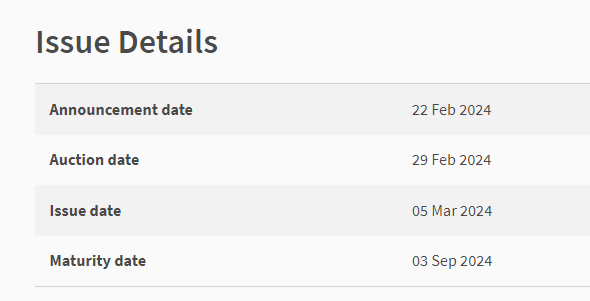

A Singapore Treasury Bill issue (BS24104T) will be auctioned on Thursday, 29 February 2024.

If you wish to subscribe successfully, get your order via Internet banking (Cash, SRS, CPF-OA, CPF-SA) or in person (CPF) by 28th February.

You can view the details at MAS here.

In the past, I have shared with you the virtues of the Singapore T-bills, their ideal uses, and how to subscribe to them here: How to Buy Singapore 6-Month Treasury Bills (T-Bills) or 1-Year SGS Bonds.

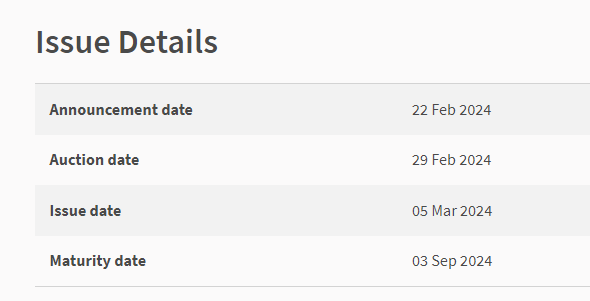

The cut-off yield successful Tbill bidders can earn is 3.66%.

If you select a non-competitive bid, you may be pro-rated the amount you bid and would yield 3.66%. If you would like to ensure you secured all that you bid, it will be better to select a competitive bid, but you need to get your bid right.

In competitive bidding, if your bid is lower than the eventual cut-off yield (in the example below), you will get 100% of what you bid for at the cut-off yield (not the lower yield that you bid for):

Competitive bidding is ideal for people who wish to secure fully what they wish to get for certain financial planning reasons, such as doing CPF Special Account (SA) shielding. But because we won’t know what is the cut-off yield, a rule of thumb I would use is half the least cut-off yield.

I have a few complaints that by putting this rule out there, I may be part of the reason the cut-off yield is lower. I feel that if someone has a certain financial planning reason (say SA Shielding) to bid lower, then I think that is natural. The auction system in place factors in characters that want the bonds regardless of the yield, and if there are a lot of people with such an urge, then the auction reflects that huge demand because when demand is big, the price (in this case, yield goes down) goes up.

Gaining Insights About the Upcoming Singapore T-bill Yield from the Daily Closing Yield of Existing Singapore T-bills.

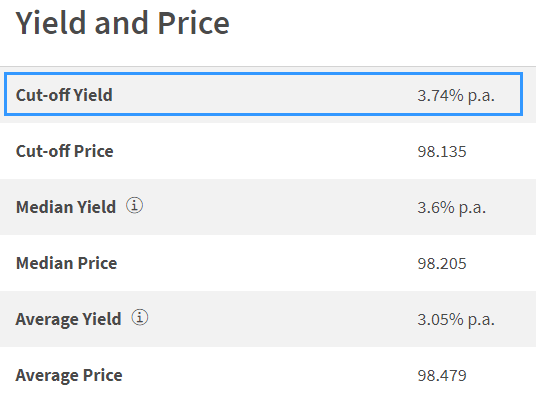

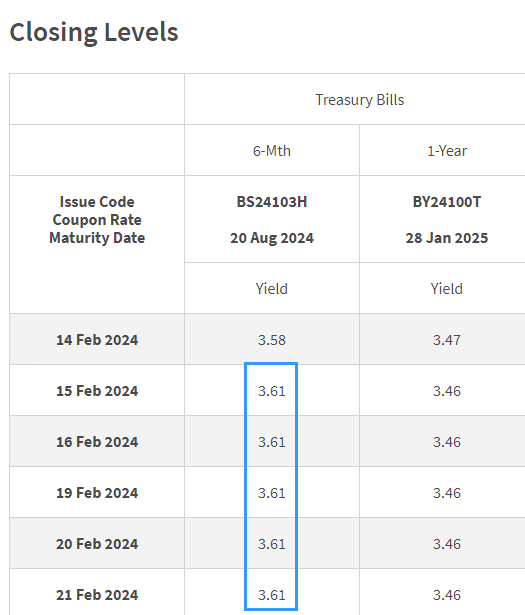

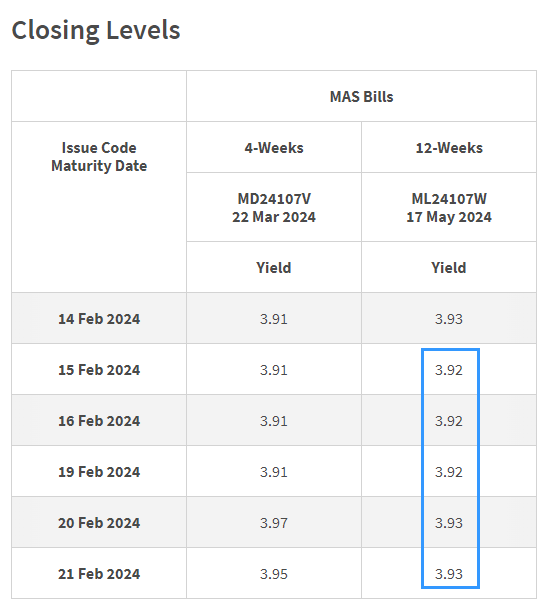

The table below shows the current interest yield the six-month Singapore T-bills is trading at:

The daily yield at closing gives us a rough indication of how much the 6-month Singapore T-bill will trade at the end of the month. From the daily yield at closing, we should expect the upcoming T-bill yield to trade close to the yield of the last issue.

Currently, the 6-month Singapore T-bills are trading close to a yield of 3.61%, slightly higher than the 3.59% yield we observed two weeks ago.

Gaining Insights About the Upcoming Singapore T-bill Yield from the Daily Closing Yield of Existing MAS Bills.

Typically, the Monetary Authority of Singapore (MAS) will issue a 4-week and a 12-week MAS Bill to institutional investors.

The credit quality or the credit risk of the MAS Bill should be very similar to Singapore T-bills since the Singapore government issues both. The 12-week MAS Bill (3 months) should be the closest term to the six-month Singapore T-bills.

Thus, we can gain insights into the yield of the upcoming T-bill from the daily closing yield of the 12-week MAS Bill.

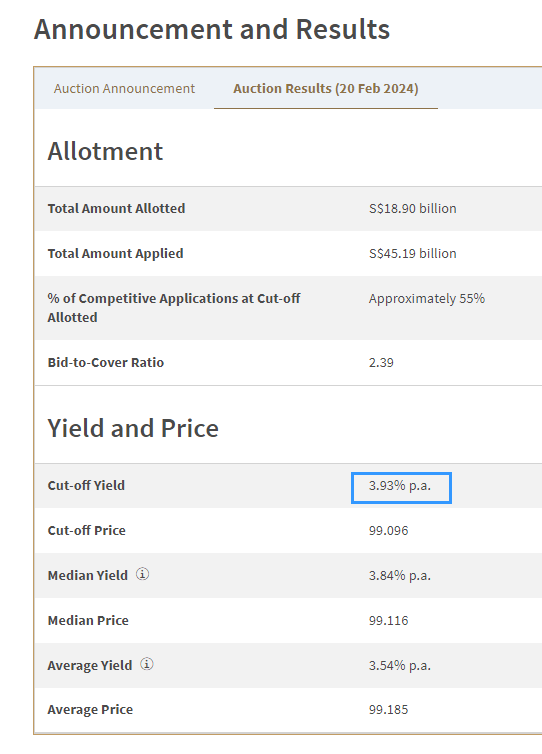

The cut-off yield for the latest MAS bill auctioned on 20th Feb (two days ago) is 3.93%. The MAS bill is slightly lower than the last issue two weeks ago.

Currently, the MAS Bill trades close to 3.92%.

Given that the MAS 12-week yield is at 3.92% and the last traded 6-month T-bill yield is at 3.61%, what will likely be the T-bill yield this time round?

The 3-month and 6-month Singapore Bond Yield trades at a bigger difference currently. This may indicate that the 6-month tenor is becoming more sensitive to changes in the market yield. This would mean that the 12-Week MAS bill has less predictive indication of the direction of the 6-month Tbill Yield.

I don’t expect the yields at the 6-month to move much in this issue, but given the higher inflation readings recently, I suspect that inflation would be more digested better in the next issue.

The yield for the issue should be closer to 3.55% in this issue.

Here are your other Higher Return, Safe and Short-Term Savings & Investment Options for Singaporeans in 2023

You may be wondering whether other savings & investment options give you higher returns but are still relatively safe and liquid enough.

Here are different other categories of securities to consider:

| Security Type | Range of Returns | Lock-in | Minimum | Remarks |

|---|---|---|---|---|

| Fixed & Time Deposits on Promotional Rates | 4% | 12M -24M | > $20,000 | |

| Singapore Savings Bonds (SSB) | 2.9% – 3.4% | 1M | > $1,000 | Max $200k per person. When in demand, it can be challenging to get an allocation. A good SSB Example. |

| SGS 6-month Treasury Bills | 2.5% – 4.19% | 6M | > $1,000 | Suitable if you have a lot of money to deploy. How to buy T-bills guide. |

| SGS 1-Year Bond | 3.72% | 12M | > $1,000 | Suitable if you have a lot of money to deploy. How to buy T-bills guide. |

| Short-term Insurance Endowment | 1.8-4.3% | 2Y – 3Y | > $10,000 | Make sure they are capital guaranteed. Usually, there is a maximum amount you can buy. A good example Gro Capital Ease |

| Money-Market Funds | 4.2% | 1W | > $100 | Suitable if you have a lot of money to deploy. A fund that invests in fixed deposits will actively help you capture the highest prevailing interest rates. Do read up the factsheet or prospectus to ensure the fund only invests in fixed deposits & equivalents. |

This table is updated as of 17th November 2022.

There are other securities or products that may fail to meet the criteria to give back your principal, high liquidity and good returns. Structured deposits contain derivatives that increase the degree of risk. Many cash management portfolios of Robo-advisers and banks contain short-duration bond funds. Their values may fluctuate in the short term and may not be ideal if you require a 100% return of your principal amount.

The returns provided are not cast in stone and will fluctuate based on the current short-term interest rates. You should adopt more goal-based planning and use the most suitable instruments/securities to help you accumulate or spend down your wealth instead of having all your money in short-term savings & investment options.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

The post New 6-Month Singapore T-Bill Yield in End-February 2024 to be Lower at 3.55% (for the Singaporean Savers) appeared first on Investment Moats.