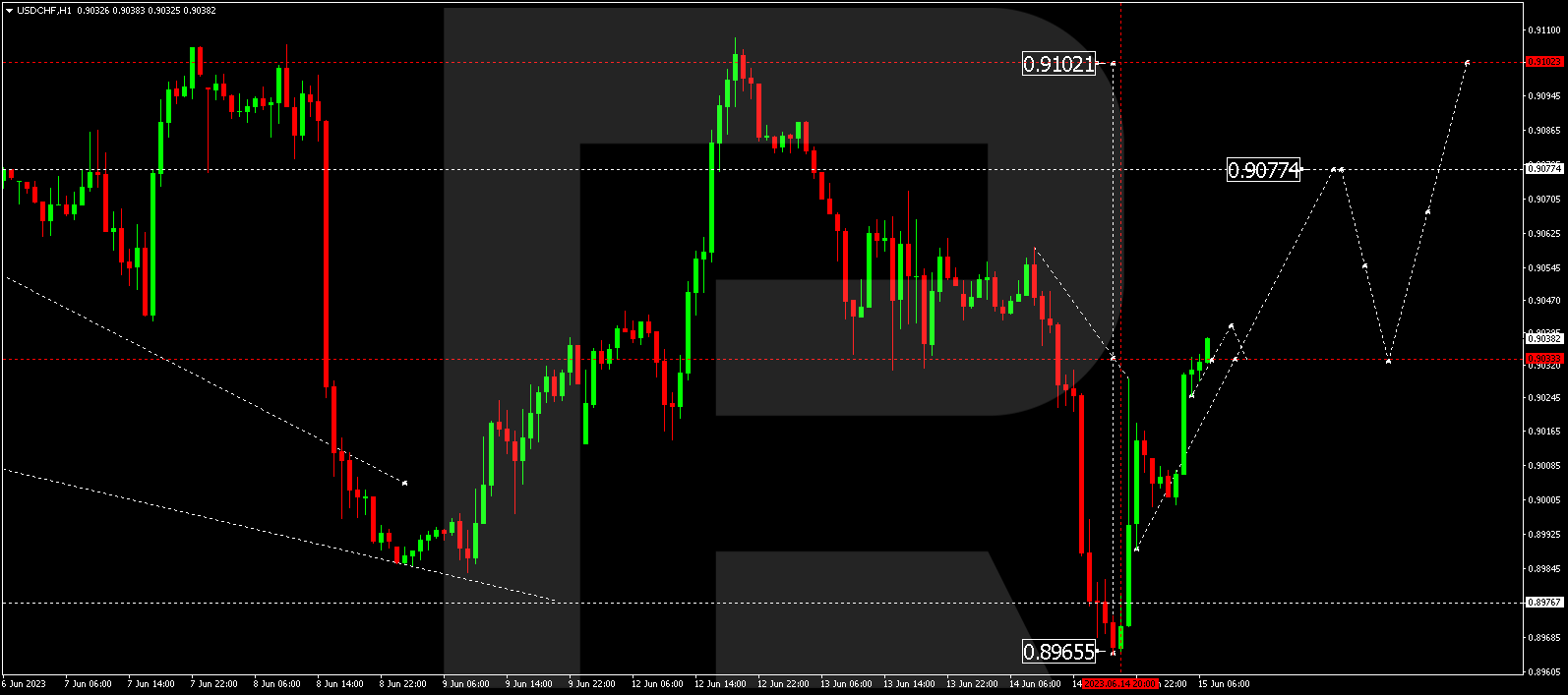

USD/CHF – US Dollar vs Swiss Franc

Following a decline to 0.8965, USD/CHF experienced a sharp impulse of growth to 0.9028 in response to recent news. The market is currently forming a consolidation range around this level. An upward breakout and continuation of the trend towards 0.9077 are anticipated, representing a local target. After reaching this level, a corrective move towards 0.9033 (a test from above) may occur, followed by a rise towards 0.9102.

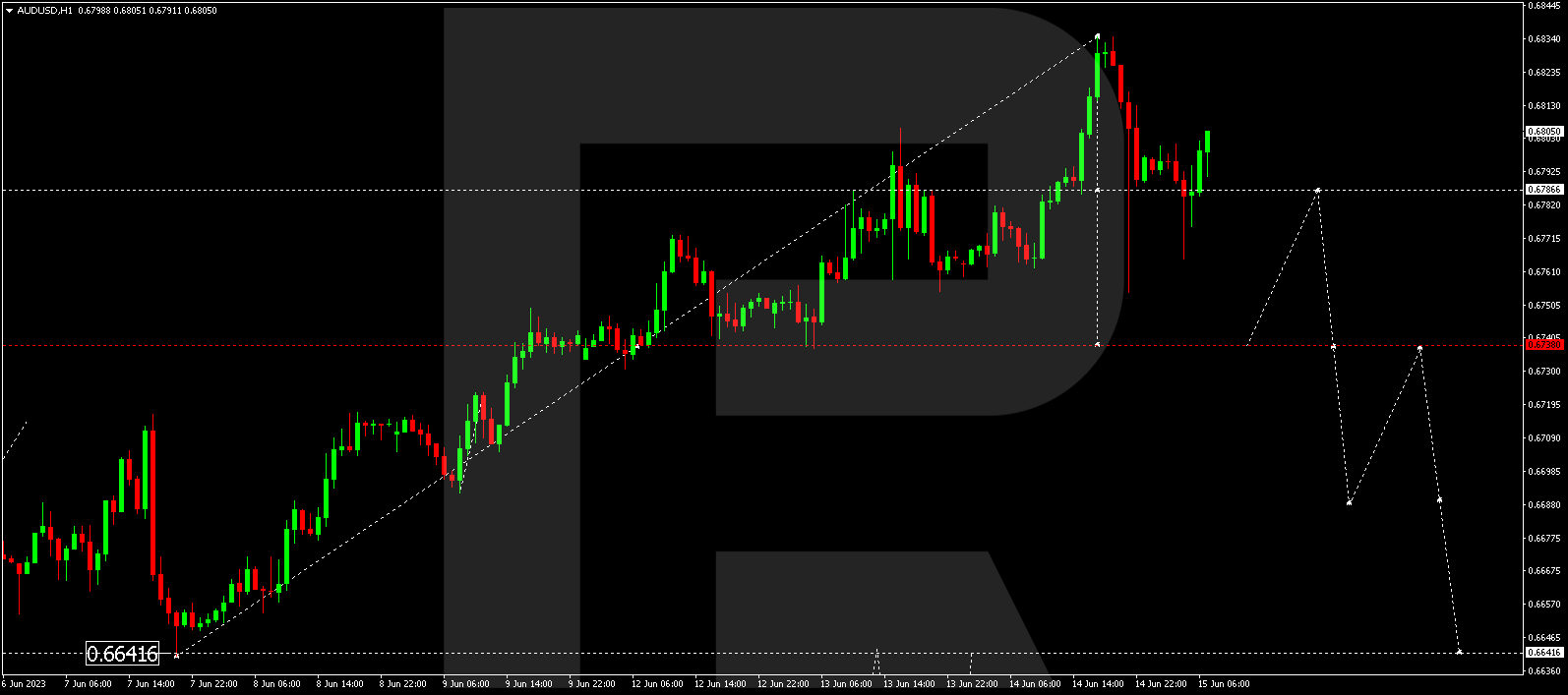

AUD/USD – Australian Dollar vs US Dollar

AUD/USD has broken out of its consolidation range upwards, reaching 0.6834. However, news developments have sparked a sudden decline. The first target could be at 0.6738. After reaching this level, a corrective move towards 0.6786 is possible, followed by a decline to 0.6644.

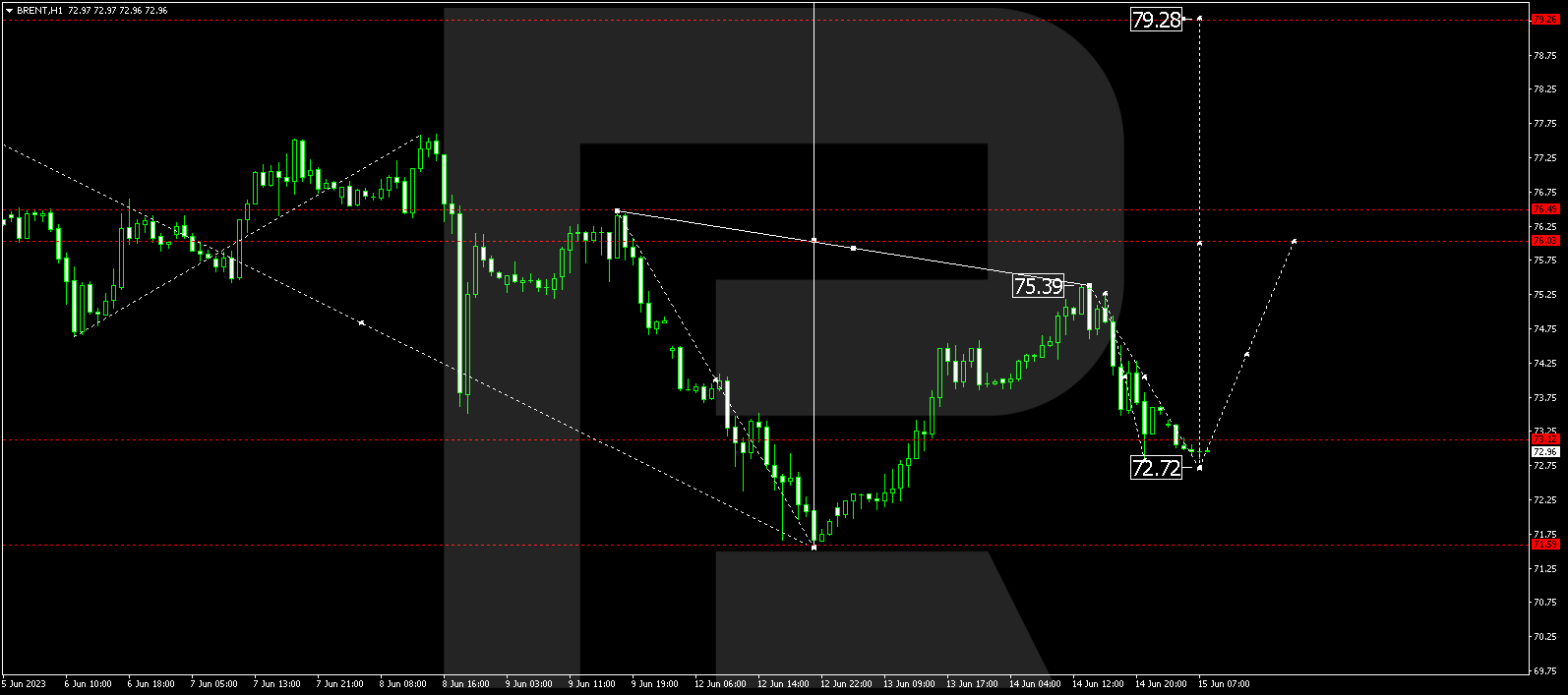

Brent

Brent completed an upward impulse to 75.39. Currently, the market is undergoing a corrective phase towards 72.72. Upon completion, a new wave of growth towards 76.00 may commence. If this level is breached as well, it may open the potential for a rise towards 79.28, serving as a local target.

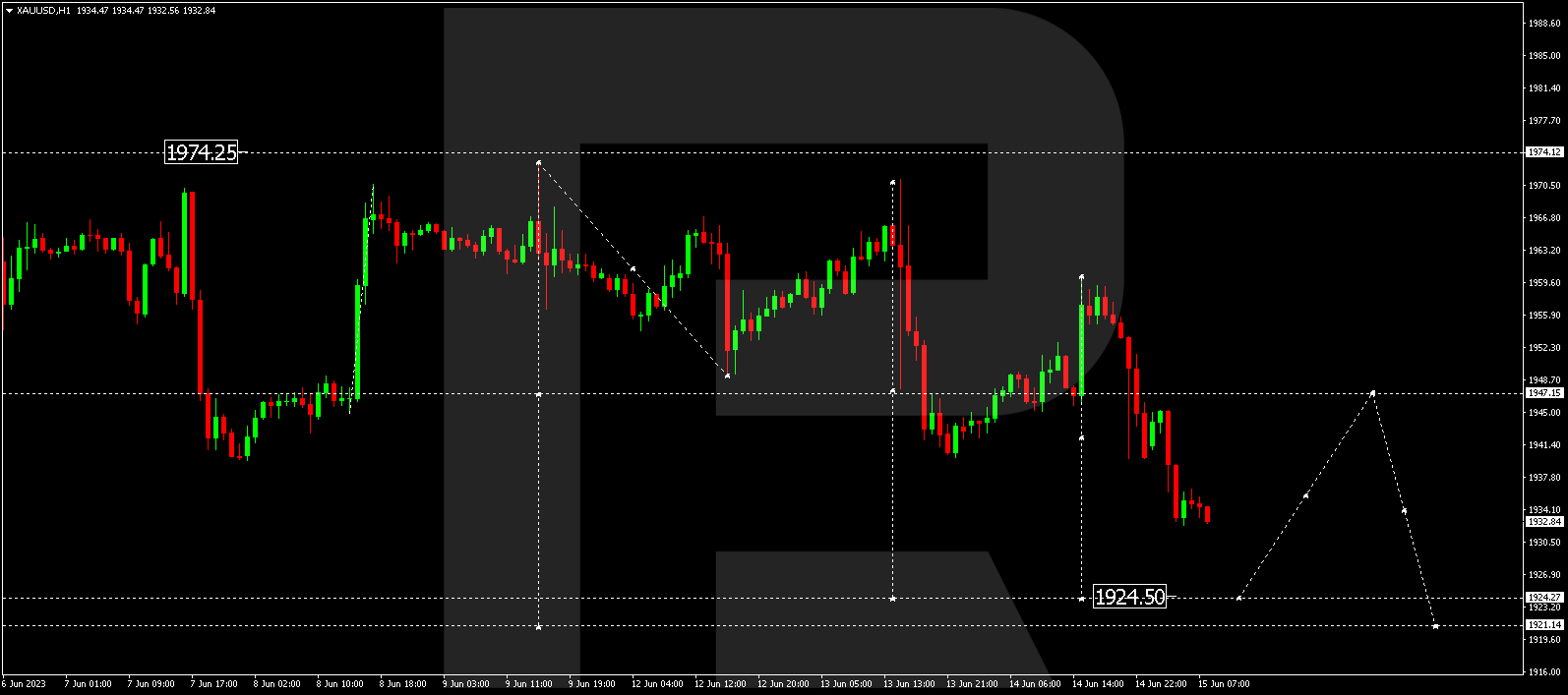

XAU/USD – Gold vs US Dollar

Gold has completed a corrective phase towards 1960.25. However, recent news has triggered a new wave of decline to 1924.50. After reaching this level, a correction towards 1947.15 is possible, followed by a decline to 1921.15, serving as a local target.

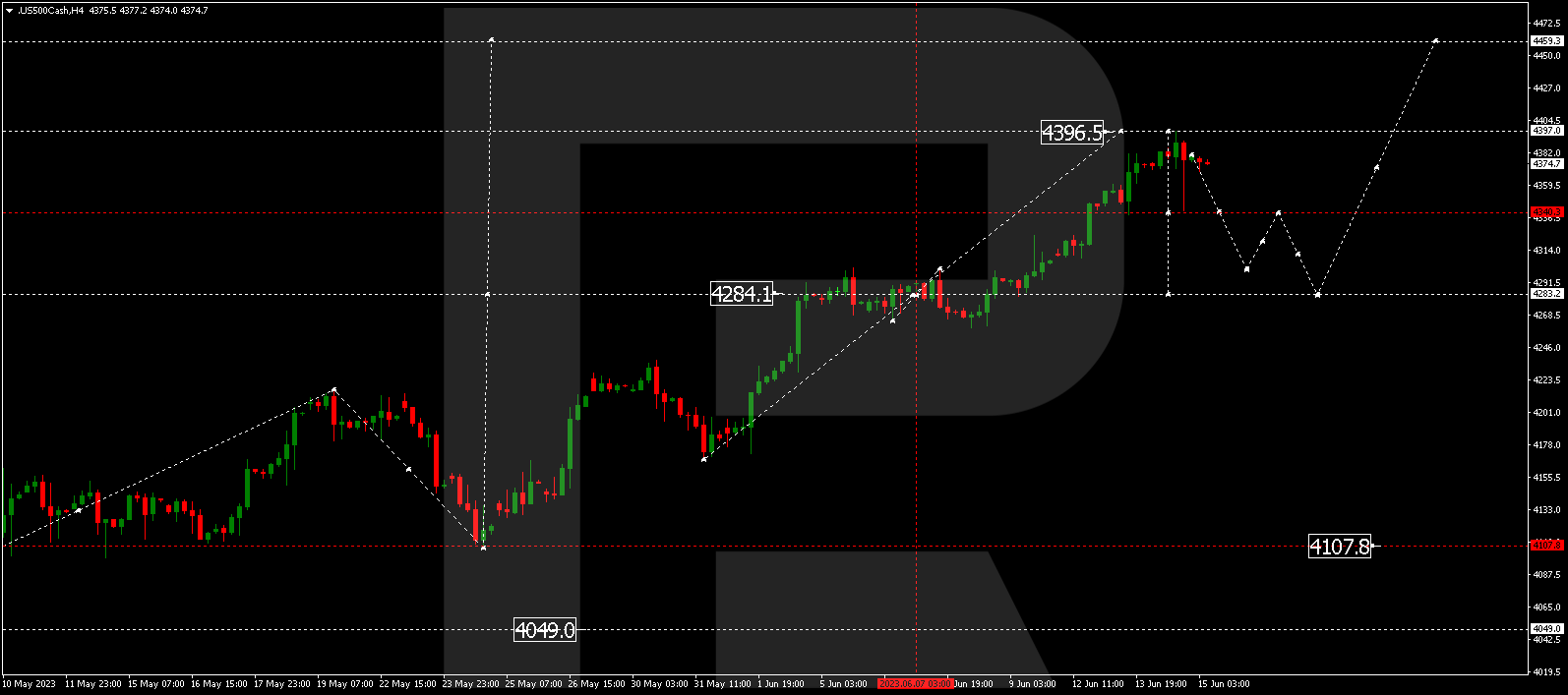

S&P 500

The S&P 500 index concluded an upward wave, reaching 4396.5. However, news developments have initiated a downward wave. A downward breakout of 4340.3 is anticipated, with an estimated target at 4283.2. Following this level, a new growth structure towards 4460.0 might commence.

The post Technical Analysis & Forecast 15.06.2023 appeared first at R Blog – RoboForex.