What happened?

StarHub has released its 2023 full-year results to much fanfare.

The telco is seeing a year-on-year revenue improvement across its divisions with its net profit more than doubling year on year.

This comes as Starhub is going through a transformation plan to improve its performance.

Investors should also be pleased with Starhub’s dividend payment.

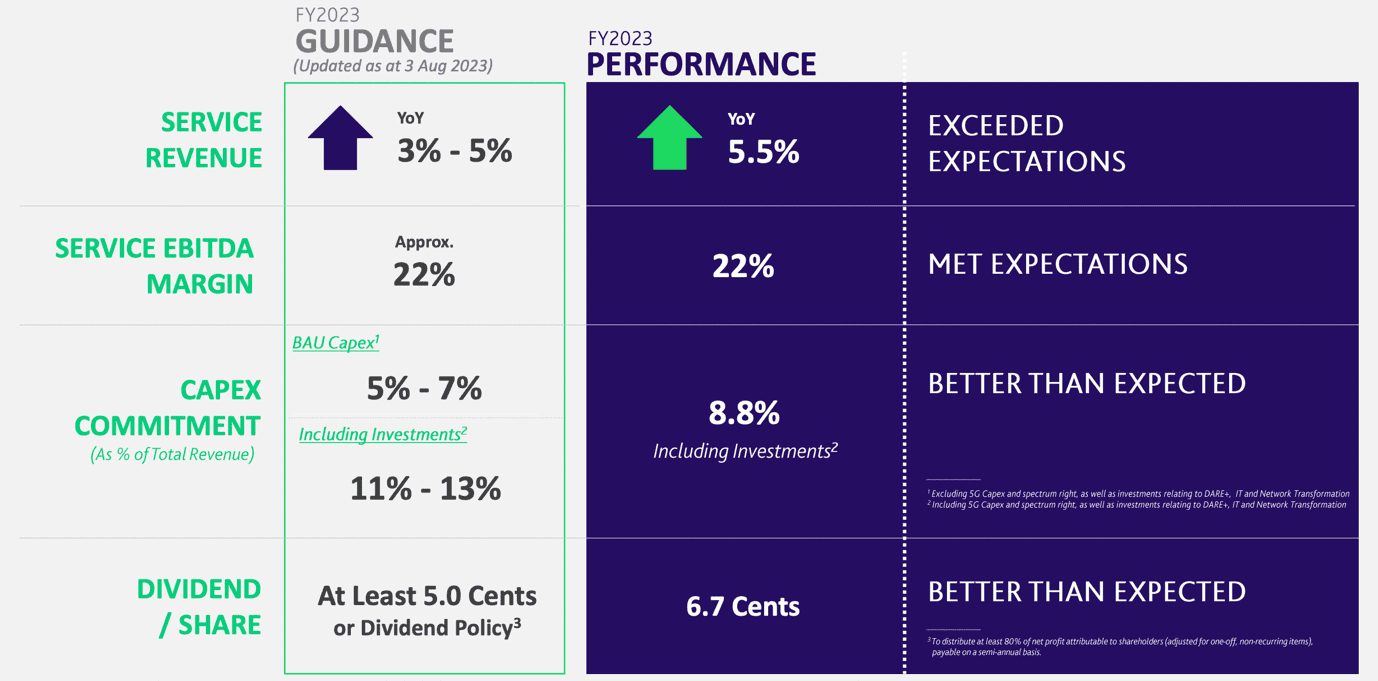

StarHub had indicated that it would pay out “at least 5 Singapore cents” in dividends but ended up doing much better.

Starhub’s 2023’s total dividend came up to S$0.067, much higher than the stated S$0.05 dividend guidance.

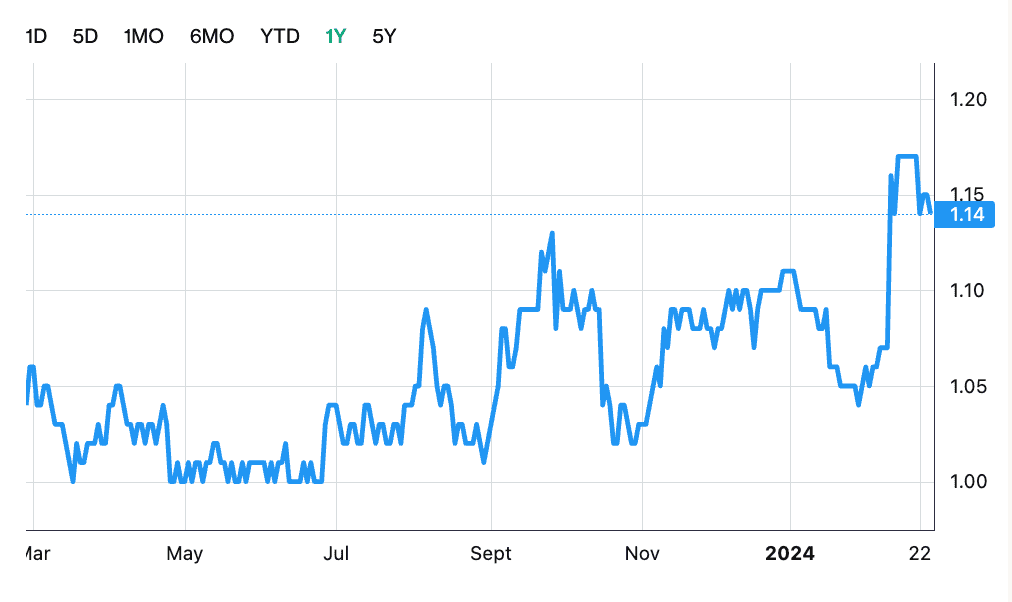

The telco’s share price has also done well, rising by 8% over the past month.

We explore if the telco can continue to dish out increasing dividends in the years to come.

What you need to know about StarHub’s latest earnings

#1 – Significantly higher core net profit

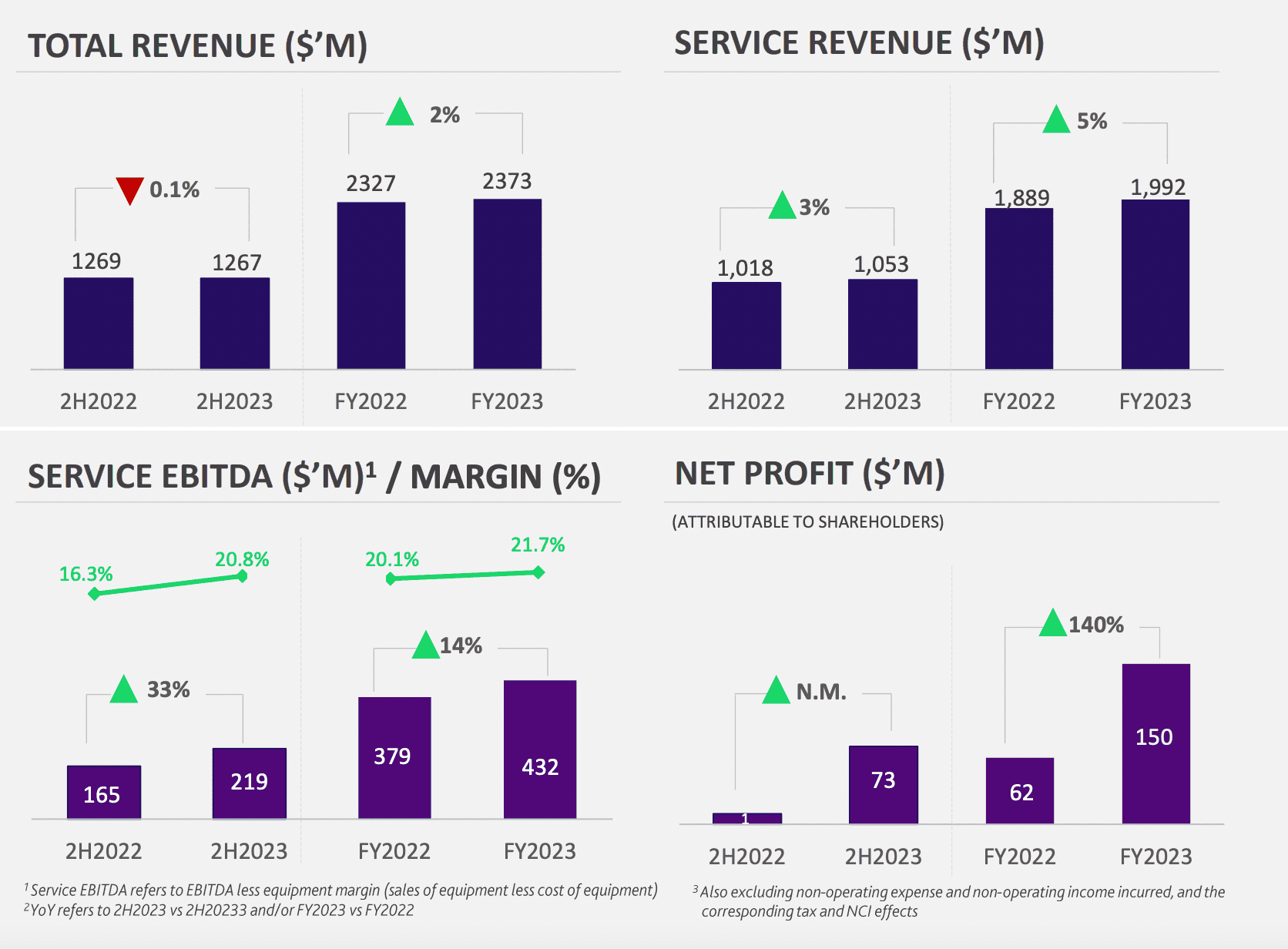

For 2023, StarHub saw its revenue rise 2% year on year to S$2.4 billion.

Operating expenses, however, shrank by 1.5% year on year to S$2.1 billion, allowing operating profit to surge by 46.3% year on year to S$226.3 million.

Accompanied by higher finance income that more than doubled year-on-year, net profit soared by 140% year on year to S$149.6 million.

If non-recurring expenses and items were excluded, StarHub’s net profit would still have climbed 76.5% year on year.

The telco also generated a positive free cash flow of S$185.9 million, although this was 16% lower than the S$222.3 million generated in the prior year.

#2 – A better performance across all divisions

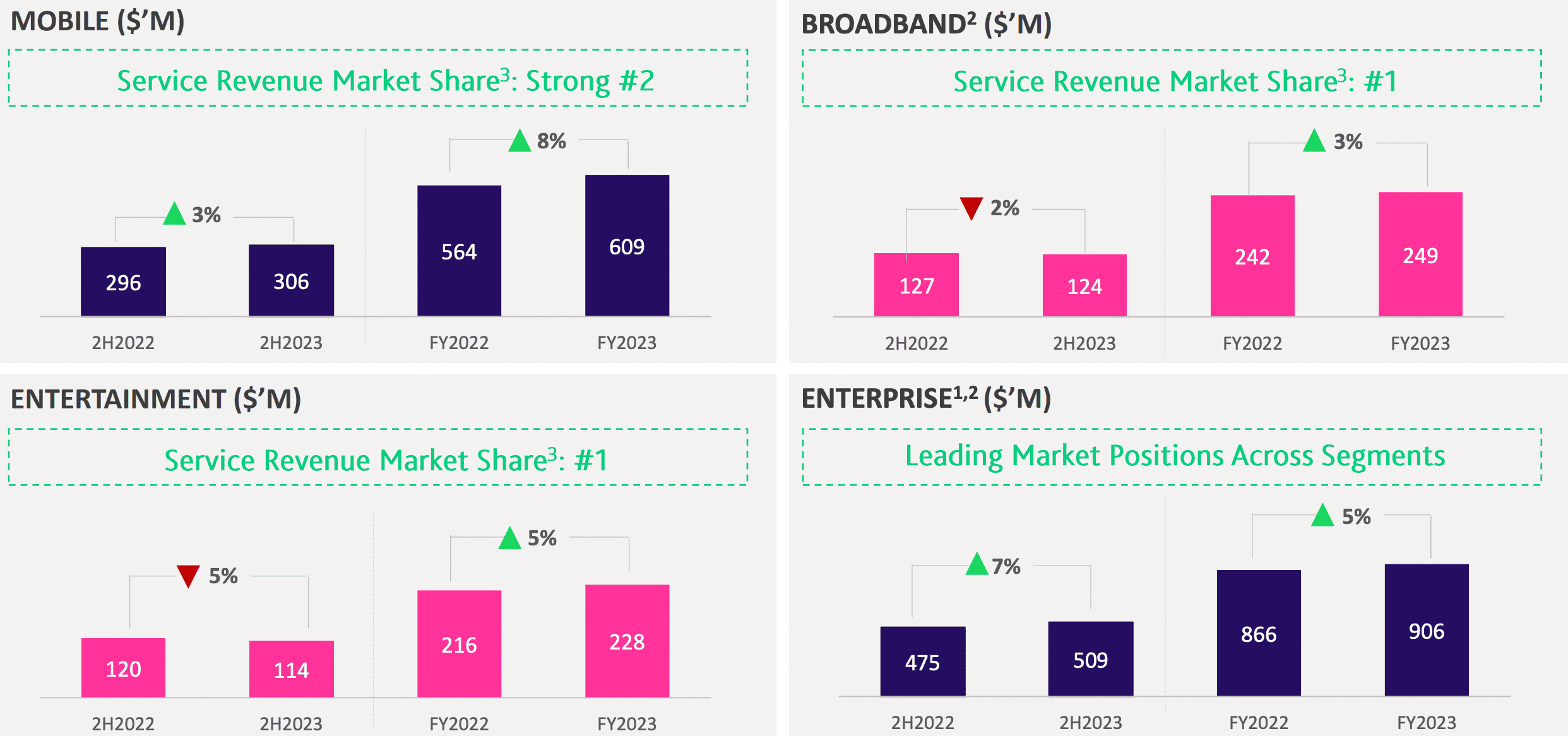

StarHub enjoyed an all-around good performance across all its divisions.

The Mobile division saw revenue rise 8% year on year to S$609 million and maintained the number 2 position in service revenue market share.

Broadband and Entertainment divisions enjoyed a 3% and 5% year-on-year increase in revenue, respectively, to S$249 million and S$228 million.

Both divisions remain in pole positions within their respective industries.

Its Enterprise division, which garnered the highest revenue share of all the divisions, saw revenue rising by 5% year on year to S$906 million.

Within the Enterprise division, cybersecurity services saw the biggest year-on-year jump in revenue, up 16.3% year on year to S$350.1 million.

#3 – DARE+ milestones achieved

DARE+ is a strategic initiative undertaken by StarHub in 2022 to achieve S$280 million in cost savings and boost gross profit by S$220 million between 2022 and 2026.

This strategy is a continuation of its DARE 1.0 strategy which concluded in October 2021 and delivered more than S$270 million in cost savings and shaved off 15% of the telco’s operating expenses.

StarHub’s CEO Nikhil Eapen commented that the group achieved its DARE+ milestone of hitting S$150 million in net profit for 2023 even while making significant investments.

#4 – A positive outlook for 2024

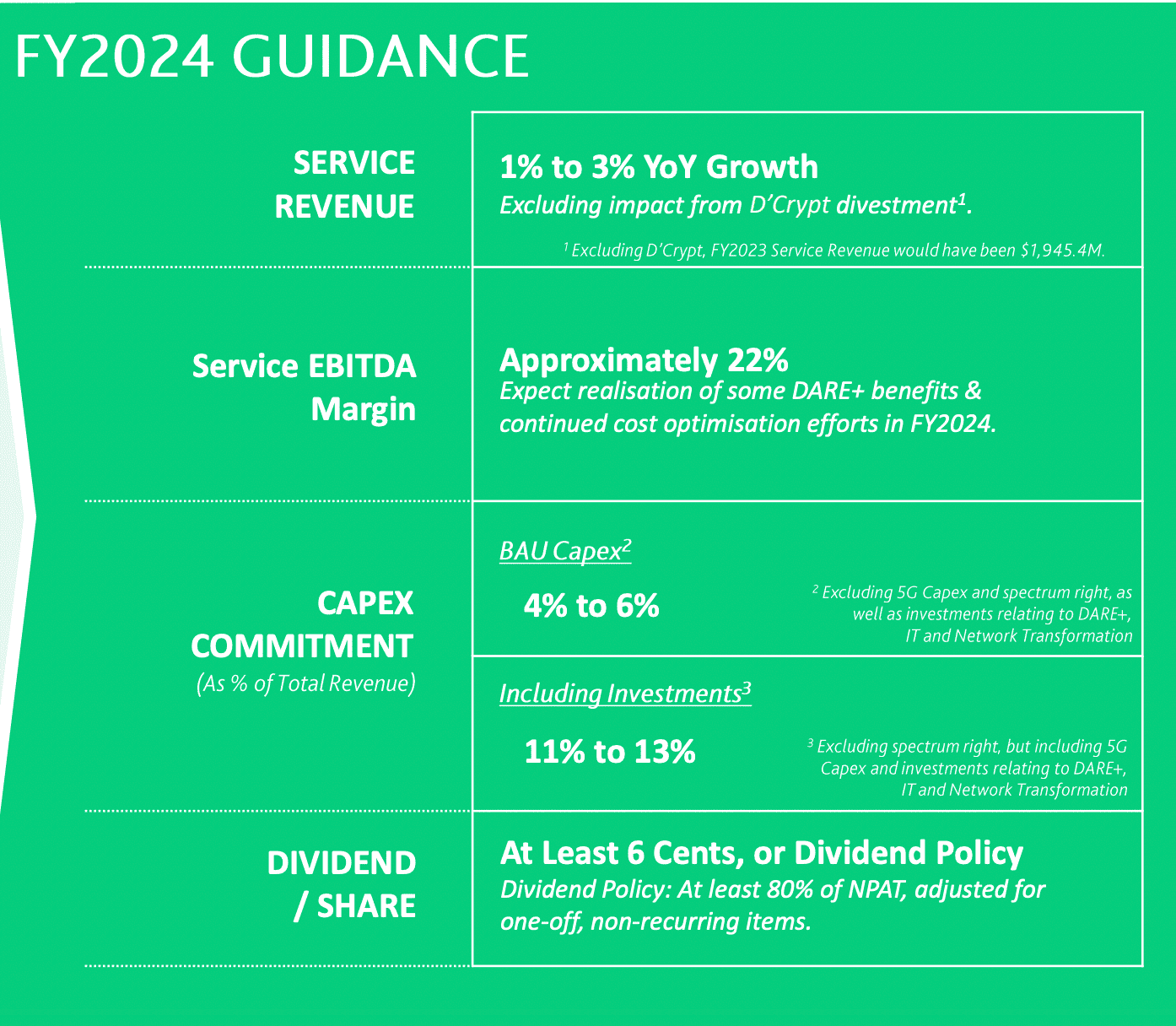

Management announced a positive outlook for this year with encouraging metrics.

Service revenue is projected to rise by 1% to 3% year on year excluding the impact from the sale of D’ Crypt.

Consumer division should remain stable despite continued market erosion as StarHub will endeavour to cross-sell its suite of Infinity Play products.

Its cybersecurity sub-division is expected to continue posting revenue growth with its Ensign division poised to do well.

With a refocus on higher-margin business, the telco’s Regional ICT services sub-division should also enjoy year-on-year growth.

Capital commitments are set to fall between 11% to 13% of revenue including investments with 90% of DARE+ S$270 million investments expected to be incurred this year.

Management has also set milestones for 2025.

Operating expenses are expected to reduce as legacy infrastructure and systems are retired, along with cost savings generated by DARE+ initiatives.

The DARE+ outcomes set out in 2022 should start to come through as investments tail off by then.

#5 – An increase in StarHub’s minimum dividend per share

Income investors should rejoice at StarHub’s announcement of a higher minimum dividend per share for 2024.

For this year, the telco will pay out “at least 6 Singapore cents”, a 20% increase from its previous announcement of paying out a minimum of 5 Singapore cents.

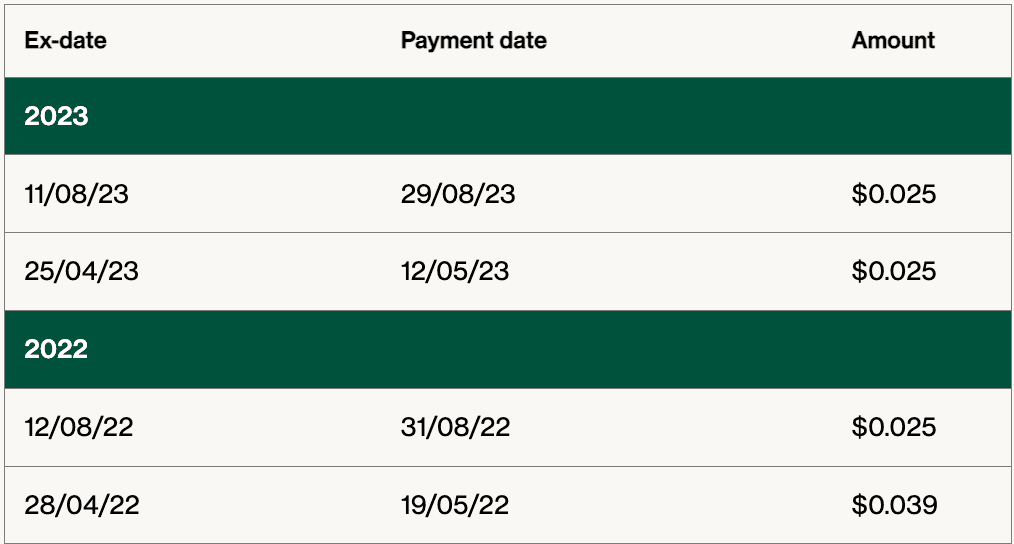

For the second half of 2023, StarHub hiked its final dividend by 68% year on year from S$0.025 to S$0.042.

With this declaration, 2023’s full-year dividend stood at S$0.067, 34% higher than the S$0.05 paid out in 2022.

What would Beansprout do?

StarHub’s DARE+ initiatives are producing a positive effect on the telco’s bottom line.

But, there may be more to come.

With more savings targeted up till 2026 and continued investments being made, investors should look forward to a leaner StarHub in the next few years.

The group’s commitment to paying out a higher minimum dividend also shows management’s confidence in its prospects and free cash flow generation capability.

Should the business do well, there is a chance that 2024’s total dividend could exceed the S$0.067 declared for 2023.

Based on the total dividends of S$0.067 and Starhub’s current share price of S$1.14, the stock offers a dividend yield of 5.9%.

This is above the dividend yield of SingTel, which is expected to offer a dividend yield of 4.5%.

We would be adding Starhub to our watchlist it might be worth adding Starhub to our watchlist with improvement in profit and attractive dividend yield.

The record date to be eligible for the Starhub’s dividend has yet to be announced, and you can refer to our Starhub stock page to get updates on the latest Starhub dividend dates.

Related links:

Join the Beansprout Telegram group and Facebook group to get the latest insights on Singapore bonds, stocks, REITs, and ETFs.