In the dynamic world of financial markets, traders are always on the lookout for strategies to maximize their profits. One powerful approach involves combining options and equity, utilizing the strengths of both to create a winning trading strategy. In this blog, we will explore how to blend options and equity in a simple and effective way, allowing you to increase your gains while managing risk. Join me as we dive into strategies and considerations that can lead to substantial profits in your trading journey.

Understanding Options and Equity

Before we jump into their combination, let’s understand the basics of options and equity trading. Options give traders the right (but not the obligation) to buy or sell an underlying asset, like stocks, at a predetermined price within a specific timeframe. Equity trading involves buying or selling shares of a company’s stock, aiming to profit from price movements. By using both options and equity, we can create a powerful trading strategy that brings the best of both worlds.

Hedging with Options

Options can act as a form of insurance in equity trading, helping to protect against potential losses in volatile markets. For example, if you own a portfolio of stocks, you can buy put options as a way to safeguard your investments. If the market experiences a downturn, the put options increase in value, offsetting the losses incurred from falling stock prices. This approach allows you to protect your capital while still being exposed to potential gains.

Generating Income with Covered Calls

A covered call strategy combines equity ownership with options writing. Here, you simultaneously hold a stock and sell call options against it. By selling call options, you earn a premium and generate income. If the stock price stays below the strike price until expiration, you keep the premium and continue holding the stock. However, if the stock surpasses the strike price, you may have to sell the stock at that price, limiting potential gains. This strategy helps you earn income while benefiting from a stable or slightly rising market.

Leveraging Options for Better Returns

Another way to combine options and equity is through leveraged strategies that amplify your returns. For instance, you can use options to control a larger position in the underlying equity with less capital. Instead of buying 100 shares of a stock, you can buy call options on the same stock. If the stock price rises, the call options increase in value at a faster rate, resulting in significant gains relative to your initial investment. However, remember that leverage also increases risks, so use caution.

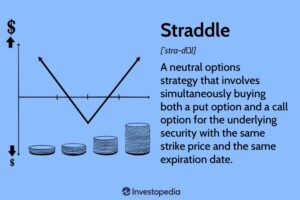

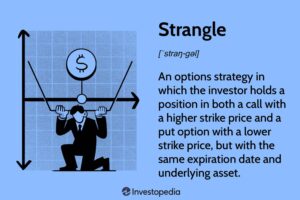

Synergistic Strategies: Straddles and Strangles

Straddles and strangles are options strategies that allow you to profit from significant price movements, regardless of the direction. A straddle involves buying both a call option and a put option with the same strike price and expiration date. A strangle, on the other hand, involves buying out-of-the-money call and put options. These strategies work well when you expect large price swings but are uncertain about the direction. By combining these options positions with an equity holding, you can create a winning strategy for volatile market conditions. These are one of the best options trading strategies you can adopt for risk mitigation and income generation.

Check out a visual breakdown of a straddle below:

Check out a visual breakdown of a strangle below:

Managing Risks and Diversification

While combining options and equity can boost your gains, it’s crucial to manage risks and diversify your trading. Options trading comes with its own set of risks, including the potential loss of the entire premium paid. Assess your risk tolerance carefully, use appropriate position sizes, and diversify your trading strategies and underlying assets to minimize potential losses. Stock and options trading is risky, but with the right stock and options trading strategies you can crush the markets in a safe and efficient manner!

If you want to watch a deeper breakdown of this concept and dive into some examples, Kunal dropped an awesome YouTube video explaining this all in detail that you can watch here: https://youtu.be/m-CNNAwlFmM

By combining options and equity in your trading, you can unlock a world of opportunities to maximize your profits. With a simple and straightforward approach, you can harness the benefits of options strategies while capitalizing on equity market movements. Remember to focus on understanding the basics, managing risks, and continuously learning. With practice and experience, you can master the art of combining options and equity, bringing you closer to your financial goals and trading success.

Ready to launch your stock trading career? Apply for our 60-day LIVE Bootcamp right here: https://bullsonwallstreet.com/register/christmas-60-day-bootcamp/

The post Stock & Options Trading Strategies – Combining Both For BIG Gains appeared first on Bulls on Wall Street.