Rane Holdings Ltd an investment and strategic arm of the Rane Group, the company drives growth across the auto component spectrum—from steering systems and seat belts to advanced safety components like airbags and friction materials. Its financial strength, proactive management, and diversified revenue base have allowed it to adapt smoothly to the cyclical nature of the auto industry. Let’s dive deeper into the company.

- About the company

- Holding Structure

- Journey Since Inception

- Board Members

- Shareholding Pattern

- Subsideries & Joint Ventures

- Revenue Segment

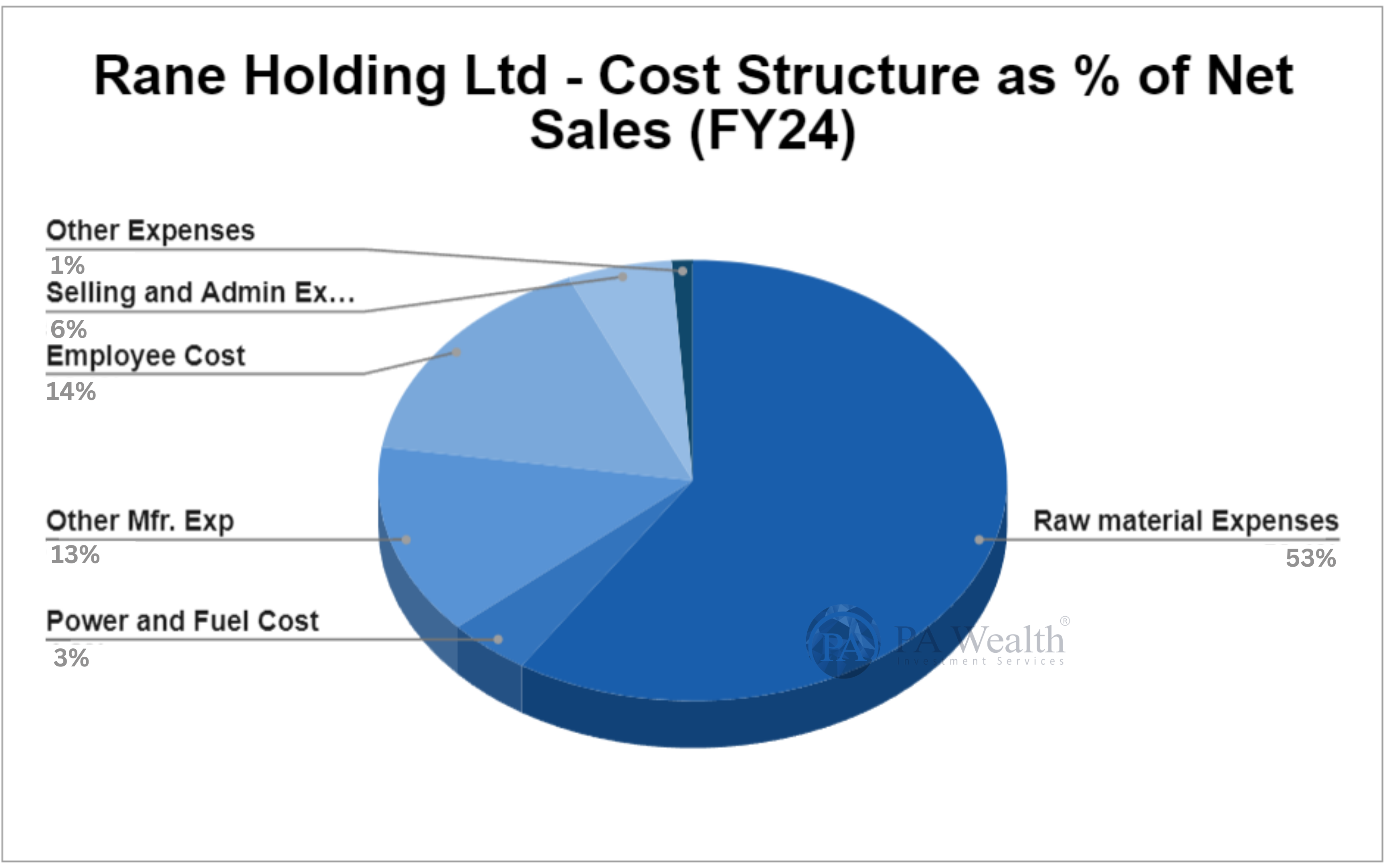

- Cost Structure

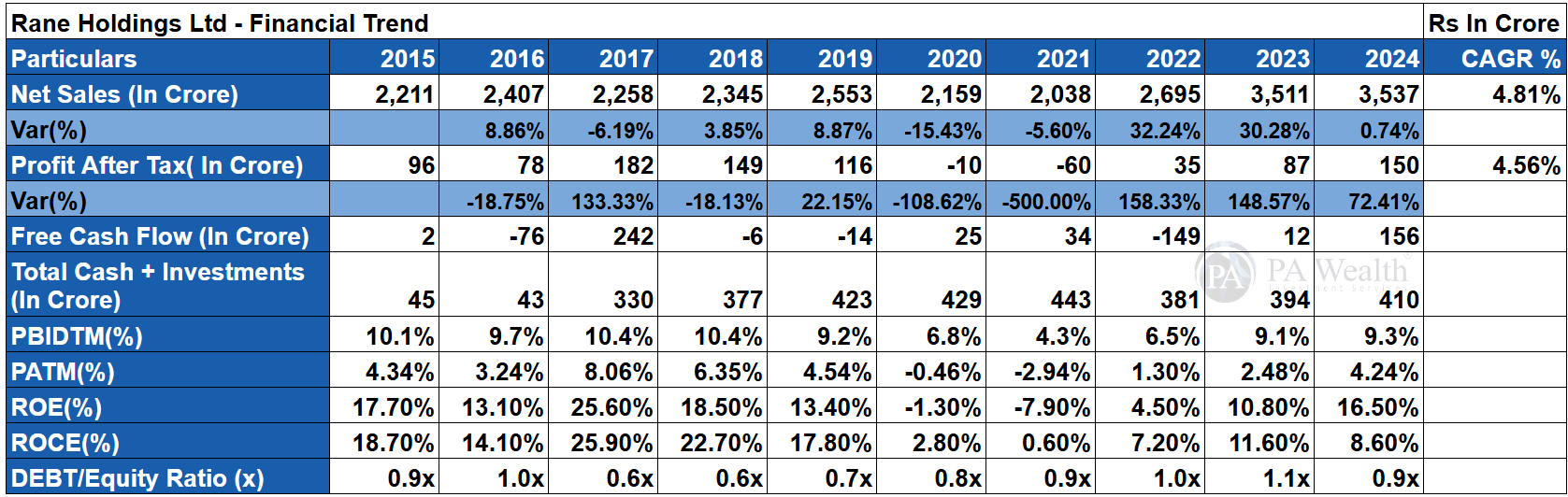

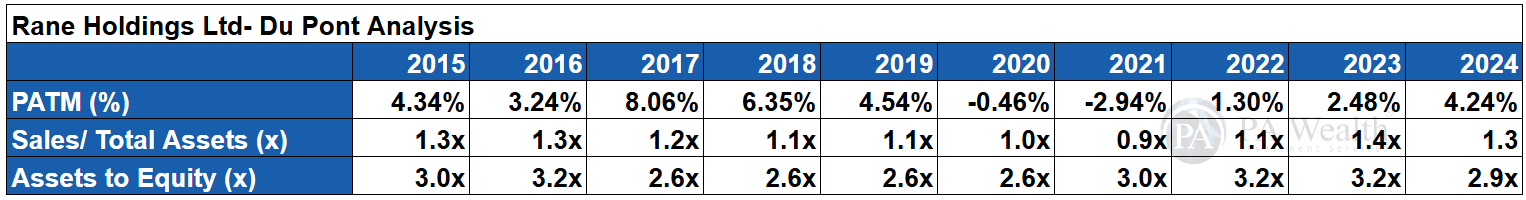

- Financial Parameters

- Management Key Highlights

- Strengths & Weaknesses

(A) About

Rane Holding is the holding company of the larger Rane Group, involved in auto-component manufacturing, with aggregate revenues of over Rs. 6,800 crore in FY2023. Company also owns the trademark in Rane and provides a range of services to group companies. This include employee training and development, investor services, business development and also Information systems support.

(B) Holding Structure

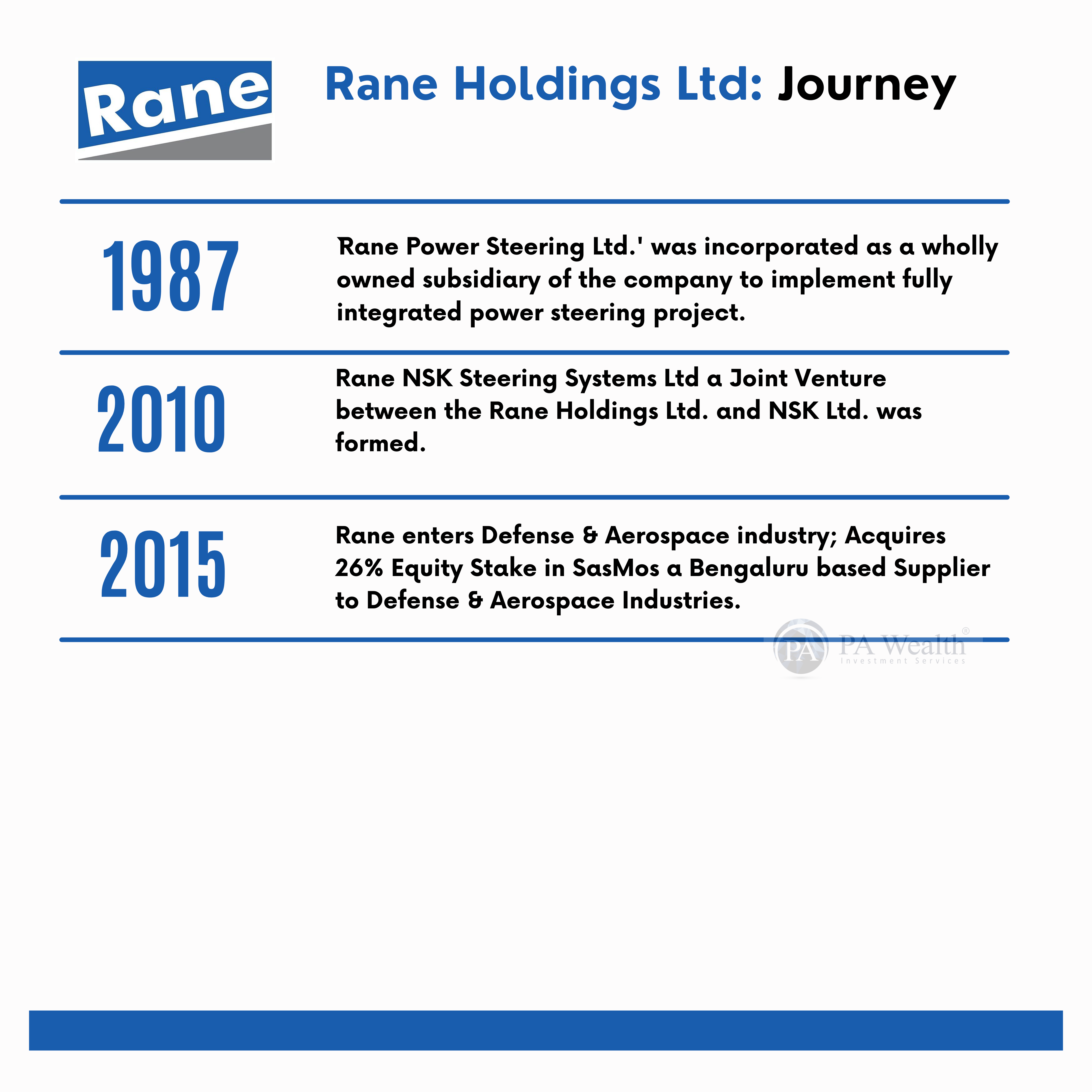

(C) Journey

(D) Board of Directors

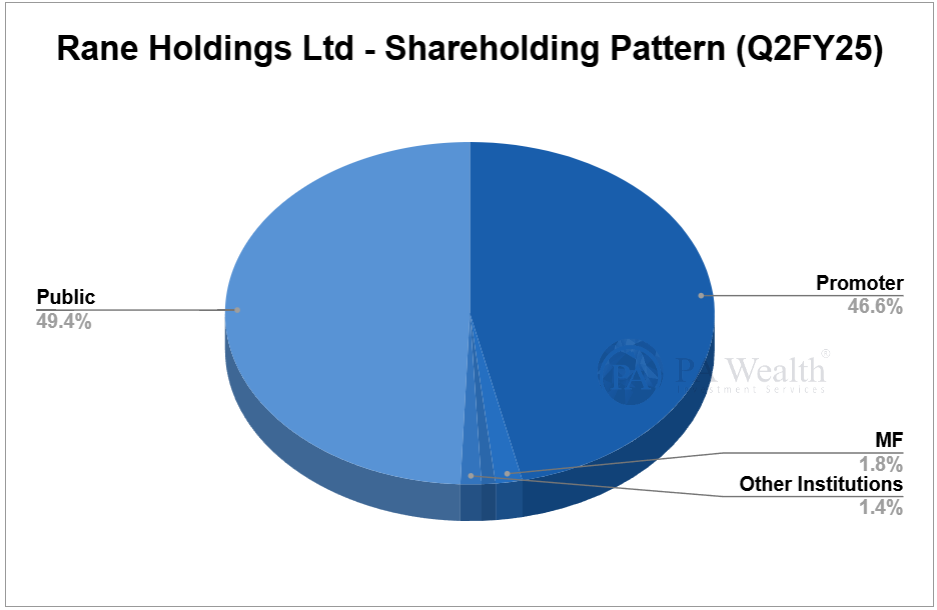

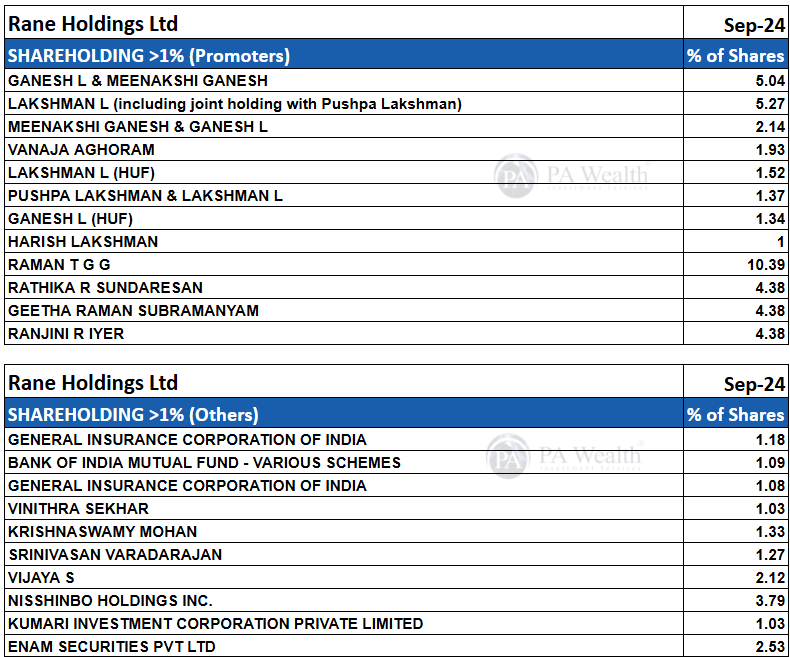

(E) Shareholding Pattern

(F) Subsideries & Joint Ventures

(i) Rane (Madras) Ltd

It manufacture steering and suspension linkage products and specialized aluminum high pressure die-casting products and also provides connected mobility solutions. It has two business divisions:

Steering and Linkage Business – This includes Manual Steering Gears, Suspension components, Steering Linkage and also Hydraulic Products.

Light Metal Casting – Hydraulic Pinion Housings, Pumps Housing, Brake Housing, etc.

(ii) Rane Engine Valve Ltd

It manufactures components for the internal combustion engine applicable for stationary and transportation engine applications. They caters to non-automotive applications such as power generation, marine, defence, locomotive, etc. Its products include Engin Valves, Valve Guides and also Mechanical Tappets.

(iii) Rane Brake Lining Ltd

Rane Brake Lining is a leading auto component group based out of Chennai. It manufactures friction material procucts such as Brake Lining, Disc pads, Clutch facing, Clutch buttons, Brake Shoes and Railway brake blocks, etc.

Moreover, it hold a sizable market share in OEM and aftermarket segment for fricton materials (34%) in the OEM segment and 19% in the aftermarket.

(iv) ZF Rane Automotive India

It is the JV partnership with ZF Group, Germany. It has two divisions –

Steering Gear Division – This caters to design, development, and application capability for a complete Hydraulic Power Steering system for all vehicles.

Occupant Safety Division – Product range includes different types of airbags and latest seatbelt technologies, Refractor, Anchor pretensioners, etc.

(v) NSK Steering Systems

It was a Joint venture between Rane & NSK Japan. It manufactures various types of steering products like Electric power steering system, manual steering coumn and also Steering shafts.

(G) Revenue Segment

(i) By Market

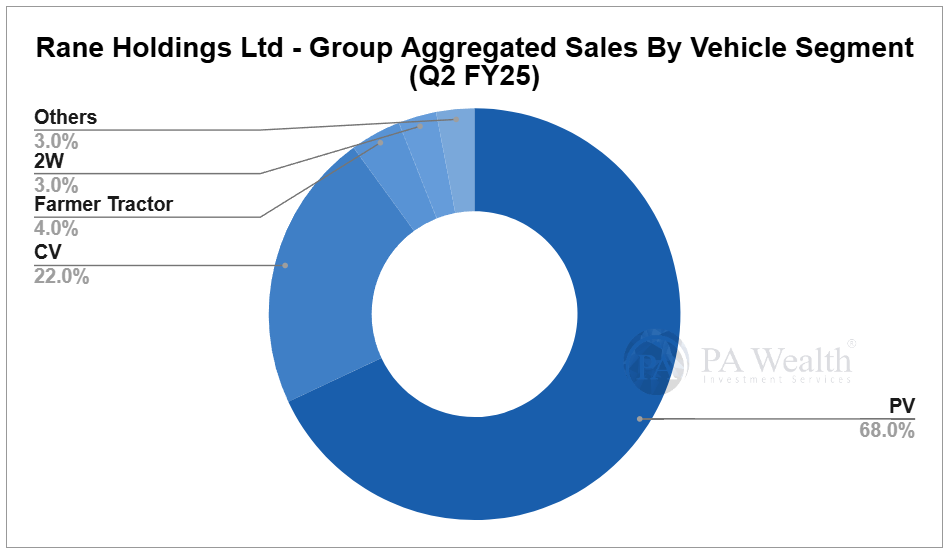

(i) By Vehicle Segment

(H) Cost Structure

(I) Financials

Company has grown its revenue at 4.81% in past 10 years, while PAT grew from Rs 96 Cr in FY14 to Rs 150 Cr in FY24 at a CAGR of 4.56%.

(J) Management Discussion & Concall

- The Company is focusing on Aftermarket segment leveraging strong in house engineering capabilities. And also increasing its efficiencies across manufacturing facilities through operational excellence and digitalization.

- Rane Holdings completes acquisition of 51% stake from NSK in JV.

- Planning to invest about ₹1,000 crores over the next three years.

- Targeting a return on capital employed of 20% plus on all investments.

- Furthermore, ZF Rane Automotive India Private Limited acquired 100% of TRW Sun Steering Wheels Private Limited.

- Revenues from International customers decreased by 10% predominantly on account of the divestment of LMCA business. On an organic basis, it declined by 2%.

- Company further announced the setting up a facility in Mexico for its steering business.

(K) Strengths & Weaknesses

Strengths

Leading position in India’s auto steering market – Company is a leading player in the domestic steering market and also has a strong presence in Occupancy safety system, Friction material components, Value train components and others.

Relatively lower debt levels than the market value of unencumbered listed investments – Its standalone debt and letter of comfort, compared to the market value of its unencumbered listed investments, have been low for the last several years, lending strong financial flexibility to the company. This is despite the increase in RHL’s debt levels in the last three to four years compared to past levels owing to debt-funded investments. In addition, RHL also has high returns offering unlisted investments in ZFRAIPL and RNSSPL.

Weaknesses

Exposure to demand cyclicality and pricing pressures from OEMs in automobile industry – Its high dependence on the OEM segment, renders its performance partly vulnerable to the inherent cyclicality in the automobile industry and any prolonged slowdown, particularly in the CV segment. However, revenue from aftermarket and exports provide some respite; besides presence across OEM sub segments is also expected to lend certain level of stability to business.

Supply chain constraints – Leading to shortage of chips, high cost of raw material, increase in logistics cost and also rising fuel prices could impact growth for the industry.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: Annual Reports, News Publications, Investor Presentations, Corporate Announcements, Management Discussions, Analyst Meets and Management Interviews, Industry Publications.

Disclaimer: The report only represents the personal opinions and views of the author. No part of the report should be considered a recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore

The post Rane Holdings Ltd – Next Big Player in the Auto Ancillaries? appeared first on PA Wealth.