How much weight does your brand carry with customers? Are your customers as loyal as they used to be? What is your retention? Is your Net Promotor Score going up or down? Have you found the secret to attracting and keeping customers through the right balance of new, innovative products and valuable preventive services?

Today’s customers are still brand-conscious, but they are less brand-loyal. For new customers, a well-placed product — the right product, sold quickly and easily, can win out in the battle of the brands. Customer retention in insurance is crucial, but your customers are at risk of shopping around — willing to trade brand loyalty for value, innovation, or an excellent experience. What are you doing to prioritize customer satisfaction and retention in insurance?

Customers are consistently making the case that it’s all about them. It’s up to insurers to prove them right if they want to improve retention and profits to set a foundation for business resilience and growth.

Customers demand new products to manage their risks; insurance customer experiences that make it simple, fast, and efficient to buy insurance; channel options that expand reach and ease of buying; and value-added services that extend the value of the insurance product. Embracing this change requires a higher level of sophistication and commitment to digital transformation than what insurers have done in the past. The insurance of tomorrow cannot be built on today’s operating business model and technology foundation.

Now is the time to reshape the operating business model and technology foundation. By moving the business to next-gen cloud intelligent core platforms with embedded technologies like APIs, microservices, AI/ML models, GenAI, and digital, insurers can drive down operational costs and increase premium growth…bending the cost curve and creating competitive differentiation in a tightly contested industry.

Leaders are rethinking their operating model and technology foundation to make their products and business processes more cost-effective, while also digitalizing them to attract today’s and the next generation of buyers. Insurers must reevaluate costs, looking to move from fixed to variable. They must rethink their business operations continuity and scalability along with how to accelerate technology adoption to drive operational effectiveness, enhance customer experiences, expand market reach, bring new products to market, and more.

Majesco Strategic Priorities surveys have given us some clear guidance on how insurers can turn customer trends into profitable action. Below are five of their timely messages.

Embrace a customer-first focus.

As we pointed out last week, there is a positive relationship between AM Best innovation assessment scores for insurers and financial results. Higher scores are now indicative of higher NPW and lower expense ratios. Leaders at these firms are consistently delivering what customers want and need to retain and grow their customer base. In contrast, laggards struggle to make headway beyond incremental improvements.

Majesco has been tracking this trend for years. In our 2023 Strategic Priorities research, insurers placed innovation as a top 10 strategic priority. Yet a shift happened in our Strategic Priorities 2024 research when improving the customer experience made the greatest shift, taking over the number one spot. Of course, customer experience initiatives also require innovation, so they aren’t mutually exclusive. But the Majesco survey signals a new era in technology, where the insurance customer journey can become more personal, more efficient, and more profitable — driving up customer satisfaction, retention, growth, and loyalty. It begins with a customer-first focus.

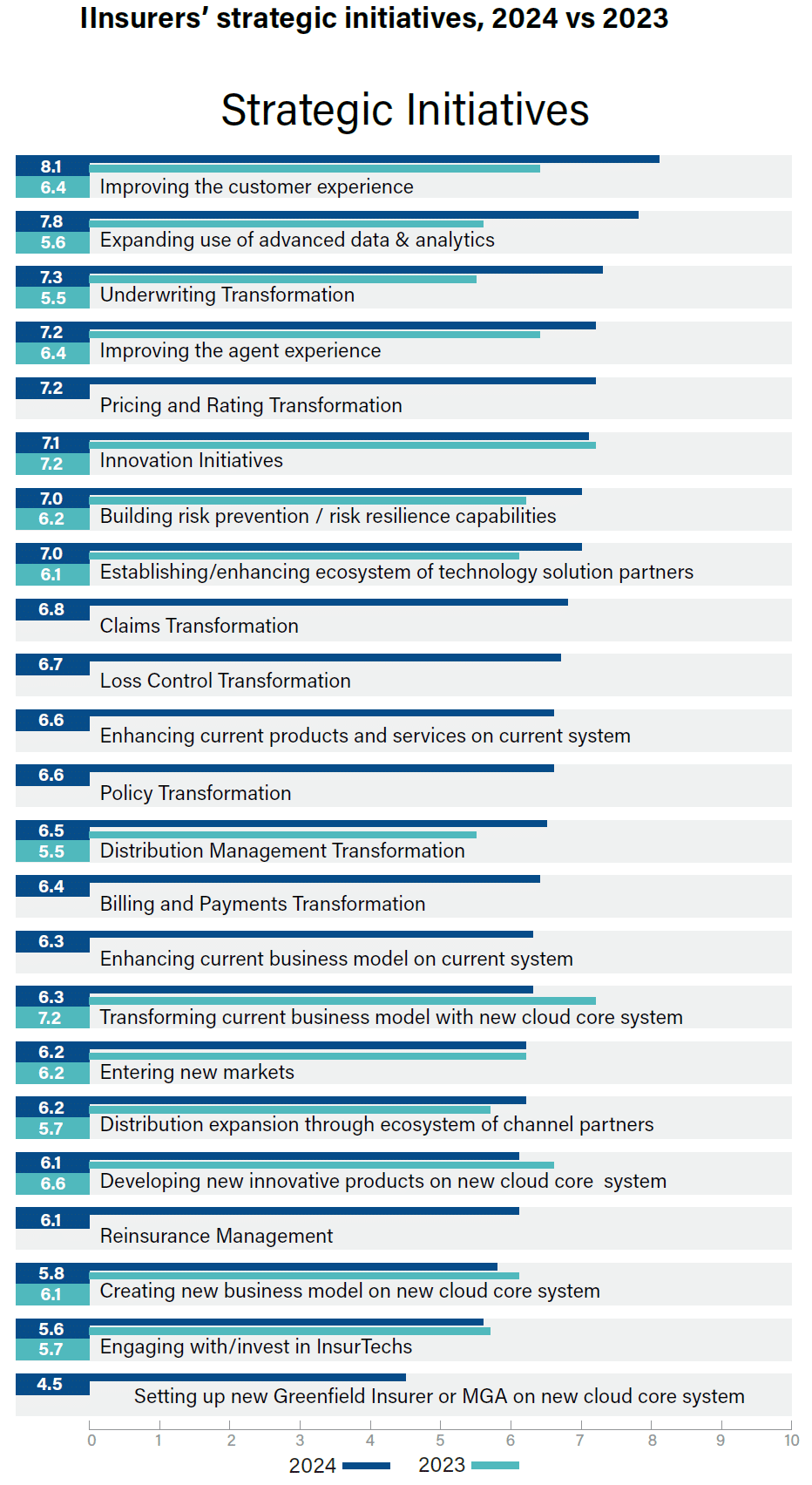

These shifts and others are shown in Figure 1. Within the top 12 priorities, 5 are new areas of focus and the other 7 have seen significant shifts in ranking, reflecting the impact of the market changes and macro-economic challenges. Rising to the top are those areas that have a direct influence or impact on profitability (underwriting transformation, pricing & rating transformation, claims transformation), growth and loyalty (customer experience, agent experience, enhancing current products and services on current system), risk management (risk prevention/risk resilience capabilities, loss control transformation) and innovation (innovation, ecosystem of solution partners).

Figure 1: Insurers’ strategic initiatives, 2024 vs 2023

Expand channels.

When it comes to product placement, today’s insurance opportunities are growing faster than ever before. We are a mobile society, and customers are hungry for technologies and products that protect them from the many risks they face to themselves and their property. Insurance customers are truly more customer-centric than ever, influenced by other industry experiences. Insurers need to find the areas where customers have interest and investment in their protection and welfare.

Smartwatches, for example, can dramatically change the traditional L&AH business model. For insurers, the surface of opportunity hasn’t even been scratched. By 2029, there will be an estimated 740 million smartwatch users globally, 92% of whom are interested in monitoring and improving their health which can drive down medical costs, a major issue in profitability. How can L&AH insurers utilize current and expanding channels to give customers what they need?

Cybercrime, hacking, and fraud are some of the growing financial risks that require new products and services. Where can insurers place their products that capitalize on the timing of the need?

Home security has changed dramatically in the last decade and smart home devices and sensors have opened up a whole new realm of prevention and protection. Now, with Matter, the smart home ecosystem that is standardizing home device protocols, it should be easier than ever for insurers to tap into data that can improve prevention, reduce claims, and perhaps improve pricing. Where can smart home device buyers opt into additional insurance coverages and services?

In today’s interconnected world, insurance must play across a wide spectrum of distribution options, expanding channels and partners to reach customers when, where, and from whom they want to buy insurance. These options form a distribution ecosystem that expands the reach but requires a partnership approach, particularly for embedded channels.

Transform the experience in ways that combine channel and experience improvements.

While expansion is important, ensuring “ease of doing business” with any of the channels, and in particular agents who will continue to dominate, is equally important from a growth and retention perspective. Insurers face the looming issues of an aging workforce, rising insurance customer expectations and changing needs, and the need for next-gen technology, including agent portals and comparative rating capabilities.

The growing spectrum of channel options, especially the exciting opportunities for embedded insurance, as well as the fight for agent/broker loyalty, demand insurers to optimize their channels to meet growing expectations from customers to achieve their growth potential fully.

Create personalized products focused on today’s risk needs to close the protection gap.

Today’s customers expect and need different products to meet their risk needs, help close the protection gap, and align to their financial parameters. They also want more than just the risk product; they want access to value-added services that can help reduce risk and an experience that humanizes and manages the process.

Part of the humanizing aspect is offering niche, personalized products that require product innovation. These products need to use more of the customer’s personal data, including telematic data, that reflects their risk and behaviors. It includes risk prevention and mitigation capabilities to help customers avoid loss, dramatically redefining the customer experience and loyalty parameters. Traditional product-oriented strategies rarely meet the heightened customer expectations in insurance.

In our consumer and SMB research in 2023, we consistently found a gap between insurers and customers in terms of interest in new products for L&AH individual and group/voluntary benefits and for P&C personal and commercial lines of business. A customer expectation gap reflects the difference between what customers expect, want, and need, compared to what insurers deliver.

This is why IoT and telematic products, on-demand/Gig economy products, parametric insurance, microinsurance, and embedded insurance are of substantial interest, particularly for Gen Z & Millennials, but also selectively with the older generation of Boomers & Gen X. With inflation eating into disposable income and claims costs driving up insurance premiums, there is a real concern that the protection gap will expand for many consumers and businesses.

Both the protection and insurance customer expectation gaps need to be as small as possible for insurers to create long-term customer growth, retention, value, and loyalty. It demands a customer-centric strategy that understands the unique generational segment differences in behaviors and lifestyles that drive insurers’ decisions about products, both traditional and innovative. Doing so will help improve underwriting profitability with more personal data-driven risk assessments and will also help drive risk avoidance or mitigation. It’s a win-win-win approach with greater cooperation and understanding between insurers and their insureds, while also providing more personalized offerings.

Reduce customer risk.

Risk doesn’t always show itself, yet it is an ever-present companion for insurers. Risk is growing and becoming more complex. Gone though is its predictability. Risk events are becoming more frequent. New risk layers, such as climate, societal, and technology risks, add new considerations and complexity that must be considered.

Resilience is essential to living in a world filled with risk. It can be described as the ability to return to the status quo after an event with a negative impact, whether to assets like our businesses, homes, or vehicles or for our own personal or employee health and wellbeing. Risk resilience focuses on the ability to avoid or minimize risk, decreasing the need for and intensity of recovery efforts.

The concept of risk resilience is closely aligned with the adage of “control what you can control.” It is now front and center for insurers as they consider new risk management strategies as a crucial component of their underwriting and customer service strategy. While most insurers are focused on improving risk assessment, many more are expanding to also focus on loss prevention and mitigation, creating needed risk resilience for their customers.

Insurers should be asking themselves, “Where are the new risks? What will be the impact of those risks on our customers? How do we help them to respond and stay protected?”

Leading insurers leverage technology such as IoT devices, advanced analytics, digital loss control assessments, and value-added services to not only assess and monitor risk but to proactively respond to it with mitigation services and actions. From concierge services, to monitoring water hazards and the safety of employees, to helping people live healthy lifestyles, leading insurers are shifting to risk resilience strategies that not only drive better business outcomes but also cultivate customer loyalty.

With risk resilience, customers experience prevention before they need protection — whether it be for businesses, homes, vehicles, assets, or employee health and wellbeing. Even better, risk resilience technologies communicate and educate. Every claim and pre-claim event becomes a teachable moment to help avoid future losses.

Risk resilience through prevention and mitigation will ultimately change and improve the insurer/relationship. Its importance may one day eclipse claims payouts, rehabilitation, repair, or restoration to drive profitability and customer loyalty. After all, nothing is more customer-centric than preventing your customer from “what might have been.”

Is your organization ready to prove to customers that, “It’s all about them,” gaining their interest, keeping their loyalty, and improving your profits?

Majesco helps insurers understand and connect with their customers by looking at their distinct needs across generations — interpreting their expectations and trends considering what is now possible with today’s insurance technologies. Join us for our upcoming webinar, Navigating the Consumer Tipping Point in Insurance to find out more about how you can position your company to grow your customer satisfaction and customer retention in insurance.

The post Meet Customer Expectations with Customer-Centric Insurance appeared first on Majesco.