Chargebacks911

Restore Online Shoppers’ Confidence Act

How Does the Restore Online Shoppers’ Confidence Act, or ROSCA, Impact Subscription Businesses?

The Restore Online Shoppers’ Confidence Act, also known as ROSCA, was approved by both chambers of congress and signed into law by the president on December 29, 2010.

The act introduces two main restrictions on businesses. First, it bans internet-based sales by third parties following an initial transaction. Second, it sets out specific conditions for the use of negative-option billing.

So, if you’re a consumer, how exactly does this benefit you? Or, if you’re a subscription-based merchant, how does it impact your operations? Let’s take a look.

Recommended reading

- Discover Chargeback Time Limits: The 2024 Guide

- American Express Chargeback Time Limits: The 2024 Guide

- Chargeback Time Limits: the Merchant’s Guide for 2024

- Chargeback Legal Process: Is There a Step After Arbitration?

- Computer Fraud and Abuse Act: 10 Must-Know Facts & Tips

- Understanding Chargeback Fees: How to Reduce Your Costs

What is the Restore Online Shoppers’ Confidence Act?

- ROSCA

-

The Restore Online Shoppers’ Confidence Act is a US federal law that prohibits any post-transaction third-party seller from charging any financial account in an internet transaction unless it has disclosed clearly all material terms of the transaction and obtained the consumer’s express informed consent to the charge. In other words, the seller must obtain the number of the account to be charged directly from the consumer in order to process a sale.

[noun]/ros • ka/

In simple terms, ROSCA protects consumers against a practice called data passing.

Data passing refers to a practice by which a merchant took a cardholder’s information and then passed it to a third party. This third party could charge the buyer for another transaction without first getting the buyer’s permission.

This practice is mostly relevant when talking about negative-option billing; a model business by which a merchant charges a buyer for a product unless the buyer explicitly cancels first. ROSCA didn’t ban this practice, as there are legitimate uses for negative-option billing, like free trials for subscription services. However, it puts clearer limitations on how negative-option billing can be used. This is why you don’t see ads for those Columbia House “12 CDs for 1 cent” deals anymore.

Why Was ROSCA Passed?

The Restore Online Shoppers’ Confidence Act was passed by the US Congress to address growing concerns about deceptive online sales and marketing practices that were considered harmful to consumers.

Before ROSCA, there were significant issues with online transactions that lawmakers aimed to rectify. Practices like abuse of negative-option billing, third-party billing, and misleading sales tactics were common. Lawmakers were concerned about:

Before ROSCA, companies could sign consumers up for subscriptions or recurring services without their clear consent. Often, the terms for cancellation were either not disclosed, or were made overly complicated, making it difficult for consumers to opt-out.

Advertisements and marketing strategies that obscured the true cost or terms of a purchase were rampant. This included hidden fees, undisclosed subscription models, and misleading trial offers.

Consumers were often billed for products or services by third parties they had not directly engaged with. This was particularly common in cases where initial transactions with a primary vendor led to the undisclosed sharing of payment information with affiliates or partners.

Before ROSCA, negative-option billing and third-party sellers often operated with minimal oversight or transparency. This led to consumer complaints and legal actions, but many consumers were simply out of luck if they got taken in by a scammer.

The act was designed to increase transparency in online transactions. It helped ensure that consumers are fully informed about the cost and terms of their purchases before they enter into any agreement.

ROSCA & Post-Transaction Third-Party Sales

The “post-transaction third-party sales” aspect of the Restore Online Shoppers’ Confidence Act is particularly aimed at addressing concerns related to transactions that occur after an initial purchase is made online. This part of the legislation focuses on the practices where consumers, after completing a primary transaction, are presented with additional offers from third-party sellers.

As mentioned above, before ROSCA, there were significant issues with how these third-party offers were presented and consented to by consumers. Often, consumers did not realize that accepting these offers would result in additional charges.

ROSCA implemented specific requirements for post-transaction third-party sales, including:

Clear & Conspicuous Disclosure

ROSCA requires full and informed disclosure. That all terms of the third-party offer, including the fact that entering into the transaction will result in a charge, must be disclosed clearly and conspicuously to the consumer.

Express Informed Consent

Third-party sellers are prohibited from charging any consumer unless they have obtained the consumer’s express informed consent for the charge. Consumers must actively agree to the transaction. They must fully understand that they are consenting to a purchase and its associated charges.

Prohibition of Data Sharing for Billing Purposes

ROSCA specifically prohibits merchants from passing payment information to a third-party seller. For a third-party transaction to occur, the consumer must directly provide payment information to that third-party seller. This prevents unauthorized charges and enhances consumer control.

Consumers now have a clearer understanding of what they are agreeing to with a purchase. They must provide explicit consent before any additional charges are made. This has helped to restore trust in online transactions and protect consumers from unwanted charges. The result: a more transparent and fair online marketplace.

How ROSCA Impacts Negative-Option Merchants

The Restore Online Shoppers’ Confidence Act directly impacts merchants who use negative-option billing. It imposes specific requirements to ensure that consumers are adequately informed before a purchase. The buyer must have explicitly consented to the billing practices in question.

Here’s how ROSCA impacts negative-option merchants specifically:

Clear & Conspicuous Disclosure of Terms

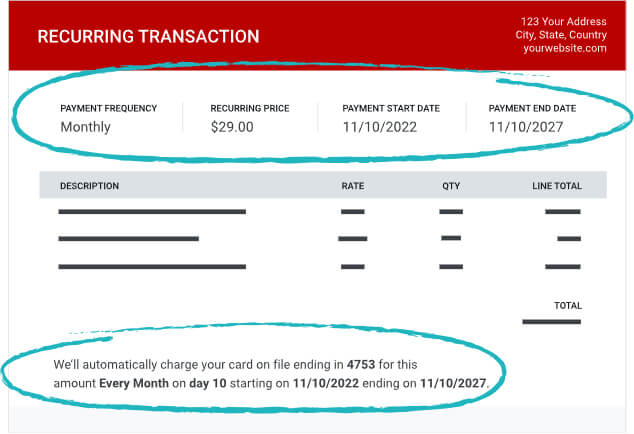

ROSCA requires that all material terms of the negative-option feature be disclosed clearly and conspicuously before obtaining the consumer’s billing information. This includes the cost of the goods or services. It also covers the frequency of recurring charges and the duration of the commitment the consumer is making. This disclosure must be made in a manner that is understandable to the average consumer. It must also be easily noticed; it can’t be hidden in tiny, indecipherable print.

Easy & Effective Cancellation Mechanism

ROSCA mandates that merchants provide a simple and straightforward way to cancel any recurring charges. This requirement aims to ensure that consumers can easily withdraw from the negative-option agreement without facing undue hurdles or complications. The cancellation process must be as easy to engage as the process for enrollment was.

Operational Adjustments

Negative-option merchants may have had to adjust their online checkout processes, marketing materials, and customer service protocols to comply with ROSCA. This includes redesigning web pages to ensure clear disclosure. Other common changes included modifying systems to capture express consent effectively, and implementing user-friendly cancellation processes.

Establishes Legal & Financial Penalties for Abusive Practices

Merchants who fail to comply with ROSCA face legal and financial risks, including actions by the FTC and potential lawsuits from consumers. Compliance with ROSCA is, therefore, not just a matter of legal obligation but also a business imperative to avoid penalties and maintain a positive brand reputation.

Did You Know?

ROSCA has significantly impacted how negative-option merchants operate. The law made it mandatory for them to conduct their businesses in a way that prioritizes consumer transparency, consent, and ease of cancellation.

How ROSCA Benefits Consumers & Merchants

Since its enactment, ROSCA has contributed to a noticeable improvement in the online shopping landscape for cardholders. This delivered benefits for consumers, of course, but it also benefited merchants.

ROSCA requires clearer disclosures, explicit consent, and easier cancellation processes. Thus, the act has directly addressed some of the core issues that made online shopping risky for consumers. This makes the online shopping landscape more fair and trustworthy for everyone, with benefits that redound to merchants.

Here are a few examples of how ROSCA improved the eCommerce landscape:

Ultimately, ROSCA has played a pivotal role in improving the online shopping environment. It implemented measures that ensure greater transparency, consent, and control over transactions.

It’s true that no single law or resolution can eliminate all potential for abuse. That said, ROSCA’s provisions have significantly mitigated the risks associated with online shopping. The result has been a safer and more consumer-friendly marketplace for all.

FAQs

What was the purpose of the Restore Online Shoppers Confidence Act?

The Restore Online Shoppers’ Confidence Act (ROSCA) aims to protect consumers from deceptive online marketing practices by requiring clear disclosure of terms and obtaining explicit consent for recurring charges, particularly in post-transaction third-party sales and negative-option billing. It ensures consumers are fully informed and agree to any charges made to their accounts in online transactions.

What is the ROSCA statute?

The ROSCA statute is a federal law designed to enhance consumer protection in online transactions by prohibiting undisclosed post-transaction charges and requiring explicit consumer consent for recurring charges.

What is a negative option feature?

A negative option feature in a subscription or agreement allows a seller to interpret a customer’s failure to take an affirmative action to reject an offer or cancel a deal as acceptance or continuation of the contract. Essentially, if the customer does not explicitly opt out, they are automatically enrolled or continued in the service.

Is negative option marketing illegal?

No. Negative option marketing is legal in many jurisdictions, provided it complies with specific regulatory requirements. For instance, clear disclosure of terms and conditions and ensuring consumers have a straightforward method to cancel or opt out. However, deceptive practices within negative-option marketing can lead to legal challenges and regulatory action.

This post Restore Online Shoppers’ Confidence Act appeared first on Chargebacks911