Looking for a clear and straightforward investing experience? You should probably consider a regulated firm that allows compensation options, diversifies your portfolio and uses advanced technology to manage your investment plans.

Read this Nutmeg.com review for more details on how this acclaimed company operates, what they have to offer and if the service meets your preferences.

| General information | |

| Name | Nutmeg |

| Type of the company | Investment Firm |

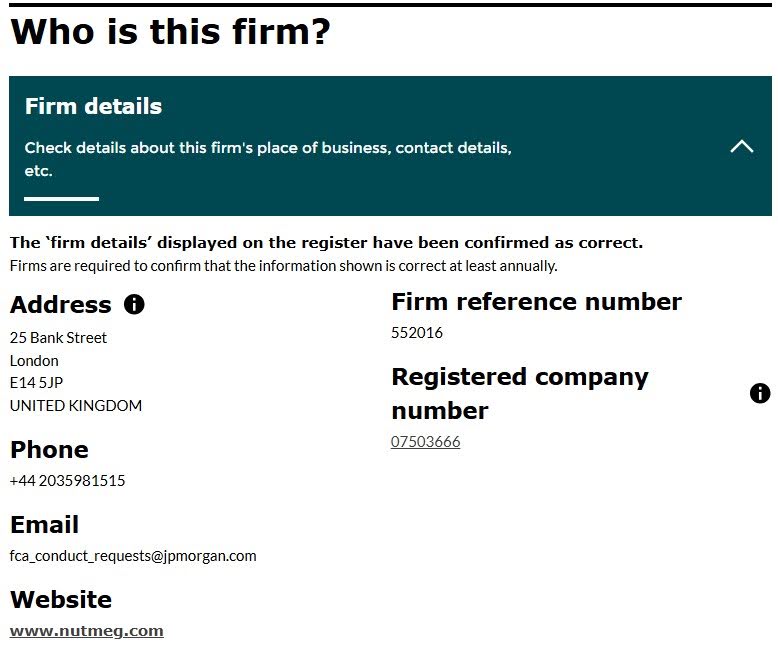

| Regulation status | Regulated by FCA |

| Warnings from Financial Regulators | No official warnings |

| Website link | nutmeg.com |

| Active since | 2011 |

| Registered in | UK |

| Contact info | 25 Bank Street, London, England, E14 5JP

+44 2035981515 020 3598 1515 – client services support@nutmeg.com |

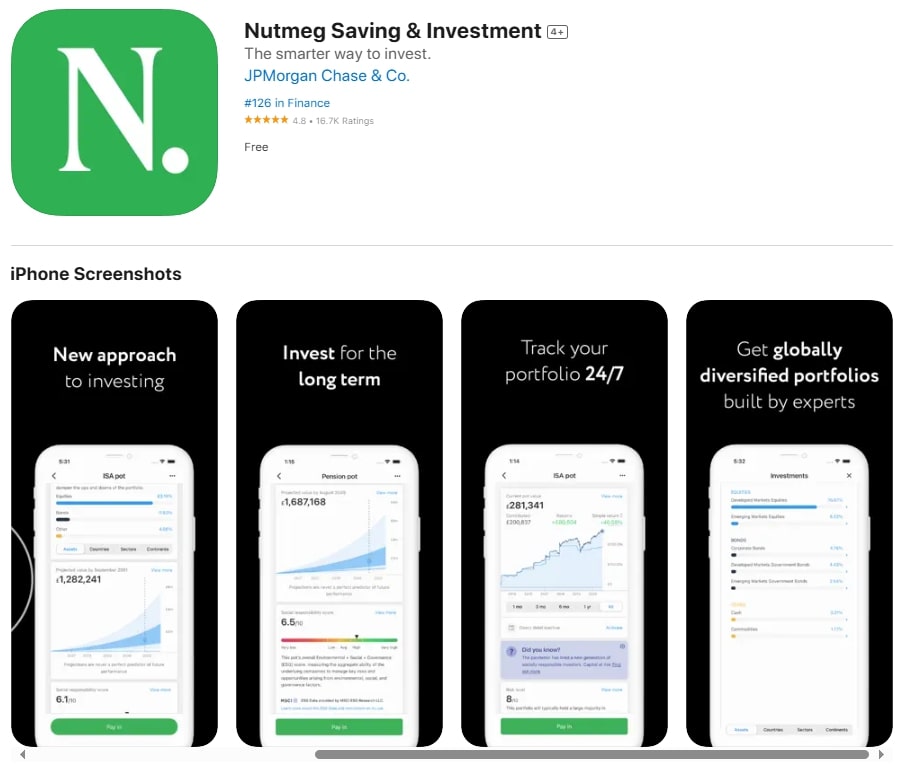

| Trading platforms | Nutmeg Saving & Investment app |

| Majority of clients are from | United Kingdom, United States, India, Ukraine, Germany |

| Customer support | Yes – phone, email, online chat |

| Compensation fund | Yes |

Who Owns Nutmeg.com Brand?

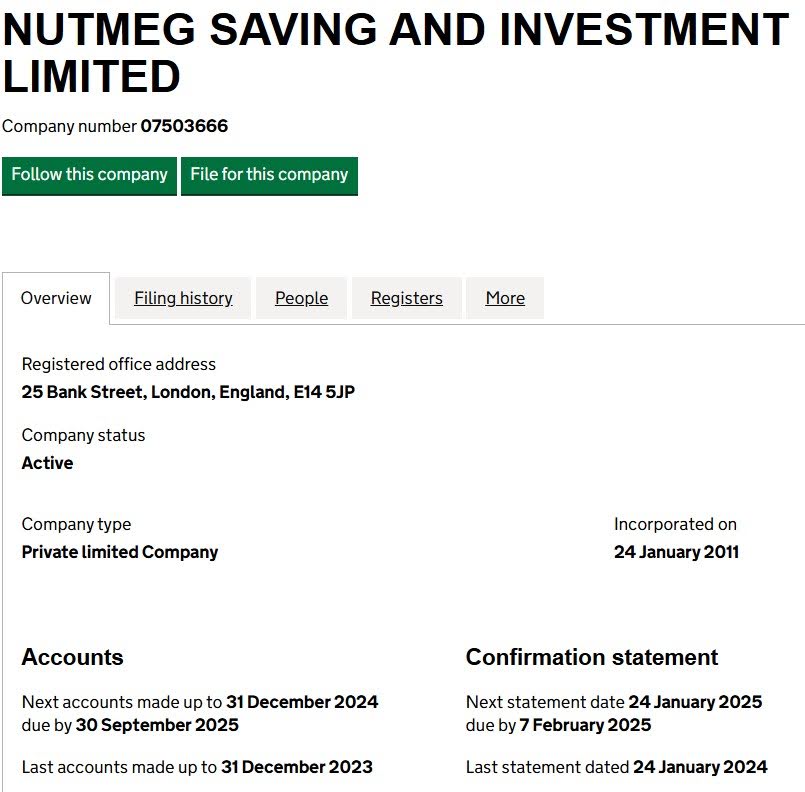

Nutmeg is an online investment services provider operating out of the UK. The company was first established in 2011, under the name of HUNGRY FINANCE LIMITED.

One year later, the firm changed its name to NUTMEG SAVING AND INVESTMENT LIMITED. It was registered under “Fund management activities” with the UK Companies house and has offices in Manchester, Edinburgh, Birmingham, Bristol, Glasgow, Cardiff, Belfast, Harrogate, London and Leeds.

The UK firm was established by Nick Hungerford (decd. 2023) and William Todd In 2011. Nutmeg was acquired by JPMorgan through a deal worth £700m in 2021. The digital wealth management giant has profiles on LinkedIn, Facebook, X and Instagram.

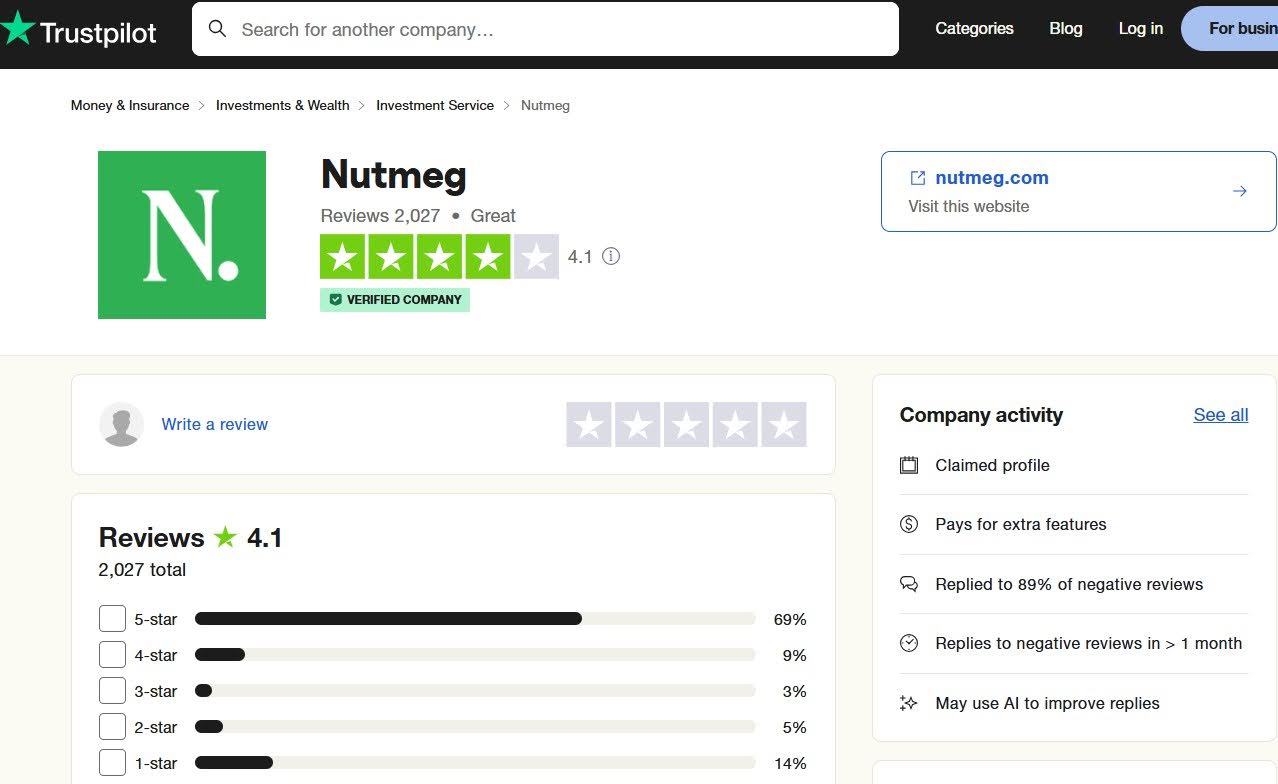

Another solid proof of how well the company is doing is the client satisfaction shown through the Nutmeg.com Trustpilot reviews.

Out of more than 2,000 reviews, the majority are positive and feature the highest ratings. Clients generally label the service as reliable, lucrative and intuitive, with the client support office being exceptionally helpful and responsive.

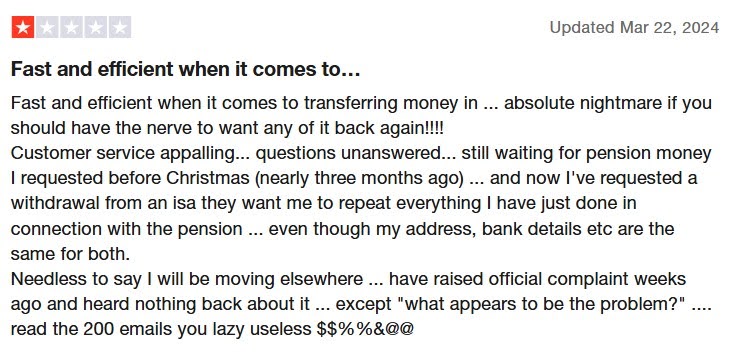

Of course, this wouldn’t be a brutally honest review if we ignored some of the Nutmeg.com complaints posted, as there’s a total of 14% of them on Trustpilot. Negative experience that clients report about pertains to delay in transfers, unpaid dividends and slow support.

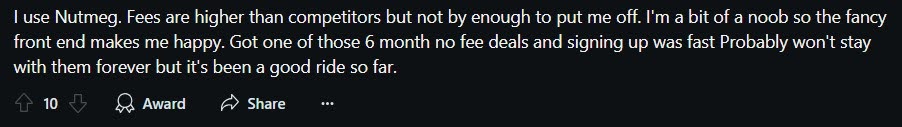

Another major drawback, according to the clients posting their opinions on Nutmeg.com Reddit topics is related to fees.

The company service is apparently described as expensive, with its fees slightly higher than competitors. While some clients don’t mind paying extra for the premier service, others are warned off by it.

Is Nutmeg.com Regulated?

A multinational finance conglomerate like JP Morgan wouldn’t choose to invest in a company unless it’s properly regulated, and conducts their business fairly and transparently.

Nutmeg has been supervised by one of the most diligent financial authorities in the world – Financial Conduct Authority (FCA) since 2011.

One of the most important aspects of this regulatory approval is that clients are able to complain to the Financial Ombudsman Service in case of irregularities and reclaim their investment through a compensation plan. Also, as per regulatory requirements, clients’ assets are held by trusted custodians, such as Barclays and State Street.

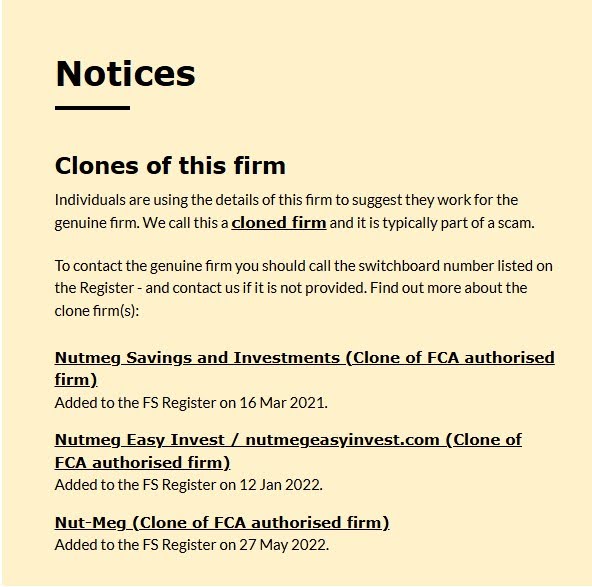

In addition, please also pay attention to the FCA notice about several fraudulent companies that are impersonating this firm. Be extra cautious if any of them approaches you and attempts to get you to invest.

Nutmeg.com Platform Overview

This service provider holds the number one position when it comes to UK based digital wealth management companies. With over 200,000 clients, the company holds over £5bn in Nutmeg.com AUM in 2023.

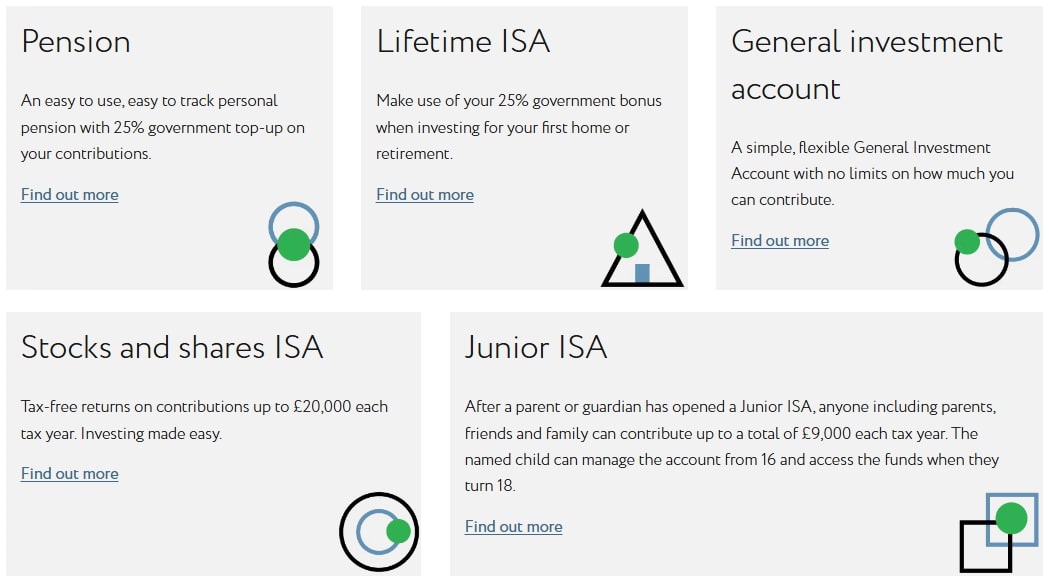

Several investment account types are available, including traditional ISA, Pension and Junior accounts. General investment account is available for all site visitors, although actually investing requires a relatively rigorous KYC policy.

Investing with the company is relatively easy. The firm specializes in ETF based investments, and will create a distinct portfolio for each client, taking into account their experience and personal preference.

The firm offers a selection of around 1,800 ETF instruments, grouped into a several types:

Investment tracking and updates may be done by email, although the preferred method remains the Nutmeg.com app.

This proprietary software is provided courtesy of JPMorgan Chase Bank, and may be downloaded for iOS and Android devices via a dedicated link. The app has an overall Nutmeg.com reviews score of 4.8 in over 200k separate downloads.

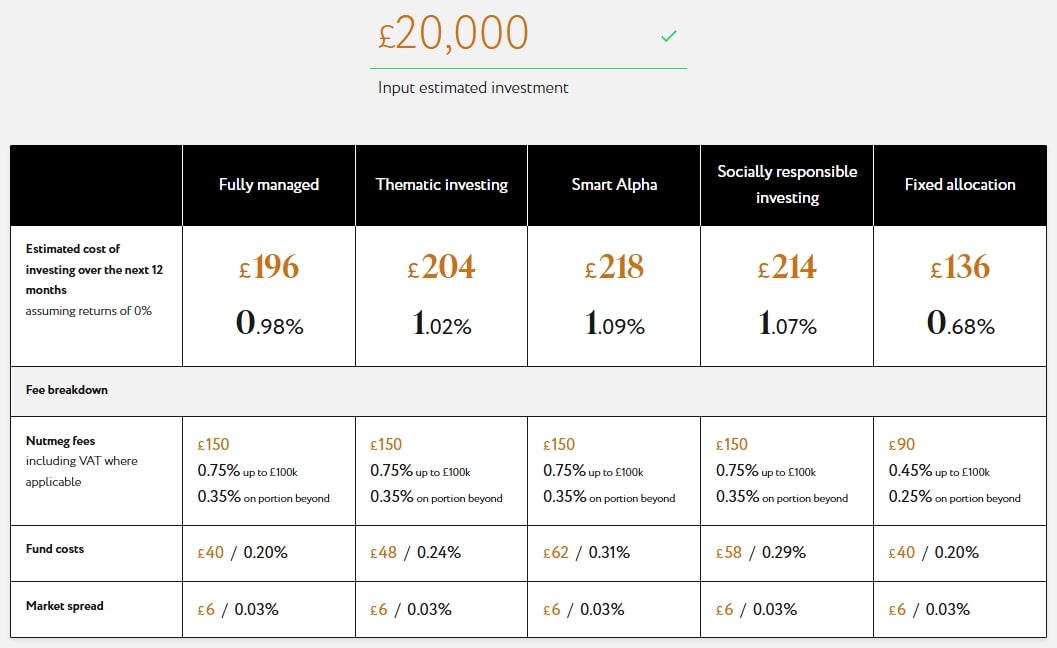

The service costs are well explained on the site, and may be divided into several Nutmeg.com fees. These are all calculated as a percentage amount, and the company even offers a free fee calculator on the site.

Here is an example of costs incurred for an investment of £20,000, calculated for a 0% annual return:

Overall, the service is quite transparent and approachable. If you wish to take the matter into your own hands and start trading, we invite you to take a look at one of our funded trading accounts.

How to Withdraw From Nutmeg.com Company?

Any payment processing is done through the client dashboard. Depending on the type of product, investment and current cash balance, the company may impose certain restrictions on withdrawals.

Otherwise, payouts may be done at any time. Should a required amount for withdrawal exceed current account balance, the company will sell off the investment in order to meet the client demand.

One thing worth noting is that the firm will always facilitate withdrawals to a UK bank account, unless instructed otherwise. If instructed to change the preferred payout method, the payout request may incur a delay or be denied if it exceeds reasonable business practices.

FAQ

What is Nutmeg.com?

Nutmeg.com is an online financial investment platform owned by JPMorgan.

Is Nutmeg.com Trustworthy?

Yes, the firm is recognized as a licensed entity by the leading UK regulatory body – FCA.

The post Nutmeg.com Review: Grow Wealth With Sharp Investment Advice appeared first on Fundevity.