SIL (Silver Miners ETF) is a financial product designed to mirror the performance of silver mining companies. It offers investors a straightforward way to gain exposure to the silver market without directly purchasing physical silver or individual mining stocks. SIL diversifies risk by spreading investments across multiple companies within the sector, potentially providing a hedge against volatility in silver prices. In this article, we will look at the Elliott Wave outlook for the ETF.

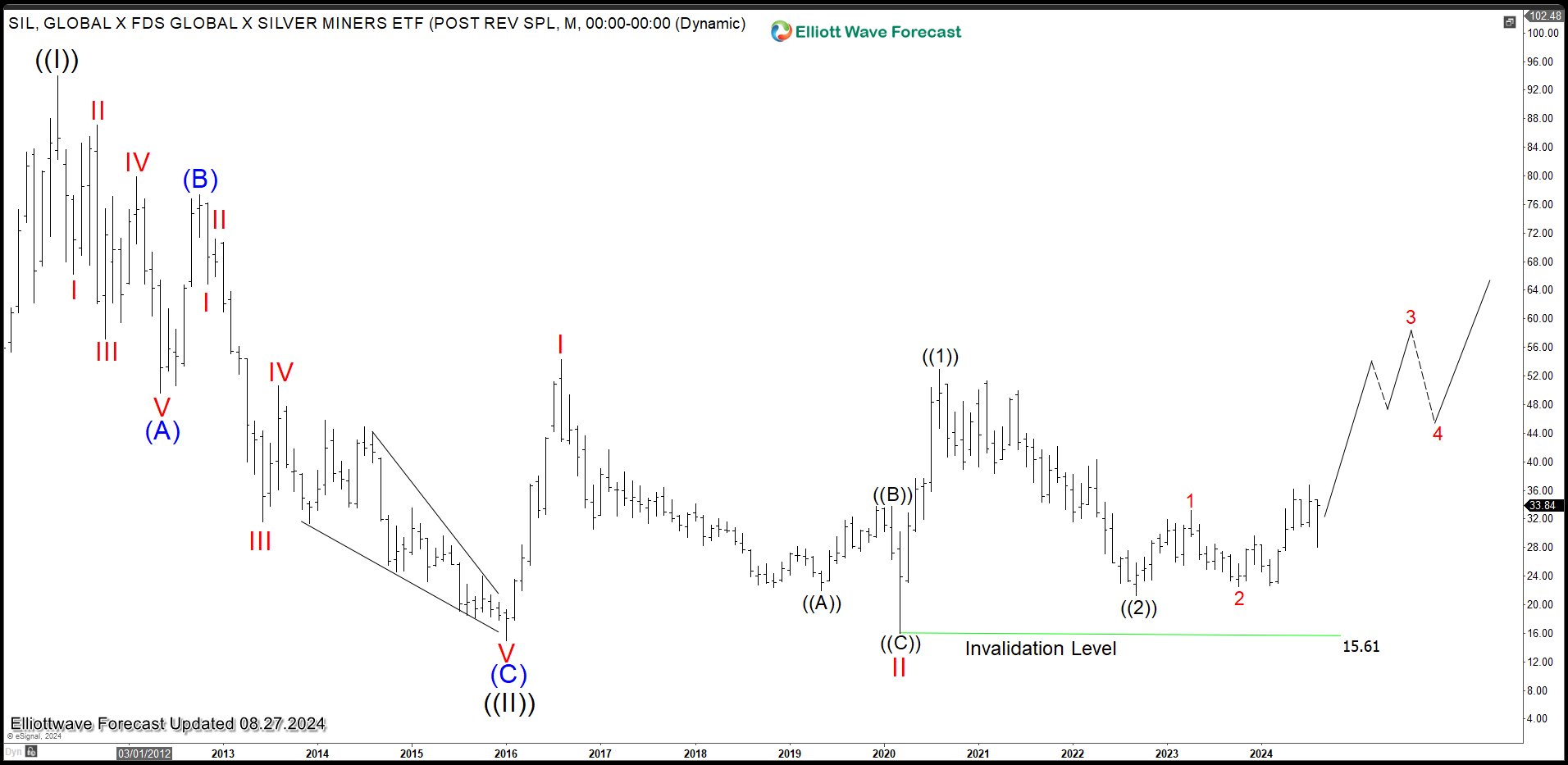

SIL (Silver Miners ETF) Monthly Elliott Wave Chart

Monthly Elliott Wave chart of SIL above shows the ETF has been in consolidation since 2016 low at 14.94. We labelled this low as Grand Super Cycle wave ((II)). Up from there, the ETF is nesting higher as an impulse. Wave I ended at 54.34 and pullback in wave II ended at 15.61. The ETF then extended higher again in wave III. Up from wave II, wave ((1)) ended at 52.87 and pullback in wave ((2)) ended at 21.26. As far as pivot at 15.61 low is intact, expect the ETF to extend higher.

Monthly Elliott Wave chart of SIL above shows the ETF has been in consolidation since 2016 low at 14.94. We labelled this low as Grand Super Cycle wave ((II)). Up from there, the ETF is nesting higher as an impulse. Wave I ended at 54.34 and pullback in wave II ended at 15.61. The ETF then extended higher again in wave III. Up from wave II, wave ((1)) ended at 52.87 and pullback in wave ((2)) ended at 21.26. As far as pivot at 15.61 low is intact, expect the ETF to extend higher.

Silver Miners ETF Daily Elliott Wave Chart

Daily Elliott Wave Chart of Silver Miners ETF (SIL) above shows rally from wave ((2)) low is in progress. Up from wave ((2)), wave 1 ended at 33.24 and wave 2 ended at 22.57. The ETF extended higher in wave ((i)) towards 36.75 and dips in wave ((ii)) ended at 28.02. Near term, as far as pivot at 21.16 low stays intact, expect pullback to find support in 3, 7, or 11 swing for further upside.

Daily Elliott Wave Chart of Silver Miners ETF (SIL) above shows rally from wave ((2)) low is in progress. Up from wave ((2)), wave 1 ended at 33.24 and wave 2 ended at 22.57. The ETF extended higher in wave ((i)) towards 36.75 and dips in wave ((ii)) ended at 28.02. Near term, as far as pivot at 21.16 low stays intact, expect pullback to find support in 3, 7, or 11 swing for further upside.

SIL Elliott Wave Video

SIL is not part of our regular service, but we cover Silver, Gold, and other commodities, ETF, Indices, Stock, and Forex. If you’d like to learn more about Elliott Wave or get regular updates, feel free to check our service and take trial here –> 14 Days Trial

The post Silver Miners ETF (SIL) Starting the Next Bullish Leg appeared first on Elliott wave Forecast.