A bull market was stamping through 2023. Then, in August, that bull began to take fright.

This September, are we seeing a return to a bear market? Or merely a correction due?

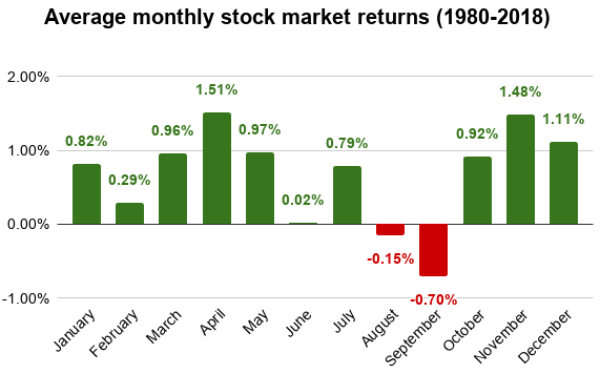

August and September are often the worst months of the year for drawdown anyway. But let’s take a look at what has spun the gloom this year.

Source: Stock Analysis

Remember: when dealing with averages, a high number can spike that average.

Put 20 investors in a room, and you may get an average net worth of $2 million.

Add Warren Buffett to that room. The addition of this one outlier could bring the average to over $5.5 billion.

We haven’t really seen a big spike down this year. But the September drawdown, especially in stocks like technology and some real estate (exposed to interest rates), has been heavy.

A key reason for this is the changing tune of central bankers on interest rates.

The ‘higher for longer’ story now extends from the United States, to Europe, to other markets.

Christine Lagarde of the European Central Bank (ECB) remarked in a speech on 25 September:

‘Based on our current assessment, we consider that our rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to our target.’

Stock market investors tend to price for about a year in advance. Investing in opportunities now for next year and beyond.

Many investors were predicting a high chance that interest rates would need to come down again sometime in 2024 to spur the economy again.

So, how long is ‘longer’, central bankers?

This is the question on every seasoned investor’s mind right now.

There’s a statement attributed to Tony Blair (and others) that comes to mind on this question:

‘I never make predictions. I never have and I never will.’

You can’t predict central bank plans because they themselves don’t yet know.

Nobody knows exactly where inflation is going to sit on the next measure.

But you can look at some of the key drivers. The oil price increased steadily through August and September. Energy transition goals and reduced investment in production are likely to keep it high in the near-term.

Source: Investing

Remember: oil has been under $80 for much of this year’s bull run in equities.

Despite this, other costs across economies are starting to fall. We’re skirting a recession.

Yes, ‘higher for longer’ tends to suggest the current rates are doing their job. Yet history suggests central bankers might overshoot. They may need to reverse course. We just don’t know when.

But here’s why they’re keeping the thumbscrews tight for now — or at least threatening to.

The Rule of 70

Signals to consumers and investors help determine what happens with inflation. Expectations drive prices.

The problem is that consumers start to get used to inflation.

Here in New Zealand, the last reading in June 2023 was 6%.

While that may not sound a lot, it is still a silent, very corrosive thief at this level.

The rule of 70 can be loosely used to work out the number of years it may take for prices to double. Should inflation remain at 6%, your $5.50 coffee would be $11.00 in just a bit over 11 years. Apply this level of increase to larger, durable consumer items, and you can see the problem.

Inflation targets are around 1% to 3%. Doubling prices over 30 years is far more digestible.

So, when you take this view, the ‘higher for longer’ promise should come as no surprise.

But is it for real? Inflation — bar the oil price — has already been coming down.

How long is this longer? Or could this be a wink to experienced investors who have seen how quickly cycles can turn?

Keep an eye on inflation updates. Forecasts with a grain of salt. And for now, that oil price.

Opportunity?

The central bankers have already been moderately successful in bringing inflation down following the Covid spend-up.

We can probably still bet that inflation will come down even more.

As 6% touches 3%, 2%… the flywheel of monetary policy may then need to turn in the other direction.

The early signs of opportunity begin with stocks with lower levels of debt. Or having prudent hedging against future interest rates.

And companies producing strong earnings despite the tougher times. Or growing their rents. These are the resilient businesses, with some moat or high demand.

This is also time for investor patience and long-run investing. Dividends can help keep pace with inflation while positioning for long run growth. Value investing tends to work out best during times of inflation.

Yes, it can be painful to buy in a falling market. One that has taken many by surprise. Enthusiasm and optimism has been curbed for now.

But if the market was high again — and markets can move quicky — you wouldn’t be able to pick up such value.

This week, we are also reporting on specific companies focused in these areas of value and real estate.

I encourage you, if you’ve not already, to join us with a Premium News Subscription.

Our special offer to take out your first few weeks at just $1.50 is available here.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the editorial content of this periodical. It is the author’s personal opinion and commentary. It is general in nature and should not be construed as any financial or investment advice.)

The post Simon Angelo on This Market appeared first on Global Opportunities Beyond the Radar.