- About the Quant Momentum Fund

- Basic Details

- Classification Portfolio of the fund

- Fund Managers & Tenure of managing the Scheme

- Fund – Investment Details

- Returns Generated

- Risk Factors

- Investment Philosophy

- Taxability of Earnings

(A) About the Quant Momentum Fund

The Quant Momentum Fund is an open-ended equity scheme. This fund falls into the equity category, and more specifically, it’s classified as a Thematic Fund. Thematic funds are equity mutual funds that invest in stocks based on a particular theme, such as infrastructure, international stocks, rural India, or commodity stocks. Thematic funds are also known as sectoral funds.

(B) Basic Details of Quant Momentum Fund

| Fund House | Quant Mutual Fund |

| Category | Equity: Thematic |

| Launch & Start Date | 21-November-2023 |

| Type | Open-ended |

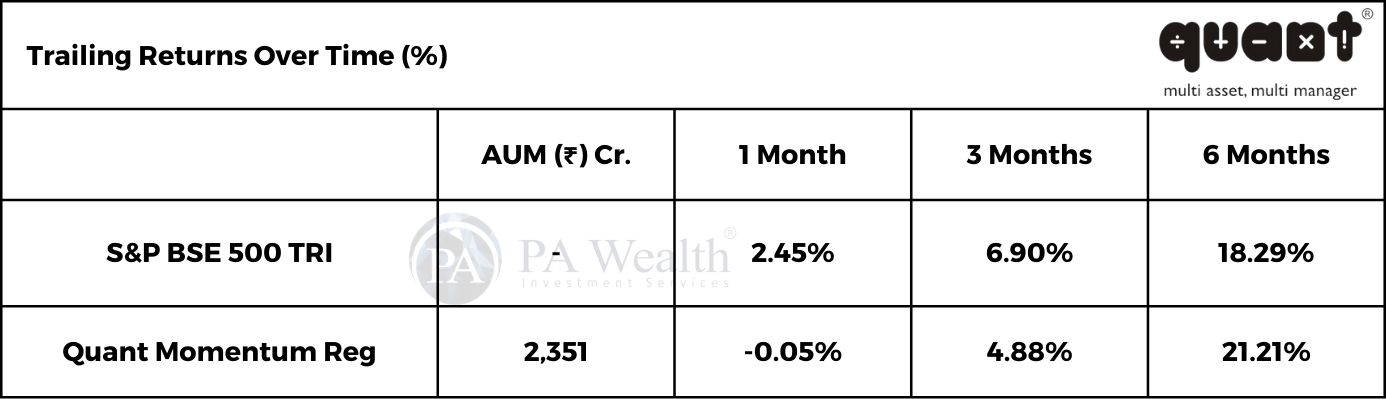

| AUM | ₹2,351 Cr (As on 31 Aug 2024) |

| Available at NAV of | ₹15.87 (As on 09 Sep 2024) |

(C) Classification Portfolio of the fund

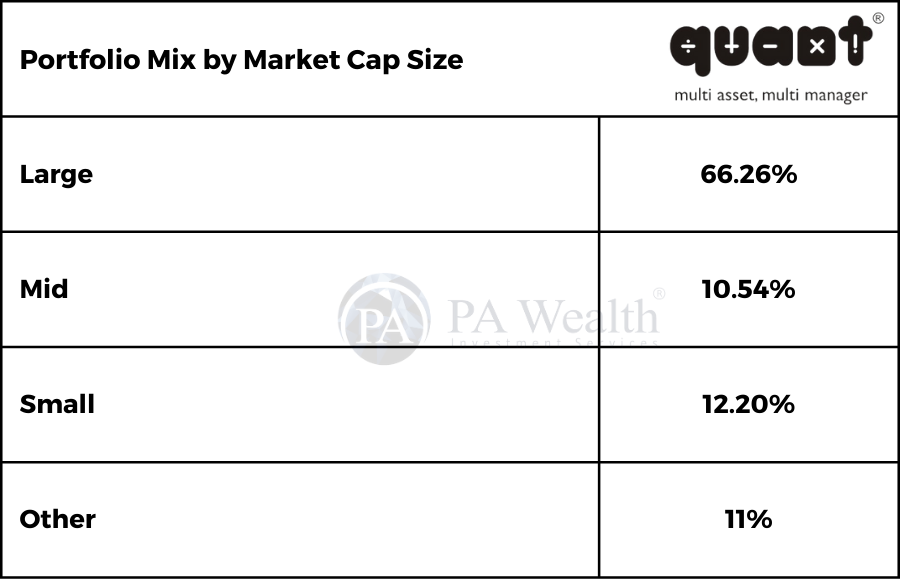

(i) Portfolio Mix by Market Cap Size

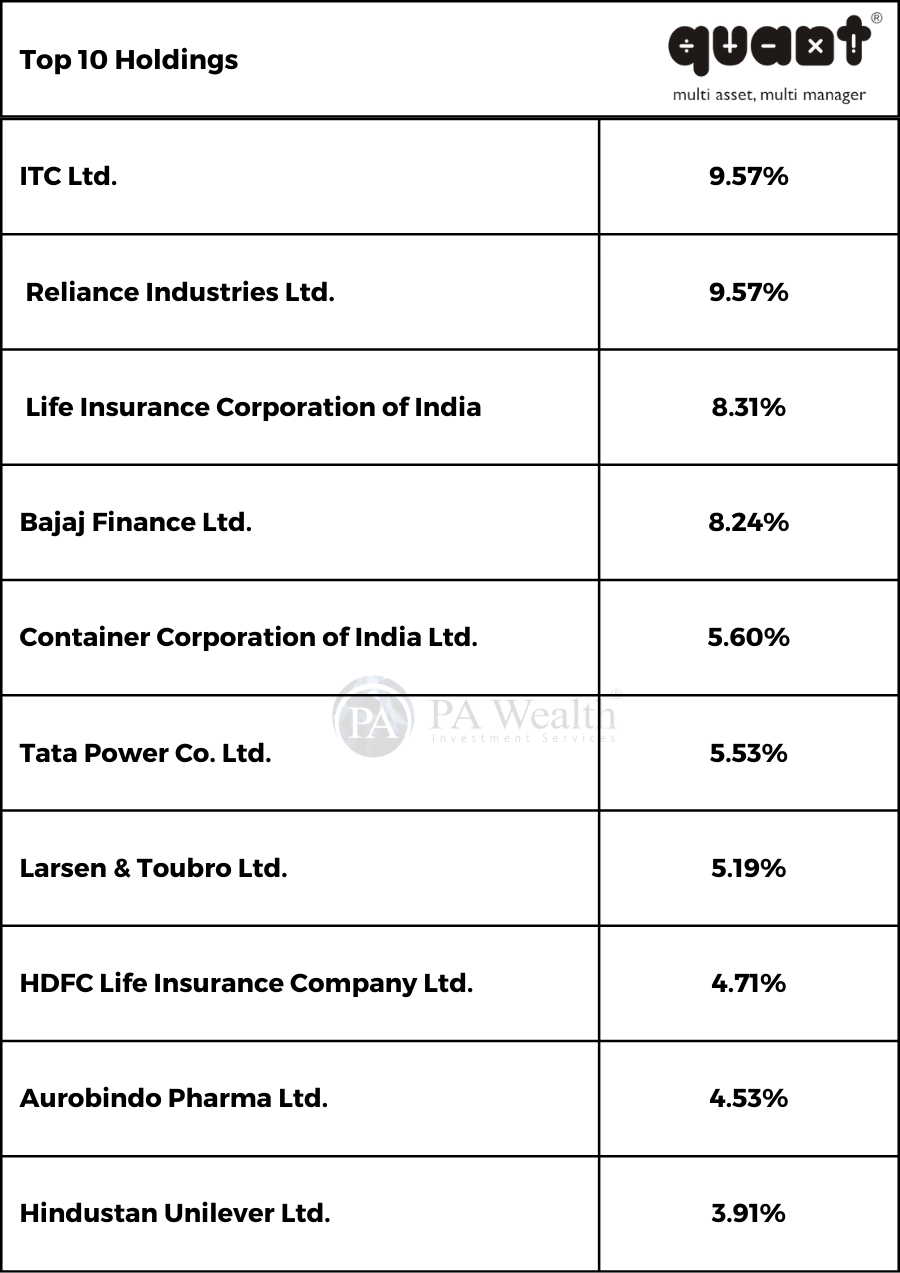

(ii) Top 10 Holdings of the fund

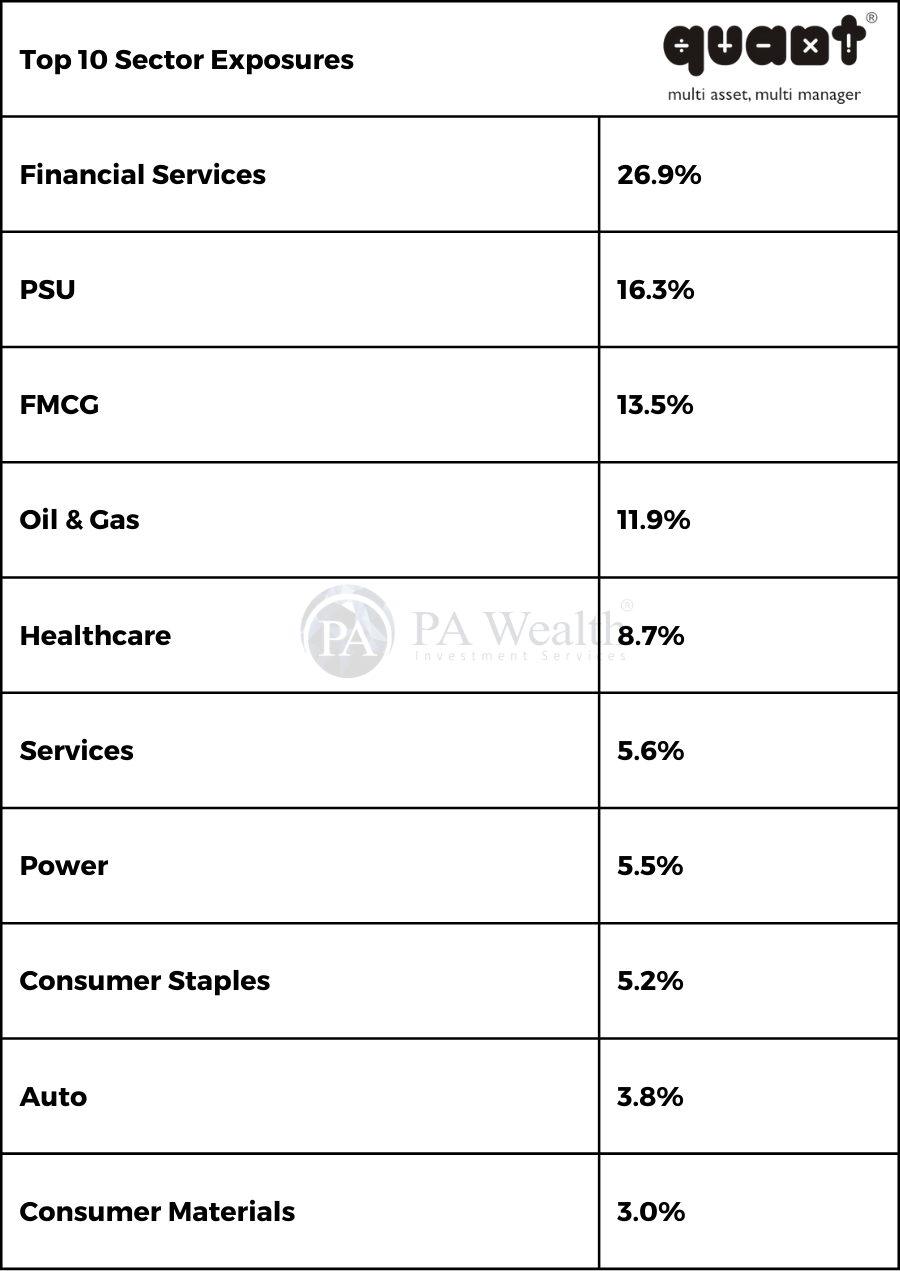

(iii) Top 10 Sectors Exposures

(D) Fund Managers & Tenure of managing the Scheme

(E) Fund – Investment Details

| Quant Momentum Fund | |

|---|---|

| Application Amount for fresh Subscription (Lumpsum) | ₹5,000 |

| Min Additional Investment (SIP) | ₹1,000 |

| Exit load | 1%* |

| Lock In | No |

| Expense Ratio | 0.74% (As on 31 July 2024) |

(F) Returns Generated By The Fund

(G) Risk Factors

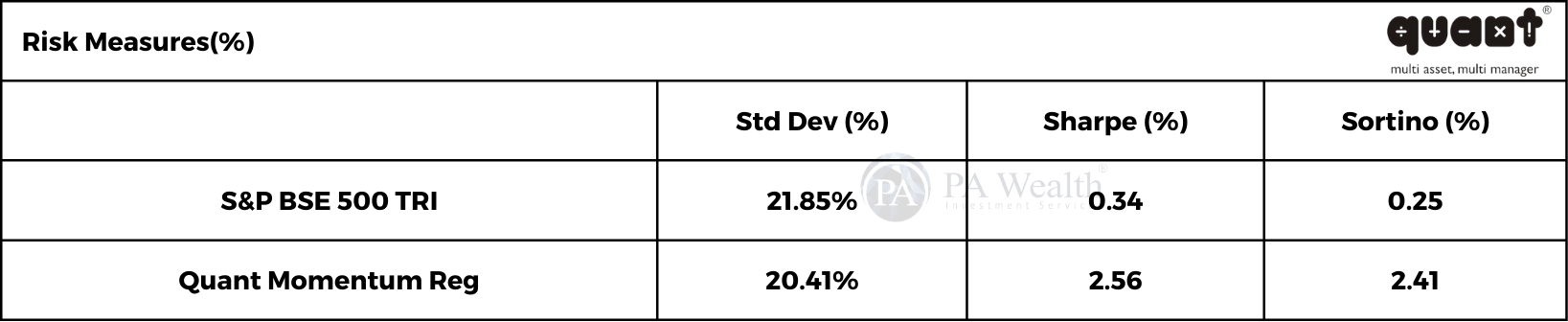

(i) Valuation Measures

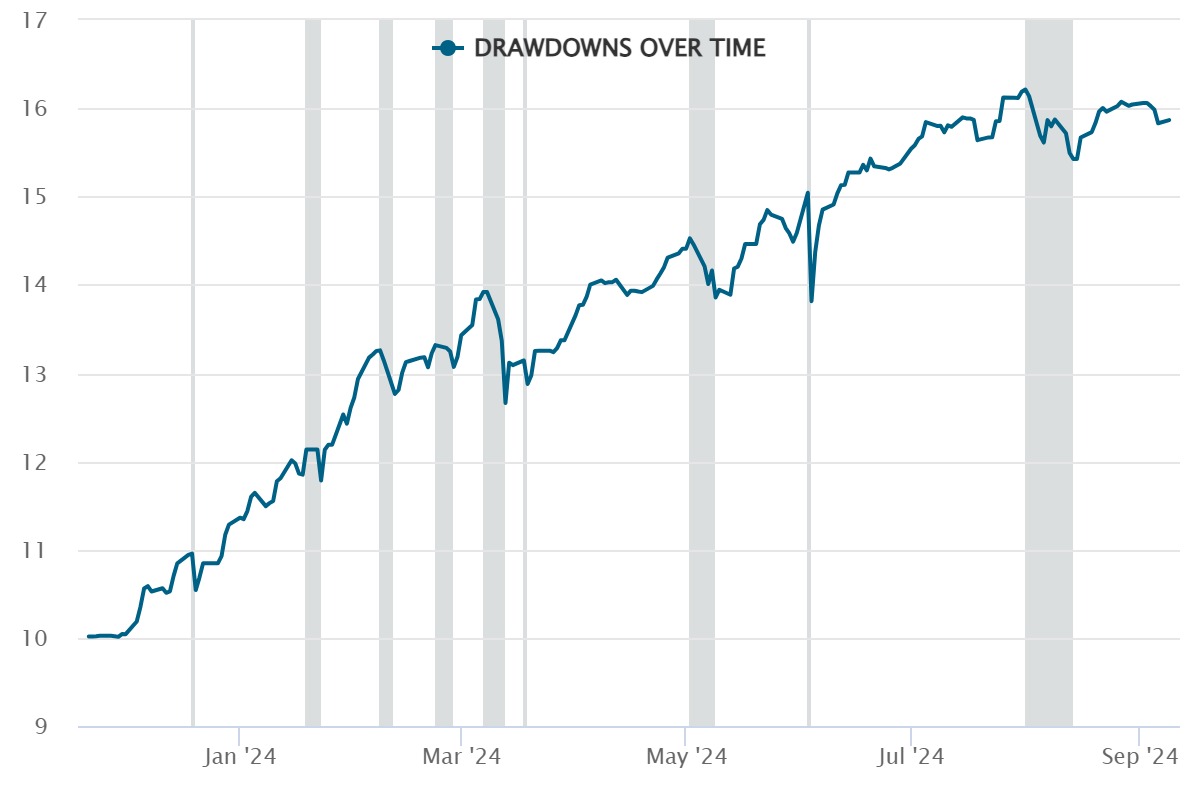

(ii) Top Drawdowns

This chart shows the ups and downs of a fund’s value from 2023 to now. When the fund’s value drops from its peak, it’s called a drawdown. The shaded area shows how long the fund stayed in a drawdown.

This chart helps investors understand how the fund has reacted to big events in the economy.

(H) Investment Philosophy

- The scheme seeks to achieve long-term capital appreciation for its investors.

- This objective will be pursued by strategically investing in a diversified portfolio of equity and equity-related instruments.

- The selection of these instruments will be based on a quantitative model meticulously designed to identify potential investment opportunities that exhibit the potential for significant capital appreciation over the specified investment horizon.

(I) Taxability on earnings

Taxation

Capital Gains Taxation

- If the mutual fund units are sold after 1 year from the date of investment, gains up to Rs 1.25 lakh in a financial year are exempt from tax. Gains over Rs 1.25 lakh are taxed at the rate of 12.5%.

- If the mutual fund units are sold within 1 year from the date of investment, entire amount of gain is taxed at the rate of 20%.

- No tax is to be paid as long as you continue to hold the units.

Dividend Taxation

- Dividends are added to the income of the investors and taxed according to their respective tax slabs. Further, if an investor’s dividend income exceeds Rs. 5,000 in a financial year, the fund house also deducts a TDS of 10% before distributing the dividend.

Drop us your query at – info@pawealth.in or Visit pawealth.in

References: valueresearchonline.com, Industry’s Publications, News Publications, Mutual Fund Company.

Disclaimer: The report only represents personal opinions and views of the author. No part of the report should be considered as recommendation for buying/selling any stock. Thus, the report & references mentioned are only for the information of the readers about the industry stated.

Most successful stock advisors in India | Ludhiana Stock Market Tips | Stock Market Experts in Ludhiana | Top stock advisors in India | Best Stock Advisors in Gurugram | Investment Consultants in Ludhiana | Top Stock Brokers in Gurugram | Best stock advisors in India | Ludhiana Stock Advisors SEBI | Stock Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Top stock advisors in India | Top stock advisory services in India | Best Stock Advisors in Bangalore

The post Quant Momentum Fund: Boost Your Portfolio with Strategic Growth appeared first on PA Wealth.