Macroeconomic/ geopolitical developments

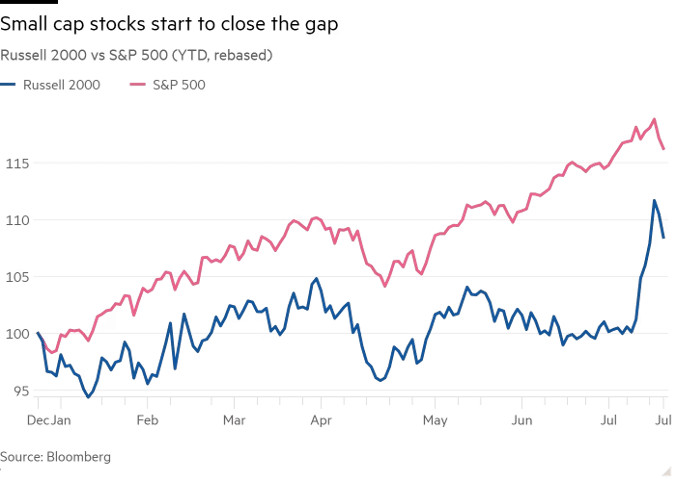

- The U.S. stock market is experiencing a sector rotation with small-cap and value stocks gaining momentum due to expectations of Federal Reserve rate cuts and favourable policies from Republican presidential candidate Donald Trump, while tech and growth stocks decline.

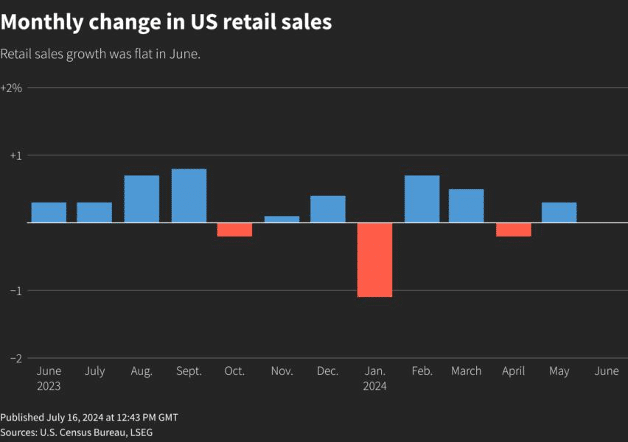

- U.S. retail sales remained unchanged in June, bolstered by broad strength despite a drop in auto dealership receipts, with year-over-year sales up 2.3% and underlying consumer spending indicating economic resilience.

- Investors are anticipating the Federal Reserve’s Sept. 17-18 meeting for a potential interest rate cut, contingent on favourable economic data, with Fed officials signalling readiness for a policy shift amid growing confidence in achieving price stability.

- The European Central Bank kept its key deposit rate at 3.75 percent while hinting at a possible rate cut in September, with President Christine Lagarde highlighting downside growth risks for 2024 and markets anticipating further rate reductions.

- President Joe Biden faces mounting pressure from within the Democratic Party to reconsider his 2024 candidacy amid concerns about his chances of winning and his recent debate performance, with some reports suggesting he could withdraw.

Global financial market developments

- US and global equity averages sold off from record/ cycle highs.

- US bonds were little changed on the week.

- The US Dollar Index sold off and rebounded from a multi-month low.

- Gold futures plunged from poking at the record high.

- Oil futures sold off Friday to a new multi-week low.

Key this week

Central Bank Watch: The main central bank activities this week are the The People’s Bank of China Interest Rate Decision on Monday and the Bank of Canada Interest Rate Decision and Monetary Policy Statement on Wednesday.

Macro Data Watch: The key macro data releases this week are the global Flash PMI data on Wednesday, US GDP and Durable Goods data Thursday, then key will be the Fed’s preferred inflation measure, the MoM and YoY PCE data on Friday.

Earnings Watch: Key focus will be on earnings from Alphabet and Tesla on Tuesday.

| Date | Major Macro Data |

| 07/22/2024 | PBoC Interest Rate Decision; German Retail Sales |

| 07/23/2024 | Nothing of note |

| 07/24/2024 | German GfK Consumer Confidence; Global Manufacturing, Composite and Service Flash PMI; BoC Interest Rate Decision and Monetary Policy Statement |

| 07/25/2024 | Germans IFO Report; US GDP, Durable Goods and PCE (QoQ); |

| 07/26/2024 | Japanese CPI; US PCE (MoM, YoY), US Michigan Consumer Sentiment Index |

| Date | Major Earnings Data |

| 07/22/2024 | Verizon |

| 07/23/2024 | Alphabet; Tesla; Visa; Coca-Cola; Texas Instruments |

| 07/24/2024 | Qualcomm; Thermo Fisher Scientific; IBM |

| 07/25/2024 | AbbVie; AstraZeneca ADR; Union Pacific |

| 07/26/2024 | Nothing of note |

The post Stock rotation continues out of large cap/ growth into mid/small cap/ value appeared first on FxExplained.