Hello Traders! Today, we’ll dive into the weekly Elliott Wave structure of Modine Manufacturing Co. ($MOD) and explain why a potential corrective pullback could present an excellent buying opportunity. Let’s analyze the price action and forecast the next steps.

About Modine Manufacturing Co.

Modine Manufacturing, established in 1916, is a global leader in thermal management solutions. For over a century, it has delivered innovative systems for heating, cooling, and improving air quality across commercial, industrial, and vehicular markets. Whether in HVAC systems or vehicle components, Modine plays a vital role in everyday life around the world.

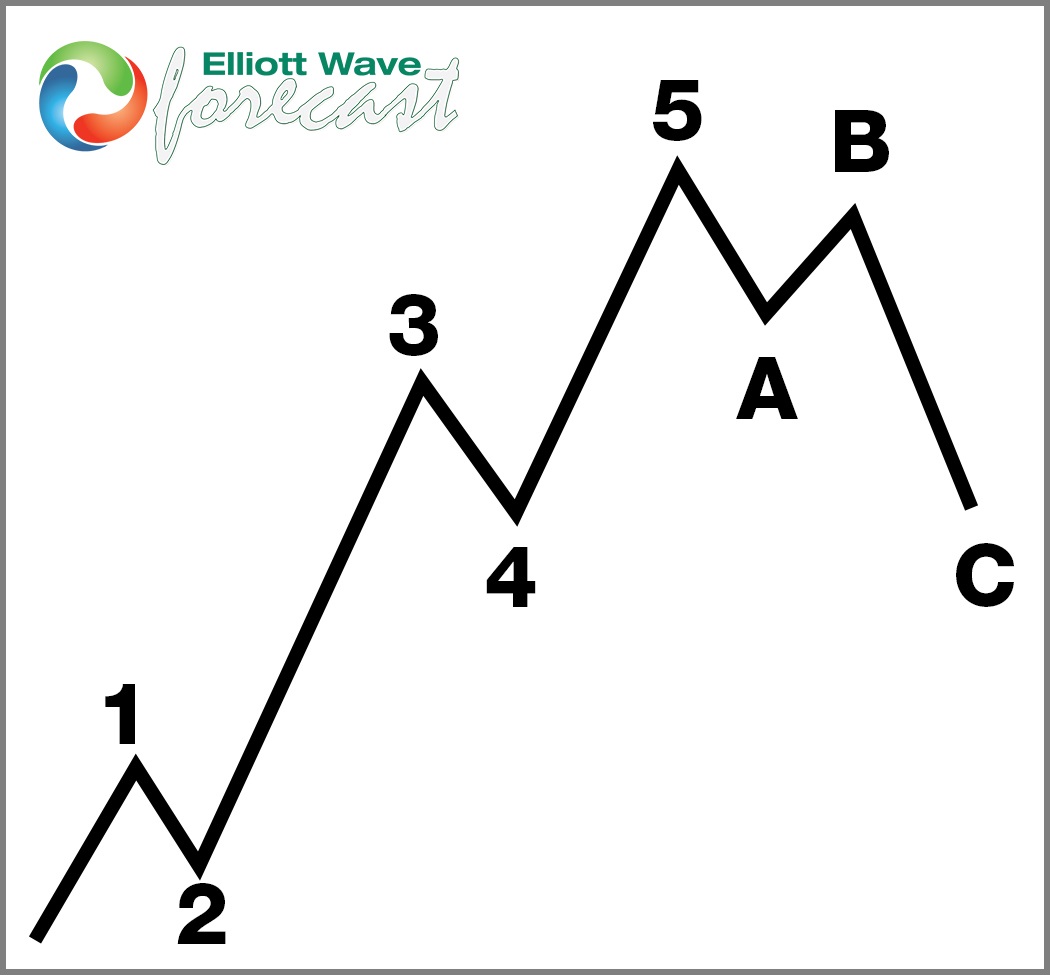

5 Wave Impulse Structure + ABC correction

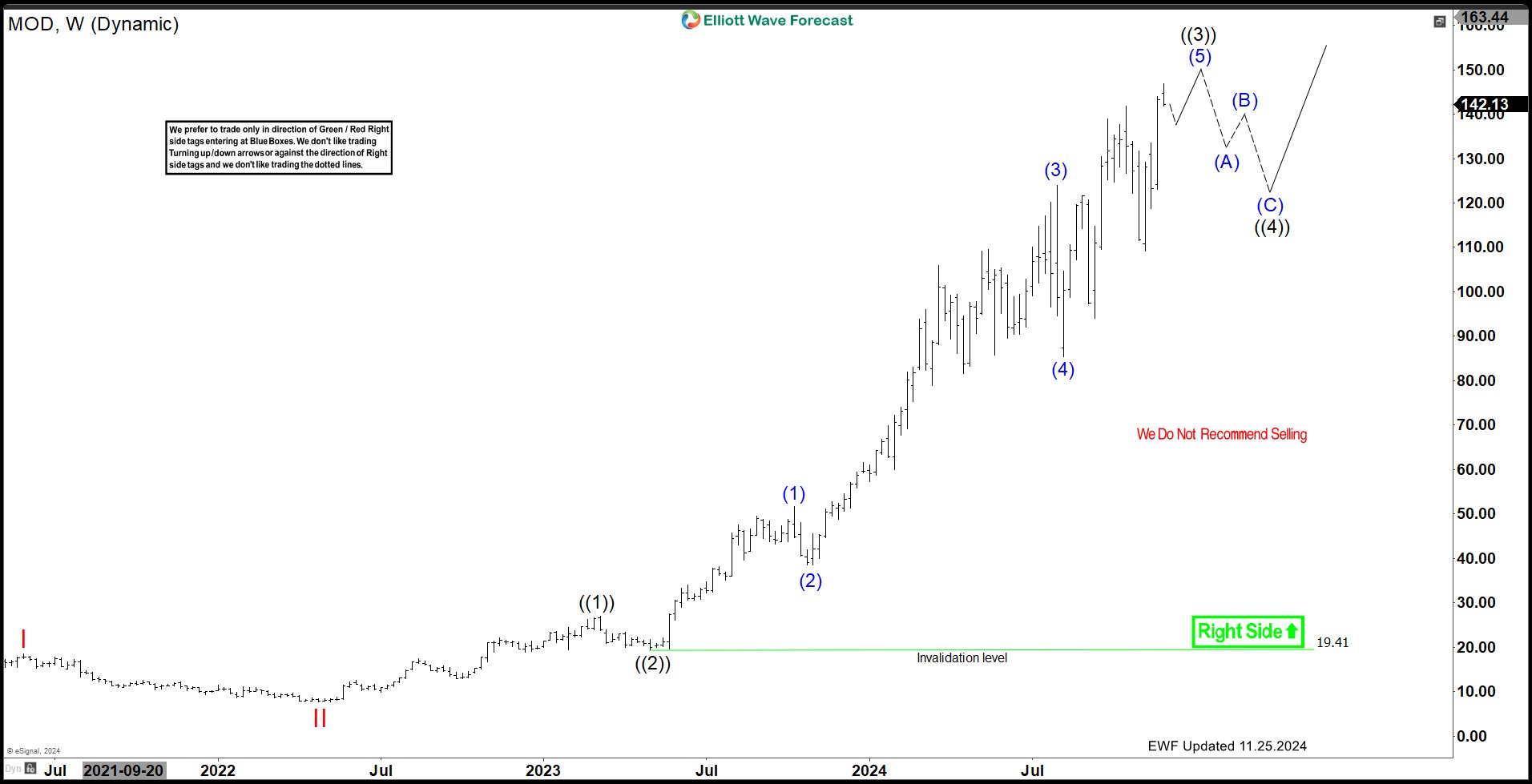

$MOD Weekly Elliott Wave View November 25th 2024:

The weekly Elliott Wave chart for $MOD reveals a 5-wave impulse structure that began from the May 2023 low. This structure indicates a strong bullish trend, and the current cycle is approaching its completion. Here’s how the sequence has unfolded so far:

The weekly Elliott Wave chart for $MOD reveals a 5-wave impulse structure that began from the May 2023 low. This structure indicates a strong bullish trend, and the current cycle is approaching its completion. Here’s how the sequence has unfolded so far:

- Wave (1) concluded on October 9, 2023, marking the first impulsive move upward.

- Following this, $MOD experienced a 3-wave correction (ABC), which bottomed at wave (2).

- The stock then rallied strongly, completing wave (3) on July 29, 2024.

- Afterward, another 3-wave correction (ABC) occurred, bottoming out at wave (4) on August 5, 2024.

- Since then, $MOD has rallied in wave (5), which is nearing completion, indicating the end of the current impulse cycle for wave ((3)).

What’s Next for $MOD?

Once wave (5) concludes and the current 5-wave impulsive cycle ends, we expect a larger 3-wave correction (ABC) to unfold. This pullback will correct the broader cycle that started in May 2023. Importantly, the corrective phase will likely provide an opportunity for buyers to re-enter the market at favorable levels. Based on Elliott Wave Theory, this correction should unfold into a Blue Box area, a high-probability reversal zone. Traders should watch for price action to find support here before the next bullish wave resumes.

Key Takeaways for Traders

- Trend Completion: The current 5-wave impulse cycle from May 2023 is nearing its end, signaling a corrective pullback is on the horizon.

- Correction Opportunity: The expected 3-wave ABC correction offers an opportunity to buy into the uptrend once support is established.

- Blue Box Strategy: Monitor the Blue Box area closely, as it provides a high-probability reversal zone for the next upward cycle.

- Long-Term Outlook: After the correction, $MOD is likely to resume its bullish trend, continuing the broader rally.

Conclusion

Modine Manufacturing Co. ($MOD) has shown a textbook Elliott Wave pattern, and the upcoming correction should present a compelling buying opportunity. As the 5-wave impulsive cycle nears completion, traders should prepare to take advantage of the anticipated pullback within the Blue Box area. Stay vigilant, and use this analysis to plan your next move in $MOD. With over a century of innovation and leadership in thermal management, Modine remains a strong contender for long-term growth. Keep an eye on the charts and let the Elliott Wave roadmap guide your strategy! $MOD Elliott Wave Video Analysis Elliott Wave Forecast

We cover 78 instruments, but not every chart is a trading recommendation. We present Official Trading Recommendations in the Live Trading Room. If not a member yet, Sign Up for Free 14 days Trial now and get access to new trading opportunities. Welcome to Elliott Wave Forecast!

The post Modine Manufacturing Co. $MOD: 5-Wave Impulse Nears Completion, Setting Up a Buying Opportunity. appeared first on Elliott wave Forecast.