Around 4.48 billion human beings on the planet have and use social media, and the average millennial has about 8.4 social media accounts[1]. It’s safe to say that the internet has turned our world into one large digital square.

This digital square has affected every aspect of our lives, from our sense of fashion to how we handle our finances. And, while it may be easy to focus on the negatives that come with social media and personal finance, such as fueling a culture of consumption and a need to keep up with the Joneses, digital platforms have also had a positive impact and empowered countless individuals to take charge of their financial lives.

So, as we strive for a balanced view, let’s look at the pros and cons that come with social media.

The Positive Effects of Social Media on Our Finances

Social media have enriched our financial lives in more ways than you might think. From how we make money to how we invest, social media has been a boon for our personal finances. Here are just a few of the many benefits:

1. Providing Extra Income

Many people have used social media to make extra money through side gigs. Digital marketers have benefited from affiliate programs offered by companies, making money through promoting products and receiving commissions. Graphic designers and copywriters have better access to freelance gigs, supplying companies with social media content and advertising.

2. Giving Access to Extra Job Opportunities

Speaking of graphic designers and copywriters, those two groups have benefited from social media beyond just getting access to freelance work. They have a platform to showcase their work and to network with other professionals in their medium.

For instance, graphic designers can use a social media platform like Instagram to highlight their portfolio and share their work process.

Professionals from all spheres can use platforms like LinkedIn to connect with customers and potential customers, building rapport over time and smoothing the runway for the day when they choose to apply. When they follow the company, they keep up with all the updates.

Finally, social media can be a way for hiring managers to find and source talent. The right platform can expand a recruiter’s search, helping them find exceptional talent they wouldn’t have found otherwise.

3. Lowering Spending Through Discounts and Offers

Many companies use discounts and coupons to entice their customers to purchase. They spread these offers through social media, hoping to maximize their reach.

As a result, if you follow your favorite brands, you will likely find many of these offers coming your way.

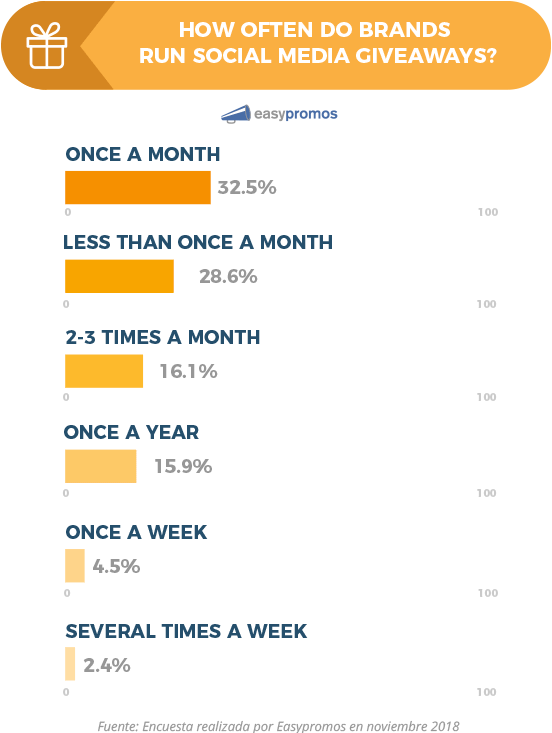

As a case in point, when Easypromo carried out a survey of companies running online giveaways, there were a few interesting findings:

- Almost two-thirds of companies organizing giveaways relied on more than one social network to distribute it to their customers, with Facebook and Instagram being the most popular.

- Around one-third of brands carried out, on average, one giveaway a month, and a little over 16% of companies ran two or more giveaways every month.

Source: Easypromo.com

So, in addition to offers, social media gives you access to fun competitions that might net you a free product from your favorite brands. The result of all of this is reduced spending and more engagement.

4. Improving Financial Literacy

Today, people have more options than ever when it comes to upping their financial literacy. For instance, they can follow one of several personal finance channels on YouTube. They can join one of countless personal finance Facebook groups or listen to one of the numerous finance podcasts out there. And this is not to mention all the finance influencers and investment gurus populating platforms like Instagram and TikTok.

What’s more, many of these influencers will focus on a particular aspect of personal finance. For example, some will talk mainly about getting rid of debt, while others might devote most of their time to saving for retirement.

There is a caveat you should bear in mind. Even though plenty of people give out good advice on social media, some peddle lousy advice. For instance, some influencers might urge you to buy a risky investment with the promise of substantial future rewards even though the risks don’t justify the purchase price.

So, while social media can improve your financial literacy, you would do well to still perform your own research before making any significant financial moves.

The Negative Effects of Social Media on Our Finances

Just as social media can positively influence your finances, it can also have a detrimental effect if you’re not careful. Here are some of the things you ought to look out for:

1. Causing You to Overspend

The most-straightforward issue is how social media can push you to overspend. It can trigger your itch for impulsive buying, especially if you spend too much time following lifestyle influencers.

In fact, there are several reasons why social media can directly harm your wallet:

– Influencers Present a Disingenuous Image

When you see your favorite influencer using a product, it’s easy to think you should buy it yourself. But what some people seem to be forgetting is that a lot of influencers not only got that product for free but are also being paid to advertise the products they seem to be “using.”

Additionally, some influencers go to extreme lengths to give off an aura of wealth. They need to keep up appearances for their followers, but it’s all a mirage.

– You Feel the Need to Keep up with the Joneses

Even if you aren’t following any influencers and are only following your friends, it is easy to get sucked into a toxic comparison mentality. After all, when you see your friends from university post their fourth set of vacation photos this year, a part of you may wonder why you haven’t taken your family on vacation as well, regardless of whether you can afford it.

Most people share their highlights on social media, but nobody ever shares their lowlights. All you see is a curated set of instances that show the people you follow in a splendid light. You never see the moments when your friends struggle to keep up with their mortgage payments or struggle to pay off credit card debt.

– Companies Leverage Targeted Ads

Social media provides companies with the ability to deliver targeted ads. If you searched “running shoes” an hour ago, a company like Nike can make sure an ad for their latest Nike Pegasus pops up on your Instagram feed. And this applies to most social media channels out there, including Facebook, Snapchat, Pinterest, and TikTok.

While a single ad might not be that big of a deal, several ads from the same brand can affect you, slowly persuading you to make a purchase you might not be able to afford.

– Social Media Make Buying Easy

Making a purchase on social media is as easy as clicking on a few buttons. In fact, according to a survey by VidMob, almost 33% of users on Instagram made a purchase directly from an ad[2]. If your credit card information is saved on your phone, there are even fewer obstacles slowing you down whenever you feel impulsive and decide to buy something you don’t need.

Studies have shown that we tend to be much more cavalier with our money when it is digital as opposed to when it is physical. The pain of parting with physical cash makes us wiser spenders. When we use digital money that we can’t see, there isn’t that fear of loss nagging at the back of our brains.

2. Distracting You and Lowering Your Productivity

Social media can be distracting, especially at work. After all, who isn’t guilty of being sucked into YouTube or Instagram and spending too much time over there rather than finishing their work?

The issue is that this eats away at our productivity. And while it may not be a problem if it happens every once in a while, it can be an issue if it’s so frequent that your career starts taking a hit.

3. Harming Your Career

Additionally, even though social media can help you find job opportunities, it can also be why you lose out on opportunities. For instance, if your LinkedIn profile doesn’t look professional or updated, a recruiter might pass you up for another less qualified candidate just because they had a better social media profile.

Also, you need to remember that the internet never forgets. So, be careful with what you share on social media because anything you say on Twitter or post on Instagram might come back to haunt you. Just ask Kevin Hart.

How to Deal with the Negative Side of Social Media

So, if you want to enjoy the benefits of social media while sidestepping the potholes, it all boils down to how you use it.

1. Be Careful Who You Follow

The content that you receive on social media affects you. If you are following the wrong kind of influencers, your feed will be filled with misleading content that could harm you. You need to be selective about who you follow.

You also might want to consider unfollowing influencers displaying lavish lifestyles, especially if you are prone to impulsive buying. The last thing you want to do is buy something you don’t need because it seemed trendy then.

2. Manage Your Time on Different Platforms and Don’t Get Sucked In

To protect your productivity and limit distractions, you need to actively manage the amount of time you spend on social media. And if you’re the kind of person who loses their sense of time while on Instagram, then you should consider setting a daily screen time limit. Not only will this help you keep track of the amount of time you spend on social media, but it will also free you up for other amazing activities away from the digital world.

At the more extreme end of the spectrum, if you feel that social media have taken over your life, you should look into a quick detox and delete any social media apps from your phone. Of course, this deletion doesn’t need to be permanent. Still, it should be enough to give you some breathing room and the ability to mentally recharge from the over-stimulation that comes with Facebook, Instagram, TikTok, and every other app that bombards your phone with millions of notifications every day.

3. Have a Clear Budget and Stick to It

One of the best things you can do for your financial future is to learn how to set a budget and stick to it (it’s one of the central tenets of personal finance). This means setting aside an emergency fund, and it also means that the amount of money you allow yourself to spend on social media is limited. This will curtail any urges toward impulsive buying.

And, to stick to your budget, here’s a little trick that might help: Always set a waiting time before making any online purchase. When you’re in the moment and overcome by FOMO, you might make a purchase that you’ll regret later. But, when you give yourself a waiting period, let’s say for two weeks, you give yourself a chance to cool down and see whether you still want that item after the waiting period is over.

Putting It All Together

Like any other technology, social media can be a force for either good or evil. It depends on how you use it. Social media platforms can help you make more income, get a new job, or even hone your financial literacy. Conversely, these same platforms can cause you to overspend, suck you into a comparison/ FOMO mentality, and harm your career.

The good news is that there is plenty you can do to maximize the benefits while avoiding the negatives. Whether you curate your feed or budget your spending, what matters at the end of the day is that you be disciplined.

The post Social Media and Personal Finance: The Good, The Bad, and The Ugly appeared first on FinMasters.